Click here to sign up to Fintech Ireland news, events, services as we announce them.

Also check Brexit pages at and tweets from at:

Also check Brexit pages at and tweets from at:

- Fintech UK: https://fintechuk.com/brexit--fintech.html / https://twitter.com/FintechUK_HQ

- Brexit Ireland: https://BrexitIreland.com / https://twitter.com/BrexitIRL

- CompliReg: https://CompliReg.com / https://twitter.com/CompliReg

Brexit saps London’s appeal to tech founders

For Rob Bishop, head of one of Europe’s fastest growing tech companies, now is the time for start-ups to relocate operations elsewhere in the EU, ahead of the UK’s departure next year. “You don’t want to get caught out at the eleventh hour,” he says. “You can’t assume things will be fine after Brexit and then find out they aren’t"

The managing director of London-based payments start-up Optal says it has applied for a regulatory licence in Ireland, in the event that the UK does not retain passporting rights. These currently enable fintech companies to sell financial services across the EU single market. Copyright Financial Times 30/04/2018

For Rob Bishop, head of one of Europe’s fastest growing tech companies, now is the time for start-ups to relocate operations elsewhere in the EU, ahead of the UK’s departure next year. “You don’t want to get caught out at the eleventh hour,” he says. “You can’t assume things will be fine after Brexit and then find out they aren’t"

The managing director of London-based payments start-up Optal says it has applied for a regulatory licence in Ireland, in the event that the UK does not retain passporting rights. These currently enable fintech companies to sell financial services across the EU single market. Copyright Financial Times 30/04/2018

More than 150 Brexit Applications filed with Central Bank of Ireland

"More than 150 financial services firms have applied for authorisations from the Central Bank to operate in Ireland and license new products here in the wake of Brexit. Companies seeking authorisations for new products drives surge" copyright Irish Independent 15/07/2018

More than 150 financial services firms have applied for authorisations from the Central Bank to operate in Ireland and license new products here in the wake of Brexit. An upswing in applications in recent weeks has compelled the Central Bank to re-allocate staff to deal with the workload. The growing prospect of a hard Brexit is believed to be behind the recent surge and applications may top 175 firms by the end of the year, sources said.

"More than 150 financial services firms have applied for authorisations from the Central Bank to operate in Ireland and license new products here in the wake of Brexit. Companies seeking authorisations for new products drives surge" copyright Irish Independent 15/07/2018

More than 150 financial services firms have applied for authorisations from the Central Bank to operate in Ireland and license new products here in the wake of Brexit. An upswing in applications in recent weeks has compelled the Central Bank to re-allocate staff to deal with the workload. The growing prospect of a hard Brexit is believed to be behind the recent surge and applications may top 175 firms by the end of the year, sources said.

If you would like to enquire about establishing a presence in Ireland, please contact us hello@fintechireland or hello@peteroakes.com with details of your query, including the type of licence you require and where possible, the date by which you need to be authorised.

We have received 100 plus calls/emails/queries from regulated and unregulated fintech firms from the UK, USA, Asia and Australia/New Zealand vexed by the uncertainty of how BREXIT will impact their business and asking questions about the authorisation regimes in Ireland and other EU Member States. This complexity is added to by PSD 2, E-Money Directive, MiFID 2, AML 5, CRR/CRD IV and the GDPR as well.

Fintech Ireland doesn't consult or provide any such paid type services. Fintech Ireland doesn't raise revenue and therefore it makes no profit and all costs associated with its activities, including this website and free guidance, can be provided by our founder, collaborators and event sponsors covering our costs. If Fintech Ireland can help sign post you to the relevant information, we'd be happy to, but please check out our News and Events page where we place relevant information and copies of powerpoint presentations before contacting us.

For consulting assistance with establishing and scaling your fintech business in Ireland you can contact Peter Oakes at hello@peteroakes.com (and visit www.peteroakes.com). Our founder, collaborating with others, has also established the Brexit & Ireland project to track companies moving to, and scaling their operations from Ireland. Visit www.brexitdublin.com (hello@brexitdublin.com) for more information.

If your a firm looking for information about getting regulated in Ireland, obviously check out the Central Bank of Ireland's website and get in touch with us hello@fintechireland.com or hello@peteroakes.com (www.peteroakes.com).

We have received 100 plus calls/emails/queries from regulated and unregulated fintech firms from the UK, USA, Asia and Australia/New Zealand vexed by the uncertainty of how BREXIT will impact their business and asking questions about the authorisation regimes in Ireland and other EU Member States. This complexity is added to by PSD 2, E-Money Directive, MiFID 2, AML 5, CRR/CRD IV and the GDPR as well.

Fintech Ireland doesn't consult or provide any such paid type services. Fintech Ireland doesn't raise revenue and therefore it makes no profit and all costs associated with its activities, including this website and free guidance, can be provided by our founder, collaborators and event sponsors covering our costs. If Fintech Ireland can help sign post you to the relevant information, we'd be happy to, but please check out our News and Events page where we place relevant information and copies of powerpoint presentations before contacting us.

For consulting assistance with establishing and scaling your fintech business in Ireland you can contact Peter Oakes at hello@peteroakes.com (and visit www.peteroakes.com). Our founder, collaborating with others, has also established the Brexit & Ireland project to track companies moving to, and scaling their operations from Ireland. Visit www.brexitdublin.com (hello@brexitdublin.com) for more information.

If your a firm looking for information about getting regulated in Ireland, obviously check out the Central Bank of Ireland's website and get in touch with us hello@fintechireland.com or hello@peteroakes.com (www.peteroakes.com).

Ireland as your financial services HQ in Europe

One of the professional advisers you may wish to consider is Peter Oakes the founder of Fintech Ireland and an internationally recognised financial services expert. Peter sits in the pre-approval controlled function of 'significance influence' and 'company director' at Irish regulated fintech firms (payments and MIFID) as well as sitting on the advisory boards of fintech and regtech, and consulting to these types of companies. If Peter Oakes cannot help you he will put you in contact with people and organisations, at your request, who hopefully will be able to assist you. These introductions will be made in good faith and the choice of your adviser is purely yours.

Peter is a non-executive director and board level strategic and regulation adviser to regulated fintech in Ireland, the United Kingdom and elsewhere. Peter is a former Director of the Irish Central Bank, and worked as a senior regulator in the United Kingdom (former Financial Services Authority - Enforcement Lawyer) and Australia (Australian Securities & Investments Commission - Senior Officer). He has also advised a number of regulators and central banks on their corporate and regulatory strategies. In Ireland Peter was personally involved in helping drive changes to the authorisation process in Ireland (see here). Peter is a solicitor admitted in Ireland, the UK and Australia. If you wish to discuss the impact of Brexit and the authorisation of your financial services company in Ireland, including steps you can take right now, contact Peter at peter@peteroakes.com (see more about Peter at our About page / LinkedIN Profile). Peter's work and blogs have a large following: Peter has 6,0000+ followers on LinkedIN and his twitter handles on fintech and regulation have 10,000+followers.

One of the professional advisers you may wish to consider is Peter Oakes the founder of Fintech Ireland and an internationally recognised financial services expert. Peter sits in the pre-approval controlled function of 'significance influence' and 'company director' at Irish regulated fintech firms (payments and MIFID) as well as sitting on the advisory boards of fintech and regtech, and consulting to these types of companies. If Peter Oakes cannot help you he will put you in contact with people and organisations, at your request, who hopefully will be able to assist you. These introductions will be made in good faith and the choice of your adviser is purely yours.

Peter is a non-executive director and board level strategic and regulation adviser to regulated fintech in Ireland, the United Kingdom and elsewhere. Peter is a former Director of the Irish Central Bank, and worked as a senior regulator in the United Kingdom (former Financial Services Authority - Enforcement Lawyer) and Australia (Australian Securities & Investments Commission - Senior Officer). He has also advised a number of regulators and central banks on their corporate and regulatory strategies. In Ireland Peter was personally involved in helping drive changes to the authorisation process in Ireland (see here). Peter is a solicitor admitted in Ireland, the UK and Australia. If you wish to discuss the impact of Brexit and the authorisation of your financial services company in Ireland, including steps you can take right now, contact Peter at peter@peteroakes.com (see more about Peter at our About page / LinkedIN Profile). Peter's work and blogs have a large following: Peter has 6,0000+ followers on LinkedIN and his twitter handles on fintech and regulation have 10,000+followers.

Tuesday 2 May 2017- Irish Government's BREXIT Strategy published

The Irish Government has published its strategy for the negotiations between the EU and the UK on Britain's exit from the bloc. Thanks to Privacy Ireland for posting.

The Irish Government has published its strategy for the negotiations between the EU and the UK on Britain's exit from the bloc. Thanks to Privacy Ireland for posting.

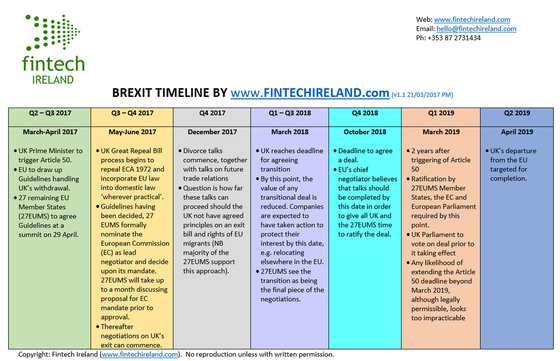

Tuesday 21 March 2017 - v1.01 Fintech Ireland has created the below graphic / timeline on Brexit. You may only use the timeline if you, in a clear and prominent manner, credit Fintech Ireland and our website

The 24th of June has come and gone. The UK has voted 51.9% Leave EU (17,410,742 votes) to 48.1% Remain In EU (16,141,241 votes).

23 December 2016: Central Bank of Ireland "Responding to the post-Brexit environment" (here)

5 December 2016: Video - Ireland's FDI agency video released as part of €700K budget (so far) for Brexit initiative to lure busin/uploads/3/5/4/5/35459745/brexit-fintech-ireland-peter-oakes.pngess to Ireland (here)

28 November 2016: Central Bank boosts staff numbers for Brexit insurers (here)

26 November 2016: Big banks are looking at Ireland - minister (here)

28 October 2016: Governor of Central Bank of Ireland - The European Financial System After Brexit' (here)

9 October 2016: Governor Philip R. Lane “The Eurozone After Brexit” at the Euro50 Group & CIGI Breakfast Meeting, Washington DC (here)

15 July 2016: Irish Central Bank hosted a roundtable discussion with Irish financial sector representatives and stakeholders about potential consequences for the sector following the Brexit vote (here)

In the immediate aftermath of this historic referendum:

23 December 2016: Central Bank of Ireland "Responding to the post-Brexit environment" (here)

5 December 2016: Video - Ireland's FDI agency video released as part of €700K budget (so far) for Brexit initiative to lure busin/uploads/3/5/4/5/35459745/brexit-fintech-ireland-peter-oakes.pngess to Ireland (here)

28 November 2016: Central Bank boosts staff numbers for Brexit insurers (here)

26 November 2016: Big banks are looking at Ireland - minister (here)

28 October 2016: Governor of Central Bank of Ireland - The European Financial System After Brexit' (here)

9 October 2016: Governor Philip R. Lane “The Eurozone After Brexit” at the Euro50 Group & CIGI Breakfast Meeting, Washington DC (here)

15 July 2016: Irish Central Bank hosted a roundtable discussion with Irish financial sector representatives and stakeholders about potential consequences for the sector following the Brexit vote (here)

In the immediate aftermath of this historic referendum:

- United Kingdom: the Bank of England released a statement (here), followed by the UK FCA statement (here).

- Ireland: Not long afterwards the Central Bank of Ireland issued a statement (here)

- France: Governor of French central bank governor warns that Britain’s financial services groups at risk of losing their right to operate across the EU (here)

- Gibraltar: Statement by the Gibraltar Financial Services Commission (here)

- Jersey: Statement by Jersey Financial Services Commission (here)