Learn about the advantages of establishing a regulated fintech presence in Ireland at the second Fintech Ireland Summit takes place on Thursday 27 November 2025 in Dublin Ireland

Are you seeking an Independent Non-Executive Director for your Fintech (payments, digital assets, MiFID, banking, insurance and funds?)

|

A key requirement of well-established and well-regulated financial services jurisdictions is the appointment of independent non-executive directors, including the role of the Chairperson, to the boards of regulated firms. Peter Oakes is Chairperson and INED of fintechs. If you are seeking someone to fulfil the regulatory role who is pre-approved for such roles, please contact Peter Oakes, Founder of Fintech Ireland for a confidential discussion.

If Peter is unable to advance an INED role, he works with many other suitably qualified persons who may suit you and he has established both FintechDirector.com and FintechDirectors.com to assist you. |

Formerly a director of enforcement at the Central Bank of Ireland, and founder of the advisory group Fintech Ireland in 2014, you’d be inclined to listen to Oakes when he says that Ireland is doing well when it comes to attracting fintechs. A non-executive director of a number of firms ... Oakes’ extensive regulation expertise has been vital to many firms making the first steps on their start-up journey..." Peter Oakes ranked in the 100 Most Powerful People in Tech in Ireland Business Post, Charlie Taylor 29 June 2024

You might need a fintech or crypto asset authorisation in the UK to complement your EEA one. We recommend you speak with FintechUK.com for that!

Learn more about the authorisation of (1) Electronic Money Institutions, (2) Payment Institutions and (3) Markets In Crypto Asset by clicking the images immediately below for those authorisations.

PLEASE REFER TO OUR BLOG ISSUED 9TH APRIL 2024 "20240409 - New/Updated Central Bank Expectations for Authorisation as a Payment Institution or Electronic Money Institution, or Registration as an Account Information Service Provider"

The changes in the new/updated Central Bank Expectations will impact some of the material appearing on this page.

The changes in the new/updated Central Bank Expectations will impact some of the material appearing on this page.

RECORDED EVENTS:

Why Ireland for Fintech?

Our Peter Oakes has written comprehensive guides/blogs on Why Ireland For Fintech for:

These guides have been downloaded 30,000+ times

If there is no link to a document you are looking for, contact office@complireg.com.

Ireland is fantastic place to obtain an e-money authorisation and a payment institution authorisation.

Peter Oakes the author of the e-money authorisation, payment institution authorisation and VASP registration guides is our Founder, Board Director of Regulated Fintech and former Director of Enforcement and AML/CTF Supervision at the Central Bank of Ireland. Peter is recognised by Chambers & Partner’s in its Fintech 2021 and 2020 edition as one of Ireland’s leading fintech experts. Peter is also a past member of the Fintech 50 Panel.

Institute of Internal Auditors

Our Peter Oakes has written comprehensive guides/blogs on Why Ireland For Fintech for:

- securing an Electronic Money Authorisation;

- securing a Payment Institution Authorisation (which includes AISP and PISPs);

- securing a Crypto Asset Services Provider Authorisation;

- securing a MiFID authorisation;

- Overview of Certain Prudential, Conduct of Business Rules, Outsourcing and AML/CFT Guide.

These guides have been downloaded 30,000+ times

If there is no link to a document you are looking for, contact office@complireg.com.

Ireland is fantastic place to obtain an e-money authorisation and a payment institution authorisation.

Peter Oakes the author of the e-money authorisation, payment institution authorisation and VASP registration guides is our Founder, Board Director of Regulated Fintech and former Director of Enforcement and AML/CTF Supervision at the Central Bank of Ireland. Peter is recognised by Chambers & Partner’s in its Fintech 2021 and 2020 edition as one of Ireland’s leading fintech experts. Peter is also a past member of the Fintech 50 Panel.

Institute of Internal Auditors

- An update of the Three Lines of Defense

- In Peter Oakes's Linkedin post of 31 August 2020, he referenced the above guide as being useful for applicants for emoney institution and payment institution applicants (Linkedin Post)

- Alternative download link here

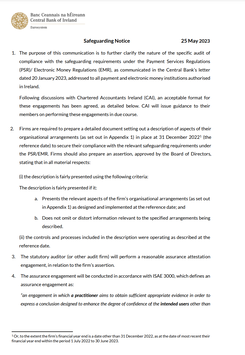

Safeguarding Notice 25 May 2023

The purpose of this communication is to further clarify the nature of the specific audit of compliance with the safeguarding requirements under the Payment Services Regulations (PSR)/ Electronic Money Regulations (EMR), as communicated in the Central Bank’s letter dated 20 January 2023, addressed to all payment and electronic money institutions authorised in Ireland.

Following discussions with Chartered Accountants Ireland (CAI), an acceptable format for these engagements has been agreed, as detailed below. CAI will issue guidance to their members on performing these engagements in due course.

Click here for the (1) 25 May 2023 Safeguarding Notice; and (2) 20 January 2023 CBI Dear CEO Letter.

The purpose of this communication is to further clarify the nature of the specific audit of compliance with the safeguarding requirements under the Payment Services Regulations (PSR)/ Electronic Money Regulations (EMR), as communicated in the Central Bank’s letter dated 20 January 2023, addressed to all payment and electronic money institutions authorised in Ireland.

Following discussions with Chartered Accountants Ireland (CAI), an acceptable format for these engagements has been agreed, as detailed below. CAI will issue guidance to their members on performing these engagements in due course.

Click here for the (1) 25 May 2023 Safeguarding Notice; and (2) 20 January 2023 CBI Dear CEO Letter.