Make sure you are on our Fintech Ireland mailing list at to ensure you are kept informed of events and news. [Other mailing lists are Peter Oakes (Regulation & Law) and FintechUK (UK Fintech stuff)]. PLEASE SCROLL DOWN THIS PAGE FOR UPCOMING EVENTS.

If you have an idea for an event, contact us hello@fintechireland.com

UPCOMING EVENTS

Hi All - despite Covid-19 we continue to: (i) present on the Fintech ecosystem in Ireland, the UK and further a field, (ii) meet with Irish startups getting ready to execute in Ireland and (iii) meet with international firms looking to set up in Ireland for the continuation of their global fintech journey whether Brexit or just good-sense driven. Of course currently we are doing this by video conferencing and webinars.

We are now approaching the end point of 2020 and we continue to host and plan events. We have more events planned not yet advertised, so watch this space. We continue to have great conversations with companies (fintech, regtech, banks, insurers, asset managers & cyber security), professional services firms, chambers of commerce, embassies and overseas governments which wish to partner to host events in 2020.

Also very happy to see Fintech Ireland included on IDA Ireland's infographic on the Fintech Ecosystem under stakeholders.

If you have an idea for an event, contact us hello@fintechireland.com

We are now approaching the end point of 2020 and we continue to host and plan events. We have more events planned not yet advertised, so watch this space. We continue to have great conversations with companies (fintech, regtech, banks, insurers, asset managers & cyber security), professional services firms, chambers of commerce, embassies and overseas governments which wish to partner to host events in 2020.

Also very happy to see Fintech Ireland included on IDA Ireland's infographic on the Fintech Ecosystem under stakeholders.

If you have an idea for an event, contact us hello@fintechireland.com

Slides: password for slides provided to attendees

Future of Financial Technology: Fintech Ecosystem

What: Future of Financial Technology: The Fintech Ecosystem for STC, Saudi Arabia

When: Tuesday 17th November 2020

Where: Online Event

Cost: Free

Registration: PRIVATE - for STC Employees only.

Slides: The slides are available here and are PASSWORD PROTECTED. Password has been provided to STC attendees.

Content:

1. An overview of drivers of Fintech

2. Examples of Fintech Ecosystems

4. Disrupters – the new innovators disrupting traditional financial services

5. Collaboration

6. Funding / Investing

7. Ecommerce and the impact of Covid-19

8. Payments and E-Wallets

10. Defi – Decentralised Finance

11. Private v Public – Crypto

12. Telecoms/Techfins

13. A & Q

Future of Financial Technology: Fintech Ecosystem

What: Future of Financial Technology: The Fintech Ecosystem for STC, Saudi Arabia

When: Tuesday 17th November 2020

Where: Online Event

Cost: Free

Registration: PRIVATE - for STC Employees only.

Slides: The slides are available here and are PASSWORD PROTECTED. Password has been provided to STC attendees.

Content:

1. An overview of drivers of Fintech

2. Examples of Fintech Ecosystems

- ◦sample of ecosystems maps

4. Disrupters – the new innovators disrupting traditional financial services

5. Collaboration

6. Funding / Investing

7. Ecommerce and the impact of Covid-19

8. Payments and E-Wallets

- from mobile to apps

- faster and frictionless payments

- growth in contactless payments

10. Defi – Decentralised Finance

11. Private v Public – Crypto

12. Telecoms/Techfins

13. A & Q

PAST EVENTS

Slides: read below for access to the slides

Regulation: Threat or Opportunity

Women in Finance Virtual Summit - UK Edition

What: Regulation: Threat or Opportunity

When: Tuesday 10th November 2020.

Where: Online Event

Cost: Free

Registration: Now Closed - https://lastwordmedia.eventscase.com/EN/WIFLondonSummit2020/Agenda

Slides & Video: Slides available here at Fintech UK.

Description: Fintech Ireland's Peter Oakes, who is also a Founder of Fintech UK will join this webinar by Women in Finance Virtual Summit on Tuesday 10th November 2020 to present on Regulation: Threat or Opportunity

Further details: Regulation - Threat or Opportunity?

Regulation: Threat or Opportunity

Women in Finance Virtual Summit - UK Edition

What: Regulation: Threat or Opportunity

When: Tuesday 10th November 2020.

Where: Online Event

Cost: Free

Registration: Now Closed - https://lastwordmedia.eventscase.com/EN/WIFLondonSummit2020/Agenda

Slides & Video: Slides available here at Fintech UK.

Description: Fintech Ireland's Peter Oakes, who is also a Founder of Fintech UK will join this webinar by Women in Finance Virtual Summit on Tuesday 10th November 2020 to present on Regulation: Threat or Opportunity

Further details: Regulation - Threat or Opportunity?

- Pre-COVID, what was the impact of heavy regulation, and increasing numbers of watchdogs?

- What does the world of financial services regulation look like now, and how do institutions need to be building it into planning?

- Is increasing regulation creating more risk? What analysis needs to be performed to protect all types of financial organisation?

- Can we expect further change and shifts from Bank of England governance?

Slides & Video : read below for access to the slides & video

Global update on fitness & probity, culture & behaviour, and the impact of SEAR

What: Global update on fitness & probity, culture & behaviour, and the impact of SEAR

When: Tuesday 10th November 2020.

Where: Online Event

Cost: Free

Registration: Now Closed

Slides & Video: Slides available here. Video available here.

Description: Fintech Ireland's Peter Oakes, who is also a strategic consultant to Clark Hill, will join this webinar by Clark Hill and The Mizen Group on Tuesday 10th November 2020 for a global update on fitness & probity, culture & behaviour, and the impact of SEAR (Senior Executive Accountability Regime) on the financial services industry. As this industry includes regulated FinTech, the presentation will be of relevance to regulated Irish fintech operating in banking, insurance, MiFID and payments/emoney to name just a few areas.

The line up includes:

We look forward to sharing with you thoughts on senior management in the global financial services industry will walk away with a better understanding of:

Global update on fitness & probity, culture & behaviour, and the impact of SEAR

What: Global update on fitness & probity, culture & behaviour, and the impact of SEAR

When: Tuesday 10th November 2020.

Where: Online Event

Cost: Free

Registration: Now Closed

Slides & Video: Slides available here. Video available here.

Description: Fintech Ireland's Peter Oakes, who is also a strategic consultant to Clark Hill, will join this webinar by Clark Hill and The Mizen Group on Tuesday 10th November 2020 for a global update on fitness & probity, culture & behaviour, and the impact of SEAR (Senior Executive Accountability Regime) on the financial services industry. As this industry includes regulated FinTech, the presentation will be of relevance to regulated Irish fintech operating in banking, insurance, MiFID and payments/emoney to name just a few areas.

The line up includes:

- MODERATOR: Tom Lyons, co-founder of The Currency

- SPEAKER: Sam Saarsteiner, Partner at Clark Hill

- SPEAKER: Paul McCarthy, CTO of The Mizen Group

- SPEAKER: Peter Oakes, Founder, Fintech Ireland and Strategic Consultant, Clark Hill

We look forward to sharing with you thoughts on senior management in the global financial services industry will walk away with a better understanding of:

- Fitness & probity expectations from the Central Bank

- How RegTech enables firms to assess, embedded, and demonstrate culture & behaviour

- What corporate and personal responsibility financial professionals have now and how this is likely to be expanded in the near future.

Slides: read below for access to the slides

Regulation: Inhibiter or Enabler of Innovation?

What: Regulation: Inhibiter or Enabler of Innovation? - Guest Presentation for Institute of Bankers, Bank Governance and Regulation Module

When: Thursday 5th November 2020.

Where: Online Event

Cost: Free

Registration: PRIVATE - for students.

Slides: In addition to the students, we are also making the 42 slide deck available to Fintech Ireland email subscribers. The slides are available here and are PASSWORD PROTECTED.

If you want the password you must be a FREE subscriber to Fintech Ireland BY JOINING OUR MAILING LIST HERE at https://fintechireland.com/get-involved.html. Subscribers will be sent the password and anyone who subscribed after we email the password to subscribers will receive the password in our welcome email. This is another free contribution by Fintech Ireland to an educational institution and its students.

Presenter: Peter Oakes, Board director of regulated fintech (MiFID, payments and emoney). Founder of Fintech Ireland, Fintech UK and Fintech Northern Ireland. Former senior central banker and regulator: Director Central Bank of Ireland (Enforcement & AML Supervision), Advisor to Governor & Deputy Governor (Banking Supervision), Saudi Arabia Monetary Authority; Enforcement Lawyer UK Financial Services Authority (now FCA); and Senior Legal Officer Australian Investments & Securities Commission.

Regulation: Inhibiter or Enabler of Innovation?

What: Regulation: Inhibiter or Enabler of Innovation? - Guest Presentation for Institute of Bankers, Bank Governance and Regulation Module

When: Thursday 5th November 2020.

Where: Online Event

Cost: Free

Registration: PRIVATE - for students.

Slides: In addition to the students, we are also making the 42 slide deck available to Fintech Ireland email subscribers. The slides are available here and are PASSWORD PROTECTED.

If you want the password you must be a FREE subscriber to Fintech Ireland BY JOINING OUR MAILING LIST HERE at https://fintechireland.com/get-involved.html. Subscribers will be sent the password and anyone who subscribed after we email the password to subscribers will receive the password in our welcome email. This is another free contribution by Fintech Ireland to an educational institution and its students.

Presenter: Peter Oakes, Board director of regulated fintech (MiFID, payments and emoney). Founder of Fintech Ireland, Fintech UK and Fintech Northern Ireland. Former senior central banker and regulator: Director Central Bank of Ireland (Enforcement & AML Supervision), Advisor to Governor & Deputy Governor (Banking Supervision), Saudi Arabia Monetary Authority; Enforcement Lawyer UK Financial Services Authority (now FCA); and Senior Legal Officer Australian Investments & Securities Commission.

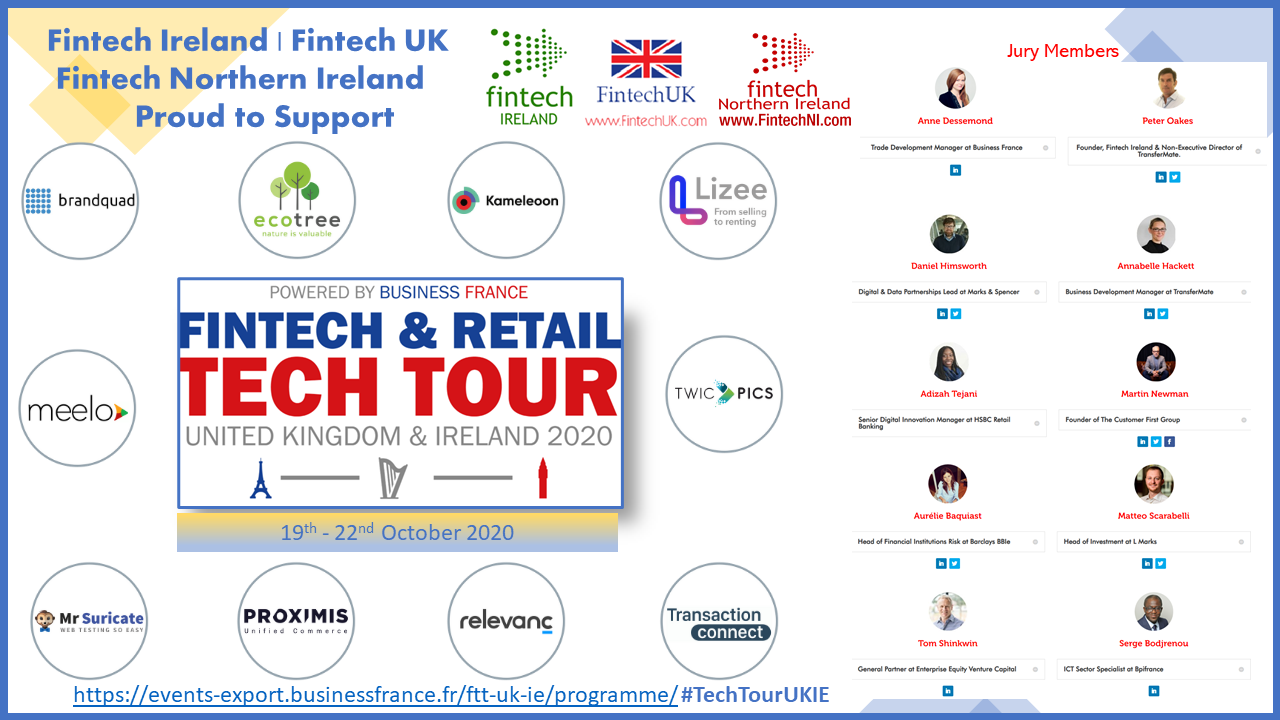

French Fintech & Retail Tour Tech Tour UK & Ireland 2020 (Powered by Business France. Supported by Fintech Ireland, Fintech UK & Fintech Northern Ireland)

UPDATE: Watch the video recording of the event on Youtube (Business France) YouTube (Fintech Ireland) or click here

21/10/2020 Panel - Embedded Finance (video links above)

What is s Embedded Finance, how is it being applied in financial services and other industries and what is the next evolution for Fintech. Fintech Ireland's and Fintech UK's Peter Oakes (https://www.linkedin.com/in/peteroakes/) moderated an exceptional panel of experts on Embedded Finance as part of the The Fintech Retail Tech Tour UK & Ireland (20th – 22nd October 2020).

The expert panel included:

* Ruth Foxe Blader, Partner Athemis Group (https://www.linkedin.com/in/ruthblader/);

* Christer Holloman, CEO and Co-Founder at Divido (https://www.linkedin.com/in/christerholloman/);

* Todd Latham, Chief Growth Officer at Currencycloud (https://www.linkedin.com/in/lathamtodd/); and

* Charles Pissavin, Business Development Manager at TransferMate (https://www.linkedin.com/in/charles-p-394b2a8b/)

What: French Fintech & Retail Tour Tech Tour UK & Ireland 2020. Powered by Business France. Supported by Fintech Ireland, Fintech UK & Fintech Northern Ireland. A 3-day event designed to increase the adoption of French technologies in 2 of the most vibrant British & Irish industries: financial services and retail. The Fintech & Retail Tech Tour UK & Ireland will bring together senior and top executives from banks, insurance companies, brick-and-mortar retailers, e-commerce players and investment & financial-related companies. Following 3 Fintech tours and 1 Retail Tech Tour, this new event will combine these 2 highly innovative sectors in Ireland and the UK, from 19th to 22nd October 2020.

When: Tuesday 19th – 22nd October

Learn More: Contact Business France at https://events-export.businessfrance.fr/ftt-uk-ie/contact/ and Pauline Tapié

Together with Fintech UK (FintechUK.com) and Fintech Northern Ireland (FintechNI.com) Fintech Ireland (FintechIreland.com) is proud to support for our third year now the annual French Fintech & Retail Tech Tour of the UK and Ireland with thanks to our friends at Business France. When Pauline Tapline, Trade Adviser New Technologies and Innovative Solutions at Business France contacted us, we jumped at the opportunity to throw our support behind the Tour again. Our Peter Oakes will be one of the Jury Members reviewing the excellent fintech and retail tech companies participating. Great to see leading Irish fintech TransferMate’s Annabelle Hackett also joining the event.

The reasons, and the benefit of greater collaboration and ties between Ireland, the UK and France, are obvious:

There is a great line up of French Fintech & Retail Tech Companies on the Tour, including:

UPDATE: Watch the video recording of the event on Youtube (Business France) YouTube (Fintech Ireland) or click here

21/10/2020 Panel - Embedded Finance (video links above)

What is s Embedded Finance, how is it being applied in financial services and other industries and what is the next evolution for Fintech. Fintech Ireland's and Fintech UK's Peter Oakes (https://www.linkedin.com/in/peteroakes/) moderated an exceptional panel of experts on Embedded Finance as part of the The Fintech Retail Tech Tour UK & Ireland (20th – 22nd October 2020).

The expert panel included:

* Ruth Foxe Blader, Partner Athemis Group (https://www.linkedin.com/in/ruthblader/);

* Christer Holloman, CEO and Co-Founder at Divido (https://www.linkedin.com/in/christerholloman/);

* Todd Latham, Chief Growth Officer at Currencycloud (https://www.linkedin.com/in/lathamtodd/); and

* Charles Pissavin, Business Development Manager at TransferMate (https://www.linkedin.com/in/charles-p-394b2a8b/)

What: French Fintech & Retail Tour Tech Tour UK & Ireland 2020. Powered by Business France. Supported by Fintech Ireland, Fintech UK & Fintech Northern Ireland. A 3-day event designed to increase the adoption of French technologies in 2 of the most vibrant British & Irish industries: financial services and retail. The Fintech & Retail Tech Tour UK & Ireland will bring together senior and top executives from banks, insurance companies, brick-and-mortar retailers, e-commerce players and investment & financial-related companies. Following 3 Fintech tours and 1 Retail Tech Tour, this new event will combine these 2 highly innovative sectors in Ireland and the UK, from 19th to 22nd October 2020.

When: Tuesday 19th – 22nd October

Learn More: Contact Business France at https://events-export.businessfrance.fr/ftt-uk-ie/contact/ and Pauline Tapié

Together with Fintech UK (FintechUK.com) and Fintech Northern Ireland (FintechNI.com) Fintech Ireland (FintechIreland.com) is proud to support for our third year now the annual French Fintech & Retail Tech Tour of the UK and Ireland with thanks to our friends at Business France. When Pauline Tapline, Trade Adviser New Technologies and Innovative Solutions at Business France contacted us, we jumped at the opportunity to throw our support behind the Tour again. Our Peter Oakes will be one of the Jury Members reviewing the excellent fintech and retail tech companies participating. Great to see leading Irish fintech TransferMate’s Annabelle Hackett also joining the event.

The reasons, and the benefit of greater collaboration and ties between Ireland, the UK and France, are obvious:

- €370 million raised by French Fintechs in 2018

- 42% of French Fintechs have activities worldwide

- 10,000 people work in Fintech in France

- Fintech, Insurtech & Regtech are the 3 segments driving growth across France’s retail & finance industries

- €803 million raised by 146 French Retail Tech start-ups in 2018 (+40% vs 2017)

There is a great line up of French Fintech & Retail Tech Companies on the Tour, including:

- BRANDQUAD

- https://brandquad.io/ https://twitter.com/BrandquadI https://www.linkedin.com/company/brandquad/

- ECOTREE

- https://ecotree.green/en/ https://twitter.com/EcoTree_contact https://www.linkedin.com/company/ecotree-international

- KAMELEOON

- https://www.kameleoon.com/en https://twitter.com/KameleoonAi / https://twitter.com/kameleoonrocks https://www.linkedin.com/company/kameleoon/

- MR SURICATE

- https://www.mrsuricate.com/ https://twitter.com/mistersuricate https://www.linkedin.com/company/mr-suricate

- PROXIMIS https://www.proximis.com https://twitter.com/ProximisUnified https://www.linkedin.com/company/proximis/

Ireland for Fintech – a European home for local and global fintech expansion

- European Union consultation on a new Digital Finance Strategy / Fintech Action Plan

Attendees and subscribers to Fintech Ireland mailing list were emailed the password to the slide on 25 June 2020. If you are you not in either group, we did not send you the email. The recording of the webinar is on our YouTube channel and above. If you don't wish to miss future events, subscribe to our email list. If you would like a copy of the slides, sign up to our mailing list and then send us an email to HELLO AT FINTECHIRELAND.COM and we'll you the password to the comprehensive deck of 78 slides.

What: Ireland for Fintech - a European home for local and global fintech expansion. The event, which will also cover the consultation for a new digital finance strategy for Europe / Fintech action plan, will include contributors from payments, regtech, blockchain and the Irish government's Department of Finance.

When: Tuesday 16th June 2020. Start time 2:00pm (Irish/UK time).

Where: Online Event

Cost: Free

Registration: CLOSED https://www.eventbrite.ie/e/ireland-for-fintech-eu-consultation-for-new-fintech-action-plan-tickets-109224214566?aff=FIWebsite [As usual we gave our Fintech Ireland subscribers advance notice to register prior to non-subscribers. If you are not a subscriber, join the email notification list at https://fintechireland.com/get-involved.html.]

Required reading: Did this get your attention? Suggest that before the webinar or during the webinar (if not already) familiarise yourself with the Consultation on a new digital finance strategy for Europe / Fintech action plan here

Details: The outcomes of this event include:

Agenda:

*Use of your data*: Please note that attendees' registration information will need be required by Fintech Ireland for the purposes of administering attendance and follow up communications on the event.

Your details will also be recorded for contact about future Fintech Ireland and Fintech UK events and news. And as we use MailChimp, there will be an easy to use unsubscribe link in each email we send.

Other terms and conditions: Please note that we reserve the right to accept, modify and cancel bookings.

Check out Fintech Ireland's handy authorisation guides for e-money institutions and payment institutions at https://fintechireland.com/fintech-authorisations.html

- European Union consultation on a new Digital Finance Strategy / Fintech Action Plan

- VIDEO: Click video image above or click here

- SLIDES: Click slide image above or click here (note slides are password protected. Use password sent to attendees and Fintech Ireland email subscribers on 25 June 2020). Large file 14MB / 76 slides

Attendees and subscribers to Fintech Ireland mailing list were emailed the password to the slide on 25 June 2020. If you are you not in either group, we did not send you the email. The recording of the webinar is on our YouTube channel and above. If you don't wish to miss future events, subscribe to our email list. If you would like a copy of the slides, sign up to our mailing list and then send us an email to HELLO AT FINTECHIRELAND.COM and we'll you the password to the comprehensive deck of 78 slides.

What: Ireland for Fintech - a European home for local and global fintech expansion. The event, which will also cover the consultation for a new digital finance strategy for Europe / Fintech action plan, will include contributors from payments, regtech, blockchain and the Irish government's Department of Finance.

When: Tuesday 16th June 2020. Start time 2:00pm (Irish/UK time).

Where: Online Event

Cost: Free

Registration: CLOSED https://www.eventbrite.ie/e/ireland-for-fintech-eu-consultation-for-new-fintech-action-plan-tickets-109224214566?aff=FIWebsite [As usual we gave our Fintech Ireland subscribers advance notice to register prior to non-subscribers. If you are not a subscriber, join the email notification list at https://fintechireland.com/get-involved.html.]

Required reading: Did this get your attention? Suggest that before the webinar or during the webinar (if not already) familiarise yourself with the Consultation on a new digital finance strategy for Europe / Fintech action plan here

Details: The outcomes of this event include:

- sharing with the audience some of the output from the Fintech Ireland Survey,

- giving an update on the fintech ecosystem

- hearing from Irish payments, regtech and blockchain experts about growing international businesses from Ireland,

- a brief update on the Ireland for Finance strategy, and

- as will be discussed during the Panel, the importance of Irish fintech attendees to have their voices heard in Europe by completing the European Commission's Consultation on a new digital finance strategy for Europe / Fintech Action Plan which closes on 26th June.

Agenda:

- Fintech Ireland Survey Results (interacts with Panel discussion): Peter Oakes, Fintech Ireland and CompliReg

- Payments - European and Global Innovation from Ireland: Gary Conroy, Chief Product & Commercial Officer, TransferMate Global Payments

- RegTech – Why is Ireland synonymous with RegTech?: Elizabeth McKeever, Head of Operations, GECKO Governance

- Blockchain – what are Ireland’s viable blockchain opportunities / Blockchain & Sustainable Digitisation : Sorcha Mulligan, Founder, The SME Chain

- Ireland for Finance Strategy – brief update on strategy and consultation paper: Dr. Paul Ryan, Head of International Finance Division, Department of Finance

- Panel discussion on each presenters insights plus a discussion on the EU Consultation Paper and suggestions for audience on completing the consultation moderated by Peter Oakes with Panel Members Elizabeth McKeever, Gary Conroy, Dr Paul Ryan and Sorcha Mulligan. An outcome of the Panel Session is to encourage firms to complete the EU Consultation, demonstrating why Ireland is a great place for fintech both indigenous and international firms

- Q&As of course!

*Use of your data*: Please note that attendees' registration information will need be required by Fintech Ireland for the purposes of administering attendance and follow up communications on the event.

Your details will also be recorded for contact about future Fintech Ireland and Fintech UK events and news. And as we use MailChimp, there will be an easy to use unsubscribe link in each email we send.

Other terms and conditions: Please note that we reserve the right to accept, modify and cancel bookings.

Check out Fintech Ireland's handy authorisation guides for e-money institutions and payment institutions at https://fintechireland.com/fintech-authorisations.html

[first posted by Fintech UK]

Panel: Has the crisis helped companies shift from being product-centric to customer centric, are they ready for consumer of 2021?

What: Fintech Week Lithuania: Panel: Has the crisis helped companies shift from being product-centric to customer-centric, are they ready for consumer of 2021?

When: Tuesday 16th June 2020. Start time 9:55am (Irish/UK time) / 11:55am (Lithuania time).

Where: Online Event.

Cost: Free

Registration: See registration link at https://fintechuk.com/events/covid19-fintech-shift-from-product-to-customer-centric

Details: Fintech UK's Peter Oakes* (Board Director at global fintech / payments business TransferMate) joins an excellent line up of fellow panel members Agnė Selemonaitė, Deputy CEO & Board Member at ConnectPay and Anastasija Oleinika, CEO of TWINO Group in a lively session moderated by Nick Price, Chief Executive of Bright Purple.

*Peter is also founder of Fintech Ireland, US Fintech, Fintech Cyprus, leading fintech advisory firm CompliReg and a director of several regulated fintech companies including Susquehanna International, Optal Financial Europe and AWM Wealth Advisers)

Panel: Has the crisis helped companies shift from being product-centric to customer centric, are they ready for consumer of 2021?

What: Fintech Week Lithuania: Panel: Has the crisis helped companies shift from being product-centric to customer-centric, are they ready for consumer of 2021?

When: Tuesday 16th June 2020. Start time 9:55am (Irish/UK time) / 11:55am (Lithuania time).

Where: Online Event.

Cost: Free

Registration: See registration link at https://fintechuk.com/events/covid19-fintech-shift-from-product-to-customer-centric

Details: Fintech UK's Peter Oakes* (Board Director at global fintech / payments business TransferMate) joins an excellent line up of fellow panel members Agnė Selemonaitė, Deputy CEO & Board Member at ConnectPay and Anastasija Oleinika, CEO of TWINO Group in a lively session moderated by Nick Price, Chief Executive of Bright Purple.

*Peter is also founder of Fintech Ireland, US Fintech, Fintech Cyprus, leading fintech advisory firm CompliReg and a director of several regulated fintech companies including Susquehanna International, Optal Financial Europe and AWM Wealth Advisers)

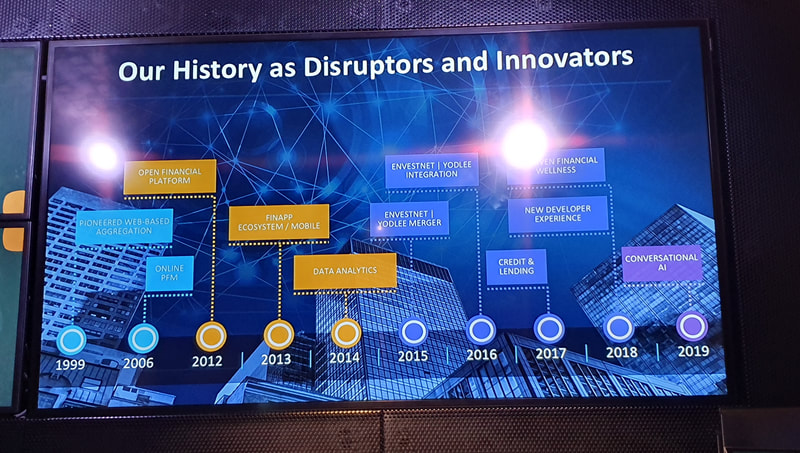

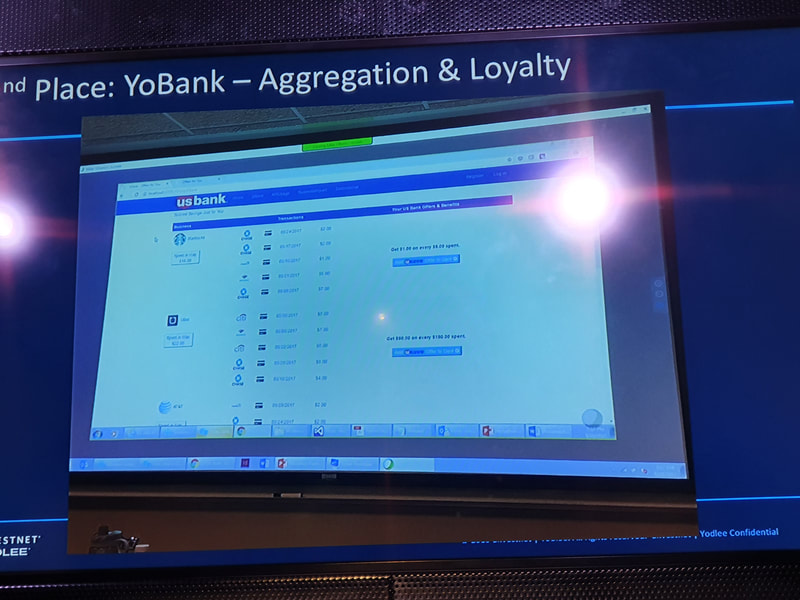

E-commerce and Open Finance: Headwinds and Tailwinds

What: E-commerce and Open Finance: Headwinds and Tailwinds with Yodlee and Fintech Ireland

When: Thursday 30th April 2020. Start time 4:00pm (Irish/UK time).

Where: Online Event

Cost: Free

Registration: https://www.eventbrite.ie/e/webinar-e-commerce-and-open-finance-headwinds-and-tailwinds-tickets-103724863860?aff=FIWebsite [If you are not on the Fintech Ireland subscriber list, join it at https://fintechireland.com/get-involved.html]

Join our experts Philippa Martinelli, Fintech Advisor / Specialist, Department for International Trade (DIT), Brian Costello, Envestnet|Yodlee, Sean Lee Rice, ClearBank® and Stijn Pieper, Revolut, me and our Master of Ceremonies Holly Weckler, Envestnet | Yodlee for great presentations and insightful thoughts on the Fintech industry, challenges, opportunities and particularly identifying and dealing with headwinds and tailwinds in E-Commerce and Open Finance, especially in the midst of a pandemic. This is a great mix of international fintech, banking and open finance experience from both industry and government.

Details: Envestnet|Yodlee and Fintech Ireland / Fintech UK are excited to partner on our Envestnet|Yodlee second Launchpad virtual event. This event will address the ever changing landscape for FinTech in the UK in relation to E-Commerce and Open Finance.

As we enter our “new normal”, what is next for FinTech in the UK and globally? Register for our webinar on April 30th at 4PM UK time to hear our fintech community experts from both industry and government discuss the following and more:

Speakers and Panelists:

What: E-commerce and Open Finance: Headwinds and Tailwinds with Yodlee and Fintech Ireland

When: Thursday 30th April 2020. Start time 4:00pm (Irish/UK time).

Where: Online Event

Cost: Free

Registration: https://www.eventbrite.ie/e/webinar-e-commerce-and-open-finance-headwinds-and-tailwinds-tickets-103724863860?aff=FIWebsite [If you are not on the Fintech Ireland subscriber list, join it at https://fintechireland.com/get-involved.html]

Join our experts Philippa Martinelli, Fintech Advisor / Specialist, Department for International Trade (DIT), Brian Costello, Envestnet|Yodlee, Sean Lee Rice, ClearBank® and Stijn Pieper, Revolut, me and our Master of Ceremonies Holly Weckler, Envestnet | Yodlee for great presentations and insightful thoughts on the Fintech industry, challenges, opportunities and particularly identifying and dealing with headwinds and tailwinds in E-Commerce and Open Finance, especially in the midst of a pandemic. This is a great mix of international fintech, banking and open finance experience from both industry and government.

Details: Envestnet|Yodlee and Fintech Ireland / Fintech UK are excited to partner on our Envestnet|Yodlee second Launchpad virtual event. This event will address the ever changing landscape for FinTech in the UK in relation to E-Commerce and Open Finance.

As we enter our “new normal”, what is next for FinTech in the UK and globally? Register for our webinar on April 30th at 4PM UK time to hear our fintech community experts from both industry and government discuss the following and more:

- Current UK FinTech Landscape

- Opportunities and Challenges for Scaling Globally for UK FinTech

- Open Banking vs. Open Finance – what is the difference? Why is it important?

- Successes and Failures with Open Finance in UK

- How is Open Finance benefiting E-Commerce?

- Where does the UK sit vis-à-vis its peers globally

- Advice for companies pursuing Open Banking in UK

Speakers and Panelists:

- Philippa Martinelli, Fintech Advisor / Specialist, Department for International Trade

- Brian Costello, Vice President, Data Strategy and Solutions, Envestnet|Yodlee

- Sean Lee Rice, Client Management, Clear Bank

- Stijn Pieper, Lead Product Owner, Revolut

- Peter Oakes, Founder, Fintech Ireland and Fintech UK

- Holly Weckler, Senior API FinTech Jedi at Envestnet|Yodlee

Webinar Videos

See below for the recording of the webinar. The first two videos are Part 1 and Part 2 of the webinar. The third video is the Linkedin promotional video.

|

|

|

|

The Fintech Ireland Webinar Series

Webinar #1: The 2020 Fintech Ireland Map Release Thursday 9th April 2020 at 1pm (Irish / UK time)

NB: 180 attendees have registered for this event within one day of its announcement. Don't miss out. See below on how to register to attend.

What: Fintech Ireland is launching the 2020 Fintech Ireland Map at its first in a series of webinars. We will be joined by Margaret Clancy of TransferMate Global Payments and Tommy Kearns of Xtremepush.

When: Thursday 9th April 2020. Start time 1:00pm (Irish/UK time) for one hour.

Where: Online Event

Cost: Free

Registration: The link to the Zoom webinar was sent to those who registered via Eventbrite before bookings closed at 10pm on 8th April. The event has proved very popular with close to 180 registered attendees. If you are keen to attend and didn't register on Eventbrite, click / copy & paste this link: https://zoom.us/webinar/register/5415863818341/WN_KWBUGrhrQrik-I4bzhU3XA

That link will take you to registration page at Zoom where you will complete your details and thereafter you will receive an email with your personal link to the webinar (please don't share).

Going forward to receive priority notice of our events, join our mailing list - Subscribe Here.

In addition to launching the updated Map, which will see the number of fintechs on the Map explode from 180 to well over 200, we will be joined by expert fintech guests to discuss the burgeoning Irish fintech landscape and to get their thoughts on the changes to Irish fintech in the past 12 months and how they see Irish fintechs scaling internationally and how they are dealing with current challenges.

Joining Peter Oakes of Fintech Ireland for the first in our series of Fintech Ireland Webinars are:

The event will cover:

*Use of your data*: Please note that attendees' registration information will need be required by Fintech Ireland for the purposes of administering attendance and follow up communications on the event.

Your details will also be recorded for contact about future Fintech Ireland and Fintech UK events and news. And as we use MailChimp, there will be an easy to use unsubscribe link in each email we send.

Other terms and conditions: Please note that we reserve the right to accept, modify and cancel bookings.

Check out Fintech Ireland's handy authorisation guides for e-money institutions and payment institutions at https://fintechireland.com/fintech-authorisations.html

Webinar #1: The 2020 Fintech Ireland Map Release Thursday 9th April 2020 at 1pm (Irish / UK time)

NB: 180 attendees have registered for this event within one day of its announcement. Don't miss out. See below on how to register to attend.

What: Fintech Ireland is launching the 2020 Fintech Ireland Map at its first in a series of webinars. We will be joined by Margaret Clancy of TransferMate Global Payments and Tommy Kearns of Xtremepush.

When: Thursday 9th April 2020. Start time 1:00pm (Irish/UK time) for one hour.

Where: Online Event

Cost: Free

Registration: The link to the Zoom webinar was sent to those who registered via Eventbrite before bookings closed at 10pm on 8th April. The event has proved very popular with close to 180 registered attendees. If you are keen to attend and didn't register on Eventbrite, click / copy & paste this link: https://zoom.us/webinar/register/5415863818341/WN_KWBUGrhrQrik-I4bzhU3XA

That link will take you to registration page at Zoom where you will complete your details and thereafter you will receive an email with your personal link to the webinar (please don't share).

Going forward to receive priority notice of our events, join our mailing list - Subscribe Here.

In addition to launching the updated Map, which will see the number of fintechs on the Map explode from 180 to well over 200, we will be joined by expert fintech guests to discuss the burgeoning Irish fintech landscape and to get their thoughts on the changes to Irish fintech in the past 12 months and how they see Irish fintechs scaling internationally and how they are dealing with current challenges.

Joining Peter Oakes of Fintech Ireland for the first in our series of Fintech Ireland Webinars are:

- Margaret Clancy, Commercial Director at TransferMate Global Payments

- Tommy Kearns, CEO & Co-Founder at Xtremepush

The event will cover:

- release of the updated Fintech Ireland Map

- webinar and future webinars will include presentations and panel guests, including CEOs and senior executives from a selection of fintech companies appearing on the Map

- opportunities and challenges facing Irish fintech growing locally and scaling internationally

- AND MUCH MORE

- We'll release further details of the 9th April 2020 event next week, including the Agenda and Speakers.

*Use of your data*: Please note that attendees' registration information will need be required by Fintech Ireland for the purposes of administering attendance and follow up communications on the event.

Your details will also be recorded for contact about future Fintech Ireland and Fintech UK events and news. And as we use MailChimp, there will be an easy to use unsubscribe link in each email we send.

Other terms and conditions: Please note that we reserve the right to accept, modify and cancel bookings.

Check out Fintech Ireland's handy authorisation guides for e-money institutions and payment institutions at https://fintechireland.com/fintech-authorisations.html

The Fintech Ireland Ecosystem

This is a private presentation for delegates of the STC (Saudi Arabia) to Ireland week of Monday 2nd March 2020. The slides are password protected for the delegates. Thanks to DogPatch Labs for reaching out to us to present to the delegation

What: The Fintech Ireland Ecosystem for delegates of STC Mission to Ireland.

When: Wednesday 4th March 2020

Where: DogPatch Labs, The Chq Building, Custom House Quay, North Dock, Dublin 1

Slides: Download slides with password here (password provided to attendees at event)

This is a private presentation for delegates of the STC (Saudi Arabia) to Ireland week of Monday 2nd March 2020. The slides are password protected for the delegates. Thanks to DogPatch Labs for reaching out to us to present to the delegation

What: The Fintech Ireland Ecosystem for delegates of STC Mission to Ireland.

When: Wednesday 4th March 2020

Where: DogPatch Labs, The Chq Building, Custom House Quay, North Dock, Dublin 1

Slides: Download slides with password here (password provided to attendees at event)

The Future of E-money - Modulr & Fintech Ireland

Check out Fintech Ireland's handy authorisation guides for e-money institutions and payment institutions at https://fintechireland.com/fintech-authorisations.html

Fully Booked: This event in Dublin has proved hugely popular. We are now fully booked.

Wait List: A wait list is in operation. Those that are subscribers to Fintech Ireland who join the wait list will receive priority if/when tickets become available. Our email list fills 90% of places for events, so you need to be on it to receive advance notice of events. If you are a subscriber, register for wait list here - www.eventbrite.ie/e/the-future-of-e-money-with-modulr-fintech-ireland-dublin-ireland-tickets-95466682417. Please don't show up unannounced if you have not registered for this event.

We are keeping this page up on Eventbrite to assist people register for the wait list and to access the Agenda below.

** If you can no longer attend, please cancel your registration at this page to free your place for another fintech enthusiast. **

Arrive at 800am for Registration & Networking.

What: Fintech Ireland is delighted to co-host with Modulr on 'The Future of E-money".

When: Tuesday 3rd March 2020 (Arrive at 800am - Ends at 1000am) in Dublin, Ireland

Where: DogPatch Labs, The Chq Building, Custom House Quay, North Dock, Dublin 1 [Map]

Cost: Free - thanks to Modulr

Registration: The link to the registration page is in the MailChimp email we sent to all of our 1,600 subscribers. If you don't subscribe to Fintech Ireland you need to! Subscribe Here. If you are a subscriber check your inbox (and junk mail - how could you!) for the email. With 1,600 subscribers and just 10 places left, you better move fast to join Modulr and us on Tuesday 3rd March 2020 at DogPatch Labs.

Wait list: Those that are subscribers to Fintech Ireland who join the wait list will receive priority if/when tickets become available. Register for wait list here - www.eventbrite.ie/e/the-future-of-e-money-with-modulr-fintech-ireland-dublin-ireland-tickets-95466682417

As at December 2019, the amount of electronic money issued in the euro area was €14 billion up 40% on the same month in 2018.

This phenomenal growth poses the big question of 'What is the Future of E-money'.

We'll unpack this question with practical insights on the growth and application of e-money with Myles Stephenson, Founder and Chief Executive and John Irwin, General Manager of Modulr, Peter Oakes, Founder of Fintech Ireland and Board Director of Regulated Fintech, J P Galligan, Partner at Clark Hill and Colin Sloan, Senior Manager at FSCom.

The event will also address:

Agenda:

Check out Fintech Ireland's handy authorisation guides for e-money institutions and payment institutions at https://fintechireland.com/fintech-authorisations.html

*Use of your data*: Please note that attendees' registration information will need to be shared between Fintech Ireland, Modulr and the venue hosts for the purposes of administering attendance and follow up communications on the event.

Your details will also be recorded for contact about future Fintech Ireland and Fintech UK events and news. And as we use MailChimp, there will be an easy to use unsubscribe link in each email we send.

Other terms and conditions: Please note that we reserve the right to accept, modify and cancel bookings.

Check out Fintech Ireland's handy authorisation guides for e-money institutions and payment institutions at https://fintechireland.com/fintech-authorisations.html

Fully Booked: This event in Dublin has proved hugely popular. We are now fully booked.

Wait List: A wait list is in operation. Those that are subscribers to Fintech Ireland who join the wait list will receive priority if/when tickets become available. Our email list fills 90% of places for events, so you need to be on it to receive advance notice of events. If you are a subscriber, register for wait list here - www.eventbrite.ie/e/the-future-of-e-money-with-modulr-fintech-ireland-dublin-ireland-tickets-95466682417. Please don't show up unannounced if you have not registered for this event.

We are keeping this page up on Eventbrite to assist people register for the wait list and to access the Agenda below.

** If you can no longer attend, please cancel your registration at this page to free your place for another fintech enthusiast. **

Arrive at 800am for Registration & Networking.

What: Fintech Ireland is delighted to co-host with Modulr on 'The Future of E-money".

When: Tuesday 3rd March 2020 (Arrive at 800am - Ends at 1000am) in Dublin, Ireland

Where: DogPatch Labs, The Chq Building, Custom House Quay, North Dock, Dublin 1 [Map]

Cost: Free - thanks to Modulr

Registration: The link to the registration page is in the MailChimp email we sent to all of our 1,600 subscribers. If you don't subscribe to Fintech Ireland you need to! Subscribe Here. If you are a subscriber check your inbox (and junk mail - how could you!) for the email. With 1,600 subscribers and just 10 places left, you better move fast to join Modulr and us on Tuesday 3rd March 2020 at DogPatch Labs.

Wait list: Those that are subscribers to Fintech Ireland who join the wait list will receive priority if/when tickets become available. Register for wait list here - www.eventbrite.ie/e/the-future-of-e-money-with-modulr-fintech-ireland-dublin-ireland-tickets-95466682417

As at December 2019, the amount of electronic money issued in the euro area was €14 billion up 40% on the same month in 2018.

This phenomenal growth poses the big question of 'What is the Future of E-money'.

We'll unpack this question with practical insights on the growth and application of e-money with Myles Stephenson, Founder and Chief Executive and John Irwin, General Manager of Modulr, Peter Oakes, Founder of Fintech Ireland and Board Director of Regulated Fintech, J P Galligan, Partner at Clark Hill and Colin Sloan, Senior Manager at FSCom.

The event will also address:

- How fintech companies are banks’ biggest challenges when it comes to an automated and instant economy.

- Regulation of e-money and other fintech in Ireland.

- Where Modulr fits into the Irish fintech ecosystem.

Agenda:

- 8-8:30 – Check-in, Networking, Breakfast.

- 8:30-8:55 – Welcome, Introduction and Update on Fintech Ecosystem in Ireland. Peter Oakes & John Irwin.

- 9:00 – 9:25 – Overview of emerging payments and where Modulr fits into this space.

- 9:25 – 9:45 – Panel: The Future of Emoney. Panel = Myles Stephenson, J P Galligan and Colin Sloan / Chair = Peter Oakes.

- 9:45-9:55 – Q&A

- 9:55 – 10:00 – Wrap up and Thank You. John Irwin.

- 10:00 – 10:30 – Optional Networking Time.

Check out Fintech Ireland's handy authorisation guides for e-money institutions and payment institutions at https://fintechireland.com/fintech-authorisations.html

*Use of your data*: Please note that attendees' registration information will need to be shared between Fintech Ireland, Modulr and the venue hosts for the purposes of administering attendance and follow up communications on the event.

Your details will also be recorded for contact about future Fintech Ireland and Fintech UK events and news. And as we use MailChimp, there will be an easy to use unsubscribe link in each email we send.

Other terms and conditions: Please note that we reserve the right to accept, modify and cancel bookings.

Peter Oakes, Founder, Fintech Ireland and Consultant to Clark Hill on fintech, regtech and financial services regulation is moderating a fantastic panel of experts in Cyprus on Thursday 6th February in at the ACAMS Anti-Financial Crime Symposium.

Peter is moderating a Panel comprising of:

We are discussing the hot topic of “Riding the Waves and Staying on the Board: Effectively Mitigating Financial Crime Risks in the Growing Virtual Asset Service Provider (VASP) Industry”

https://www.acams.org/anti-financial-crime-symposium-cyprus/

Peter is moderating a Panel comprising of:

- Professor George M. Giaglis, Executive Director of the Institute for the Future (IFF) at the University of Nicosia (UNIC), as well as a leading expert on blockchain technology and applications.

- Kayla Izenman, Research Analyst at the Royal United Services Institute’s Centre for Financial Crime and Security Studies

- Danielle Jukes, Consultant, FINTRAIL

We are discussing the hot topic of “Riding the Waves and Staying on the Board: Effectively Mitigating Financial Crime Risks in the Growing Virtual Asset Service Provider (VASP) Industry”

https://www.acams.org/anti-financial-crime-symposium-cyprus/

Fintech Bridge - Fintech Ireland and FinTech Scotland

** THIS EVENT TAKES PLACE IN GLASGOW, SCOTLAND, UK **

What: A collaboration between www.FintechIreland.com and www.FinTechScotland.com. A Fintech Bridge Event in Glasgow Scotland by Fintech Ireland and Fintech Scotland and supported by Fintech UK, Deloitte and Envestnet | Yodlee

When: Thursday 16th January 2020 (530-830pm) in Glasgow, Scotland, United Kingdom

Where: Deloitte (Glasgow Office) 110 Queen Street, Glasgow, Scotland, G1 3BX, UK

Cost: Hey, we are Fintech Ireland - it's FREE

Registration: Make your booking here - https://www.eventbrite.ie/e/fintech-bridge-fintech-ireland-fintech-scotland-glasgow-scotland-uk-tickets-86359546729

Fintech Ireland (@FintechIreland) and Fintech Scotland (@FintechScotland) are joining effort to create a unique event that brings together two great FinTech communities across the sea and gives you the opportunity to expand your network whilst gaining insight into current innovation trends in two leading global Celtic FinTech hubs.

Agenda:

530pm: Arrive for Registration into Event

600pm: Event starts

We are working on the program for the event as we type and so stay tuned - more details to follow.

All Fintech Ireland events fill quickly, so reserve your seat today!

*Use of your data*: Please note that attendees' registration information will need to be shared between Fintech Ireland, FinTech Scotland, Fintech UK and other event partners for the purposes of administering attendance.

Your details will also be recorded for contact about future events and news. And as we use MailChimp, there will be an easy to use unsubscribe link in each email we send.

Other terms and conditions: Please note that we reserve the right to accept, modify and cancel bookings.

** THIS EVENT TAKES PLACE IN GLASGOW, SCOTLAND, UK **

- We are developing the agenda over the coming weeks. We may add additional speakers, sponsors and content in response to the activity this event is creating in Ireland and Scotland. Thanks to those that have reached out to offer thoughts and sponsorship.

- We are looking for two fintech/regtechs from Ireland and two fintech/regtechs from Scotland to join us on a panel. If interested email hello@fintechireland.com. You will need to pay your own way to Glasgow and accommodation (Fintech Ireland is a free network and there is no fee to attendees to join the event) and in return you will get our marketing support and will be showcased on the evening to a great Celtic Fintech audience and fantastic network opportunities. We expect to get receive a good response to this call for fintechs/regtechs, so please get in touch at hello@fintechireland.com ASAP

What: A collaboration between www.FintechIreland.com and www.FinTechScotland.com. A Fintech Bridge Event in Glasgow Scotland by Fintech Ireland and Fintech Scotland and supported by Fintech UK, Deloitte and Envestnet | Yodlee

When: Thursday 16th January 2020 (530-830pm) in Glasgow, Scotland, United Kingdom

Where: Deloitte (Glasgow Office) 110 Queen Street, Glasgow, Scotland, G1 3BX, UK

Cost: Hey, we are Fintech Ireland - it's FREE

Registration: Make your booking here - https://www.eventbrite.ie/e/fintech-bridge-fintech-ireland-fintech-scotland-glasgow-scotland-uk-tickets-86359546729

Fintech Ireland (@FintechIreland) and Fintech Scotland (@FintechScotland) are joining effort to create a unique event that brings together two great FinTech communities across the sea and gives you the opportunity to expand your network whilst gaining insight into current innovation trends in two leading global Celtic FinTech hubs.

Agenda:

530pm: Arrive for Registration into Event

600pm: Event starts

- Welcome

- Fintech Ireland Presentation (including updates on our Fintech Ireland Survey and the equally famous Fintech Ireland Map)

- Fintech Scotland Presentation (update on current and future initiatives for Scottish fintech)

- A couple of senior industry stakeholder presentations

- Meet the fintechs/regtechs - 2 x Irish fintechs and 2 x Scottish fintechs will take to the stage to explain their business models, the challenges they are trying to solve with fintech/regtech and their journeys to date.

- Panel Session 1 (moderated by Fintech Ireland) - Session with the 4 fintechs/regtechs unpacking the points made during their updates, where they see the industry heading and what government and other stakeholders can do more to advance fintech.

- Panel Session 2 (moderated by Fintech Scotland) - Session with selection of banks, investors and other senior level stakeholders on where they see fintech/regtech heading, what opportunities they look for when deciding if and how to partner or invest in fintech/regtech initiatives

- Networking

We are working on the program for the event as we type and so stay tuned - more details to follow.

All Fintech Ireland events fill quickly, so reserve your seat today!

*Use of your data*: Please note that attendees' registration information will need to be shared between Fintech Ireland, FinTech Scotland, Fintech UK and other event partners for the purposes of administering attendance.

Your details will also be recorded for contact about future events and news. And as we use MailChimp, there will be an easy to use unsubscribe link in each email we send.

Other terms and conditions: Please note that we reserve the right to accept, modify and cancel bookings.

Photo Gallery - Merry Fintech Christmas Drinks

Merry Fintech Christmas Drinks

With thanks to Envestnet | Yodlee together with its Senior API Jedi, Holly Weckler and the team at Envestnet | Yodlee , Fintech Ireland is delighted to announce an evening of festivities with a Merry Fintech Christmas Drinks on Tuesday 17th December 2019 (600--800pm) at Dogpatch Labs, The Chq Building, Custom House Quay, North Dock, Dublin to celebrate and look back on a great Irish Fintech Year that was 2019.

We'll talk through the results of our famous Fintech Ireland Survey and fingers crossed (if the elves work hard enough) we may be in a position to announce and release the updated (equally famous) Fintech Ireland Map. Join us and your fintech peers for a lively evening of fun and frivolities as we hit the final countdown for Christmas and New Year

Date: Tuesday 17th December 2019, 600-800pm

Venue: Dogpatch Labs, The Chq Building, Custom House Quay, North Dock, Dublin 1

Sponsors: Envestnet | Yodlee

Start of Festivities: 600pm

End of Proceedings: 800pm

Cost: Hey, we are Fintech Ireland - it's FREE

REGISTER HERE: www.eventbrite.ie/e/merry-fintech-christmas-drinks-tickets-85808107359

Refreshments and nibbles will be served thanks to our Sponsors Envestnet | Yodlee.

*Use of your data*: Please note that attendees' registration information will need to be shared between Fintech Ireland, Yodlee and DogPatch Labs, and other event Partners for the purposes of administering attendance.

Your details will also be recorded for contact about future events and news. And as we use MailChimp, there will be an easy to use unsubscribe link in each email we send.

Other terms and conditions: Please note that we reserve the right to accept, modify and cancel bookings.

With thanks to Envestnet | Yodlee together with its Senior API Jedi, Holly Weckler and the team at Envestnet | Yodlee , Fintech Ireland is delighted to announce an evening of festivities with a Merry Fintech Christmas Drinks on Tuesday 17th December 2019 (600--800pm) at Dogpatch Labs, The Chq Building, Custom House Quay, North Dock, Dublin to celebrate and look back on a great Irish Fintech Year that was 2019.

We'll talk through the results of our famous Fintech Ireland Survey and fingers crossed (if the elves work hard enough) we may be in a position to announce and release the updated (equally famous) Fintech Ireland Map. Join us and your fintech peers for a lively evening of fun and frivolities as we hit the final countdown for Christmas and New Year

Date: Tuesday 17th December 2019, 600-800pm

Venue: Dogpatch Labs, The Chq Building, Custom House Quay, North Dock, Dublin 1

Sponsors: Envestnet | Yodlee

Start of Festivities: 600pm

End of Proceedings: 800pm

Cost: Hey, we are Fintech Ireland - it's FREE

REGISTER HERE: www.eventbrite.ie/e/merry-fintech-christmas-drinks-tickets-85808107359

Refreshments and nibbles will be served thanks to our Sponsors Envestnet | Yodlee.

*Use of your data*: Please note that attendees' registration information will need to be shared between Fintech Ireland, Yodlee and DogPatch Labs, and other event Partners for the purposes of administering attendance.

Your details will also be recorded for contact about future events and news. And as we use MailChimp, there will be an easy to use unsubscribe link in each email we send.

Other terms and conditions: Please note that we reserve the right to accept, modify and cancel bookings.

Photo Gallery - Global Open Banking: Fintechs, Banks & Regulators

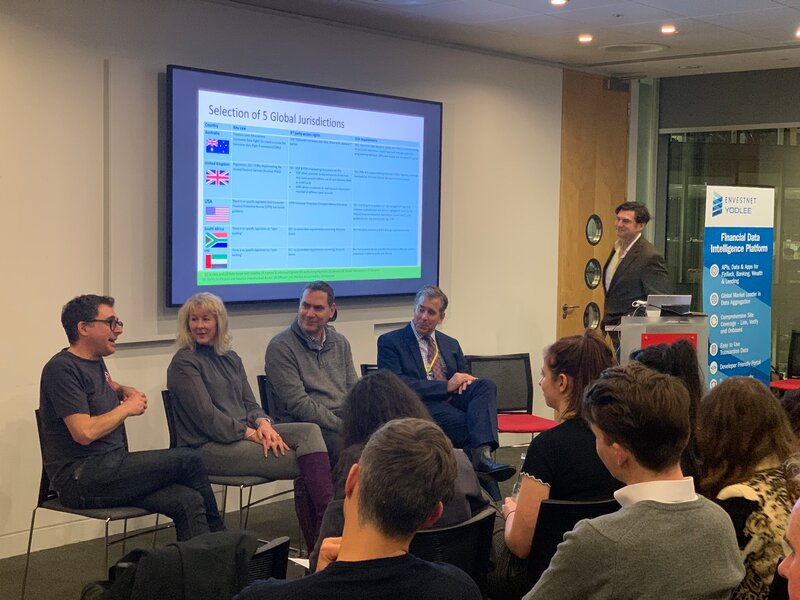

Global Open Banking: Fintechs, Banks & Regulators

** THIS EVENT TAKES PLACE IN LONDON **

Fintech Ireland and Fintech UK are delighted to partner with Envestnet | Yodlee to bring you an evening of insightful fintech presentations and a lively Panel debate on Global Open Banking. We'll host a short presentation followed by a Panel of Experts session. Speakers include:

Date: Tuesday 10th December 2019. 600-830pm

Venue: London & Partners, 6th Floor, 2 More London Riverside, London SE1 2RR, United Kingdom [MAP]

Sponsors: Envestnet | Yodlee

Registration: 600pm (don't be late)

Start of Proceedings: 630pm (sharp)

End of Proceedings: 830pm

REGISTER HERE https://www.eventbrite.ie/e/global-open-banking-fintechs-banks-regulators-tickets-84529021579

Refreshments and nibbles will be served thanks to our Sponsors Envestnet | Yodlee

Open Banking is a hot buzz word right now but what does it mean in a Global Ecosystem? Being a global company, Envestnet | Yodlee under

stands the importance of the initiative and is bringing together industry experts from all over the world for a lively discussion on what’s happening now, what’s next, and how it impacts the global ecosystem. Join us for networking, drinks, and appetizers to discuss Open Banking and Global FinTech Innovation.

*Use of your data*: Please note that attendees' registration information will need to be shared between Fintech Ireland, Yodlee and London & Partners, and other event partners for the purposes of administering attendance.

Other terms and conditions: Please note that we reserve the right to accept, modify and cancel bookings.

There will be photography and/or filming at this event and your image may be captured by us and used for promotional purposes in print on our website. By registering for the event you are giving us your permission to use your image in this way. If you have any queries about this, however, please email hello@fintechireland.com

** THIS EVENT TAKES PLACE IN LONDON **

Fintech Ireland and Fintech UK are delighted to partner with Envestnet | Yodlee to bring you an evening of insightful fintech presentations and a lively Panel debate on Global Open Banking. We'll host a short presentation followed by a Panel of Experts session. Speakers include:

- Holly Weckler, Senior API FinTech Jedi at Envestnet | Yodlee (yes, that is Holly's job title!)

- Peter Oakes, Founder of Fintech Ireland and Fintech UK

- Shaul David, Partnerships and New Propositions, Railsbank

- Samantha Seaton, CEO, Moneyhub Enterprise

- Bill Parsons, Group President, Data & AI/Analytics, and International, Envestnet | Yodlee

- Brian Costello, Vice President, Data Strategy & Strategic Solutions at Envestnet | Yodlee

- Kevin Sefton, CEO, Untied

Date: Tuesday 10th December 2019. 600-830pm

Venue: London & Partners, 6th Floor, 2 More London Riverside, London SE1 2RR, United Kingdom [MAP]

Sponsors: Envestnet | Yodlee

Registration: 600pm (don't be late)

Start of Proceedings: 630pm (sharp)

End of Proceedings: 830pm

REGISTER HERE https://www.eventbrite.ie/e/global-open-banking-fintechs-banks-regulators-tickets-84529021579

Refreshments and nibbles will be served thanks to our Sponsors Envestnet | Yodlee

Open Banking is a hot buzz word right now but what does it mean in a Global Ecosystem? Being a global company, Envestnet | Yodlee under

stands the importance of the initiative and is bringing together industry experts from all over the world for a lively discussion on what’s happening now, what’s next, and how it impacts the global ecosystem. Join us for networking, drinks, and appetizers to discuss Open Banking and Global FinTech Innovation.

*Use of your data*: Please note that attendees' registration information will need to be shared between Fintech Ireland, Yodlee and London & Partners, and other event partners for the purposes of administering attendance.

Other terms and conditions: Please note that we reserve the right to accept, modify and cancel bookings.

There will be photography and/or filming at this event and your image may be captured by us and used for promotional purposes in print on our website. By registering for the event you are giving us your permission to use your image in this way. If you have any queries about this, however, please email hello@fintechireland.com

|

Irish Tech Companies: want to do more business in Britain?

Date: Thursday 14 November 2019 Venue: London and Patrners, London, United Kingdom Slides: Click here for our slides Information: Our Peter Oakes will discuss "What we're hearing and seeing from Irish fintechs scaling into London" Registration: https://www.bita.ie/event/detail/seminar--growing-irish-tech-companies-in-the-uk-market-.html By the way, Fintech Ireland is a member of the British Irish Trading Alliance. See https://www.bita.ie/search/index/?keyword=fintech+ireland |

Fintech Abu Dhabi 2019

Date: Monday 21-Wednesday 23 October 2019

Venue: Abu Dhabi National Exhibition Centre - ADNEC

Registration: www.eventbrite.ie/e/fintech-state-of-the-global-nation-tickets-73257991625

Our Peter Oakes is to representing Fintech Ireland at Fintech Abu Dhabi 21-23 October 2019.

Big thanks to Allie Laurent and Darren Murphy of Unbound Live for the opportunity to attend & speak at #FintechAbuDhabi.

Abu Dhabi is a thriving innovative fintech centre. This is Fintech Ireland's second of three trips to Abu Dhabi this year.

We had such an excellent trip last time with meetings with government, industry and regulatory experts we have decided to return. If you a UK fintech looking at the opportunities a relationship with Abu Dhabi can deliver, why not join us 21-23 October and take the opportunity to:

There is brilliant support for fintech within the Abu Dhabi Global Market Regulatory Authority. If you're thinking of a regulatory presence in the UAE, make sure you discuss your ambitions with the team there. Richard Teng, Thomas Hirschi, Vishal Sacheendran and Fraser Brown

www.fintechabudhabi.com

Date: Monday 21-Wednesday 23 October 2019

Venue: Abu Dhabi National Exhibition Centre - ADNEC

Registration: www.eventbrite.ie/e/fintech-state-of-the-global-nation-tickets-73257991625

Our Peter Oakes is to representing Fintech Ireland at Fintech Abu Dhabi 21-23 October 2019.

Big thanks to Allie Laurent and Darren Murphy of Unbound Live for the opportunity to attend & speak at #FintechAbuDhabi.

Abu Dhabi is a thriving innovative fintech centre. This is Fintech Ireland's second of three trips to Abu Dhabi this year.

We had such an excellent trip last time with meetings with government, industry and regulatory experts we have decided to return. If you a UK fintech looking at the opportunities a relationship with Abu Dhabi can deliver, why not join us 21-23 October and take the opportunity to:

- discuss with us how to establish your #UKFintech business in Abu Dhabi and your Abu Dhabi Fintech company in the UK;

- network with 5,000 fellow FinTech professionals;

- attend 2 days of FinTech-focused content;

- hear from leaders of global fintech companies;

- update our knowledge on #cybersecurity #regtech #suptech fintech #tonenization #blockchain

- watch #startups & #scaleups compete in pitch battles;

- learn about the challenges facing the MENA region; and

- identify opportunities for #UKFintech.

There is brilliant support for fintech within the Abu Dhabi Global Market Regulatory Authority. If you're thinking of a regulatory presence in the UAE, make sure you discuss your ambitions with the team there. Richard Teng, Thomas Hirschi, Vishal Sacheendran and Fraser Brown

www.fintechabudhabi.com

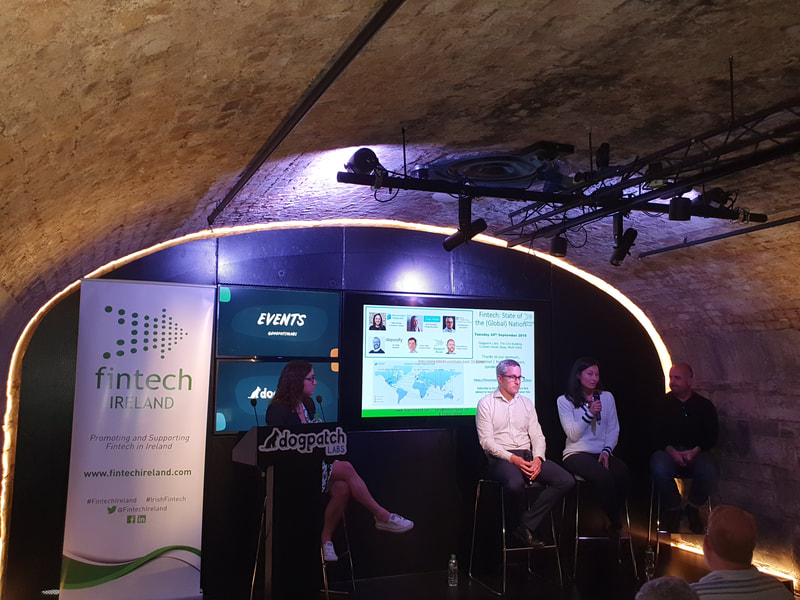

Photo Gallery - Fintech: State of the (Global) Nation

Fintech: State of the (Global) Nation

Date: Tuesday 24th September. 600-800pm

Venue: Dogpatch Labs, The Chq Building, Custom House Quay, North Dock, Dublin

Sponsors: Envestnet | Yodlee

Registration: 600pm (don't be late)

Start of Proceedings: 630pm (sharp)

End of Proceedings: 800pm

Cost: Hey, we are Fintech Ireland - it's FREE

Registration: www.eventbrite.ie/e/fintech-state-of-the-global-nation-tickets-73257991625

Fintech Ireland is delighted to partner with Envestnet | Yodlee to bring you an evening of insightful fintech presentations and a lively Panel debate on the status of Fintech in Ireland and internationally. We'll host two short presentations and a Panel of Experts session.

Refreshments and nibbles will be served thanks to our Sponsors Envestnet | Yodlee.

*Use of your data*: Please note that attendees' registration information will need to be shared between Fintech Ireland, Yodlee and DogPatch Labs, and other event Partners for the purposes of administering attendance.

Other terms and conditions: Please note that we reserve the right to accept, modify and cancel bookings.

Date: Tuesday 24th September. 600-800pm

Venue: Dogpatch Labs, The Chq Building, Custom House Quay, North Dock, Dublin

Sponsors: Envestnet | Yodlee

Registration: 600pm (don't be late)

Start of Proceedings: 630pm (sharp)

End of Proceedings: 800pm

Cost: Hey, we are Fintech Ireland - it's FREE

Registration: www.eventbrite.ie/e/fintech-state-of-the-global-nation-tickets-73257991625

Fintech Ireland is delighted to partner with Envestnet | Yodlee to bring you an evening of insightful fintech presentations and a lively Panel debate on the status of Fintech in Ireland and internationally. We'll host two short presentations and a Panel of Experts session.

- Holly Weckler, Senior API FinTech Jedi at Envestnet | Yodlee (yes, that is Holly's job title!) will present on US perspectives on international trade and will give the audience an introduction to Envestnet | Yodlee and its plans for Ireland and Europe. Holly will also address how financial services incumbents are responding to ever increasing number of disruptors and what the international fundraising scene looks like for Fintech.

- Peter Oakes, Founder of Fintech Ireland will provide a review of Fintech in 2019 thus far and will read the tea leaves for Fintech opportunities and challenges 2020-2025. Fintech Ireland will also release data from its ongoing Survey and explain, using the famous Fintech Ireland Map, who is doing what in the Irish Fintech scene and how & where Irish Fintech is planning to scale.

- Following the two presentations, Holly Weckler will moderate a Panel of Experts including Lizzy Hayashida, Co-Founder of Change Donations and Jon Bayle, Founder of Deposify. The Panel will unpack and explore the presentation topics, and will also throw-in a number of additional insights into the mix based on what they are seeing and experiencing when doing business internationally.

Refreshments and nibbles will be served thanks to our Sponsors Envestnet | Yodlee.

*Use of your data*: Please note that attendees' registration information will need to be shared between Fintech Ireland, Yodlee and DogPatch Labs, and other event Partners for the purposes of administering attendance.

Other terms and conditions: Please note that we reserve the right to accept, modify and cancel bookings.

4th Annual Blockchain for Finance 2019 EU

Date: 7th-9th October 2019

Venue: Raddisson Blu Royal Hotel, Dublin 2 [Map here]

Brochure: Download the Brochure now for the full speaker line-up, agenda, audience analysis and the Fintech Ireland discounted registration rates at - http://bit.ly/2HdHCjH

Discount Code: If you are asked for the discount code during registration, use discount code - FINRE10

Key Features for BFC EU 2019:

Date: 7th-9th October 2019

Venue: Raddisson Blu Royal Hotel, Dublin 2 [Map here]

Brochure: Download the Brochure now for the full speaker line-up, agenda, audience analysis and the Fintech Ireland discounted registration rates at - http://bit.ly/2HdHCjH

Discount Code: If you are asked for the discount code during registration, use discount code - FINRE10

Key Features for BFC EU 2019:

- 300+ SENIOR LEVEL DELEGATES from banks, insurance companies, stock exchanges, fintechs, tech companies & blockchain tech companies

- 50+ EXPERT SPEAKERS discussing latest advancements ripe for disruption including payments, capital markets, trade finance & digital identity

- 15+ LIVE DEMO STATIONS showcasing the leading technical solutions transforming financial services

- LATEST TECH TRENDS Explore key technologies disrupting financial services such as DLT/blockchains, AI/machine learning, big data, cloud & more

- INTERACTIVE WORKSHOPS hosted by Deloitte helping you to get to grips with the basics of coding

- VIP PRE-CONFERENCE DRINKS EVENING Join us at Deloitte’s Blockchain Lab for more content and networking on the evening of October 7th

Ireland China Financial Forum Breakfast Briefing

Event: Ireland China Financial Forum Breakfast Briefing (Ireland China Business Association & Bank of Ireland)

Date: Wednesday 11th September 2019

Time: 08.00am - 10.00am

Venue: Bank of Ireland

Details: Peter Oakes of Fintech Ireland is doing a Q&A with Enterprise Ireland's Head of Financial Services & FinTech, Asia-Pacific, Mo Harvey, discussing the fintech ecosystem and fintech opportunities in Ireland and China.

Attendance: To attend, you need to contact the Ireland China Business Association at http://irelandchina.org/contact-us/

The event will be opened by Paul Ryan, Head of International Finance Division, Department of Finance. Attendees will receive a China market update, followed by panel discussion on fintech, funds and financial services.

Slides from the Event - click here (there is no password to open or save the slides)

Enterprise Ireland's Guides - Mainland China and Hong Kong, China

Event: Ireland China Financial Forum Breakfast Briefing (Ireland China Business Association & Bank of Ireland)

Date: Wednesday 11th September 2019

Time: 08.00am - 10.00am

Venue: Bank of Ireland

Details: Peter Oakes of Fintech Ireland is doing a Q&A with Enterprise Ireland's Head of Financial Services & FinTech, Asia-Pacific, Mo Harvey, discussing the fintech ecosystem and fintech opportunities in Ireland and China.

Attendance: To attend, you need to contact the Ireland China Business Association at http://irelandchina.org/contact-us/

The event will be opened by Paul Ryan, Head of International Finance Division, Department of Finance. Attendees will receive a China market update, followed by panel discussion on fintech, funds and financial services.

Slides from the Event - click here (there is no password to open or save the slides)

Enterprise Ireland's Guides - Mainland China and Hong Kong, China

Event: Choose New Jersey

Date: Monday 8th July 2019

Time: 1100am - 2.00pm

Venue: J.P. Morgan, Dublin, Ireland

Details: Peter Oakes of Fintech Ireland presenting on the Irish fintech ecosystem and opportunities for them in New Jersey.

CLICK HERE FOR SLIDES

Date: Monday 8th July 2019

Time: 1100am - 2.00pm

Venue: J.P. Morgan, Dublin, Ireland

Details: Peter Oakes of Fintech Ireland presenting on the Irish fintech ecosystem and opportunities for them in New Jersey.

CLICK HERE FOR SLIDES

Event: French Fintech Tour

Date: Thursday 4th July 2019

Time: Full day

Venue: LinkedIN Campus, Dublin, Ireland

Details: Peter Oakes of Fintech Ireland presenting on Irish and French fintech ecosystems.

CLICK HERE FOR SLIDES

Date: Thursday 4th July 2019

Time: Full day

Venue: LinkedIN Campus, Dublin, Ireland

Details: Peter Oakes of Fintech Ireland presenting on Irish and French fintech ecosystems.

CLICK HERE FOR SLIDES

Event: Banking Litigation Forum

Date: Friday 25th May 2019

Time: Full day

Venue: Leman Solicitors, Dublin, Ireland

Details: Peter Oakes of Fintech Ireland presenting on regulation, compliance and regtech.

Thanks to Ronan McGoldrick, Partner, Litigation and Dispute Resolution Team at Leman Solicitors for the invitation to talk on regulation, compliance and regtech, which a focuss on senior manager accountability across the globe in financial services and culture.

CLICK HERE FOR SLIDES

Date: Friday 25th May 2019

Time: Full day

Venue: Leman Solicitors, Dublin, Ireland

Details: Peter Oakes of Fintech Ireland presenting on regulation, compliance and regtech.

Thanks to Ronan McGoldrick, Partner, Litigation and Dispute Resolution Team at Leman Solicitors for the invitation to talk on regulation, compliance and regtech, which a focuss on senior manager accountability across the globe in financial services and culture.

CLICK HERE FOR SLIDES

Event: FS DUBLIN FORUM (www.FSDublin.com) Breakfast. In conversation - Alastair Lukies, CBE (Chair of Motive Partners, Chair of the Fintech Alliance and the UK Prime Minister's Business Ambassador for Fintech) and Peter Oakes (Founder, Fintech Ireland and FintechUK.com)

Date: Thursday 23rd May 2019

Time: Breakfast Forum 07:30-1030am

Venue: Stephens Green Hibernian Club, 9 Stephens Green, Dublin 2

Registration: Registration Closed. See media coverage about the event here

The event is for senior decision-makers and professionals working in Banking, Insurance, FinTech, Asset Management, Financial Services, Investment companies and financial departments. It’s a free event for senior financial services professionals.

FS DUBLIN Forum is an event that gathers together financial services leaders to discuss and debate the ever-evolving Fintech industry and how these evolutions will affect the industry in Ireland as a global financial services hub.

See media coverage about the event here

Date: Thursday 23rd May 2019

Time: Breakfast Forum 07:30-1030am

Venue: Stephens Green Hibernian Club, 9 Stephens Green, Dublin 2

Registration: Registration Closed. See media coverage about the event here

The event is for senior decision-makers and professionals working in Banking, Insurance, FinTech, Asset Management, Financial Services, Investment companies and financial departments. It’s a free event for senior financial services professionals.

FS DUBLIN Forum is an event that gathers together financial services leaders to discuss and debate the ever-evolving Fintech industry and how these evolutions will affect the industry in Ireland as a global financial services hub.

See media coverage about the event here

Event: 7th NEXGEN PAYMENTS FORUM - Innovation in a disruptive digital economy

Date: Thursday 9th May to Friday 10th May 2019

Time: Full day each day

Venue: Grand Hotel Excelsior, Valetta, Malta

Registration: Full details of Speakers, Partners, Agenda and how to book here

The Qube NEXTGEN Payments Forum has become a leading forum for the exchange of practical and thought provoking dialogue and challenge for innovative fintech, payments and regtech and policy makers, central banks and regulators. Our Peter Oakes has again been invited to chair a number of Panel and Challenger Sessions at the event. Take your seat next to a diverse mix of professionals - institutional members, policymakers, executives from leading corporations, Bankers, Fintechs and Merchants, gathering for two days to explore every aspect of the way we pay.

Date: Thursday 9th May to Friday 10th May 2019

Time: Full day each day

Venue: Grand Hotel Excelsior, Valetta, Malta

Registration: Full details of Speakers, Partners, Agenda and how to book here

The Qube NEXTGEN Payments Forum has become a leading forum for the exchange of practical and thought provoking dialogue and challenge for innovative fintech, payments and regtech and policy makers, central banks and regulators. Our Peter Oakes has again been invited to chair a number of Panel and Challenger Sessions at the event. Take your seat next to a diverse mix of professionals - institutional members, policymakers, executives from leading corporations, Bankers, Fintechs and Merchants, gathering for two days to explore every aspect of the way we pay.

Event: Fintech Ireland trade mission to Abu Dhabi

Date: Tuesday 30th April to Thursday 2nd June 2019

Time: Full day each day

Venue: Abu Dhabi

Details: Contact us at hello@fintechireland.com.

Fintech Ireland is continuing its international tour of hot fintech hubs. After the successful launch of Fintech Cyprus (www.fintechcyprus.com) and before we go to Malta for QUBE Events and Fintech Malta (www.fintechmalta.com) on 8-10 May, we are heading to Abu Dhabi. We will be in Abu Dhabi from Tuesday 30th April for meetings with the fintech community and the people including the Government and regulators which are enabling the growth of Fintech in Abu Dhabi.

If you are an Irish or a UK fintech firm (we are www.fintechuk.com too), looking to learn more about Abu Dhabi or an Abu Dhabi finserv or fintech looking to learn more about Ireland's (or UK's) ecosystem, get in contact with us ASAP as the diary for the visit is filling fast. We believe that there are great opportunities for collaboration.

Did you know: Abu Dhabi Global Market (ADGM) is an important strategic partner of innovation and fintech and is also Abu Dhabi’s award winning International Financial Centre and business hub, that is ranked #1 FinTech Hub in MENA? This is a great achievement by many in Abu Dhabi including Mr Richard Teng, Chief Executive Officer, Financial Services Regulatory Authority of ADGM and his team.

Announcement of Visit on Linkedin - https://www.linkedin.com/feed/update/urn:li:activity:6526139288231378944

Date: Tuesday 30th April to Thursday 2nd June 2019

Time: Full day each day

Venue: Abu Dhabi

Details: Contact us at hello@fintechireland.com.

Fintech Ireland is continuing its international tour of hot fintech hubs. After the successful launch of Fintech Cyprus (www.fintechcyprus.com) and before we go to Malta for QUBE Events and Fintech Malta (www.fintechmalta.com) on 8-10 May, we are heading to Abu Dhabi. We will be in Abu Dhabi from Tuesday 30th April for meetings with the fintech community and the people including the Government and regulators which are enabling the growth of Fintech in Abu Dhabi.