- To be informed of upcoming Fintech Ireland Events and Meetups subscribe to our Newsletter here.

- We will be co-hosting / hosting further Fintech Ireland events in 2024. If you are looking to co-host and/or sponsor these events contact us at [email protected].

|

Future events and sponsorship:

0 Comments

Join Fintech Ireland on 11 June 2025 in Dublin, Ireland as it partners with Global Government Fintech Lab 2025What: Global Government Fintech Lab 2025 When: Wednesday 11 June 2025 Where: Dublin, Ireland Details: Fintech Ireland's Peter Oakes will join a stellar line up of experts at the fourth Global Government Fintech Lab 2025 taking place in Dublin, Ireland on Wednesday 11 June 2025. Registration: More details about Registration HERE Costs:

The Lab is being organised in partnership with Department of Finance Ireland, which also hosted the Global Government Fintech Lab in 2024 and 2023. Attending Organisations 2024Fintech Ireland PartnershipFintech Ireland is delighted to be partnering with the Global Government Fintech Lab 2025. We have been provided a special offer for fintechs in the Fintech Ireland Network. Contact us at [email protected] to learn more. Who Should Attend?This event is for government departments, public sector agencies and authorities looking to capitalise on the possibilities of technology to transform their operations and the services they deliver and the event also welcomes professionals from the Private Sector too. Learn more at the Registration Page Who is Speaking?Thus far, speakers announced include:

As further speakers are added, we will update here. Registration: Last minute bookings/confirmation of existing bookings for this event can be made directly at the Zoom Webinar Page HERE What: Banking without a Bank and Payments Orchestration. Part of the Fintech Leaders' Series. This webinar with Feargal Brady, CEO NoFrixion When: Tuesday 4th March 2025 at 09:00am (1 hour) Where: Webinar - Link will be made available after registration and before the event.. Cost: Free Registration: Last minute bookings/confirmation of existing bookings for this event can be made directly at the Zoom Webinar Page HERE Details: Join Fintech Ireland when we meet and hear from serial entrepreneur Feargal Brady, CEO & Co-Founder of leading Irish fintech NoFrixion on “Banking without a Bank and Payments Orchestration”. Feargal will also share insights on what’s ahead for NoFrixion and fintech in 2025 and beyond This is the first of many Fintech Leaders' Series Webinars to be hosted by Fintech Ireland in 2025. Although we have agreed further Fintech Leaders' Series Speakers, we may have overlooked an important stakeholder. If you feel that is you, then contact us via the email address on our website to express your interest and share bullet points about what you believe our audience will be interested in about you and your fintech. *Use of your data*: Please note that attendees' registration information will need be required by Fintech Ireland for the purposes of administering attendance and follow up communications on the event. Your details will also be recorded for contact about future Fintech Ireland, Fintech UK, USTechFin, Crypto Assets Ireland and CompliReg events and news. And as all use MailChimp, there will be an unsubscribe link in each email we send.

Other terms and conditions: These are set out in the booking process at Eventbrite. Please note that we reserve the right to accept, modify and cancel bookings. There will be photography and/or filming/recording at this event and your image may be captured by us and used for promotional purposes in print on our website. By registering for the event you are giving us your permission to use your image in this way. If you have any queries about this, however, please email [email protected] All Fintech Ireland events fill quickly, so reserve your seat today! Check out Fintech Ireland's and CompliReg’s handy authorisation guides for e-money institutions and payment institutions at https://fintechireland.com/fintech-authorisations.html Keep in touch with Fintech Ireland by:

SLIDES HERE FOR ATTENDEES (PASSWORD PROTECTED)Booking ClosedFintech Ireland is very happy to be one of the first supporters of the excellent initiative of Crypto Assets Ireland. The aim is to build a network and voice for the #cryptoasset and #digitalasset community in Ireland to help issuers, exchanges and service providers and those closely connected to scale locally and globally. Registration Link - CLICK HERE Click the Map for a Larger Image Bookings ClosedCrypto Asset Ireland - Launch Thursday 30th January 2025What: “Crypto Asset Launch”.

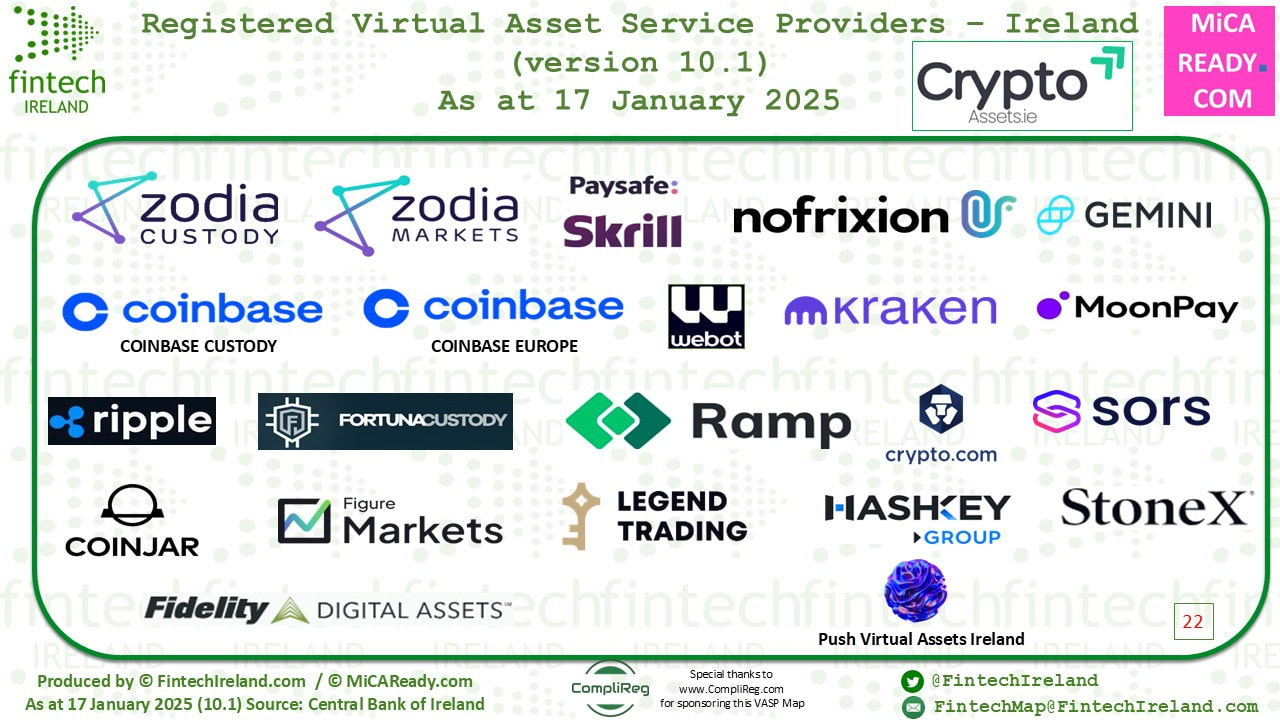

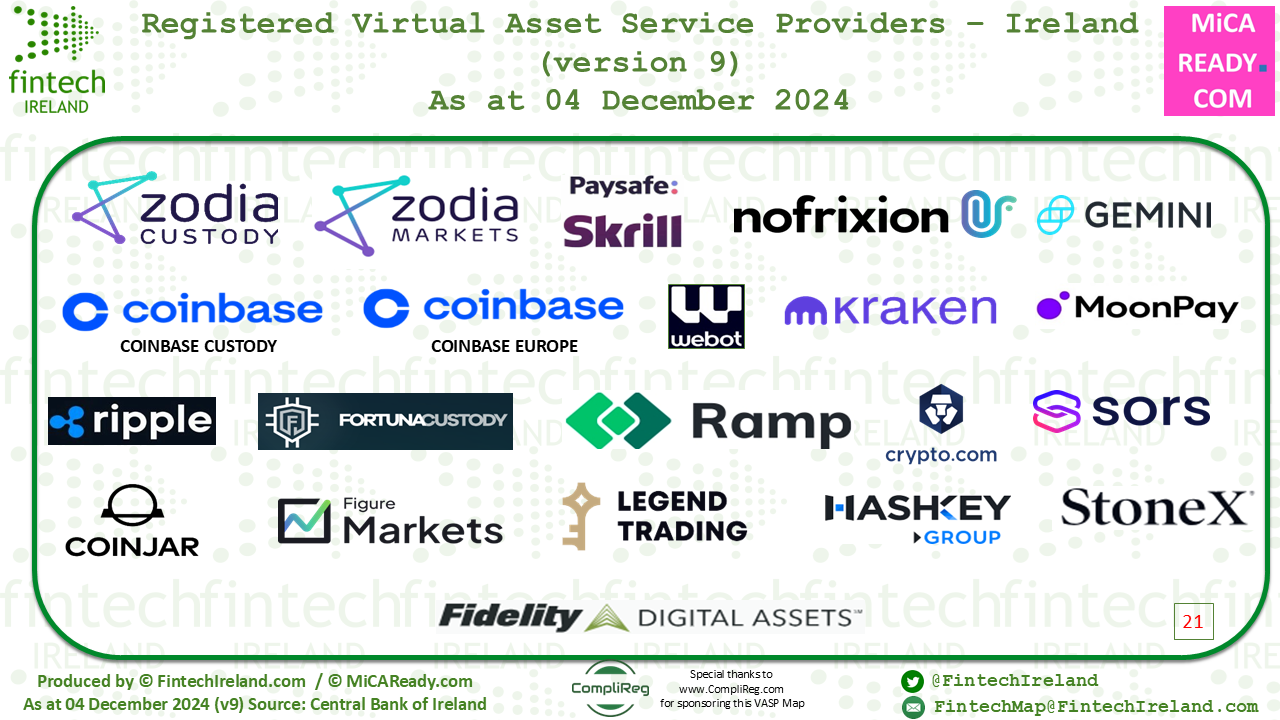

When: 0900am, Thursday 30th January 2025. Concludes at 1100am. Where: Intercept Technologies, Glandore Business Centre, Fitzwilliam Hall, Fitzwilliam Place, Dublin 2 Cost: Free Registration: Bookings Closed Details: Launch of Crypto Assets Ireland. Congratulations Joe McCann and others for walking the walk when many other just talk the talk by launching Crypto Assets Ireland. Launch date Thursday 30th January 2025 (link below to register your request to attend). Fintech Ireland is very happy to be one of the first supporters of this excellent initiative to build a network and voice for the #cryptoasset and #digitalasset community in Ireland to help issuers, exchanges and service providers and those closely connected to scale locally and globally. Attendees: We are going to ask for some patience. We will prioritise booking requests from VASPs, CASPs and those going through the regulatory process. Then will will do our best to accommodate other stakeholders to attend as much as possible. This will be subject to the size of the venue, and if we need a bigger boat, I think we can find one. PLEASE NOTE THAT YOU MUST REGISTER WITH A BUSINESS EMAIL ADDRESS (NO HOTMAIL, GMAIL OR OUTLOOK ETC, IE PERSONAL DATA EMAIL ADDRESSES). *Use of your data*: Please note that the Data Controllers for the event are Intercept Technologies and Fintech Ireland . The Data Controllers will receive the data from your registration form in order to administer services to attendees on the day, including ingress and egress from the venue. and for follow up communications after the event. Your details will also be recorded for contact about future events of the Data Controllers, jointly or severally. Fintech Ireland uses MailChimp. There will be an unsubscribe link in each email we send. Other terms and conditions: Please note that we reserve the right to accept, modify and cancel bookings. ** SLIDES FOR ATTENDEES ONLY HERE ** Password has been sent to attendees WE ARE NOW CLOSED FOR BOOKINGS ** SLIDES FOR ATTENDEES ONLY HERE ** Password has been sent to attendees WE ARE NOW CLOSED FOR BOOKINGS. Thanks to those that have registered. We have hit full capacity for the Venue. ** 2025 MiCAR RoundTable Event ** If you see this post and have missed out on the 12th December event, contact us at [email protected] with a cc to [email protected] with your name, company name and mobile to register interest in an early 2025 event. We broaden the attendee base for a 2025 event subject to demand. To apply for a limited spot at the Roundtable - CLICK HERE (this will open an email to [email protected]). Be great if you would please insert your company name and MiCAR Rountable in the subject header. Please note that this event is co-hosted by MiCAReady.com. You need to use a corporate email address to book. Note this event is for firms registered as VASPs and those applying for authorisation under MiCA. Your attendance will be confirmed following your registration of interest. You must use a corporate email address to book. What: MiCAR Key Facts Document Industry Roundtable [Markets in Crypto-Asset Regulation] When: 0830 Registration for 900am Kick-Off, Thursday 12th December 2024. Where: Dublin City Location* Cost: Free Registration: To apply for a limited spot at the Roundtable - CLICK HERE (this will open an email to [email protected]). Be great if you would please insert your company name and MiCAR Rountable in the subject header. Please note that this event is co-hosted by MiCAReady.com. You need to use a corporate email address to book. * Dublin City Location - We have two central Dublin locations reserved. The venue choice will depend upon bookings) Details: The Industry Roundtable will discuss the Central Bank of Ireland’s KFD, approaches to dealing with questions/issues posed within (15 sections and 5 Appendices), authorisation strategies and execution of MiCAR authorisation application. This Industry Roundtable is for firms registered as VASPs and those applying for authorisation under MiCAR. Your attendance will be confirmed following your registration of interest. You must use a corporate email address to book. Did you know that Ireland is now home to 21 Registered Virtual Asset Service Providers? Six (6) virtual assets service providers join the latest Fintech Ireland / MiCA Ready Map (thanks to CompliReg.com supporting the Map)!Fintech Ireland is thrilled to announce the inaugural Fintech Ireland Summit, taking place in Dublin Ireland on Thursday 28 November 2024 in conjunction with the Finance Leadership Summit. It is an event so big that it needs its own webpage. See the Agenda here: https://www.financesummit.ie/fintech Click here to learn more and register your interest to discuss sponsoring, exhibiting, speaking and/or attending on Thursday 28th November 2024. Fintech is now a settled part of everyday life. Yet it risks being misunderstood in terms of its potential and limitations. The Fintech Ireland Summit will focus on the challenges and opportunities for fintech as a driver for economic growth with real-life showcases while looking ahead to future enablers of fintech and techfin. See the Agenda here: https://www.financesummit.ie/fintech Join us the first Fintech Ireland Summit this November to contribute to unleashing the potential and addressing the limitation of the new digital and decentralised world. Who should attend: This summit welcomes ambitious, innovative fintech professionals from all sectors and financial leaders committed to steering their organisations toward a resilient future through strategic talent management and robust technological integration. Click here to learn more and register your interest to discuss sponsoring, exhibiting, speaking and/or attending on Thursday 28th November 2024.

CLOSED FOR BOOKINGS. WAITLIST IN OPERATION. Registration Link - CLICK HERE (waitlist in operation) Topic: "An international fintech journey, what to consider when growing from domestic startup to international scaleup”Fintech Ireland is partnering with Fintech Wales, The Welsh Government in Ireland, PWC and the British Irish Chamber of Commerce to convene key players from the Irish and Welsh fintech ecosystems to explore key challenges and discuss best practice in international scaling. Wales is home to an abundance of household fintech names including Go.Compare, Admiral, Money Supermarket, Confused.com, Monzo, Startling Tandem and Zero. What: “An international fintech journey, what to consider when growing from domestic startup to international scaleup”. When: 0730am, Wednesday 18th September 2024. Concludes at 0915am. Where: PwC Ireland, One Spencer Dock, North Wall Quay, North Wall, Dublin 1 Cost: Free Registration: Register to attend this in-person Event. CLICK HERE Details: From development of an innovative idea, to ensuring financial stability through growth stage and dealing with rules and regulations and crucially attracting the talent required to evolve from startup to scaleup. Join us on the 18th September to hear from an expert panel and guest speakers to discuss all of these key challenges from both an Irish and Welsh viewpoint. Running order on the day will be:

Panel

Fintech Ireland is delighted to be supporting yet another free Fintech Bridge Event as part of its continuing effort to host informative fintech events. Fintech Ireland Event page for this event - https://fintechireland.com/events/fintech-bridge-ireland-and-wales

Fintech Ireland page for all Events - https://fintechireland.com/events.html Going forward to receive priority notice of our events, join our mailing list - Subscribe Here. *Use of your data*: Please note that Fintech Ireland and the Welsh Government are joint Data Controllers for this event. PwC Ireland and British Irish Chamber of Commerce are are Data Processors. Data Controllers will receive the name and company of attendees in order to administer services to attendees on the day, including ingress and egress from the venue. Attendees' registration information will be required by Fintech Ireland and the Welsh Government for the purposes of administering the event, your attendance and follow up communications on the event. Your details will also be recorded for contact about future Fintech Ireland, Fintech UK, USTechFin and CompliReg events and news. And as all use MailChimp, there will be an unsubscribe link in each email we send. Other terms and conditions: Please note that we reserve the right to accept, modify and cancel bookings. There will be photography and/or filming/recording at this event and your image may be captured by us and used for promotional purposes in print on our website. By registering for the event you are giving us your permission to use your image in this way. If you have any queries about this, however, please email [email protected] All Fintech Ireland events fill quickly, so reserve your seat today! To ensure you don't miss out on future events subscribe to https://fintechireland.com/get-involved.html and follow us on twitter - https://twitter.com/FinTechIreland Keep in touch with Fintech Ireland by:

Fintech Ireland Summit Thursday 24th November 2024 Fintech Ireland is thrilled to announce the inaugural Fintech Ireland Summit, taking place in Dublin Ireland on Thursday 28 November 2024 in conjunction with the Finance Leadership Summit.

It is an event so big that it needs its own webpage. See the Agenda here: https://www.financesummit.ie/fintech Click here to learn more and register your interest to discuss sponsoring, exhibiting, speaking and/or attending on Thursday 28th November 2024. Fintech is now a settled part of everyday life. Yet it risks being misunderstood in terms of its potential and limitations. The Fintech Ireland Summit will focus on the challenges and opportunities for fintech as a driver for economic growth with real-life showcases while looking ahead to future enablers of fintech and techfin. See the Agenda here: https://www.financesummit.ie/fintech Join us the first Fintech Ireland Summit this November to contribute to unleashing the potential and addressing the limitation of the new digital and decentralised world. Who should attend: This summit welcomes ambitious, innovative fintech professionals from all sectors and financial leaders committed to steering their organisations toward a resilient future through strategic talent management and robust technological integration. Click here to learn more and register your interest to discuss sponsoring, exhibiting, speaking and/or attending on Thursday 28th November 2024. Join us at the The Global Government Fintech Lab 2024 on 25th April 2024 at The Printworks, Dublin Castle, Ireland Offers for Fintech Ireland supporters to avail of:

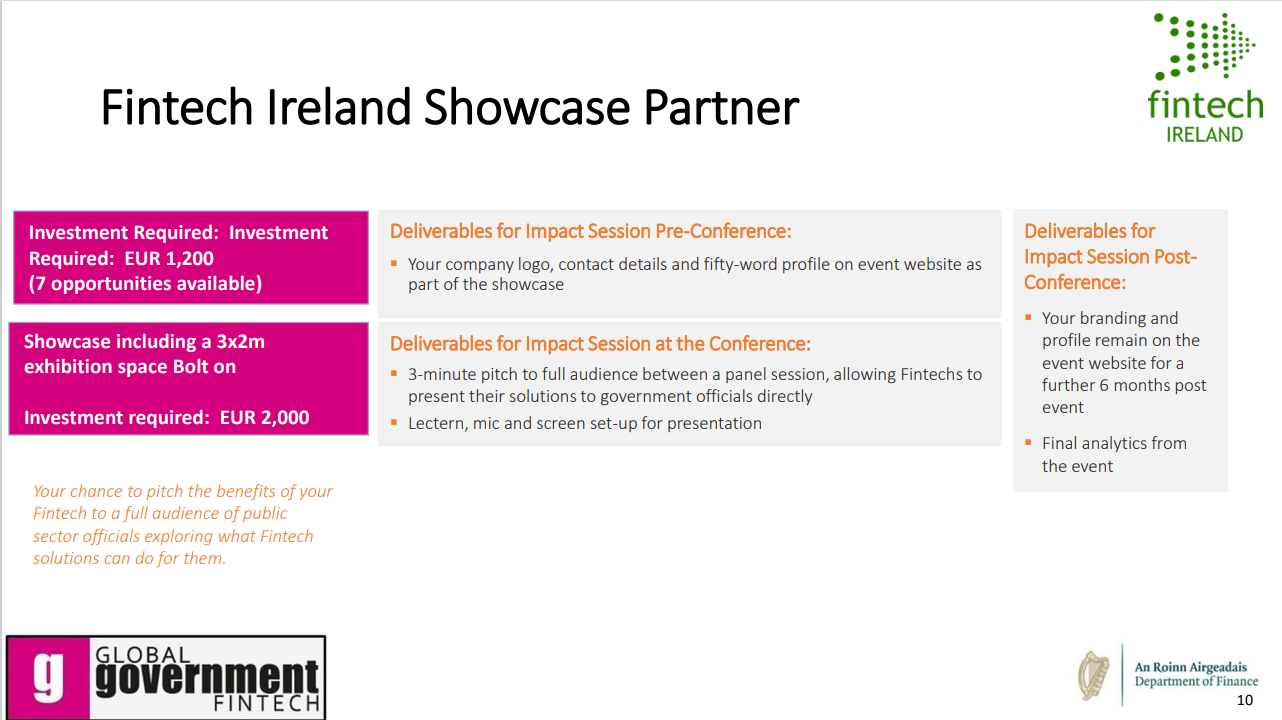

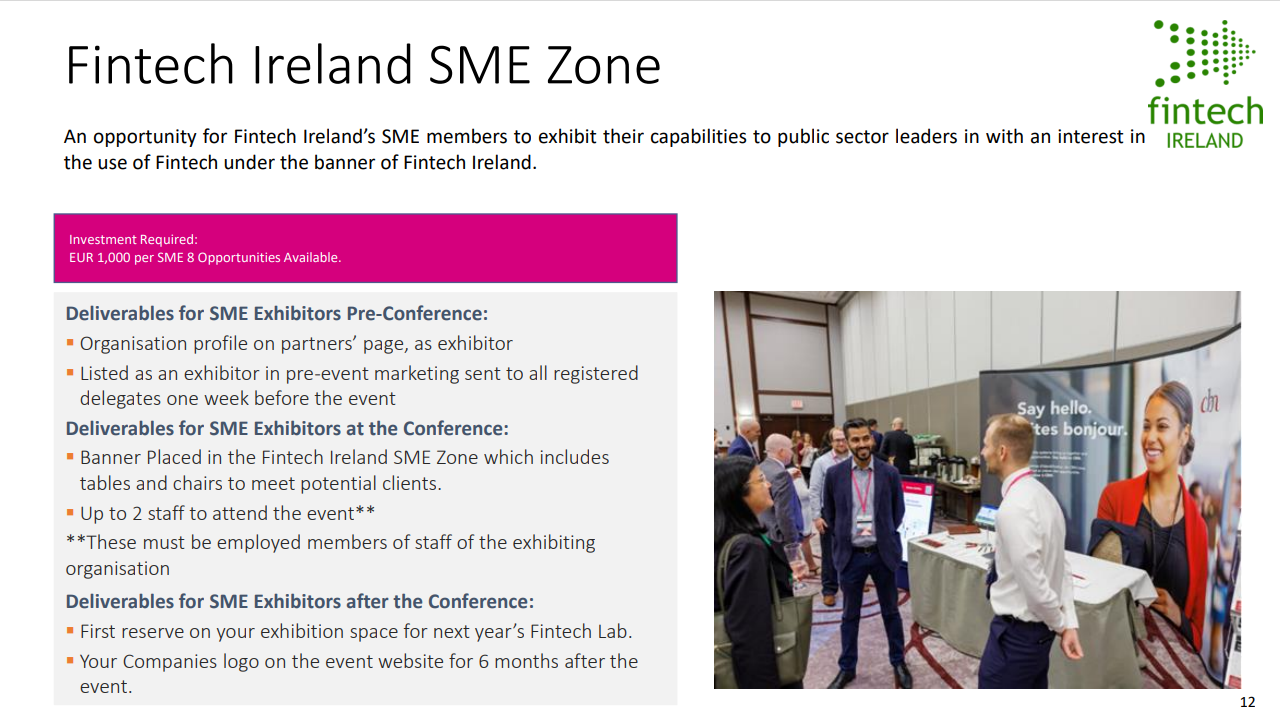

Registration: To sign up as an attendee, register through Fintech Ireland's link here. NB The event is free to attend if you are a public servant and a fair fee is charged for non-public servants. "This was one of the best events I joined in 2023. Access to regulators and central bankers is unparalleled. The openness of the dialogue was greatly appreciated. An excellent learning experience and many wonderful & meaningful connections made. This event was last held in Dublin on 18th May 2023 at Dublin Castle. (see details of the 2023 event here). It was an excellent event. It is returning to the Printworks Building at Dublin Castle on 25th April 2024 and Fintech Ireland is delighted to be partnering with the organisers. Fintech Ireland has worked with the team at Global Government Fintech to provide the following exclusive offers:

SEE FULL DETAILS HERE - Global Government Fintech, LAB, 25 April 2024 Fintech Ireland Members Pack To speak to the team at Global Government Fintech to learn more about the sponsorship and exhibitor offerings, including the Fintech Ireland Showcase Partner offering and the Fintech Ireland SME Zone offering please speak with: Matt Hoare Media Sales Director Global Government Forum T: +44 20 4583 6160 E: [email protected] And you can contact us at [email protected] if you would like to hear about our positive experience of working with the Global Government Fintech Team at the 2023 event. What: The Global Government Fintech Lab 2024

Keynote speeches, panel discussions, topic specific sessions and more, including: Governments and fintech: on the right path?; Financial regulators and innovative technology: on the right path?; Public sector financial innovation through payments technology; Fighting financial fraud with technology; frontiers of public sector fintech (and beyond). When: Thursday 25th April 2024 (08:30-19:00, Irish Time) Who: Those regulated under the Central Bank of Ireland regime and those interested in it. In PCF role holders such as INEDs, CEO, CFOs, COOs, Compliance Officers, MLROs, CROs, CIOs and their colleagues. Professional services firms and regulators/central banks (near and far) welcome too. Where: The Printworks, Dublin Castle, Ireland. Offers for Fintech Ireland supporters to avail of:

Registration: To sign up as an attendee, register through Fintech Ireland's link here. NB The event is free to attend if you are a public servant and a fair fee is charged for non-public servants. Agenda:

SLIDES FROM TODAY - CLICK HERE What: The Financial Crime Forum: Online EU When: Tuesday 16th April 2024 14:00-16:00 Frankfurt Time (1pm Irish/UK time) Where: Online Registration: To register to attend and to see the Programme details, visit: Team Leader at Expertise France for the European Commission, Since January 2019, David Hotte has been the Team Leader of the EU Global Facility, a European Union project dedicated on AML/CFT. Since 1998, he has particularly worked in the field of AML/CFT in developing countries for several national and international organizations (including UNDCP, IMF and the Office of the High Representative in Bosnia). He has undertaken numerous technical assistance missions on AML/CFT issues providing technical advice to several countries and regional Organizations, including French and English-speaking African countries, Bosnia, Palestine, Sri Lanka, Turkey, China, Laos and Syria. Prior to joining international organizations he was serving in the Gendarmerie Nationale with the rank of lieutenant. Christian is the founder of Human Risk, a Behavioural Science led Consulting and Training Firm, specialising in the fields of Ethics & Compliance. He was formerly MD at UBS where he was Head of Behavioural Science. Christian joined the Firm in Compliance & Operational Risk Control, leading the function globally for UBS Asset Management. Prior to joining UBS, he was COO of the UK Prudential Regulation Authority, a subsidiary of the Bank of England responsible for regulating financial services. He is the author of a book ‘Humanizing Rules’ and the presenter and producer of the Human Risk podcast. Peter is a professional INED of several globally operating fintech companies covering electronic trading, investment services and payments sectors. Peter is well-known in the fintech community, having established the free FintechIreland.com network in 2014. Through CompliReg.com he advises boards and executives on EU establishment. Peter has also established fintech networks in the UK, Malta, Cyprus and Lithuania. Peter has worked in senior roles at Central Bank of Ireland (Director of Enforcement & Money Laundering), the (now) UK FCA, ASIC (Australia) & SAMA. Peter is qualified as a solicitor in Ireland, the UK and Australia. Who Should Attend: Founders, Financial Crime Risk and Compliance Officers, Law enforcement Legislators, policy-makers and regulators, C-Suite officers in commerce, trade and industry, Risk managers Insurance underwriters, Venture Capitalists/Investment funds, Owners and Directors of corporations and other business structures, Trustees, Computer scientists, Data analysts, On-line marketing practitioners and Customer engagement specialists. Programme 16th April, 2024 14:00 Frankfurt time 13:45 Platform opens for login 14:00 Welcome and introduction Presentations 14:05 Peter Oakes - Why Ireland has proved so popular as a base for FinTech companies and how passporting helps expansion onto mainland Europe. 14:30 David Hotte - Supporting third countries to minimise the risk of listing. 14:55 Christian Hunt - The behavioural science aspects of ethics and compliance. The Forum 15:20 Speakers respond to questions submitted during the Presentations 15:45 Wrap up and thanks. 16:00 Platform closes. Registration: To register to attend and to see the Programme details, visit:

|

Fintech IrelandWelcome to the FintechIreland.com Events Page. Archives

March 2025

Categories

All

|

RSS Feed

RSS Feed