Book here www.fintechirelandsummit.com

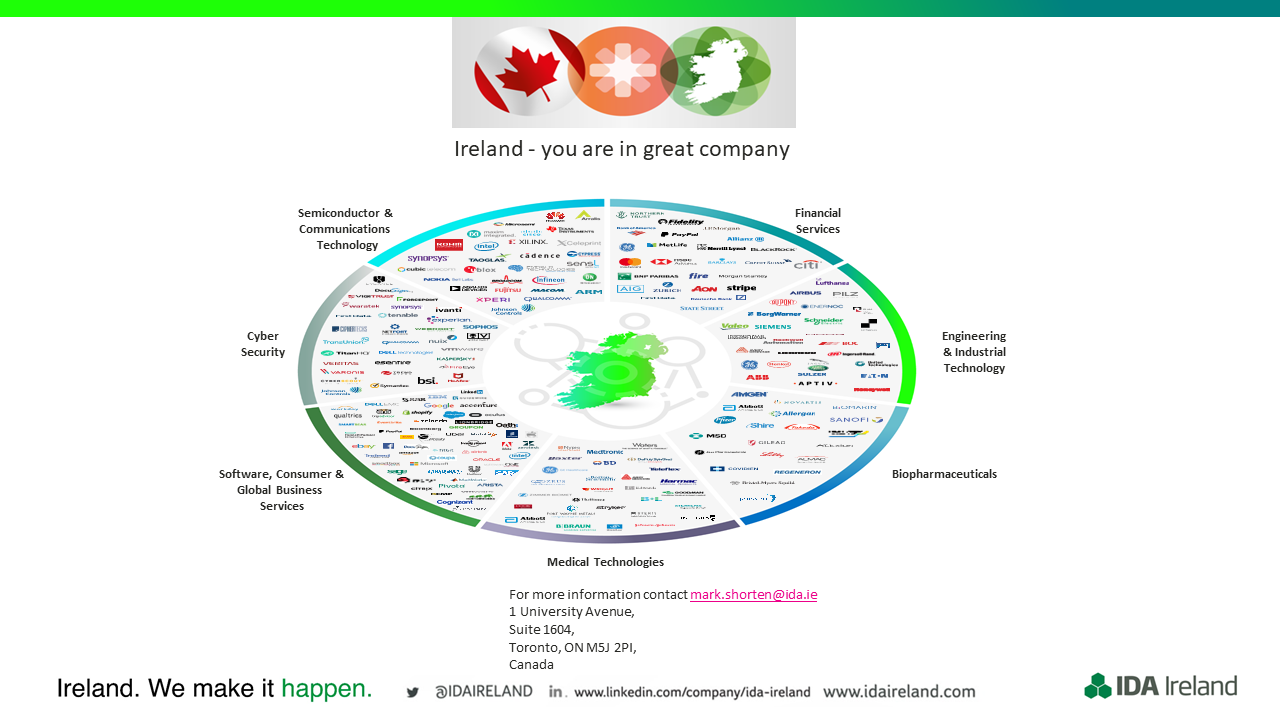

Leading up to the 2nd Fintech Ireland Summit on 27th November 2025 (http://www.fintechirelandsummit.com) Fintech Ireland has partnered with the Ireland Hong Kong Business Forum to host a presentation and panel session on the challenges and opportunities for fintechs in Europe and Asia and building the Ireland-Hong Kong Fintech Bridge!

We will be welcoming the Hong Kong Trade Development Council to Dublin, Ireland.

The Ireland Hong Kong Fintech Bridge Session takes place on Monday 29th September 2025 (1530-17:15)

Join:

- Peter Oakes, INED for Fintechs & Founder, Fintech Ireland

- Joe McCann, CEO & Founder, Intercept Technologies

- Niall Twomey, CTO, Fenergo

- James Hannigan, CEO & Founder, FacePOS

- Paul Hearns, Director, Blockchain Ireland

Fintech Ireland has some free slots we can allocate to those involved in the Irish/Hong Kong Fintech Scene.

1) Scan QR Code, or

2) Going to

https://docs.google.com/forms/d/1nRlZomlW2lJnS0XW2TtxAFUAhBdXwpT0isaS3VCl3dM

DON'T FORGET TO BOOK SOR THE FINTECH IRELAND SUMMIT FOR THURSDAY 27TH NOVEMBER 2025. Book here - http://www.fintechirelandsummit.com

[This is our second #FintechBridge Event in our series following Portugal and ahead of the soon to be announced Ireland & Switzerland event. Wish to learn more about future events? Then subscribe to the free newsletter at https://fintechireland.com/get-involved.html]

Book here www.fintechirelandsummit.com

RSS Feed

RSS Feed