When: Tuesday 16th April 2024 14:00-16:00 Frankfurt Time (1pm Irish/UK time)

Where: Online

Registration: To register to attend and to see the Programme details, visit:

Since January 2019, David Hotte has been the Team Leader of the EU Global Facility, a European Union project dedicated on AML/CFT. Since 1998, he has particularly worked in the field of AML/CFT in developing countries for several national and international organizations (including UNDCP, IMF and the Office of the High Representative in Bosnia). He has undertaken numerous technical assistance missions on AML/CFT issues providing technical advice to several countries and regional Organizations, including French and English-speaking African countries, Bosnia, Palestine, Sri Lanka, Turkey, China, Laos and Syria. Prior to joining international organizations he was serving in the Gendarmerie Nationale with the rank of lieutenant.

Christian is the founder of Human Risk, a Behavioural Science led Consulting and Training Firm, specialising in the fields of Ethics & Compliance. He was formerly MD at UBS where he was Head of Behavioural Science. Christian joined the Firm in Compliance & Operational Risk Control, leading the function globally for UBS Asset Management. Prior to joining UBS, he was COO of the UK Prudential Regulation Authority, a subsidiary of the Bank of England responsible for regulating financial services. He is the author of a book ‘Humanizing Rules’ and the presenter and producer of the Human Risk podcast.

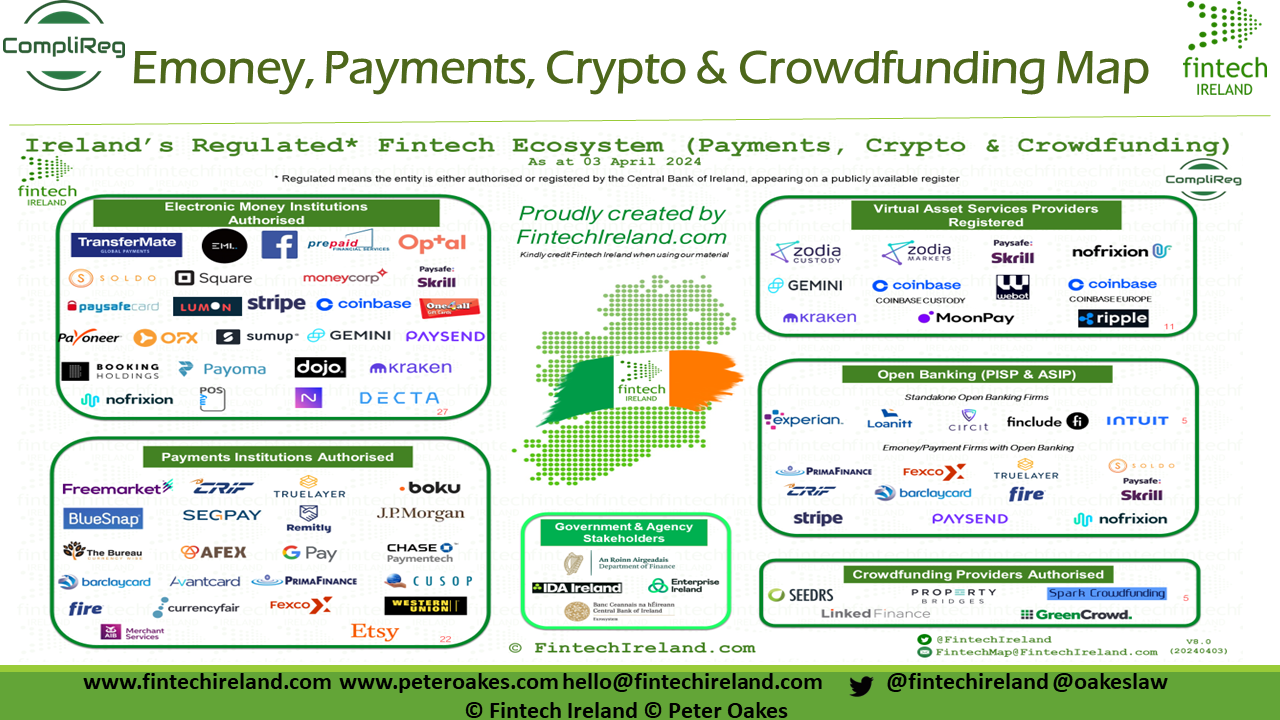

Peter is a professional INED of several globally operating fintech companies covering electronic trading, investment services and payments sectors. Peter is well-known in the fintech community, having established the free FintechIreland.com network in 2014. Through CompliReg.com he advises boards and executives on EU establishment. Peter has also established fintech networks in the UK, Malta, Cyprus and Lithuania. Peter has worked in senior roles at Central Bank of Ireland (Director of Enforcement & Money Laundering), the (now) UK FCA, ASIC (Australia) & SAMA. Peter is qualified as a solicitor in Ireland, the UK and Australia.

Legislators, policy-makers and regulators, C-Suite officers in commerce, trade and industry, Risk managers

Insurance underwriters, Venture Capitalists/Investment funds, Owners and Directors of corporations and other business structures, Trustees, Computer scientists, Data analysts, On-line marketing practitioners and Customer engagement specialists.

16th April, 2024 14:00 Frankfurt time

13:45 Platform opens for login

14:00 Welcome and introduction

Presentations

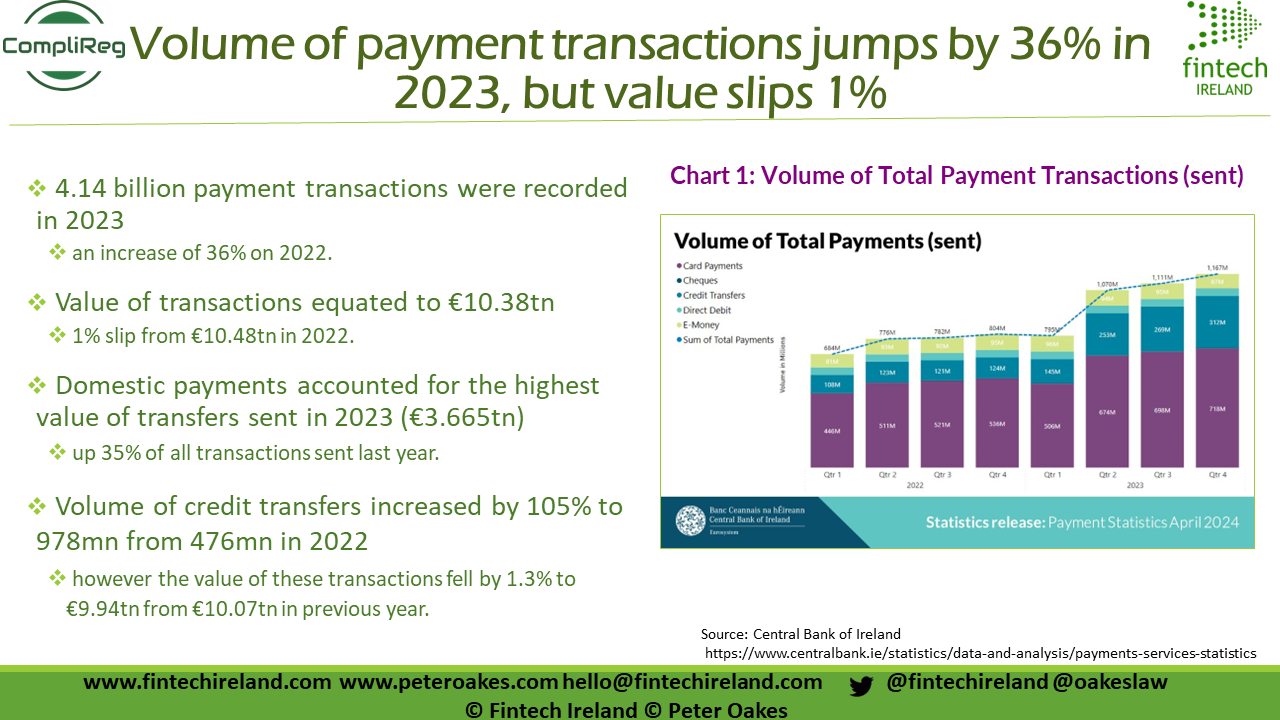

14:05 Peter Oakes - Why Ireland has proved so popular as a base for FinTech companies and how passporting helps expansion onto mainland Europe.

14:30 David Hotte - Supporting third countries to minimise the risk of listing.

14:55 Christian Hunt - The behavioural science aspects of ethics and compliance.

The Forum

15:20 Speakers respond to questions submitted during the Presentations

15:45 Wrap up and thanks.

16:00 Platform closes.

RSS Feed

RSS Feed