Fintech Bridge - Ireland and Canada. Tuesday 30th November 2021 at 15:30-16:30 (Irish Time) / 10:30-11:30 (ET) one hour

What: Fintech Bridge - Ireland and Canada Webinar (Tues 30th November 2021 at 15:30 -16:30 Irish Time / 10:30-11:30 ET).

Our line up of speakers include :

- Nancy Smyth, Ambassador of Canada to Ireland, Embassy of Canada

- Eamonn McKee, Ambassador of Ireland to Canada, Embassy of Ireland

- Meena Bhullar, Vice Consul & Trade Commissioner, Embassy of Canada in Ireland

- Kaz Nejatian, Vice President, Merchant Services, Shopify

- Jennifer Reynolds, President & CEO, Toronto Finance International

- Andrea Reynolds, CEO & Founder, Swoop

- Mark Shorten, VP Financial Services & Life Sciences, IDA Ireland

- Peter Oakes, Founder, Fintech Ireland & CompliReg

When: Tuesday 30th November 2021. 15:30 to 16:30 (Irish time) / 10:30 to 11:30 (Eastern Time).

Where: Online Event

Cost: Free

Registration: Slides of event appear at top of this post

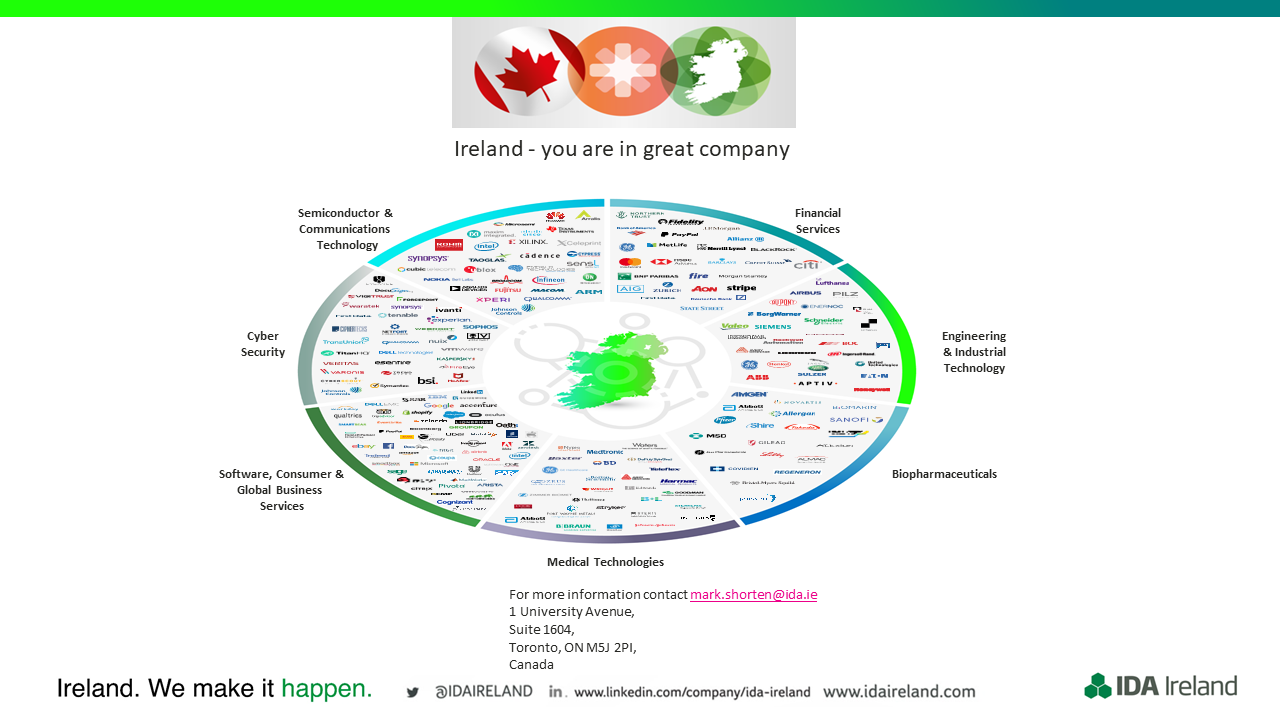

Following hot on the heels of the Release of the famous Fintech Ireland Maps on Thursday 18th November 2021, we get to take a deeper look at fintech in Canada and Ireland and the opportunity for the industry in each other's country.

Did you know that:

- Canada's GDP at USD $1.65tn is almost four times that of Ireland at $420bn.

- Canada provides Irish fintech, regtech and finserv with an excellent opportunity to scale their businesses in North America, while Ireland provides these Canadian businesses with an European beachhead to access both a local population of 5mn and 27 EU Member States.

- More that 350+ fintechs operate from Ireland locally and scaling internationally.

- More than 100 Irish tech start-ups together raised a record €932m in the first half of 2021 from venture capital, debt finance, grants and crowdfunding.

- Canadian FinTech sector is poised to grow further in 2021 following $700m of investments in Q1 2021, led by deals in Toronto.

- Companies based in Toronto raised half of the 10 largest FinTech deals in Canada.

Details:

Presentations from:

- Nancy Smyth, Ambassador of Canada to Ireland

- Eammon McKee, Ambassador of Ireland to Canada

- Peter Oakes, Founder of Fintech Ireland

- Jennifer Reynolds, CEO of Toronto Finance International

Panel Session & Q&A: Growing and scaling fintech globally and Canadian and Irish Experiences

- Kaz Nejatian, Vice President, Merchant Services, Shopify.

- Andrea Reynolds, CEO/C-Founder, Swoop Funding (NED Berkshire Hathaway European Insurance).

- Meena Bhullar, Vice-Consul & Trade Commissioner, Canadian Trade Commissioner’s Office.

- Mark Shorten, VP Financial Services & Life Sciences, IDA Ireland

- Moderator - Peter Oakes, Founder of Fintech Ireland

Going forward to receive priority notice of our events, join our mailing list - Subscribe Here.

*Use of your data*: Please note that attendees' registration information will need be required by Fintech Ireland for the purposes of administering attendance and follow up communications on the event.

Your details will also be recorded for contact about future Fintech Ireland, Fintech UK, USTechFin and CompliReg events and news. And as all use MailChimp, there will be an unsubscribe link in each email we send.

Other terms and conditions: Please note that we reserve the right to accept, modify and cancel bookings.

There will be photography and/or filming/recording at this event and your image may be captured by us and used for promotional purposes in print on our website. By registering for the event you are giving us your permission to use your image in this way. If you have any queries about this, however, please email [email protected]

All Fintech Ireland events fill quickly, so reserve your seat today!

#openbanking #bigdataanalytics #dataanalytics #regulation #aiforbusiness #artificialintelligence #machinelearning

To ensure you don't miss out on future events subscribe to https://fintechireland.com/get-involved.html and follow us on twitter - https://twitter.com/FinTechIreland

RSS Feed

RSS Feed