at The Printworks, Dublin Castle, Ireland

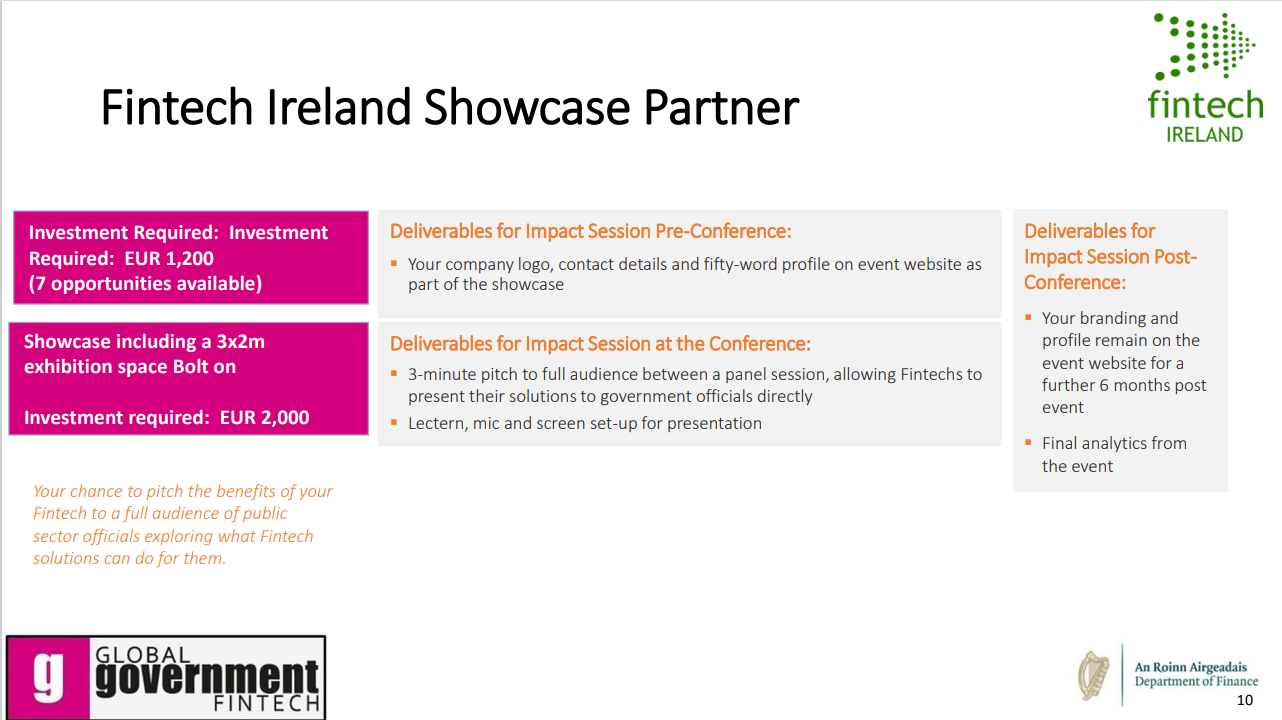

- Fintech Ireland Showcase Partner Offering: (see page 10 here)

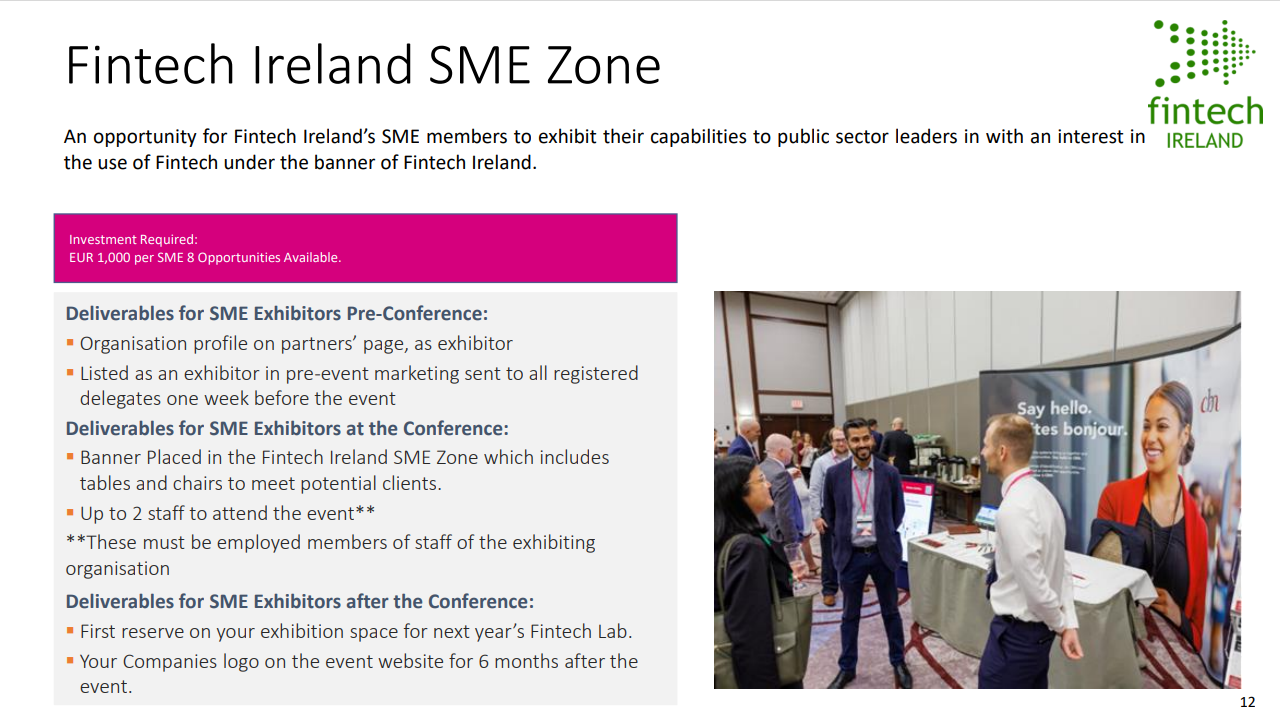

- Fintech Ireland SME Zone Offering: (see page 12 here)

Registration: To sign up as an attendee, register through Fintech Ireland's link here. NB The event is free to attend if you are a public servant and a fair fee is charged for non-public servants.

"This was one of the best events I joined in 2023. Access to regulators and central bankers is unparalleled. The openness of the dialogue was greatly appreciated. An excellent learning experience and many wonderful & meaningful connections made.

Delighted to be joining this premier event in 2024, to be held in Dublin again."

Peter Oakes, Fintech Ireland

It was an excellent event. It is returning to the Printworks Building at Dublin Castle on 25th April 2024 and Fintech Ireland is delighted to be partnering with the organisers.

- Fintech Ireland Showcase Partner

- Fintech Ireland SME Zone

- Other deals to Sponsor this premier Event - including Headline Knowledge Partner, Topic Knowledge Partner and Exhibitor

SEE FULL DETAILS HERE - Global Government Fintech, LAB, 25 April 2024 Fintech Ireland Members Pack

Matt Hoare

Media Sales Director Global Government Forum

T: +44 20 4583 6160

E: [email protected]

And you can contact us at [email protected] if you would like to hear about our positive experience of working with the Global Government Fintech Team at the 2023 event.

Keynote speeches, panel discussions, topic specific sessions and more, including: Governments and fintech: on the right path?; Financial regulators and innovative technology: on the right path?; Public sector financial innovation through payments technology; Fighting financial fraud with technology; frontiers of public sector fintech (and beyond).

When: Thursday 25th April 2024 (08:30-19:00, Irish Time)

Who: Those regulated under the Central Bank of Ireland regime and those interested in it. In PCF role holders such as INEDs, CEO, CFOs, COOs, Compliance Officers, MLROs, CROs, CIOs and their colleagues. Professional services firms and regulators/central banks (near and far) welcome too.

Where: The Printworks, Dublin Castle, Ireland.

Offers for Fintech Ireland supporters to avail of:

- Fintech Ireland Showcase Partner Offering: (see page 10 here)

- Fintech Ireland SME Zone Offering: (see page 12 here)

Registration: To sign up as an attendee, register through Fintech Ireland's link here. NB The event is free to attend if you are a public servant and a fair fee is charged for non-public servants.

Agenda:

- Governments and the future of finance

- Financial regulators and innovative technology: on the right path?

- Public sector Financial innovation through payments technology

- Fighting financial fraud with technology

- Frontiers of Fintech

- Governments and Fintech

RSS Feed

RSS Feed