SLIDES HERE FOR ATTENDEES (PASSWORD PROTECTED)

Booking Closed

Bookings Closed

Crypto Asset Ireland - Launch Thursday 30th January 2025

When: 0900am, Thursday 30th January 2025. Concludes at 1100am.

Where: Intercept Technologies, Glandore Business Centre, Fitzwilliam Hall, Fitzwilliam Place, Dublin 2

Cost: Free

Registration: Bookings Closed

Details: Launch of Crypto Assets Ireland. Congratulations Joe McCann and others for walking the walk when many other just talk the talk by launching Crypto Assets Ireland. Launch date Thursday 30th January 2025 (link below to register your request to attend).

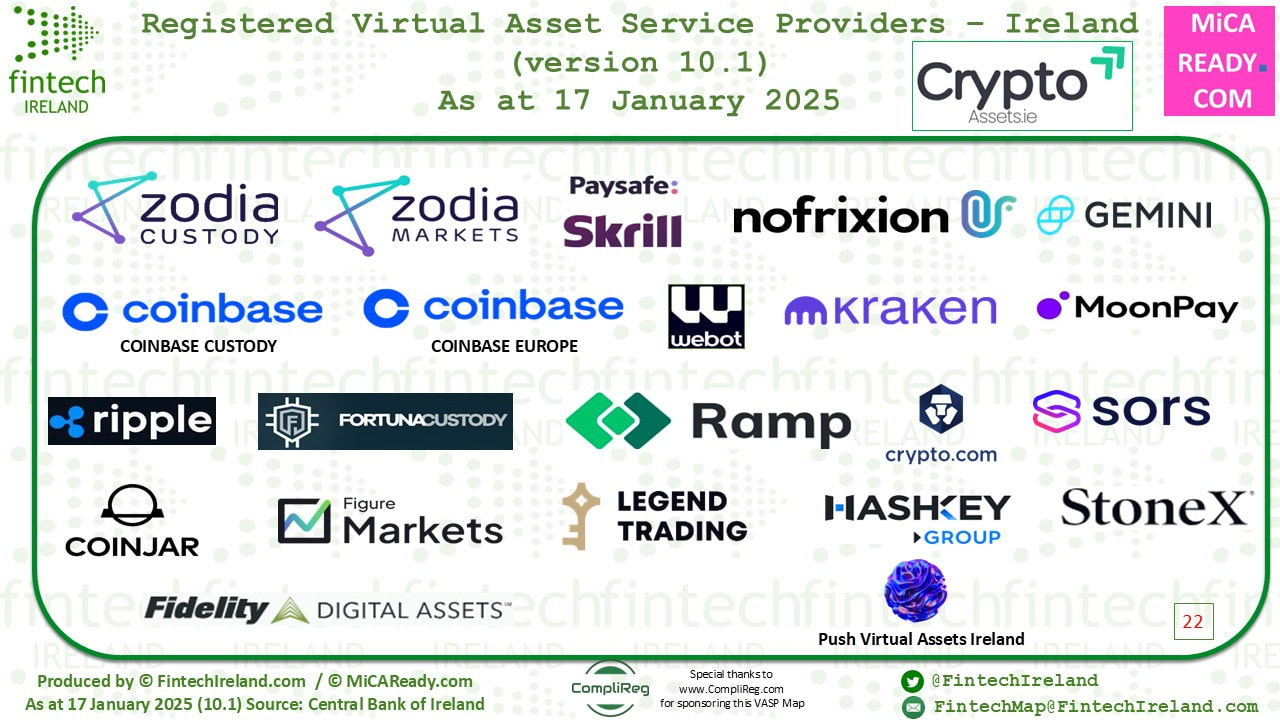

Fintech Ireland is very happy to be one of the first supporters of this excellent initiative to build a network and voice for the #cryptoasset and #digitalasset community in Ireland to help issuers, exchanges and service providers and those closely connected to scale locally and globally.

Attendees: We are going to ask for some patience. We will prioritise booking requests from VASPs, CASPs and those going through the regulatory process. Then will will do our best to accommodate other stakeholders to attend as much as possible. This will be subject to the size of the venue, and if we need a bigger boat, I think we can find one.

PLEASE NOTE THAT YOU MUST REGISTER WITH A BUSINESS EMAIL ADDRESS (NO HOTMAIL, GMAIL OR OUTLOOK ETC, IE PERSONAL DATA EMAIL ADDRESSES).

*Use of your data*: Please note that the Data Controllers for the event are Intercept Technologies and Fintech Ireland . The Data Controllers will receive the data from your registration form in order to administer services to attendees on the day, including ingress and egress from the venue. and for follow up communications after the event. Your details will also be recorded for contact about future events of the Data Controllers, jointly or severally.

Fintech Ireland uses MailChimp. There will be an unsubscribe link in each email we send.

Other terms and conditions: Please note that we reserve the right to accept, modify and cancel bookings.

RSS Feed

RSS Feed