- Need assistance with an emoney or payments authorisation or an account information service provider or virtual asset services provider registration application, contact CompliReg.com at [email protected].

- Check out Fintech Ireland and CompliReg's handy authorisation guides at https://fintechireland.com/fintech-authorisations.html.

Before we dive into the detail contained in the new (issued 9 April 2024) "Central Bank Expectations for Authorisation as a Payment Institution or Electronic Money Institution, or Registration as an Account Information Service Provider", a couple of things to note:

- the format, look and feel of the new webpage on the CBI's website;

- the links from How We Regulate leading to the Authorisation Page, regardless if you clicked on Payments Institutions, Electronic Money Institutions, Small Electronic Money Institutions or Account Information Service Providers redirect you to the same page. That page ends in payment-authorisation. Seems that from a pragmatic and practical stance, the CBI is getting ready for the merging of the e-money and payment services regimes under the current PSD3 legislative proposal;

- [12+ months for authorisation] although buried away at the bottom of the CBI's webpage, there is this very welcome statement about how long it may take to get authorised. "Experience suggests that it can take over 12 months for firms to provide all of the information necessary to enable a decision to be made" ;

- [requirement for a pre-application meeting] each proposed Applicant must meet with the CBI before an Application is filed;

- [no triple hatting] the Central Bank informs that it has not approved applications which propose triple hatting. It also states that "Proposals to triple hat roles present significant doubt as to the commitment of an applicant firm to have adequate governance in place."

- [dual hatting]. Dual hatting is permissible on a case-by-case basis, depending on the nature, scale and complexity of the proposal, and insofar as there is no potential or perceived blurring of the three lines of defence. Any proposal for dual hatting of PCF roles should be accompanied by a detailed rationale setting out how the role holder would have sufficient capacity, and the appropriate qualifications/experience, to effectively perform the proposed roles.

- [appointment of CEO, chair & others] the Central Bank states that "the appropriateness of resources will be determined at each stage on a case-by-case basis, applicant firms which have made senior appointments (for example Chair and Chief Executive Officer) at the application point tend to progress through the authorisation process in a more timely manner.". The Central bank also states that "Applicant firms which have made the necessary senior appointments early in the process generally submit a more complete application and, therefore, tend to progress through the assessment process in a timelier manner."

- currently, there is no fee for submitting an Application (but there is of a course the separate Industry Funding Levy);

- Dormancy Policy - the CBI's dormancy policy applies when an applicant has not provided an adequate response within 60 working days following the issuance of comments. A “Minded to Deem Withdrawn” letter is sent to the applicant after 50 working days of comments issued, notifying the applicant that it has 10 working days to provide all outstanding documentation or the application will be considered withdrawn. If the applicant does not respond within the 10 working days, a “Deemed Withdrawn” letter is sent and the application is not considered further by the CBI.

| It is important to read the Central Bank Expectations for Authorisation as a Payment Institution or Electronic Money Institution, or Registration as an Account Information Service Provider. Issued 9 April 2024 |

| Referred to below is the Pre-Application Key Facts Document (“KFD”). The purpose of the KFD is to provide sufficient detail to the CBI on an applicant's proposal for authorisation/registration. It would normally consist of c.15-20 pages. It should be included in first batch of documents an Applicant reads. Issued 9 April 2024. |

| A document that should be read along-side the above Expectations document is the CBI's Guidance Note on Completing an Application for Authorisation under PSD2. Issued September 2020 |

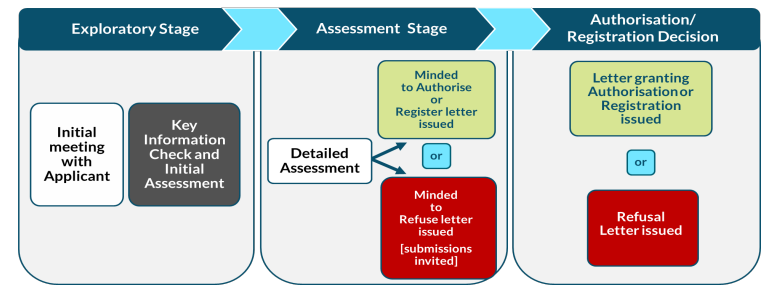

1. Exploratory Stage. This consists of two phases:

- Initial meeting with the applicant firm; and

- Submission of required information (Key Information Check) and initial assessment;

2. Assessment Stage; and

3. Authorisation/Registration Decision Stage.

Firms seeking to pursue an application for authorisation as a Payment Institution or Electronic Money Institution or seeking registration as an Account Information Service Provider should contact the Payments Authorisation Team ([email protected]) to arrange an initial meeting.

In advance of the initial meeting, the Pre-Application Key Facts Document (“KFD”) must be completed. The purpose of the KFD is to provide sufficient detail to the Central Bank on the applicant firm’s proposal for authorisation/registration in advance of the initial meeting. In order to provide sufficient detail to the Central Bank, it is expected that the KFD would consist of c.15-20 pages in MS Word format.

The completed KFD should be submitted at least 5 working days in advance of the initial meeting to [email protected].

The initial meeting provides an opportunity to discuss the contents of the KFD and enables the applicant to raise any questions it might have regarding the authorisation/registration process and the requirements pertaining to the proposed business model.

The meeting also provides the Central Bank with the opportunity to:

- provide greater clarity in relation to the assessment process, and the requirements for authorisation/registration;

- identify any initial matters with the proposal which, if not addressed, would preclude the application from proceeding; and

- highlight any issues/areas of focus which need to be specifically addressed in an application.

The initial meeting complements the early engagement route via the Central Bank Innovation Hub and the Innovation Sandbox Programme are designed as resources to help innovators navigate the regulatory landscape.

In addition to ensuring that all required documentation has been provided, this phase encompasses an initial assessment of the submission.

At the end of this phase, the Central Bank will notify the firm of the outcome which is either:

- Progression

- Issues have been Identified Precluding Progression

At the end of the assessment process, the Central Bank will notify the firm of the outcome of its assessment. There are two possible outcomes:

- Positive Outcome (“Minded To Authorise/Register” letter)

or

- Negative Outcome (“Minded to Refuse” letter)

- Positive Outcome (Letter Granting Authorisation/Registration)

or

- Negative Outcome (Letter of Refusal)

- Another regulatory authority has to be contacted;

- Persons are subject to interview;

- Significant legal issues arise;

- Significant fitness and probity issues arise;

- The business model is complex or novel in nature;

- Significant changes to the business model, the applicant’s shareholder structure or other key aspects of an application arise during the review process, or where the application becomes dormant; or

- The CBI is minded to refuse an application.

This means that when an applicant has not provided an adequate response within 60 working days following the issuance of comments. A “Minded to Deem Withdrawn” letter is sent to the applicant after 50 working days of comments issued, notifying the applicant that it has 10 working days to provide all outstanding documentation or the application will be considered withdrawn. If the applicant does not respond within the 10 working days, a “Deemed Withdrawn” letter is sent and the application is not considered further by the Central Bank.

- Application Form for Authorisation as a Payment Institution (including the specific information and documentation requested therein)

- Application Form for Authorisation as an Electronic Money Institution (including the specific information and documentation requested therein)

- Application Form for Registration as an Account Information Service Provider (including the specific information and documentation requested therein)

- the Irish Anti-Money Laundering, Counter-Terrorist Financing and Financial Sanction regime

- the Qualifying Shareholders of Payment Institutions and Electronic Money Institutions requirements

- Pre-Approval Controlled Function Roles regime

The Questionnaire will only apply post-registration to those Account Information Service Providers that come within the definition of a ‘designated person’ under the Criminal Justice (Money Laundering and Terrorist Financing) Act 2010 (“CJA 2010”). Firms that are classed as a ‘designated person’ under the CJA 2010 are subject to all of the AML/CFT obligations contained under Part 4 of the legislation.

1) Legal Persons/Entities

2) Natural Persons

3) Executive Directors of Legal Persons/Entities

While the above forms are not required to be completed for Account Information Service Providers, the Central Bank will assess the suitability of all legal and natural persons with a qualifying holding.

These should be submitted electronically via the Central Bank of Ireland Portal. Please note access to the Portal is only provided once an application has progressed to Stage 2 - Assessment Phase.

- EBA Guidelines on the Information to be Provided for Authorisation and Registration under PSD2 – Final Guidelines on Authorisations of Payment Institutions (EBA-GL-2017-09).pdf

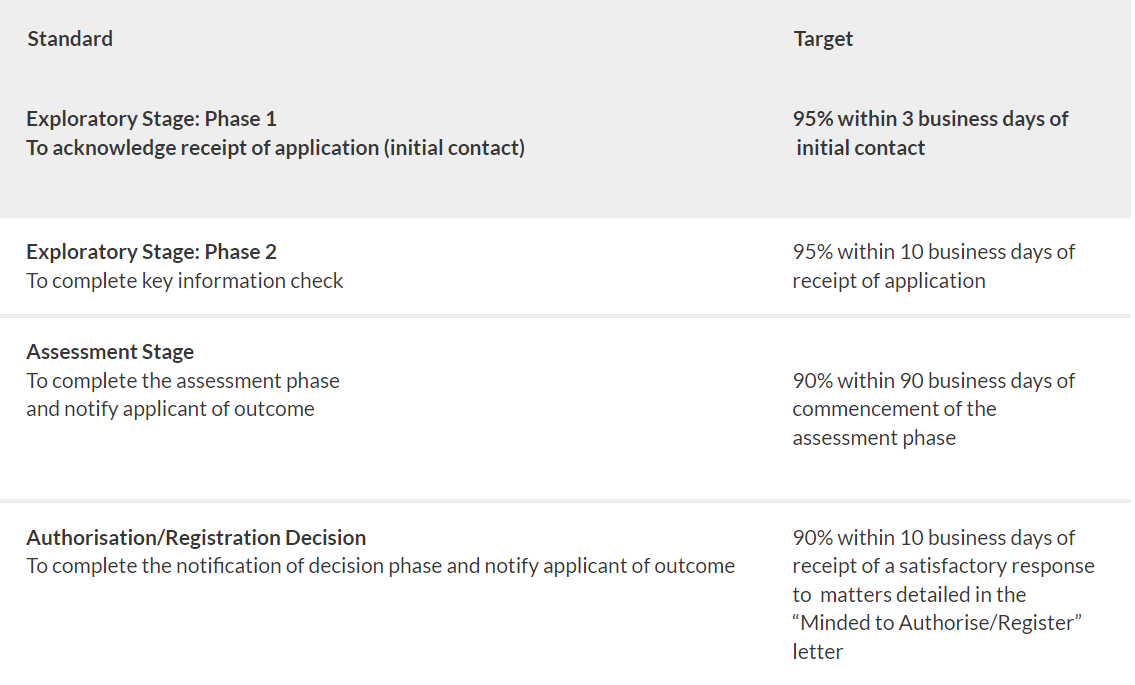

- Service Standards issued by the CBI

There is currently no fee for submitting an application. Once authorised, a firm is subject to an annual Industry Funding levy. For further information on the levy see here.

How do I submit the application?

Applications must be submitted via Kiteworks. Please contact [email protected] to obtain access.

How long is the process expected to take?

The time taken to receive an authorisation decision is primarily dependent on the preparedness of an applicant firm to undertake the assessment process, and on the quality and timeliness of submissions. The Central Bank will, in accordance with relevant legislation complete its assessment within 3 months of the receipt of the application, or if the information is incomplete, within three months of receiving all of the information required for the Central Bank to make a decision on the application. Experience suggests that it can take over 12 months for firms to provide all of the information necessary to enable a decision to be made. See above for further information on Service Standards.

Is a Pre-Application meeting required before an Application can be submitted?

Yes, see above for details of the Initial Meeting which forms part of the Exploratory Stage.

What to do if I need more help?

For any authorisation related queries, you contact the Payments Authorisation Team ([email protected]). If you have a query in relation to new technologies, email [email protected].

If you need help and support too file your Application, talk to Peter Oakes at CompliReg via [email protected].