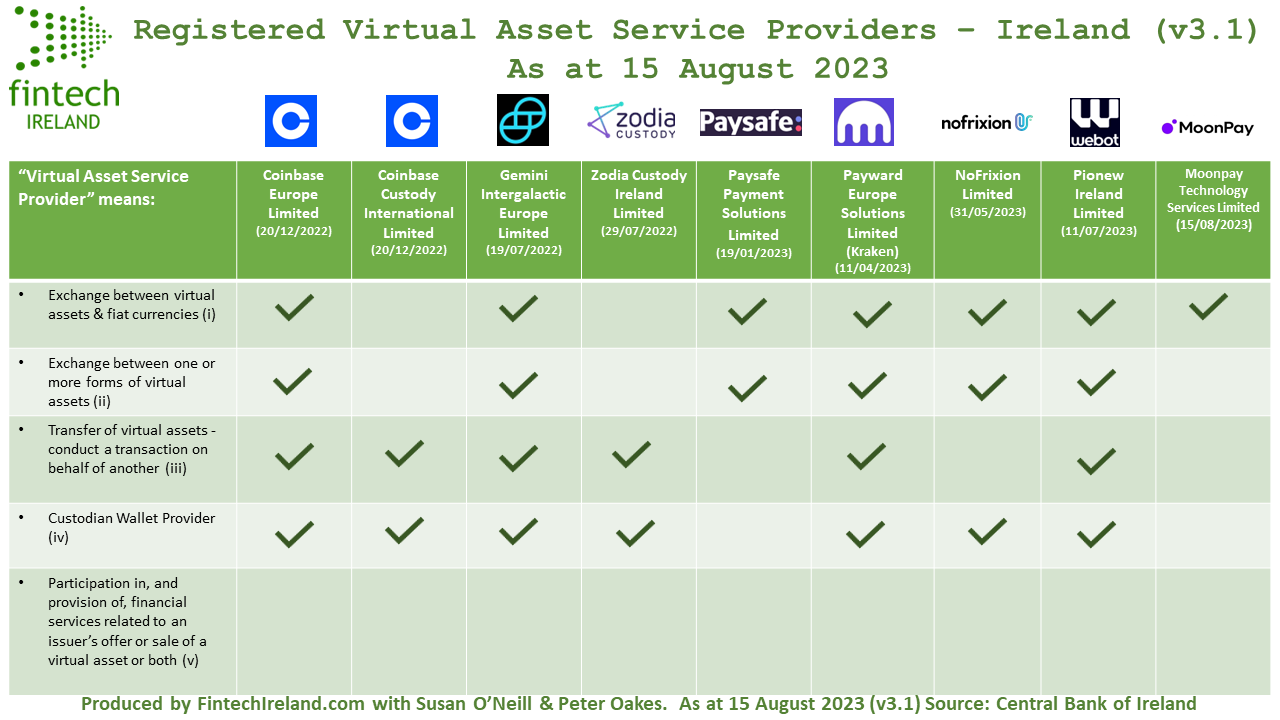

Welcome MoonPay to Fintech Ireland's Registered Virtual Asset Service Providers Map v 3.1

Since then the Map has been updated twice to record the registration of addition virtual asset firms registered in Ireland. We have now updated the Map to Version 3 as at Wednesday 30th August 2023. That date is the most current run date on the Central Bank of Ireland's register for virtual asset firms.

Welcome MoonPayTechnology Services Limited to the Map.

MoonPay was registered on 15 August 2023 and is registered for service number (ii), the exchange between one or more forms of virtual assets.

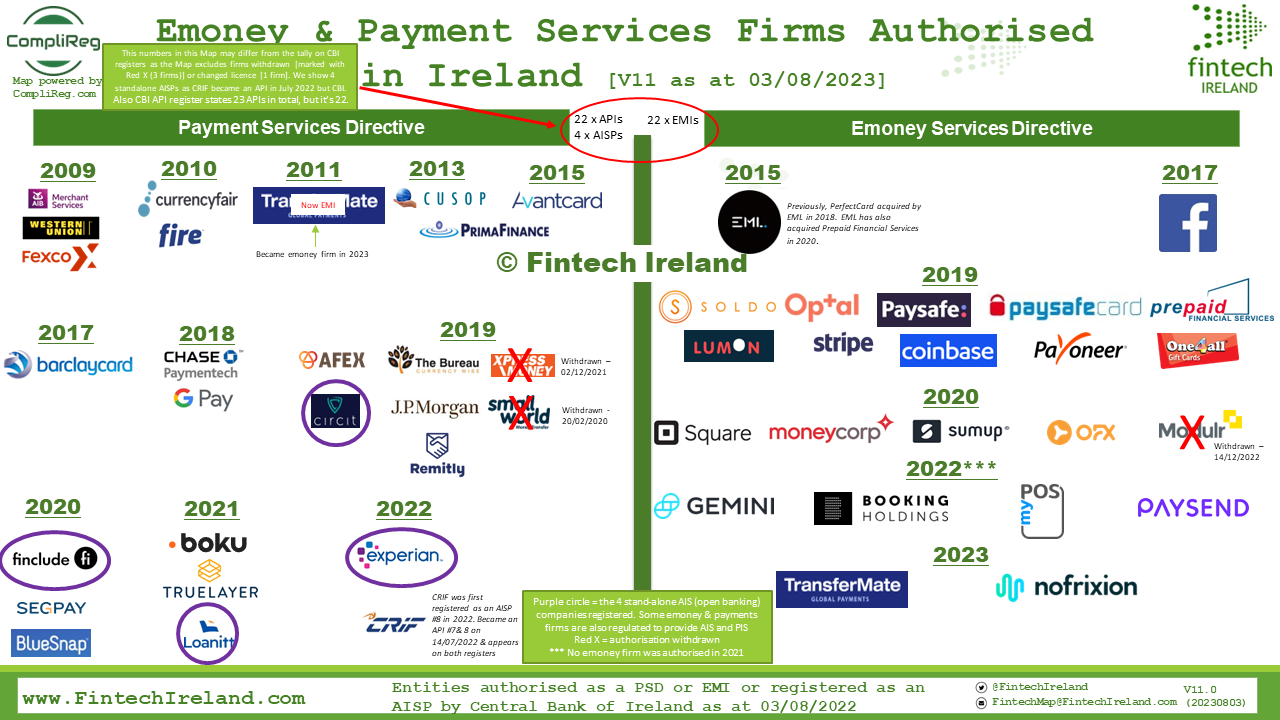

MoonPay joins other registered virtual asset firms including Coinbase Europe Limited, Coinbase Custody International Limited, Gemini Intergalactic Europe Limited, Zodia Custody Ireland Limited, Paysafe Payment Solutions Limited, NoFrixion Ireland Limited and Pionex Ireland Limited. Some of these crypto firms also hold an electronic money authorisation with the Central Bank of Ireland.

MoonPay's local board of directors (according to Companies Registration Office records) are Maximilian (Max) Crown (Co-Founder & CFO) and Ivan Soto-Wright (Co-Founder CEO). Max is also a director of other MoonPay entities in the UK, Malta and USA.

MoonPay, was launched in 2019 to allow people to buy and sell Non-Fungible Tokens. It is backed by celebrities such as Justin Bieber and Gwyneth Paltrow. In a statement to the Irish Independent, the company said it has now established a presence in Ireland. “MoonPay [now] has a team in Ireland. We also expect our headcount to grow in line with business demands and to ensure we remain in compliance with our regulatory obligations,” it said.

MoonPay builds payment infrastructure for crypto and has about 500 industry partners ranging from crypto wallets to layer-1 and layer-2 blockchains, Abhay Mavalankar, VP of corporate development and investments said. The company is valued at $3.4 billion, has more than 5 million customers and supports over 80 assets, according to its website.

At the end of August 2023, MoonPay launched MoonPay Ventures an investment arm that will focus on early-stage startups in web3, gaming and adjacent fintech categories (reported by Jacquelyn Melinek in TechCrunch). The investment arm, dubbed MoonPay Ventures, will mainly invest between $100,000 to $1 million, targeting seed and Series A rounds. It has already invested in more than 25 companies, including BCB Group, Ledger, BRUT, BeatClub, absolute labs, Create/OS, BridgeTower Capital and Mythical Games, according to MoonPa's Abhay Mavalankar.

There isn’t a specific fund amount that MoonPay is allocating, and the team will invest off its balance sheet with a “definite angle” toward commercial ROI. “When it comes to web3 and backing exceptional founders, this is a logical extension of that,” Mavalankar said.

BTW, Fintech Ireland and Peter Oakes are supporting MiCA Ready which tracks materially important EU news on MiCA and Digital Assets Africa.

Don't forget to check out our Fintech Ireland Crypto Page.

Previous editions of the Map.