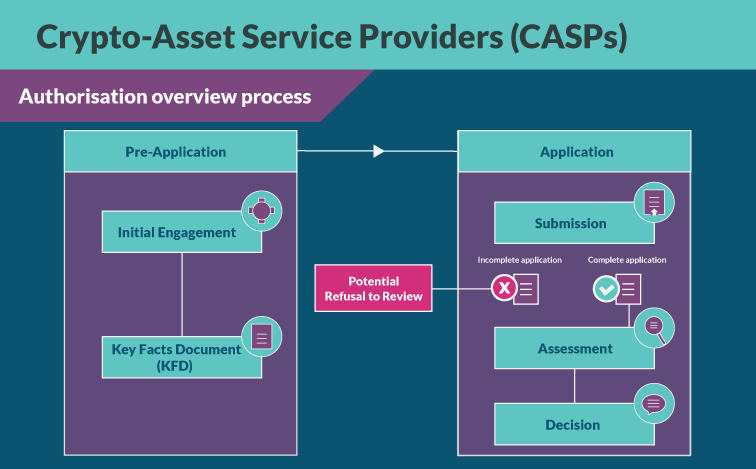

1) Application Form for Markets in Crypto Asset Regulation

2) The Key Facts Document

3) MiCAR Authorisation and Supervision Expectations

https://complireg.com/casp-micar.html]

Great to finally see that Ireland's National Competent Authority for #MiCAR (Markets in CryptoAssets Regulation) has published:

1) An Application Form (35 pages) to complement the MiCAR Key Facts Document (32 pages)

2) A statement confirming that "to ensure successful implementation of the new MiCAR regime in Ireland, cognisant of business demands and the 12-month transition period, we have put in place a well-resourced and expert team to deal with the CASP authorisation process. This team will continue to engage extensively and constructively with the sector and applicants."

CompliReg has helpfully placed a copy of both the MiCAR Application Form and the previously published Key Facts Document on its website here https://complireg.com/casp-micar.html. Get in touch with them if you are on the journey to become MiCAR authorised in Europe. Ireland is but just one country where the team works on MiCAR and Emoney/Payment authorisations.

We understand that Crypto Assets Ireland is holding its second #DigitalAssets meeting later this month. Since its arrival on the scene in mid January, Crypto Assets Ireland founded by Joe McCann has run informative in-person and online events and has published a lot of useful stuff. Explains why there are more than 600 followers of its linkedin page which went live just over two months ago. Click its name above to follow it (to learn about its next event) and also kindly follow Fintech Ireland which is supporting the Crypto Assets Ireland initiative with content and information.

What is the new MiCAR Application Form?

1. General information

2. Programme of Operations

3. Prudential requirements

4. Governance arrangements and internal control mechanisms.

5. Business Continuity

6. Detection and prevention of money laundering and terrorist financing

7. Management Body

8. Shareholders or members with qualifying holding

9. ICT systems and related security arrangements

10. Segregation of clients’ crypto-assets and funds

11. Complaints-handling

12. Custody and administration policy

13. Operating rules of the trading platform and market abuse detection

14. Exchange of crypto-assets for funds or other crypto-assets

15. Execution Policy

16. Provision of advice or portfolio management on Crypto-assets

17. Transfer Services

18. Cross-border provision of crypto-asset services

19. Other comments

Source - Peter Oakes