The Irish company is led by CEO, Ciaran O’Hare and its Independent Chairperson is Peter Oakes.

“Securing the MiCA license from the Central Bank of Ireland marks a pivotal milestone in our global strategy. Ireland is renowned for its high regulatory standards and robust financial ecosystem, and we are honored to collaborate closely with its regulators under this new framework. This license not only strengthens our presence in Europe but also enhances the trust of our clients and partners worldwide. We will continue to balance compliance and innovation, expanding the boundaries of our products and services to accelerate the convergence of traditional finance and digital assets.”

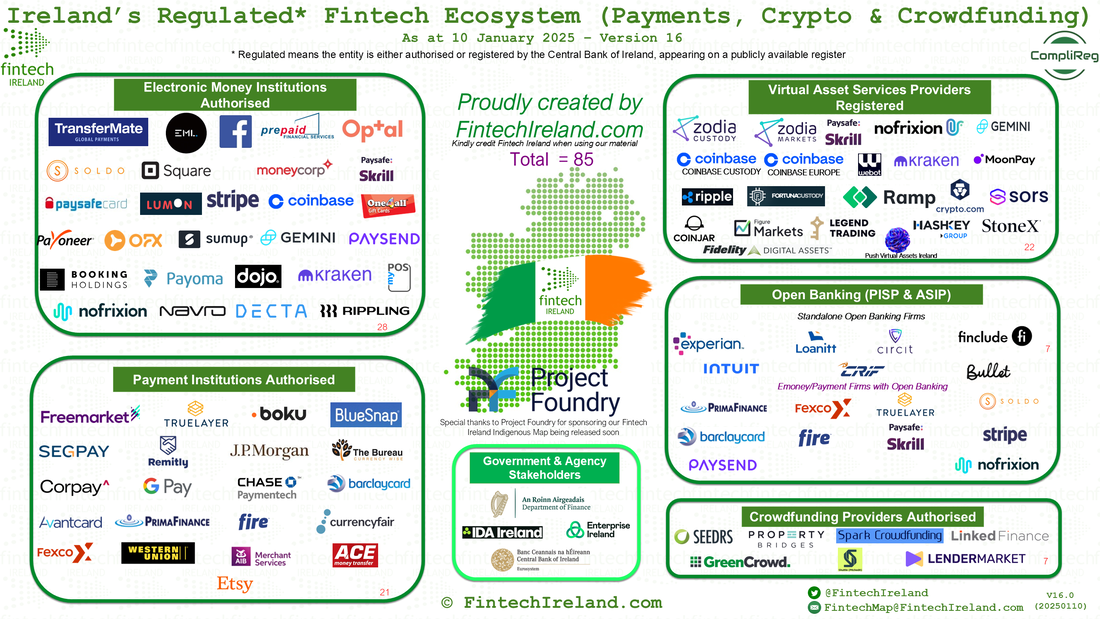

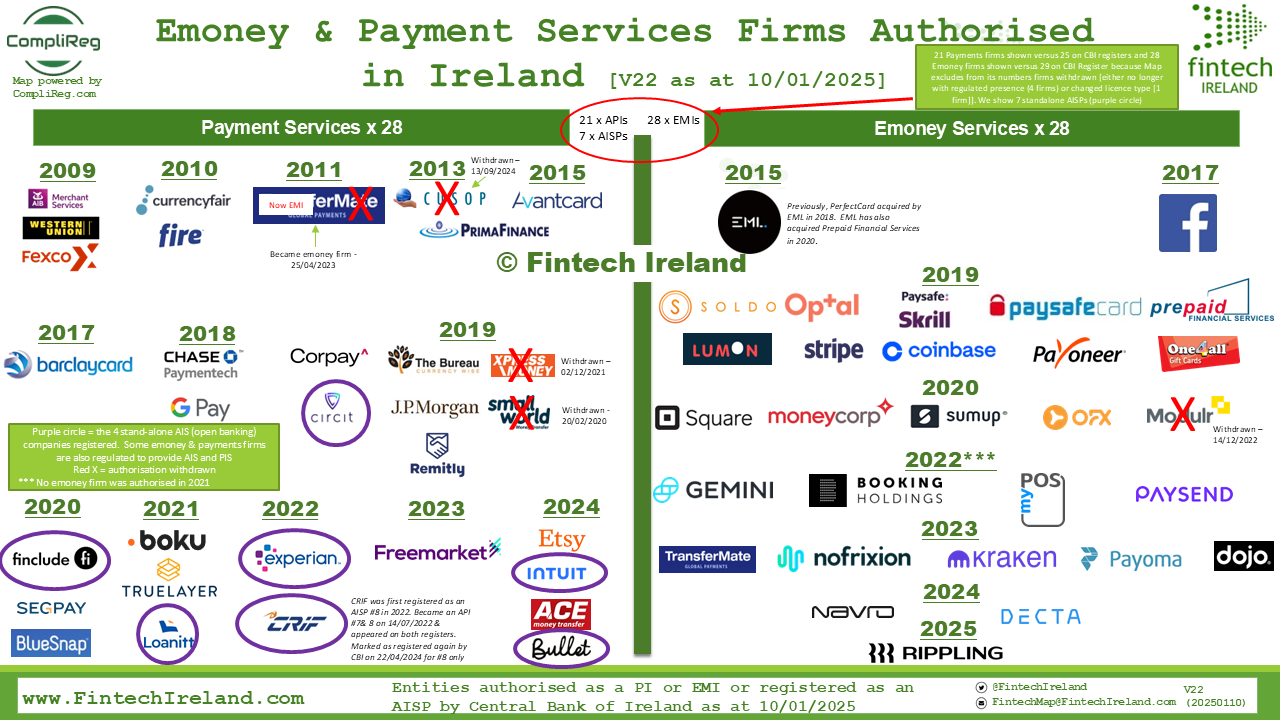

Today, Fintech Ireland released Version 19 of Ireland’s Regulated Fintech Ecosystem (Payments, Crypto & Crowdfunding) to include Legend Financial Ireland Limited. That Map showcases the 89 fintech licences issued by the Central Bank of Ireland Read more HERE.

- Sign up to our Newsletter here.

- Attend the Fintech Ireland Summit here.

- Need assistance with an emoney or payments authorisation or an account information service provider or virtual asset services provider registration application, check out Fintech Ireland and CompliReg's handy authorisation guides at https://fintechireland.com/fintech-authorisations.html.