- Sign up to our Newsletter here.

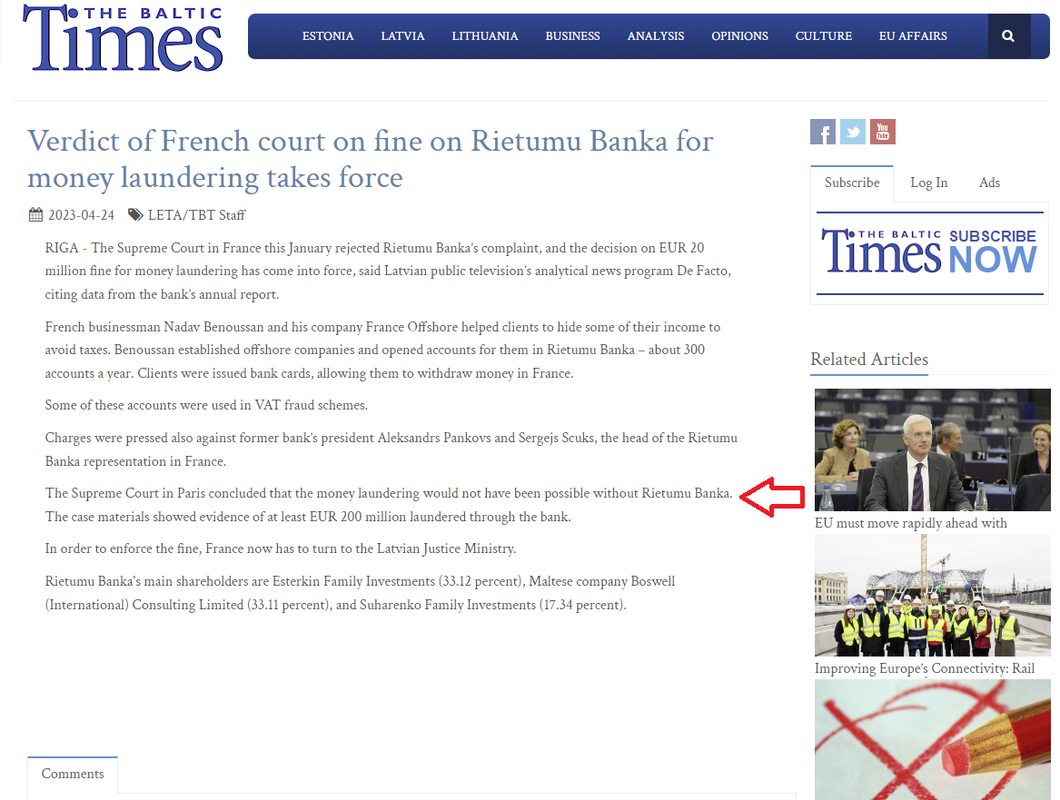

- Need assistance with an emoney or payments authorisation or an account information service provider or virtual asset services provider registration application, check out Fintech Ireland and CompliReg's handy authorisation guides at https://fintechireland.com/fintech-authorisations.html.

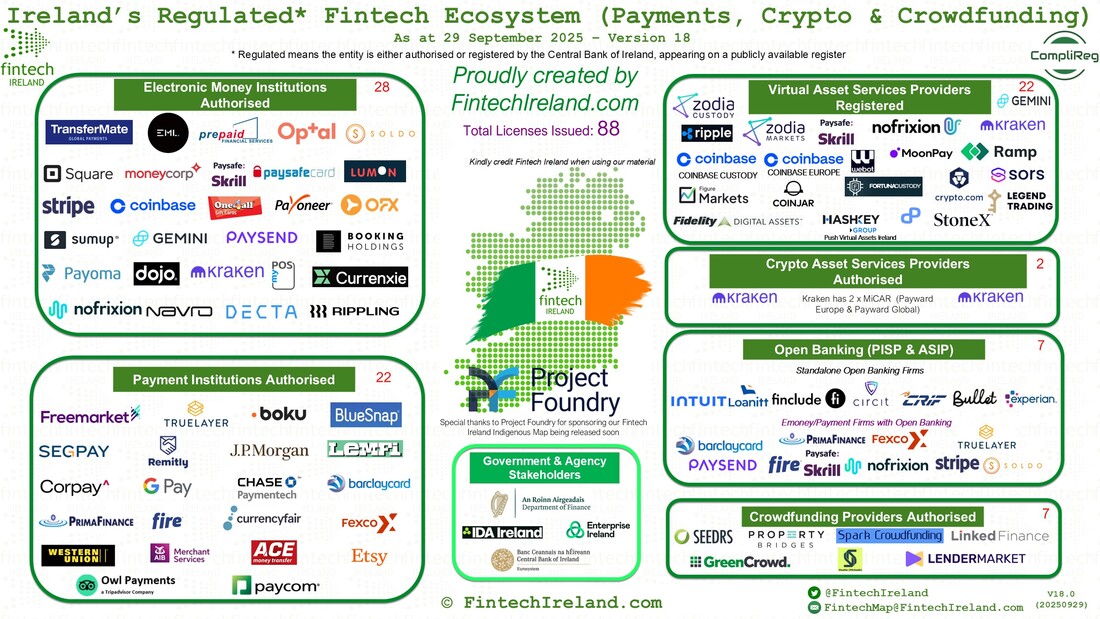

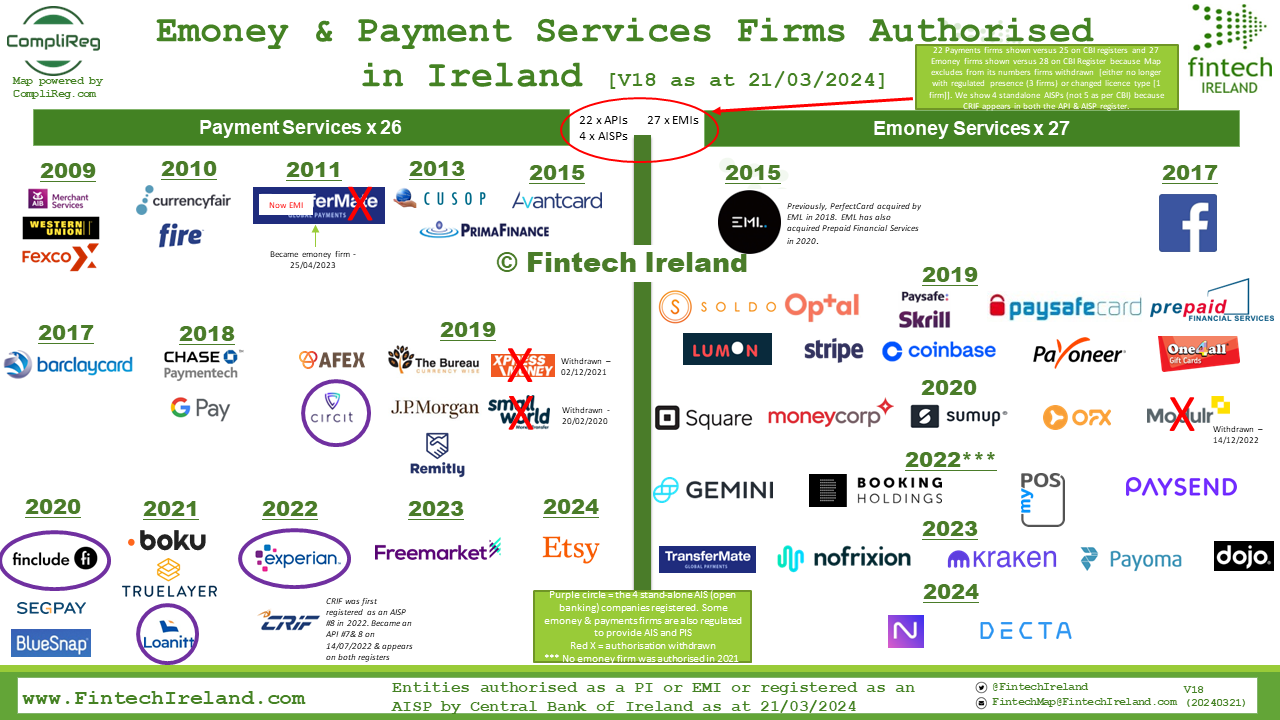

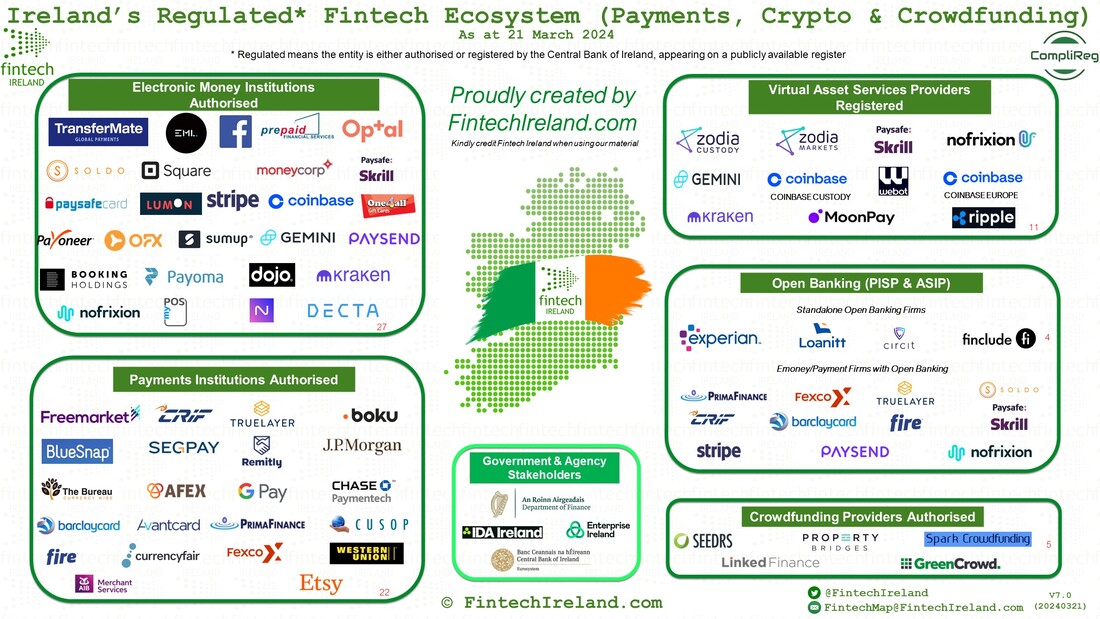

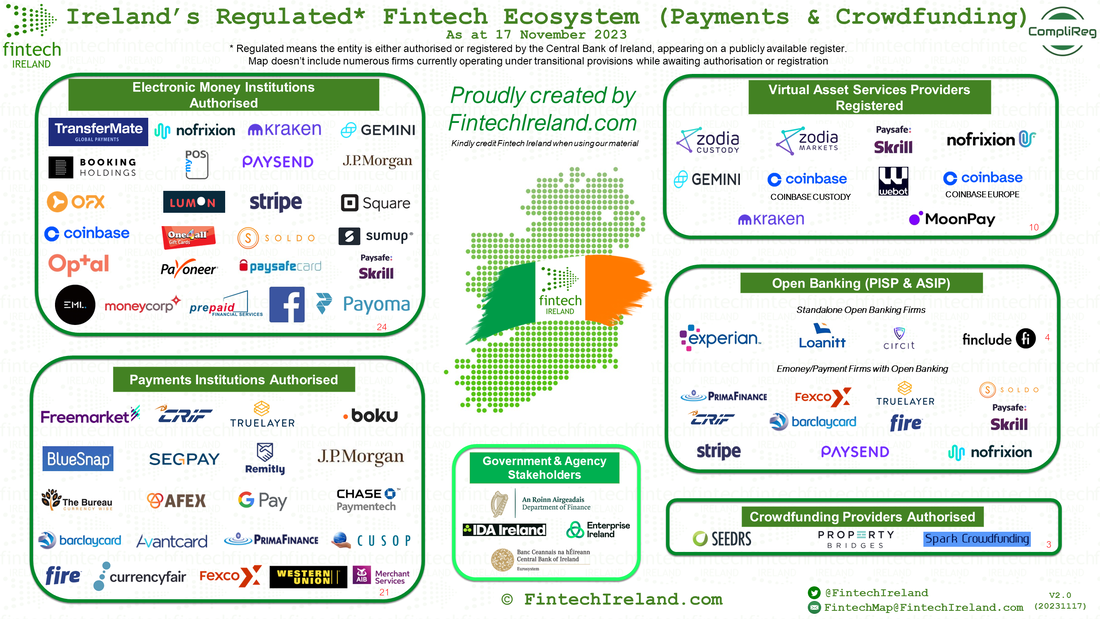

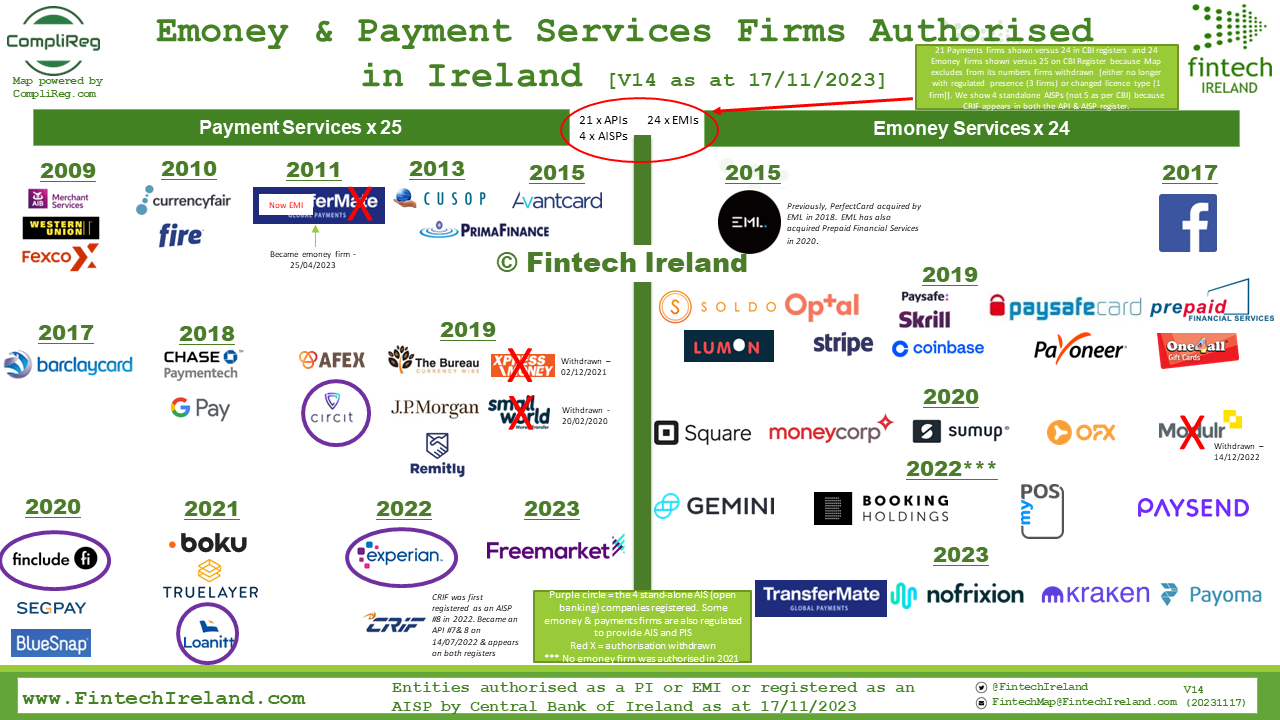

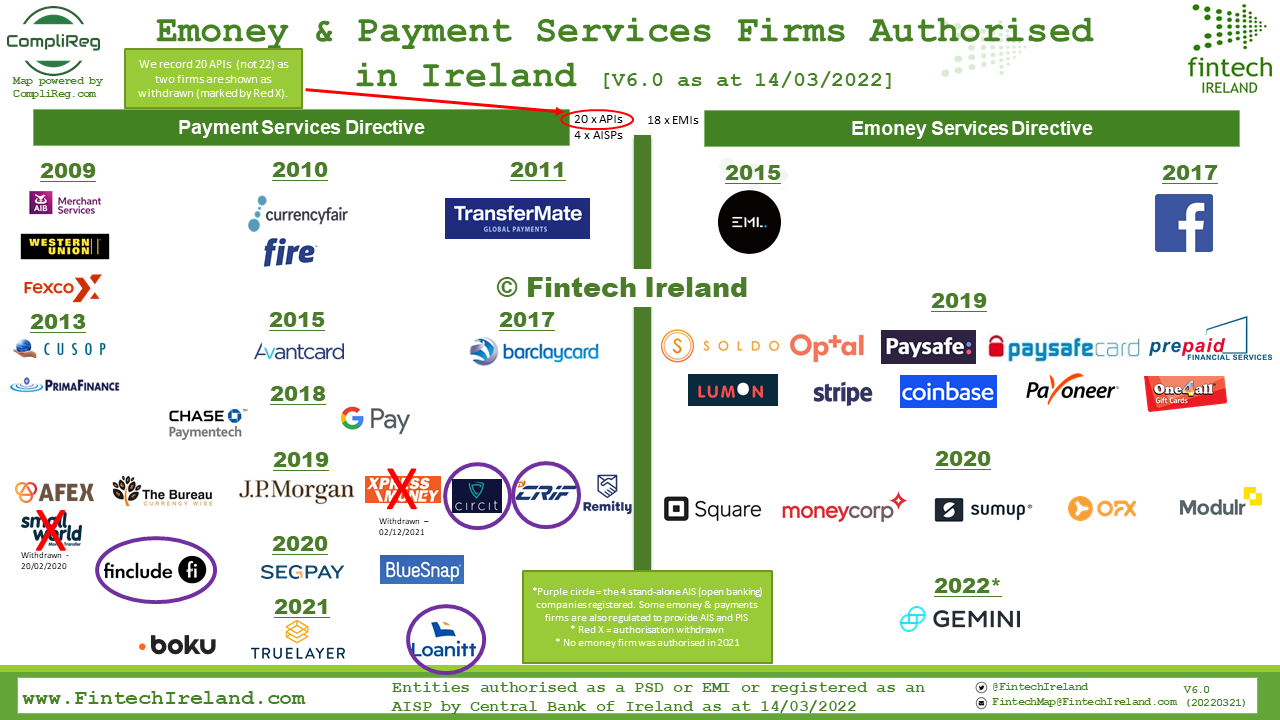

There are a number of points to note about the Map. Thanks to CompliReg, leading fintech authorisation specialist across Europe and the UK.

Firstly, we officially welcome:

- Currenxie Technologies Limited and Paycom Europe Limited to the Map. Currenxie is authorised as an Electronic Money Institution with payment services 3b, 3c, 5. Paycom is authorised as a Payments Institution with permissions 3(a) and 3(c). We were delighted that the team from Currenxie joined us at last night's event.

- Kraken, otherwise known as Payward Europe Solutions Limited and Payward Global Solutions Limited. Thus Kraken effectively (and for the time being) three crypto across two legal entitles according to the Central Bank Registers, i.e. 1 VASP registration (Payward Europe Solutions) and 2 x CASP authorisations (Payward Europe Solutions and Payward Global Solutions).

Secondly, we remember those that left the Map this year (and thus far):

- Facebook Payments International Limited

- AVANTCARD DAC (Avant Money) - authorisation withdrawn 28 April 2025

- Bureau Buttercrane Limited, which leaves the map in name only following its rebranding to Lemfi Europe Limited follow an acquisition

Thirdly, the Map records only those companies which are registered or authorised. Any discrepancy between the Map and the Central Bank's registers is due to the fact the Central Bank does not remove the names of e-money and payments firms that withdraw authorisation but instead mark these with the withdrawal date.

In preparing for last night's presentation we re-confirmed some fun facts about Ireland's fintech and finserv industries. Did you know that:

- The Central Bank of Ireland regulates 13,000 firms?

- Ireland is the 3rd largest exporter of financial services in Europe and is ranked 8th globally?

- 250+ of the world's largest finservs have operations in Ireland, including 22 of the world's top finservs and 21 of the top global banks?

- €5.1 trillion of net assets are domiciled in Ireland?

- 142,000 people are employed in financial services in Ireland with 60,100 of them employed directly in international financial services? Fintech Ireland reckons that of these, 9,000 are employed in fintech.

- 106,000+ people are technology sector employees and that 16 of the top 20 global tech companies operate in and from Ireland?

- Learn more about the Irish Fintech Ecosystem at the Fintech Ireland Summit on Thursday 28 November 2025 here

- You can find the Map here.

- You can find Fintech Ireland's presentation on a Fintech Bridge between Ireland and Hong Kong here

- You can find the slides to most of the events that Fintech Ireland has presented here

- Sign up to our Newsletter here.

- Need assistance with an emoney or payments authorisation or an account information service provider or virtual asset services provider registration application, check out Fintech Ireland and CompliReg's handy authorisation guides at https://fintechireland.com/fintech-authorisations.html.