- Ireland is now home to 65 regulated fintech entities and is continuing to be described in glowing terms by applicants.

- There is a payments entity up for sale (if interested contact me - as I am in discussions with the owner - email officeATcompliregDOTcom).

- In the past 5 working days I have had discussions with 5 overseas groups looking to commence preparations for filing applications with the Central Bank of Ireland in the first part of 2024.

Linkedin blog at https://www.linkedin.com/posts/peteroakes_irishfintech-fintech-electronicmoney-activity-7143319059621638145-0HM_

Now I might be tempting fate here; meaning that Fintech Ireland and MiCA Ready may have to issue a further updated Regulated Fintech Map later this week given that several fintech have been notified that they are close to authorisation.

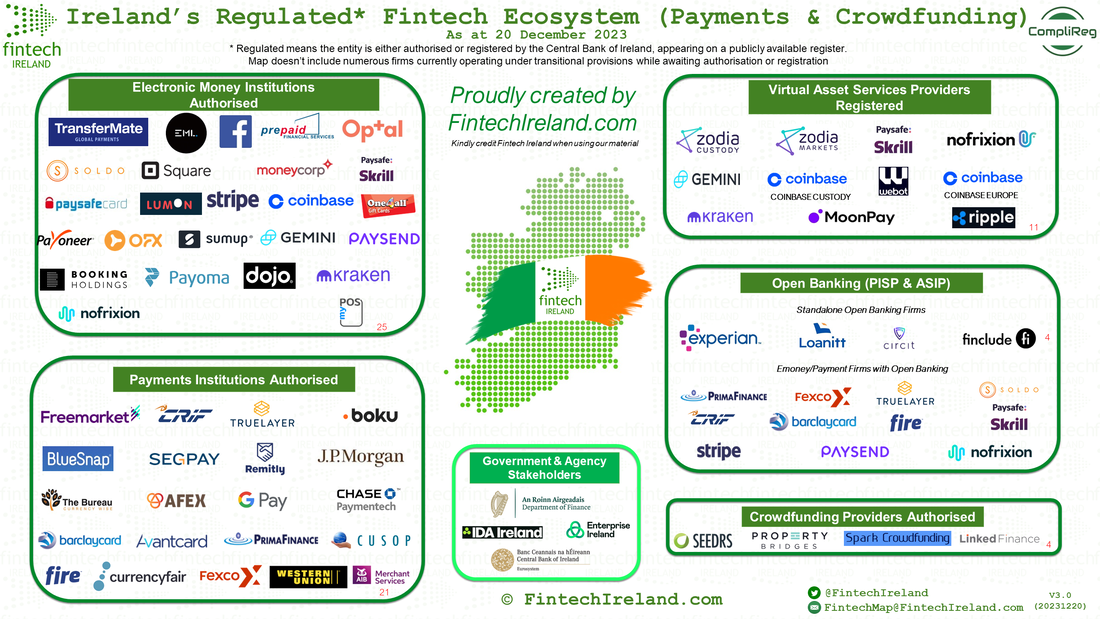

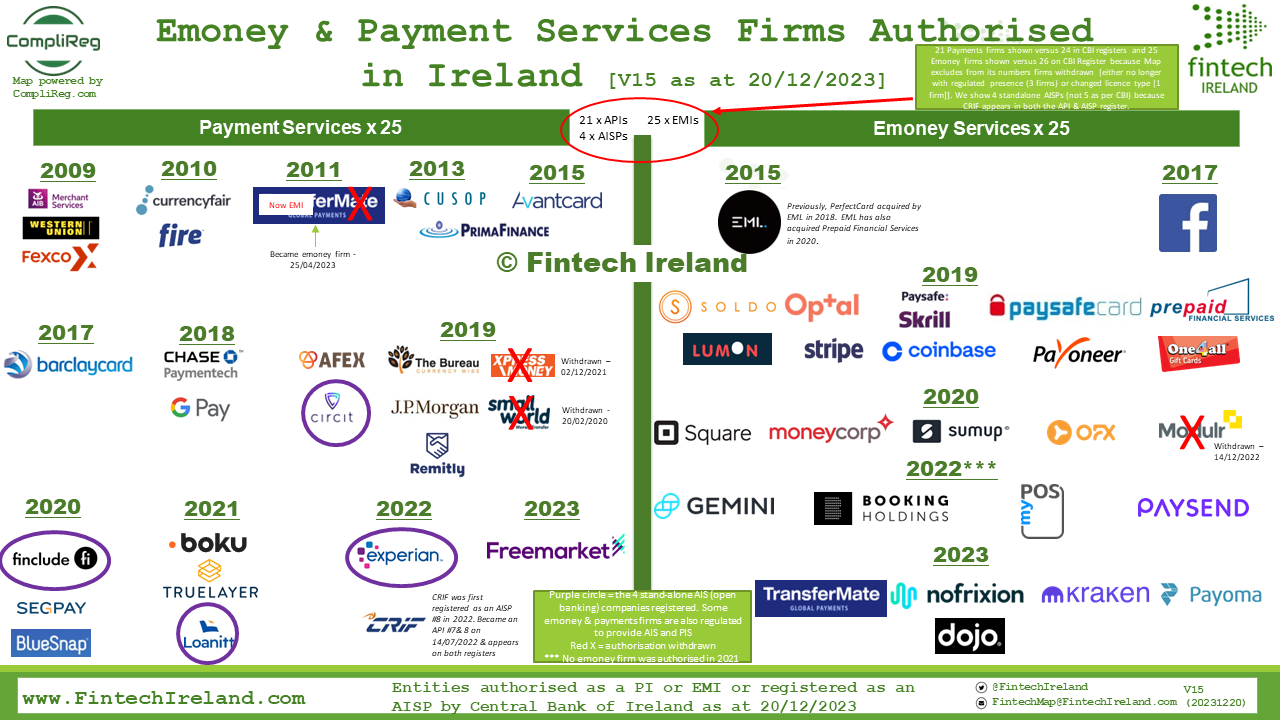

In any event, for today as of close of business Wednesday 20 December 2023, based on the Central Bank of Ireland's publicly available registers, the 65 regulated #fintech entities appearing on the Map are split - 25 x #ElectronicMoney; 21 x #Payments Institutions; 4 x Standalone Open Banking (AISP); 11 x #VirtualAssets and 4 x #Crowdfunding Services Providers.

This follows recent activity including Ripple's registration in Ireland as a Virtual Asset Services Provider and Linked Finance's authorisation as a Crowdfunding Services Provider yesterday (19 December 2023).

In summary:

- Ripple Markets Ireland Limited's can now provide the following services: (i) Provision of exchange services between virtual assets and fiat currencies; (ii) Exchange between one or more forms of virtual assets; (iii) Transfer (to conduct a transaction on behalf of another natural or legal person that moves a virtual asset from one virtual asset address or account to another) of virtual assets; and (iv) Custodian wallet providers. Congratulations Mark Doggett, Brian Spahn and Team.

- Linked P2P Limited (trading as Linked Finance) is now authorised for the facilitation of granting of loans. Congratulations ✅ Peter O'Mahony Niall Dorrian (ACMA) Niall O'Grady and Team.

“By providing regulatory clarity for the industry, Ireland — and the EU more broadly — are boosting confidence in the digital assets, payments and fintech ecosystem,”. - Eric van Miltenburg, Ripple’s senior vice president for strategic initiatives

Who is new to the Map? In addition to Ripple and Linked Finance, we have added PaymentSense Ireland / Dojo which achieved emoney authorisation in Ireland on 22 November 2023 to provide, in addition to emoney services, payment services 3b, 3c, 5. Congratulations Agata Strozynska. Máire Duffy Donal Collins, Jean ODonovan and Team.