Fintech Ireland's Peter Oakes had the opportunity to find out more on Square's plans from Jason Lalor, Executive Director for its European operations, his background, culture, diversity, inclusiveness and what advice Jason would give his younger self.

Q1: Tell me about your background

Born and bred in Portlaoise, I am an Executive Director at Square and responsible for leading our European and International commercial operations, payments, and industry relations team. I joined Square in November 2019 and have over 20 years experience in financial services and payments, I spent six and a half of these as the General Manager of Ireland at Mastercard, prior to joining Square.

Q2: Tell me about the beta announcement into Ireland - what products and services will this include? What business-sectors are you targeting?

We have publicly announced the launch of our Early Access Programme which brings Square’s suite of business tools to Irish businesses of all sizes. This marks the first time Square is available to Irish merchants, introducing our full ecosystem of products and services to offer all the tools that sellers need to start, run, grow and adapt.

Space in Square’s Early Access Programme is limited and will be filled on a first-come, first-served basis. Interested businesses across Ireland should visit squareup.com/IrelandEAP to learn more and secure their spot. Merchants who enroll in the Early Access Programme can get started with Square products in just days, with no long-term contracts or start-up fees, and qualify for free Square hardware.

The goal is to have as diverse a group of businesses as possible to make sure we have holistic and well-rounded feedback that will enable us to confidently and successfully launch our products for general availability in Ireland later in 2021.

Q3: How long does Square plan to be in beta-phase for? When can we expect a full launch?

The plan is to offer our products for general availability in Ireland later in 2021 - hopefully soon, depending on a successful Early Access Programme.

Q4: How will Square’s presence and ecosystem impact Ireland’s business landscape?

Covid-19 has had a significant impact on small businesses and we think now is the right time to launch in Ireland with a product suite that will help them to recover faster. Throughout the pandemic, we’ve taken steps to support our sellers through free advice issued on our customer dashboard and by making available services designed to help them adapt to the changing market demands. We want to bring these benefits to Irish businesses and understand more about how the pandemic is impacting Irish businesses, so we know how best to support them.

space in Square’s Early Access Programme is limited and will be filled on a first-come, first-served basis

We know that Ireland has a very entrepreneurial small business landscape, in 2018, SMEs generated over 46% of total turnover in the Irish business economy

We know that Ireland has a very entrepreneurial small business landscape, in 2018, SMEs generated over 46% of total turnover in the Irish business economy, while micro accounted for 91.9% of all enterprises. By launching our ecosystem of products in Ireland, Square can help meet demands and support businesses to grow and adapt. We also have our European HQ here in Dublin which made expanding here a natural choice for us.

Q6: What makes Square different to its competitors?

There are multiple payment providers out there - but no other company offers what Square does. We’re the only comprehensive solution of our kind when you consider omnichannel selling across in-store and online, which is more important than ever due to the impact of the pandemic. Square has a suite of products that fully integrate to save businesses time and offer solutions to a multitude of problems, all in one place.

I was genuinely looking for a company that had a strong ethos for why they existed and I don’t think there’s a more authentic brand when it comes to values and belief systems ... Authenticity is underrated

Lots of people talk about values and when I joined Square, I was genuinely looking for a company that had a strong ethos for why they existed and I don’t think there’s a more authentic brand when it comes to values and belief systems, particularly when it comes to the economic empowerment of businesses. This is reflected in the sheer diversity of talent at Square and the attitude we collectively hold of wanting to learn and having both the skill and the will to work with our sellers in the best way we can.

When it comes to recruiting talent we do see this as a competitive advantage. We’re hiring all the time and currently have around 20 jobs live on our website. These include business development, customer success, finance, marketing, and software engineering, so across almost all functions here in Ireland.

Q8: At Fintech Ireland, we are all about the Fintech ecosystem. Do you think that there will be opportunities to partner/collaborate with young, hungry and fast growing Irish fintech?

At the moment we are laser-focused on ensuring that we have a successful beta phase and Early Access Programme, however the possibilities are endless when looking to the future.

Q9: We spoke about your background earlier, what are three bullet points of advice you’d give to your younger self (and budding fintech entrepreneurs out there?)

The three bullet points I would give myself are:

- Authenticity is underrated: Doing something you enjoy for a living where you can stay true to yourself, and your own value system is probably more important than anything else

- Focus on having a Growth Mindset: Openness to learning, making mistakes and stepping out of your comfort zone will pay dividends

- Calmness, patience and embracing problems trump anger, frustration and stress on most occasions!

‘economic empowerment’ is what we stand for, it’s what inspires us and connects us across business units, teams, offices and drives our mission

Our purpose of ‘economic empowerment’ is what we stand for, it’s what inspires us and connects us across business units, teams, offices and drives our mission. Over the course of Square’s history and its future, we’ll have many missions and each mission will eventually end. But each mission serves a greater ending purpose, which is to empower people to participate in the economy. Read more on this point at https://squareup.com/us/en/press/2020-bitcoin-investment

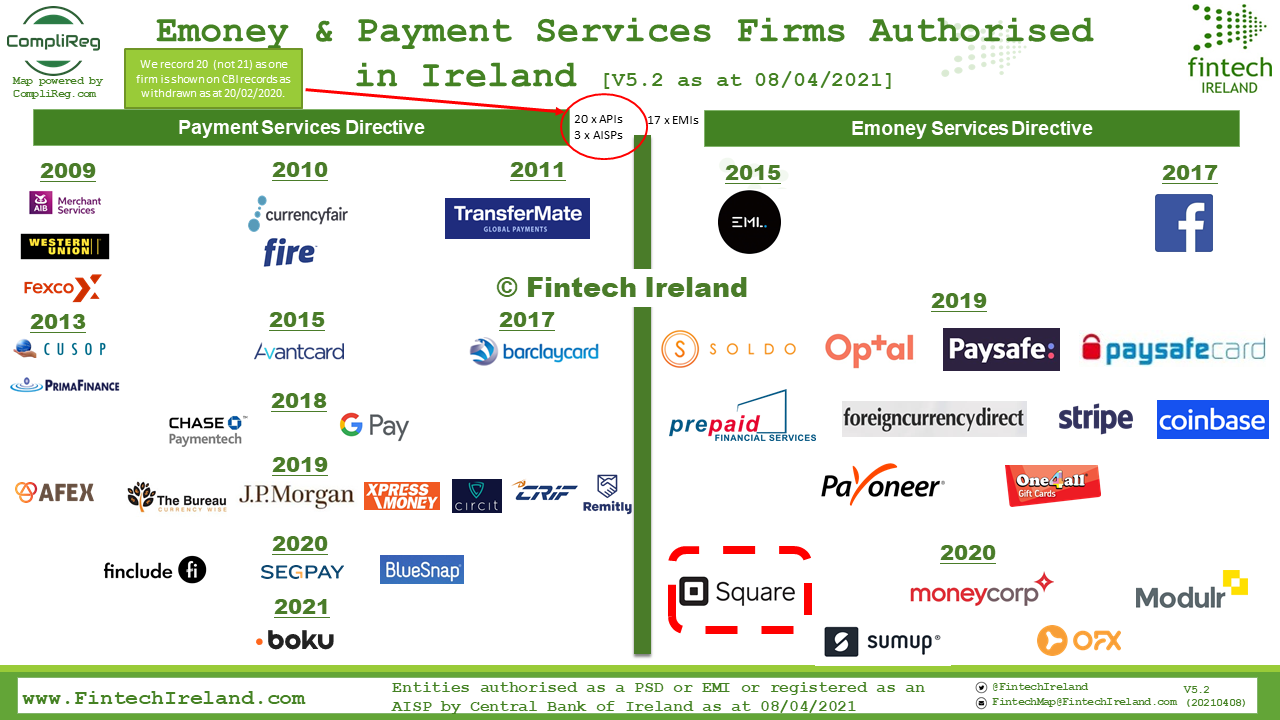

3) Execution of payment transactions, including transfers of funds on a payment account with the user’s payment service provider or with another payment service provider ... 3.b) Execution of payment transactions through a payment card or a similar device.

5) Issuing of payment instruments and/or acquiring of payment transactions.