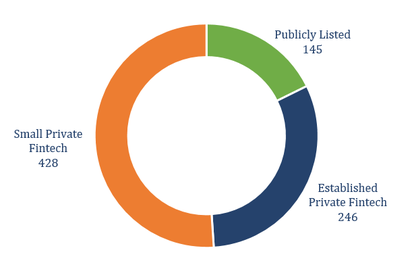

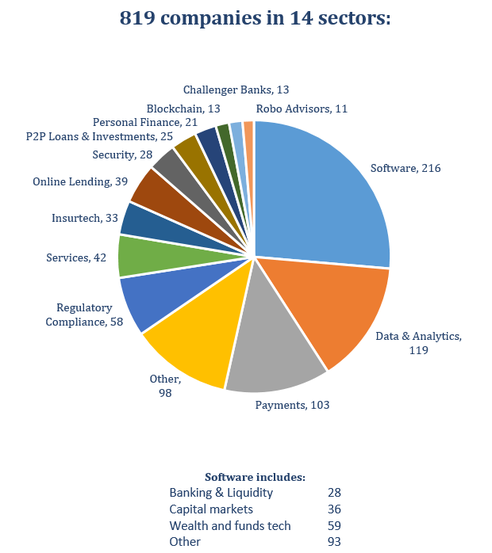

By analysing the historical financial performance of 819 fintech companies, the research provides guidance to owners and managers of Fintech companies on their relative performance, enabling them to see how others in the sector are doing in terms of growth and profitability

It examines the relationship between financial performance and valuations by considering the correlations:

- between share price movement and underlying performance for public companies,

- between the valuations achieved for private companies and their underlying performance prior to exit

Complimentary copies of the research can be downloaded from www.novitasftcl.com

- Private Fintech Financial Overview

- Private Fintech by Company Age

- The Performance Of Publicly Listed Fintech

- The Performance Of Public Vs Private Fintech: Revenue Growth

- The Performance Of Public Vs Private Fintech: Profitability

- What about the Performance of Individual Companies?

- Software Including Banking & Liquidity, Capital Markets And Wealth & FundsTech

- Data & Analytics

- Payments: Including Cross Border Payments

- Services & Other: Including BPO & Consultancy

- Does Performance Vary By Company Size?

- Does Performance Vary By Company Age?

- And What About By Ownership?

- Growth of Small Fintech

- Individual Performance Of Small Fintech Vs Established Fintech

- Individual Performance Of Small Fintech

- Individual Performance Of Small Fintech By Ownership

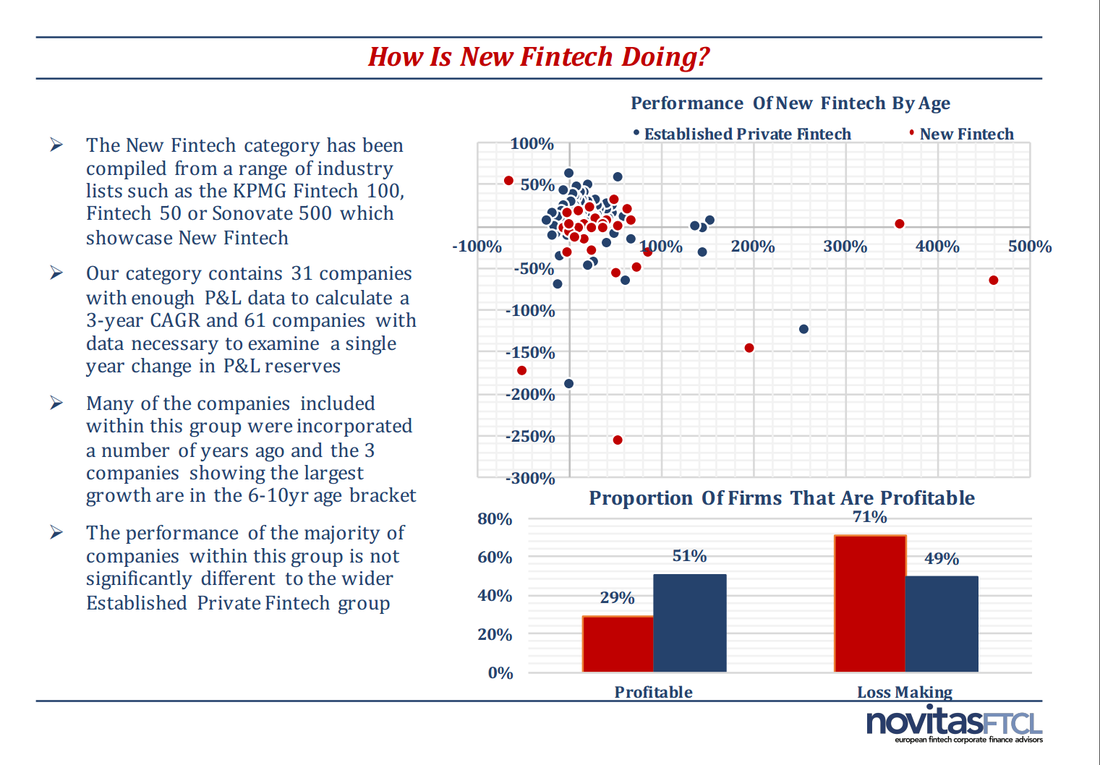

- How is New Fintech Doing

- Individual Performance Of Small Fintech Vs Established Fintech Vs New Fintech

- Correlation Between Growth In EBITDA And Share Price is strong

- Financial Performance Drives Valuation Multiples

- Performance Of Acquired Private Fintech

NovitasFTCL - has been advising the shareholders of European financial technology companies for over a decade and we hope you will find the information in our research interesting and informative. NovatisFTCL is Authorised and Regulated by the Financial Conduct Authority.