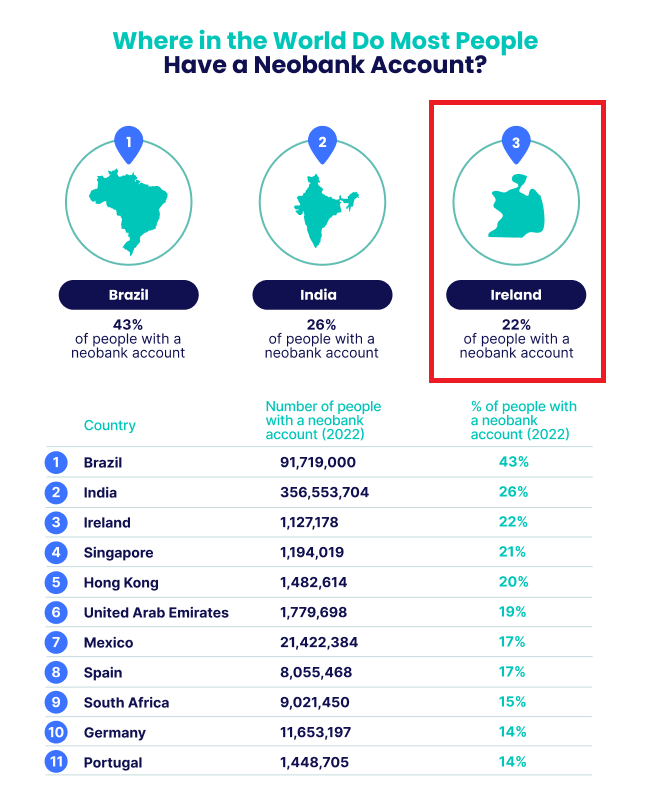

Which Countries Have Adopted Neobanks the Most?

Ireland - 22% of Irish people use a digital-only bank

Beating Ireland to the top spot is Brazil at #1 with 43% of the population having a Neobank account followed by India in the #2 spot with 26% of Indians using a digital-only bank.

Seon Technologies, which used data from Finder, reported that around 356,553,704 of India's populatuion could be Neobank account holders, putting them in first place as the country that uses digital banking the most. Meanwhile according to current population estimate for Braziln at 91,719,000, digitization of its economy has been accelerated by both the pandemic and popular Neobanks seeing their client base grow exponentially (a bit of a cause and effect observation). Brazil is also home to Latin America’s biggest Neobank, NuBank, which has over 48 million users.

In the BRICs, Neobanks appear to be offer their customers convenience, 24-hour support and often reduced costs as they help serve the unbanked and underbanked.

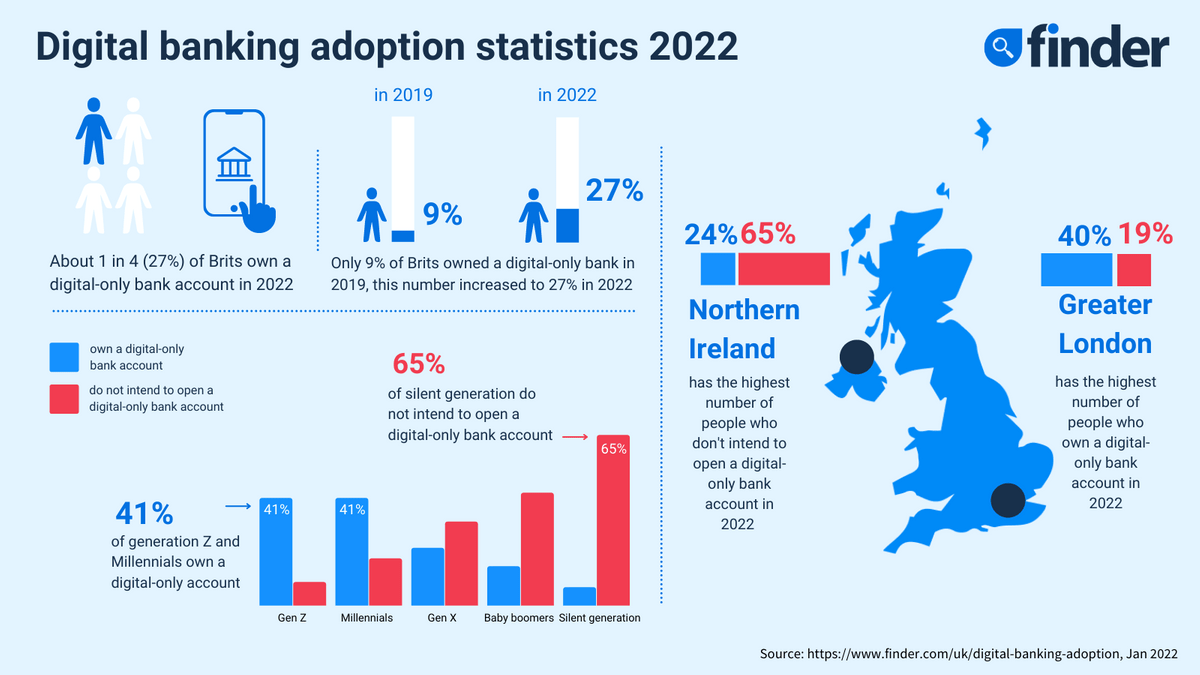

It reported at the time that about 1 in 4, in fact 27%, of Brits own a digital-only bank account. (1) It is hard to believe that the percentage has dropped in the period between January to July 2022; and (2) accordingly, why was the UK left off Finder's July 2022 update which showed that the top three spaces fell to Brazil, India and Ireland. At 27%, all things being equal, the UK at either the #2 (or #3) spot would have edged Ireland into 4th spot, right?

Which Neobanks have raised the most capital?

UK leads the way for Neobank capital raisings

The US comes 2nd to the UK based on the above figures at $11.5mn, with Brazil and Germany in 3rd and 4th place at $3.9mn and $1.7mn respectively.

Where Are Neobanks Being Adopted Faster?

No surprise to many of us in global fintech that Portugal makes the top 3 in this group. Around 14% of the Portuguese population currently uses a Neobank, and an estimated 32% will use Neobanking services by 2027. This indicates a 129% increase in Neobanking usage in the next five years.