** Authorisation by Central Bank of Ireland of an Electronic Money Institution and a Payments Institution **

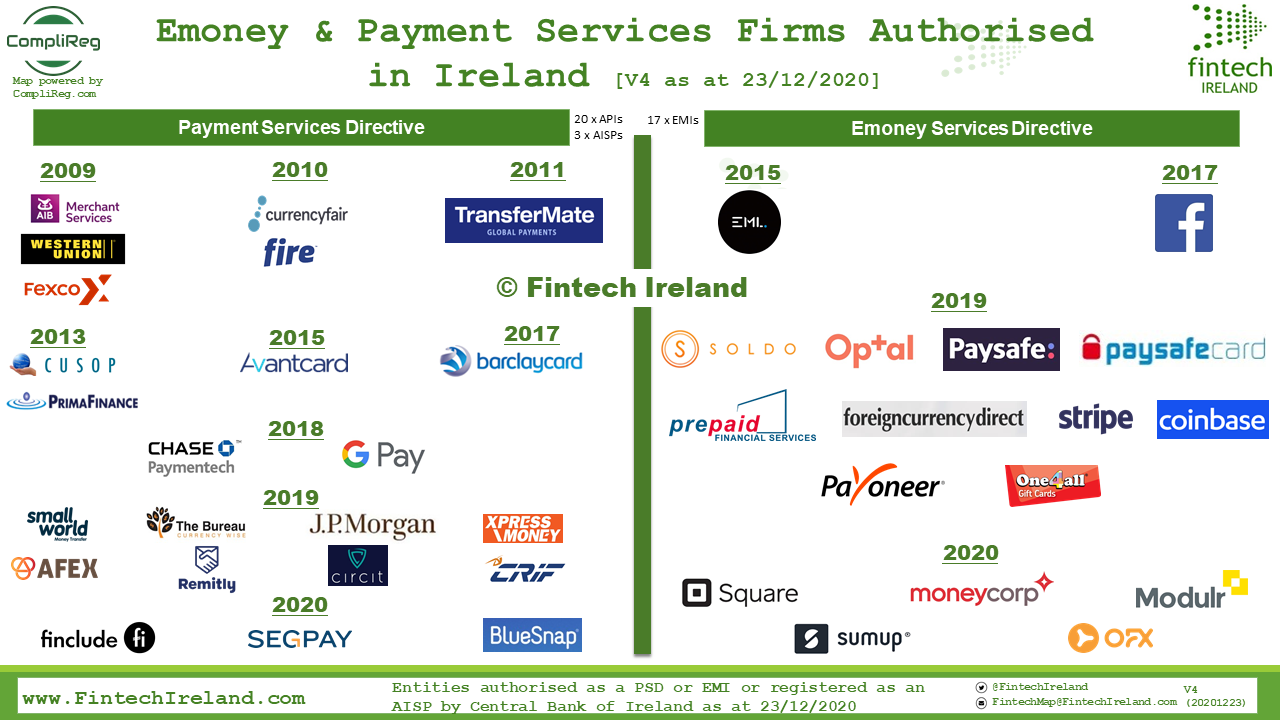

Our last post on additions to the Irish regulated fintech family of payment services firms and electronic money firms was back on 5 November 2020 when we released Version 3.0 of the 'Emoney & Payment Services Firms Authorised in Ireland Map' as at 2 November 2020.

Again thanks to CompliReg we have released an update to that Map, which now stands at Version 3.0. The new joiners are OFX Payments Ireland Limited and BlueSnap Payment Services Ireland Limited.

OFX Payments was authorised on 16 December 2020, and in addition to its authorisation to issue emoney it also secured payments services 3c, 4c, 5, and 6. BlueSnap Payments received its payments institution authorisation on 23 December 2020 and is authorised to provide payment service 5. See below for a description of these payment services numbers*.

Both firms arrive in Ireland ahead of the end of the Brexit transition date from the UK where their UK affiliates are authorised by the UK Financial Conduct Authority. OFX's global headquarters is in Sydney, Australia and BlueSnap was founded in Israel.

Welcome to Ireland OFX and Bluesnap. We know that there are others soon to join the regulated fintech ecosystem in Ireland which are making their way through the Central Bank of Ireland authorisation pipeline!

Those firms in the above Map which are indigenous to Ireland also appear on our bigger Fintech Ireland Map version 3.0 which you can find here. If you think you should be on the Fintech Ireland Map, complete our Survey. Do it soon as version 4 of that Map is slated for release very shortly!

If you are looking to get authorised in Ireland as an emoney or payments firm, see these Authorisation Guides and feel free to contact us for a informative dialogue on the authorisation process. We are chatting with about 4-5 firms a week. The completion of the Brexit transition period has not cooled interest in Ireland as a home for regulated fintech!

* Payment Services:

3. Execution of payment transactions, including transfers of funds on a payment account with the user’s payment service provider or with another payment service provider ... (c). Execution of credit transfers, including standing orders

4. Execution of payment transactions where the funds are covered by a credit line for a payment service user ... (c). Execution of credit transfers, including standing orders

5. Issuing of payment instruments and/or acquiring of payment transactions

6. Money remittance