- Payoma Ireland Limited (authorised electronic money institution)

- Bridge Peer Financial Limited trading as Property Bridges (authorised crowdfunding services provider)

- Slua Ventures Ltd t/a Spark Crowdfunding (authorised crowdfunding services provider)

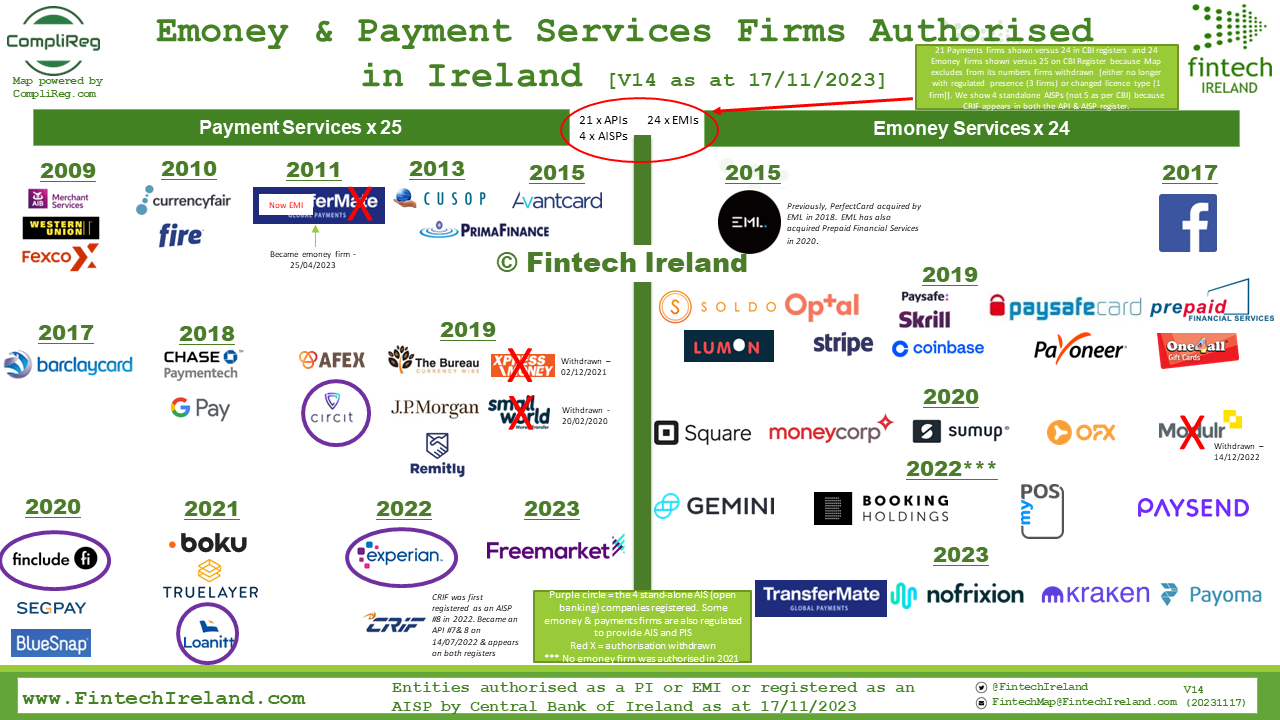

Payoma has also been added to our other regulated fintech map, Version 14, showcasing emoney and payments firms only.

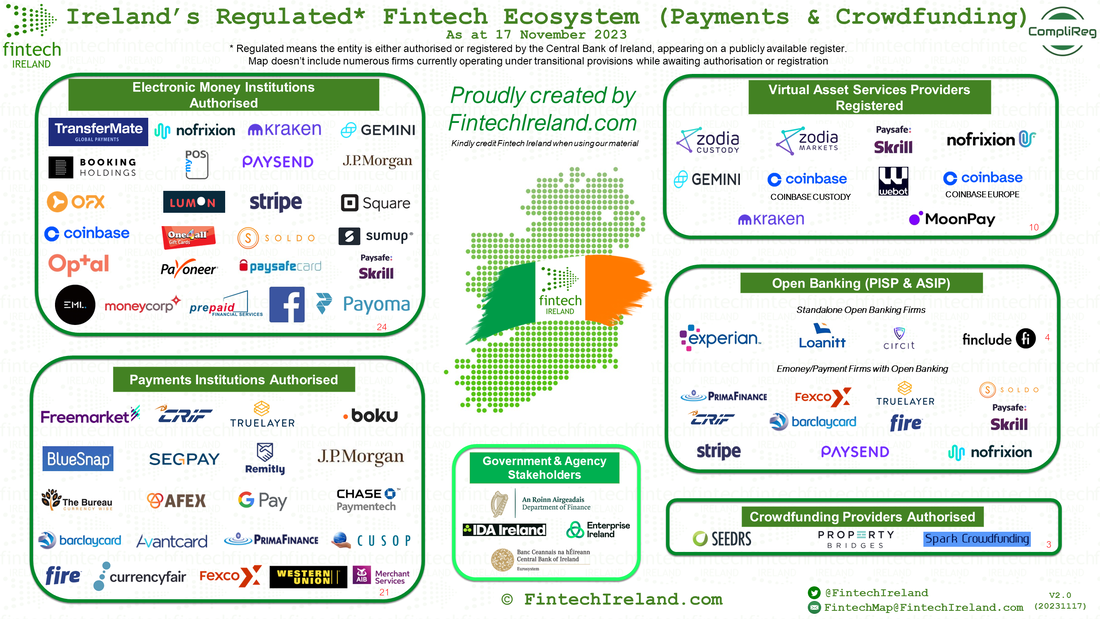

Ireland is now home to 62 authorised or registered fintech across emoney, payments, open banking and crowdfunding.

“Our heartfelt gratitude extends to the entire team at the Central Bank of Ireland for their unwavering support and belief in the potential of our project. Their guidance has been invaluable, and it is with their assistance that we have realized this ambitious goal.”

It is 100% owned by Payoma Limited in the UK which is authorised as an emoney firm by the Financial Conduct Authority. Payoma continues a trend of firms happy to go on the record about their positive experience of dealing with Ireland’s national competent authority, the Central Bank of Ireland saying in a statement “Our heartfelt gratitude extends to the entire team at the Central Bank of Ireland for their unwavering support and belief in the potential of our project. Their guidance has been invaluable, and it is with their assistance that we have realized this ambitious goal.”

Property Bridges and Spark Crowdfunding, both authorised by the cut-off date of 10 November 2023 join Seedrs Europe Limited as the only locally authorised crowdfunding service providers.

Further Reading:

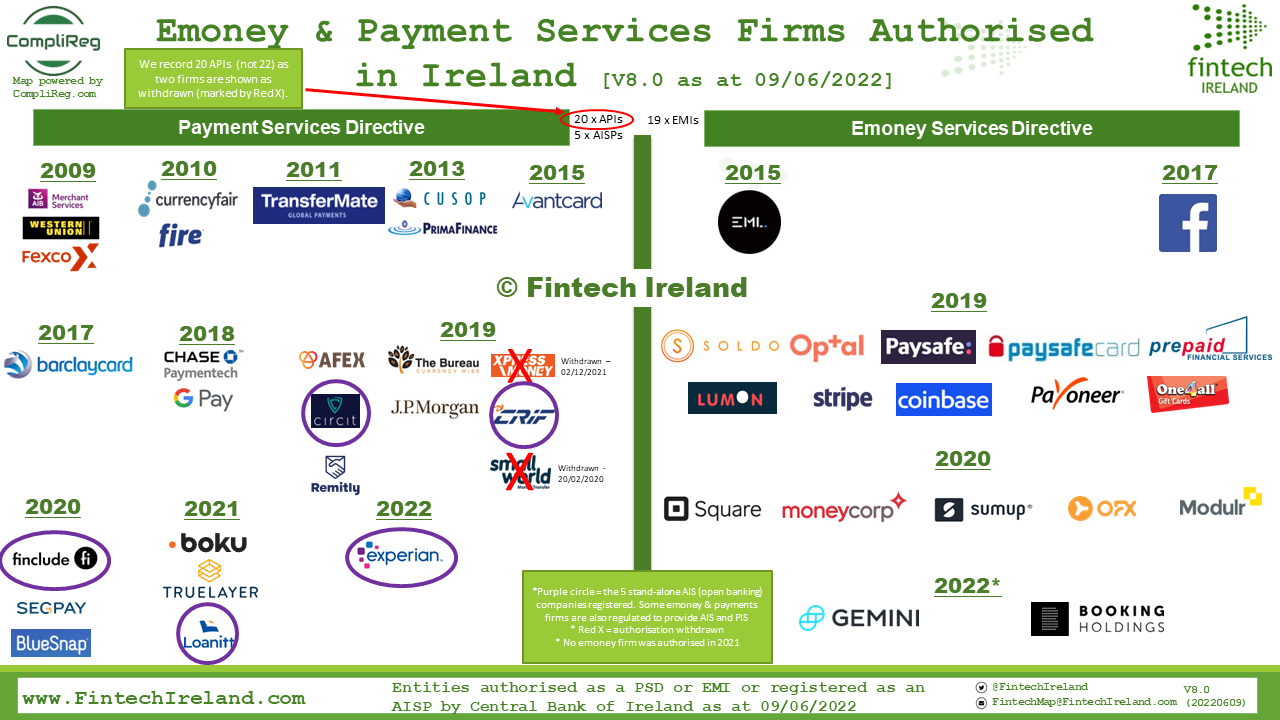

- Release of version 13 of the Regulated Fintech Emoney & Payments Map

Sign-up to the Fintech Ireland Newsletter here to keep up to date with Irish fintech news, follows us on Twitter and follow the Fintech Ireland's Linkedin Page. If you are first connections with Peter Oakes, you can also join the Fintech Ireland Group on Linkedin.