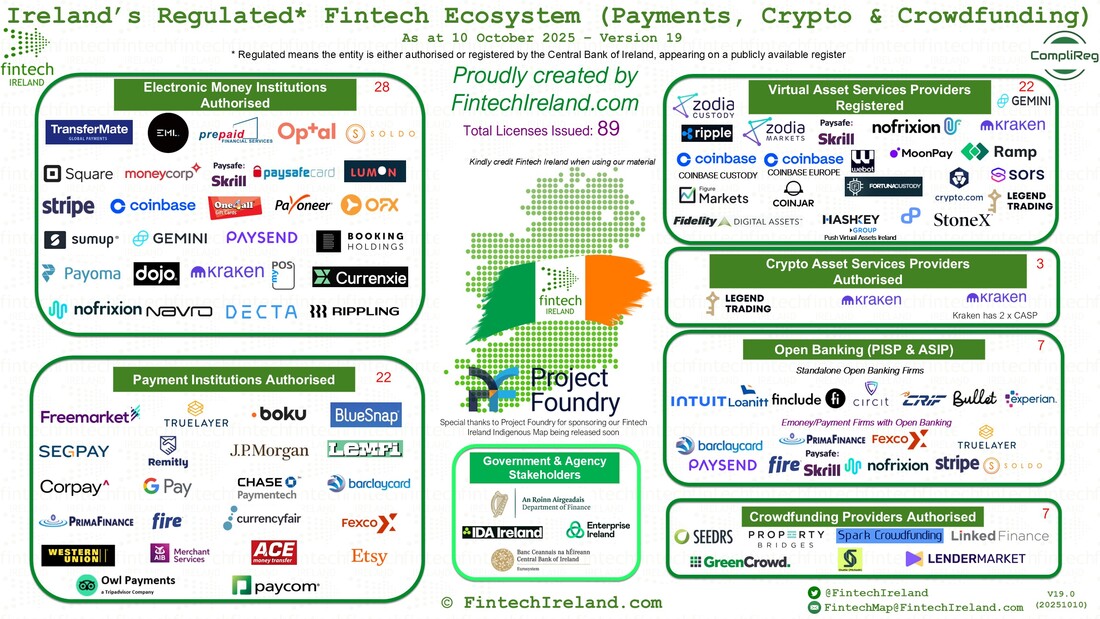

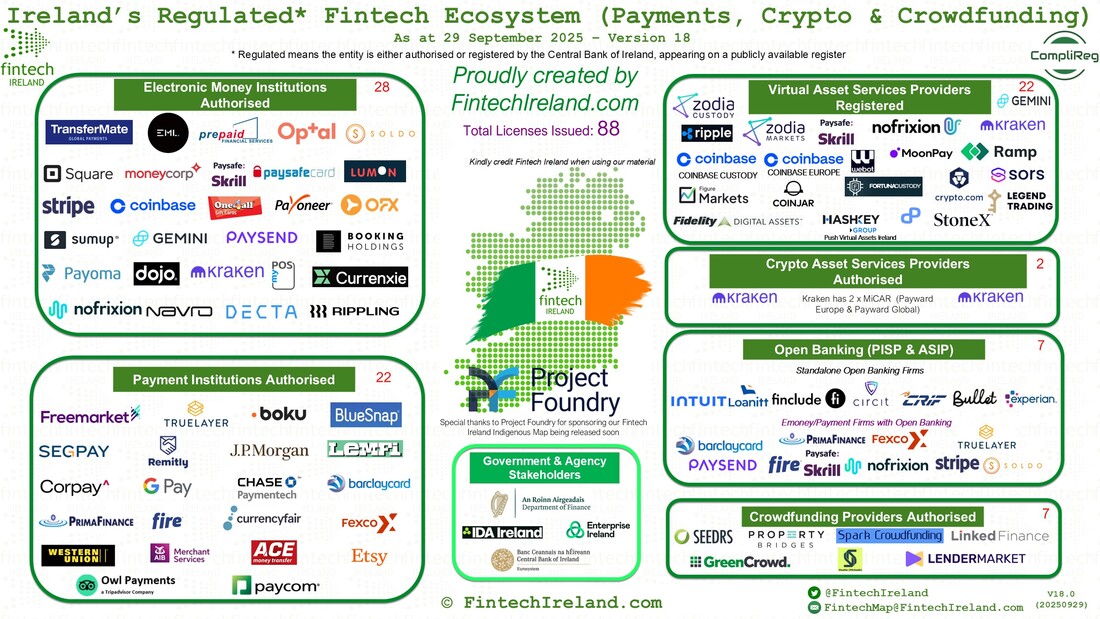

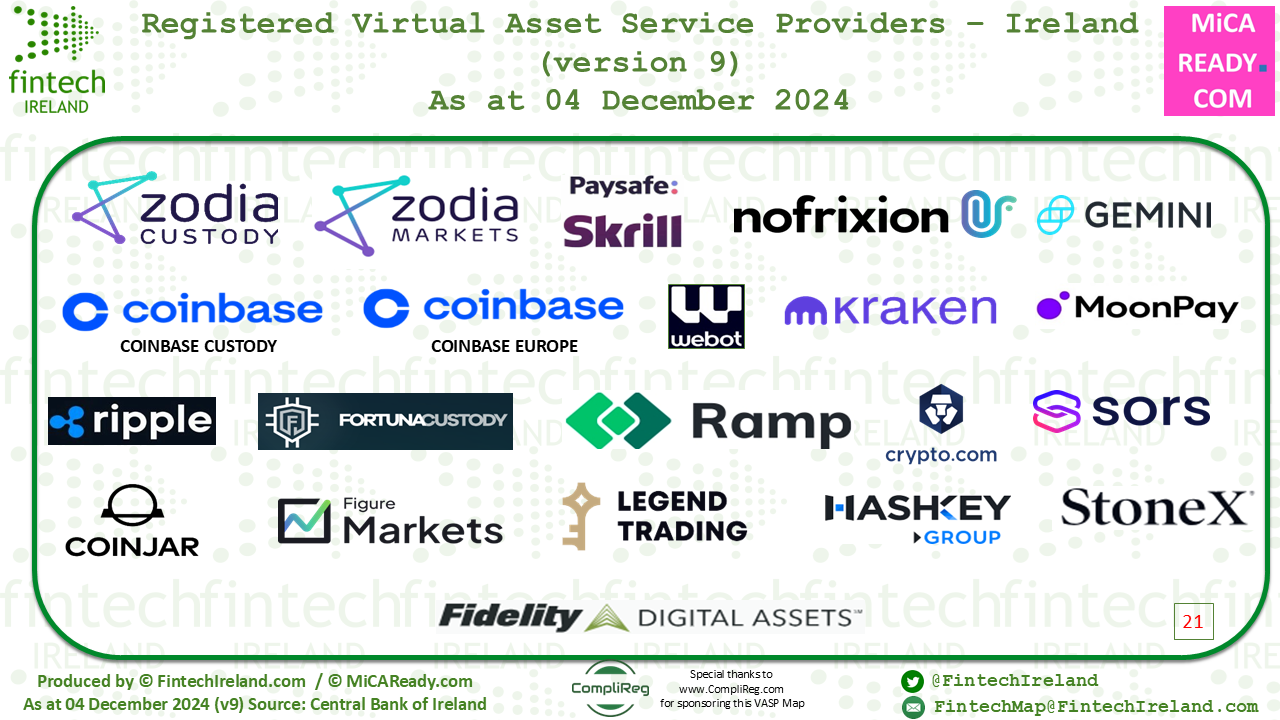

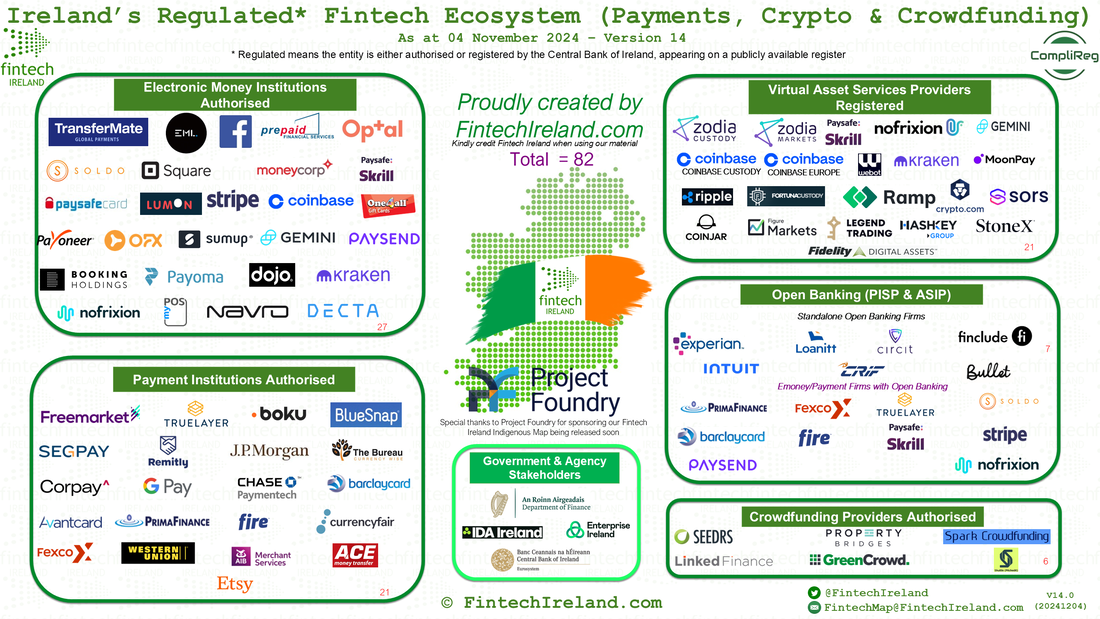

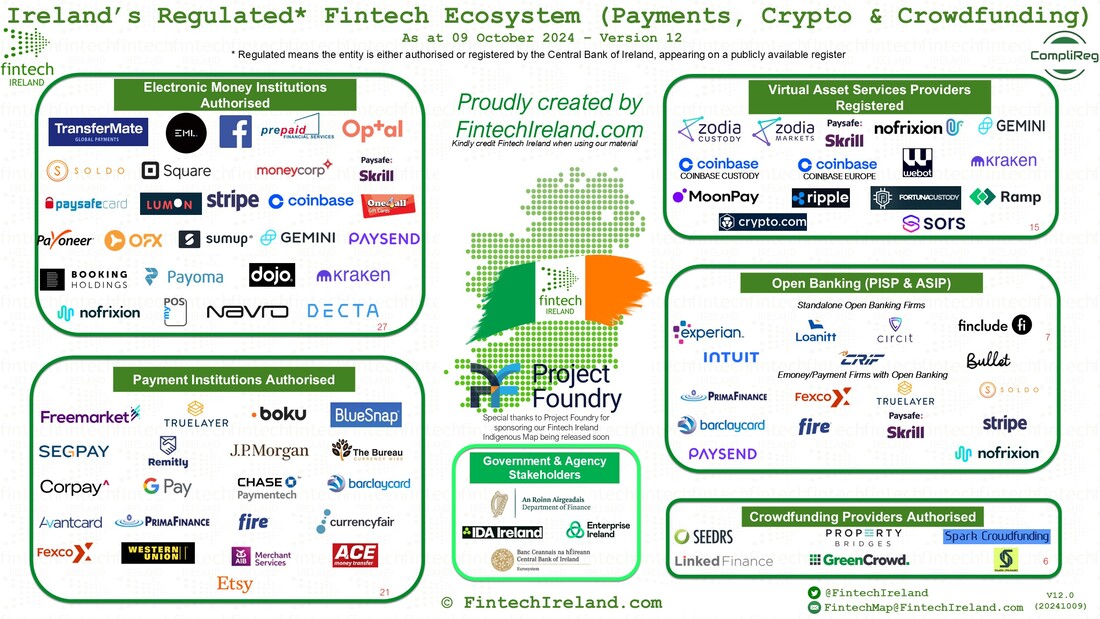

Thanks to CompliReg for powering the Map. Check out their services HERE.

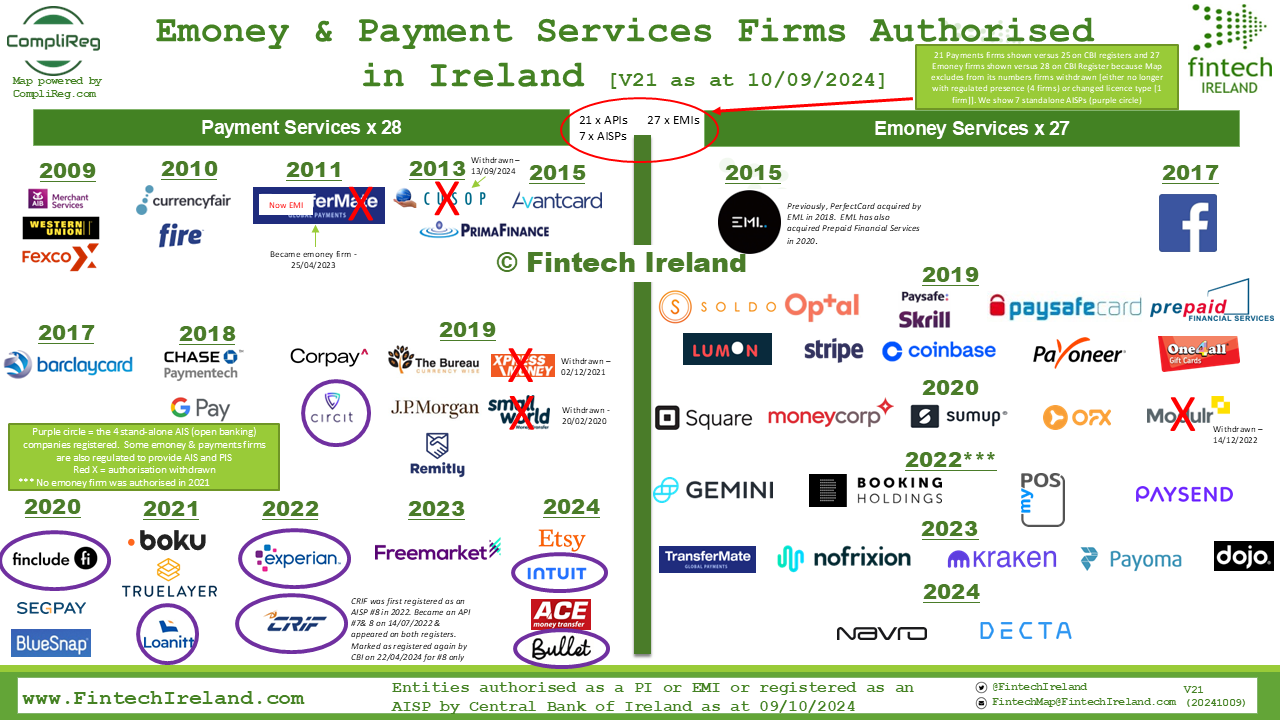

The Fintech Ireland Map records only those companies which are registered or authorised. Any discrepancy between the Map and the Central Bank's registers is due to the fact the Central Bank does not remove the names of e-money and payments firms that withdraw authorisation but instead mark these with the withdrawal date.

We expect to see more and more fintechs achieve authorisation from the Central Bank in coming weeks, so keep an eye of this website. And get along to the Fintech Ireland Summit on Thursday 27th November 2025 where we will take a deeper dive into this topic.

If your logo or name has changed, please email us at [email protected] with your newer logo (in jpeg / png format) and any name change. If your company is not on the relevant Map and you wish to join, please start the process by completing the Fintech Ireland Survey. it.

- Sign up to our Newsletter here.

- Attend the Fintech Ireland Summit here.

- Need assistance with an emoney or payments authorisation or an account information service provider or virtual asset services provider registration application, check out Fintech Ireland and CompliReg's handy authorisation guides at https://fintechireland.com/fintech-authorisations.html.