- Sign up to our Newsletter here.

- Need assistance with an emoney or payments authorisation or an account information service provider or virtual asset services provider registration application, check out Fintech Ireland and CompliReg's handy authorisation guides at https://fintechireland.com/fintech-authorisations.html.

- Attend, exhibit and/or sponsor the upcoming Fintech Ireland Summit. Details here.

Pitchedit (Shuttle) and Gleman Software (Bullett)

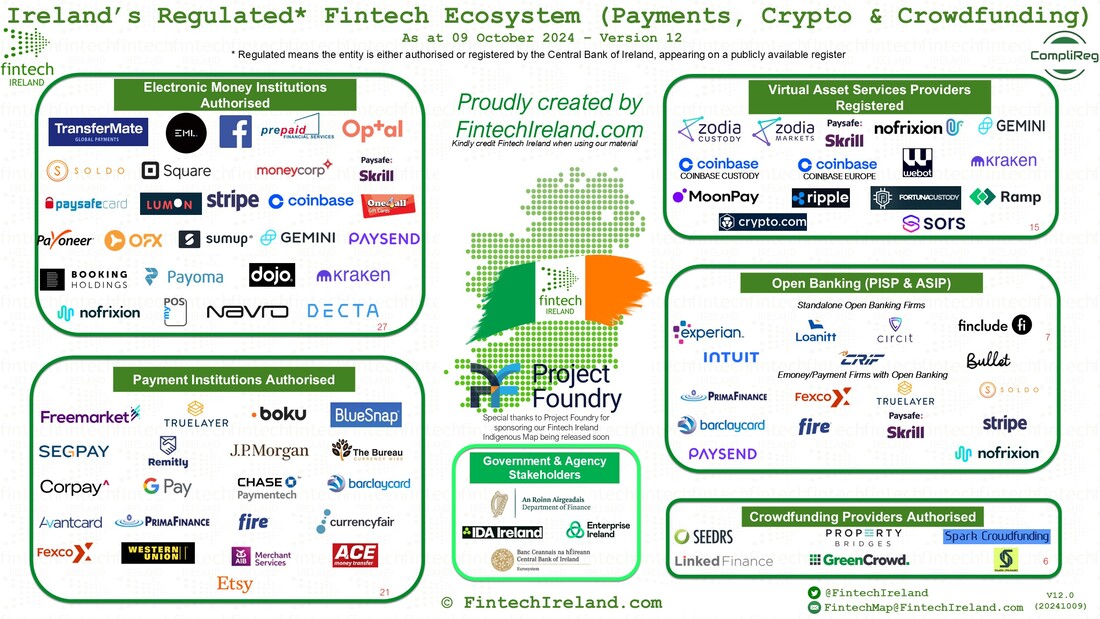

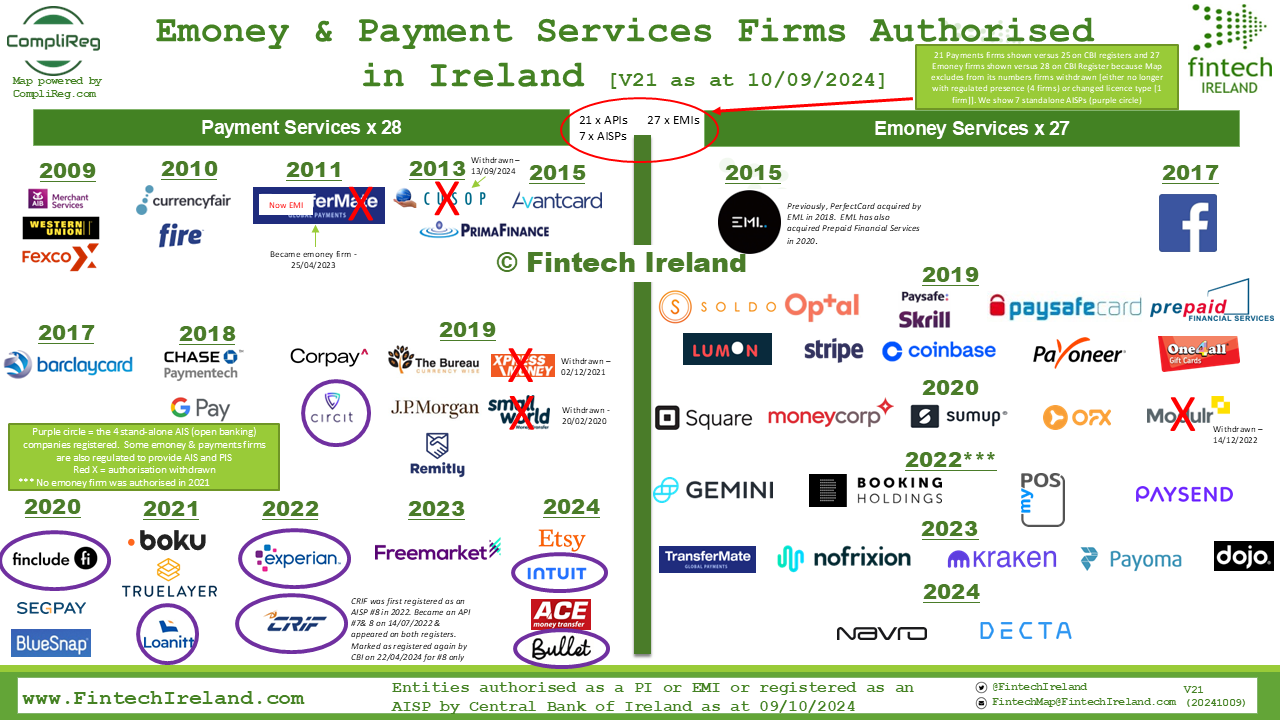

We last issued the Regulated Fintech Map and the Emoney & Payments Map on 19 July 2024 (version 11). At that time there were 75 such firms showcased on the Regulated Fintech Map. Joining version 12 of that Map are:

- Pitchedit Limited trading as Shuttle which achieved authorisation as a crowdfunding firm on 28 August 2024 under Article 12 of Regulation (EU) 2020/1503.

- Gleman Software Development trading as Bullet, which achieved registration on 3 September 2024 as an open-banking firm under Regulation 25(1)(b) of the European Union (Payment Services) Regulations 2018.

Bullet also joins version 21 of the Emoney and Payments Map by virtue of it being an account information services provider.

Fintech Ireland is delighted to welcome both firms to the ever-growing Regulated Fintech Map (Version 12) and the VASP Map (version 8). Thanks to CompliReg which supports firms in the fintech industry.

Congratulations to both for increasing the ranks of Irish regulated fintech.

Shuttle, founded by the infectious Robert Halligan and Scott Ashmore, is an alternative investment platform providing investors with access to private market investment opportunities through a subscription service. Both Robert and Scott are directors of Shuttle, which was incorporated in June 2021. When we spoke to Scott and Rob recently, they informed us "We're really excited to get authorised by the CBI and appreciate all the support Fintech Ireland have given us these last two years".

Bullet is all-in-one toolkit built on a finance platform. Its sole director is Peter Connor. It was incorporated way back in July 2020 before there was such a word as ‘fintech’!

CUSOP (Payments) surrender its authorisation

CUSOP (Payments) established in August 2011 was set up as a shared services entity to provide electronic payment services to participant credit unions and is owned by the CUSOP Trust on behalf of the participating credit unions. While it made a loss for the year ending 2023 in the amount of €774K and saw a drop in the number of credit unions which it served, the fintech processed €25.8mn in payments in 2023 up from €24.1 in the previous year. The associated value processed grew to a new record of €7.8bn up 10% from €7.1bn in 2022.

So why did the fintech wind down its business and withdrew its authorisation?

This is owed to the outcome of the due diligence phase of a merger process involving CUSOP and Payac when it become clear that the proposed merger could not proceed as originally envisaged. It did not help that there was a decreasing number of credit unions availing of CUSOP’s services and other considerations.

- 27 authorised electronic money institutions

- 21 payments institutions,

- 7 standalone open banking firms,

- 15 VASP, and

- 6 crowdfunding services providers.