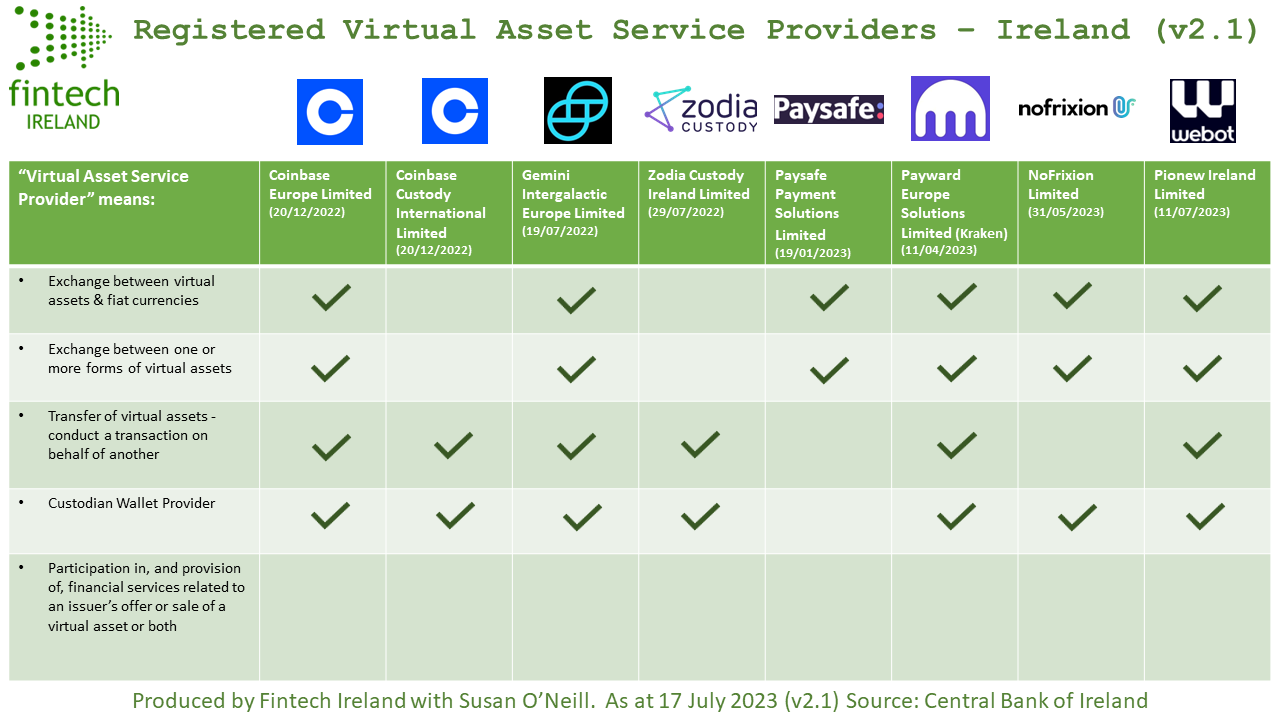

Welcome NoFrixion and Pionew Ireland to Fintech Ireland's Registered Virtual Asset Service Providers Map v 2.0

We have now updated the Map to Version 2 as at Monday 17 July 2023.

Welcome NoFrixon Limited and Pionew Ireland Limited to the Map.

No Frixon was registered on 31 May 2023 and Pionew Ireland followed on 11 July 2023. Both firms are registered to

- (i) provision of exchange services between virtual assets and fiat currencies

- (ii) exchange between one or more forms of virtual assets; and

- (iii) transfer (to conduct a transaction on behalf of another natural or legal person that moves a virtual asset from one virtual asset address or account to another) of virtual assets.

They join Coinbase Europe Limited, Coinbase Custody International Limited, Gemini Intergalactic Europe Limited and Zodia Custody Ireland Limited and Paysafe Payment Solutions Limited.

According to records at the Companies Registration Office,

- NoFrixion Ireland has 6 Irish resident directors (Aaron Clauson, Kathryn Hotten, Maurice Roche, Patrick Pinschmidt, Kieran Francis Mcloughlin and Feargal Brady); and

- Pionew Ireland has two USA resident directors (Robert Francis Morris and Tang Guojing) and one Irish resident director (Anne Rothwell).

BTW, Fintech Ireland and Peter Oakes are supporting MiCA Ready which tracks materially important EU news on MiCA and Digital Assets Africa