- Sign up to our Newsletter here.

- Need assistance with an emoney or payments authorisation or an account information service provider or virtual asset services provider registration application, check out Fintech Ireland and CompliReg's handy authorisation guides at https://fintechireland.com/fintech-authorisations.html.

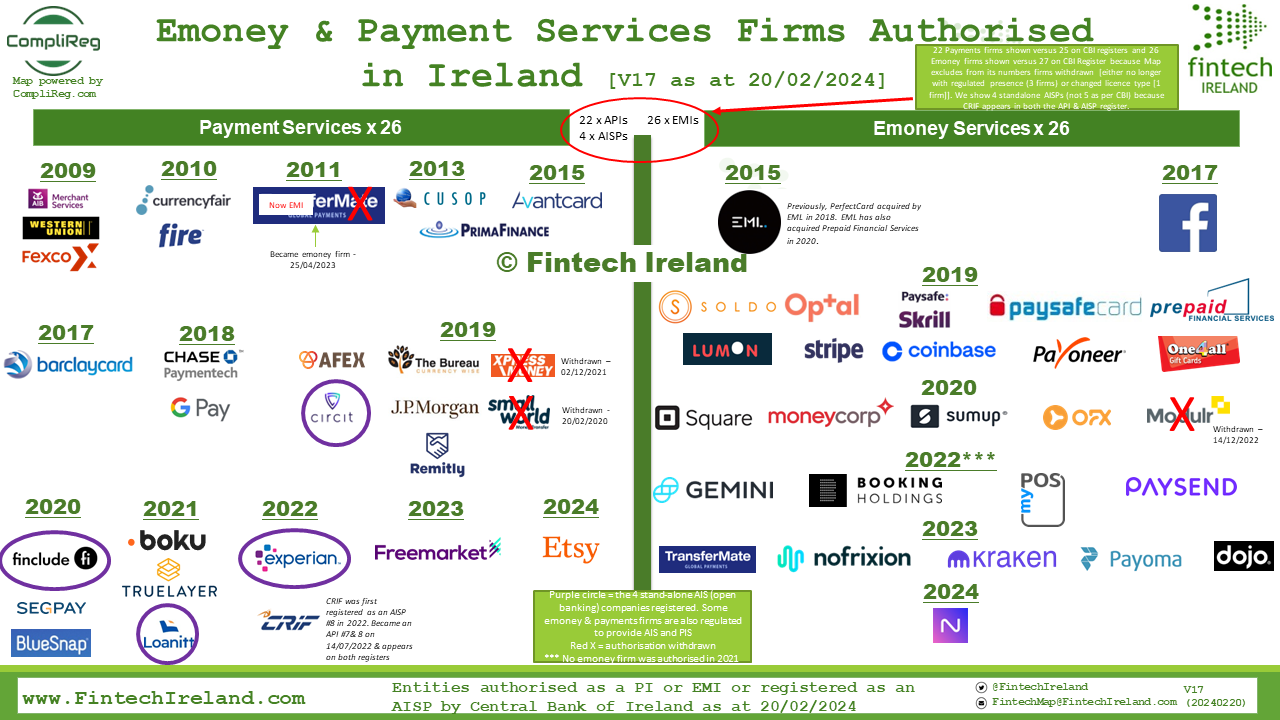

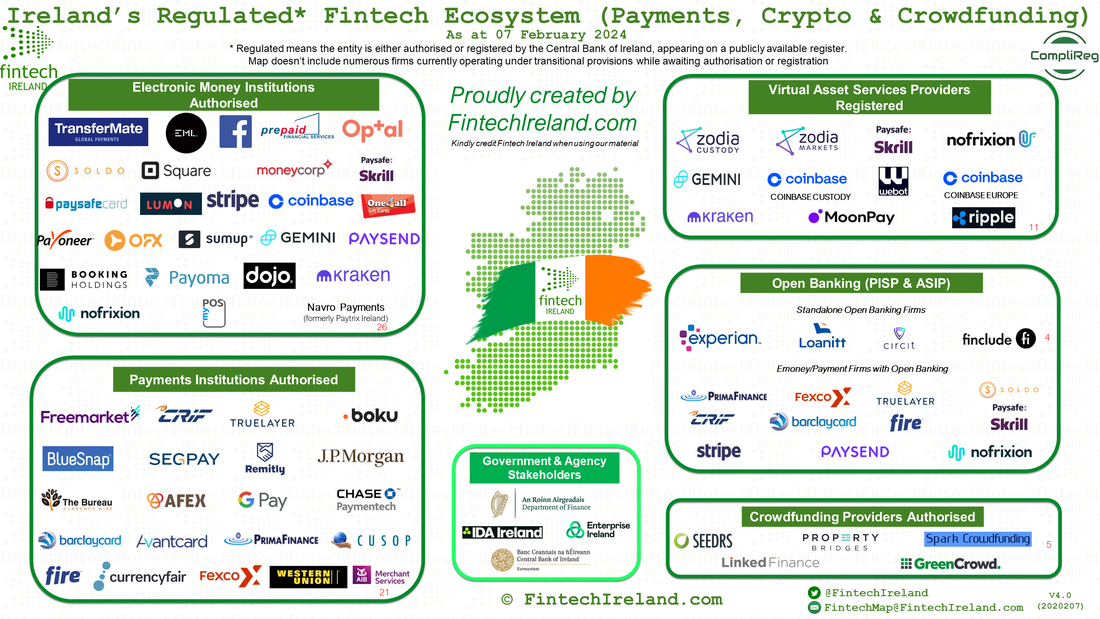

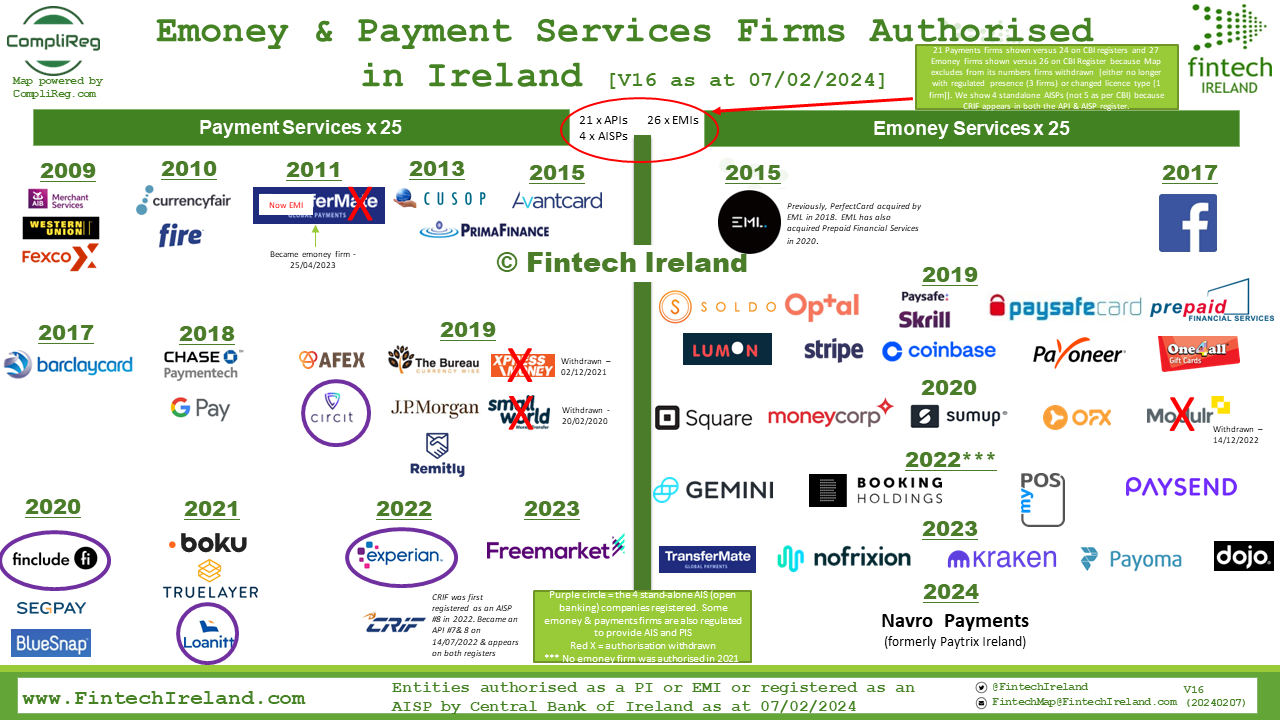

- 26 authorised electronic money institutions

- 21 payments institutions,

- 4 standalone open banking firms

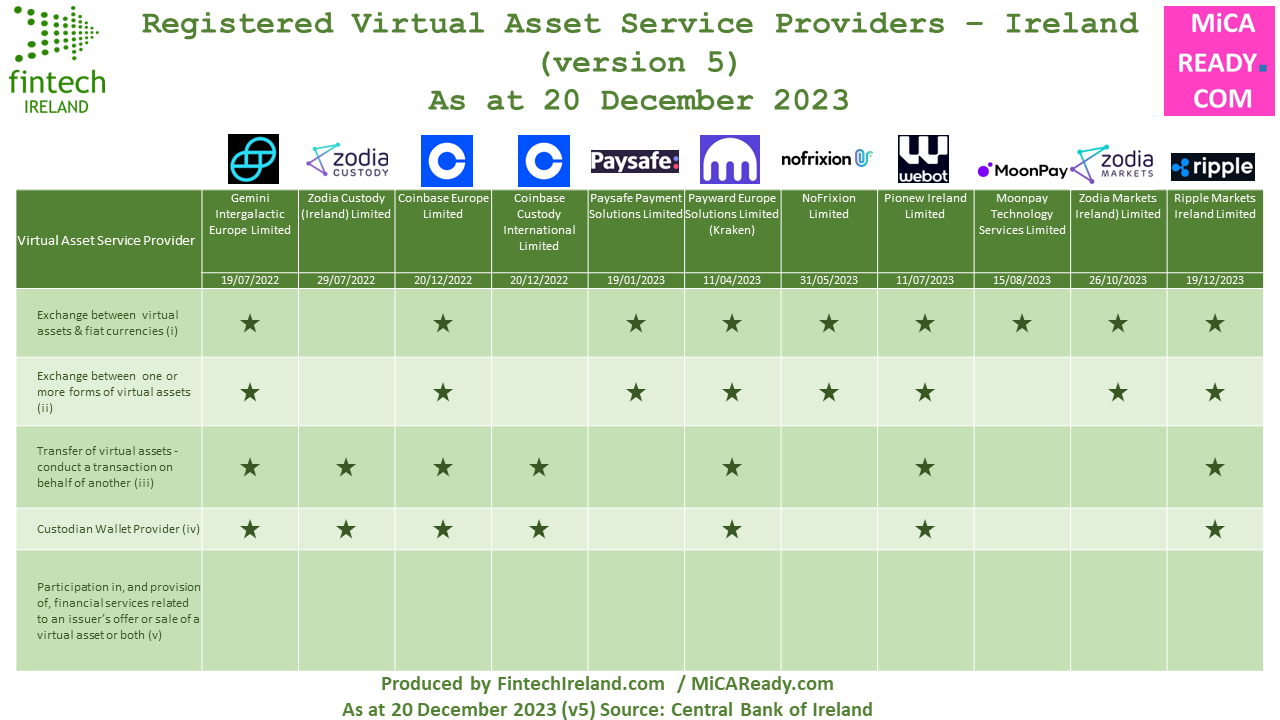

- 11 virtual asset services providers and

- 5 crowdfunding services providers.

We are pretty sure that these numbers will continue to grow in 2024.

Etsy Payments Ireland was authorised by the Central Bank of Ireland on Tuesday 20 February 2024 as a payments institution. It is the first payments institutions to be authorised in Ireland in 2024 and the first such firm authorised since early September 2024 when Freemarketfx Ireland Limited became authorised. Earlier this month an electronic money institution received authorisation.

Gary French announced his appointment to the role of Chief Executive Officer at Etsy Payments Ireland in a Linkedin post yesterday. Gary is also on the board of the company. Before joining the Etsy brand, Gary worked at Google / Google Payment Ireland Limited and Elavon.

- Sign up to our Newsletter here.

- Need assistance with an emoney or payments authorisation or an account information service provider or virtual asset services provider registration application, check out Fintech Ireland and CompliReg's handy authorisation guides at https://fintechireland.com/fintech-authorisations.html.