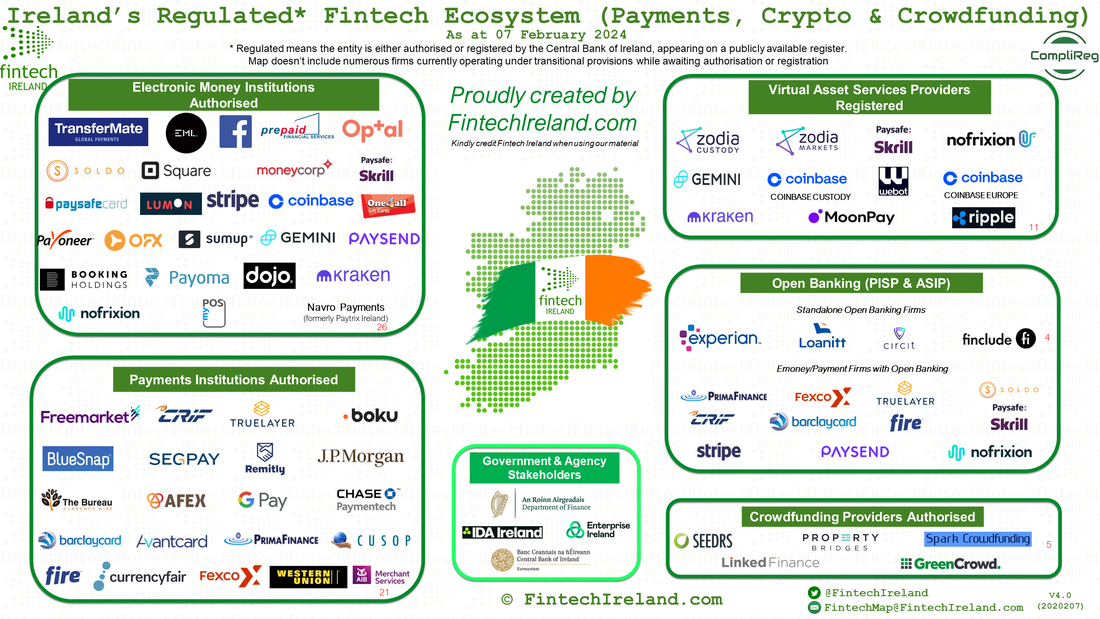

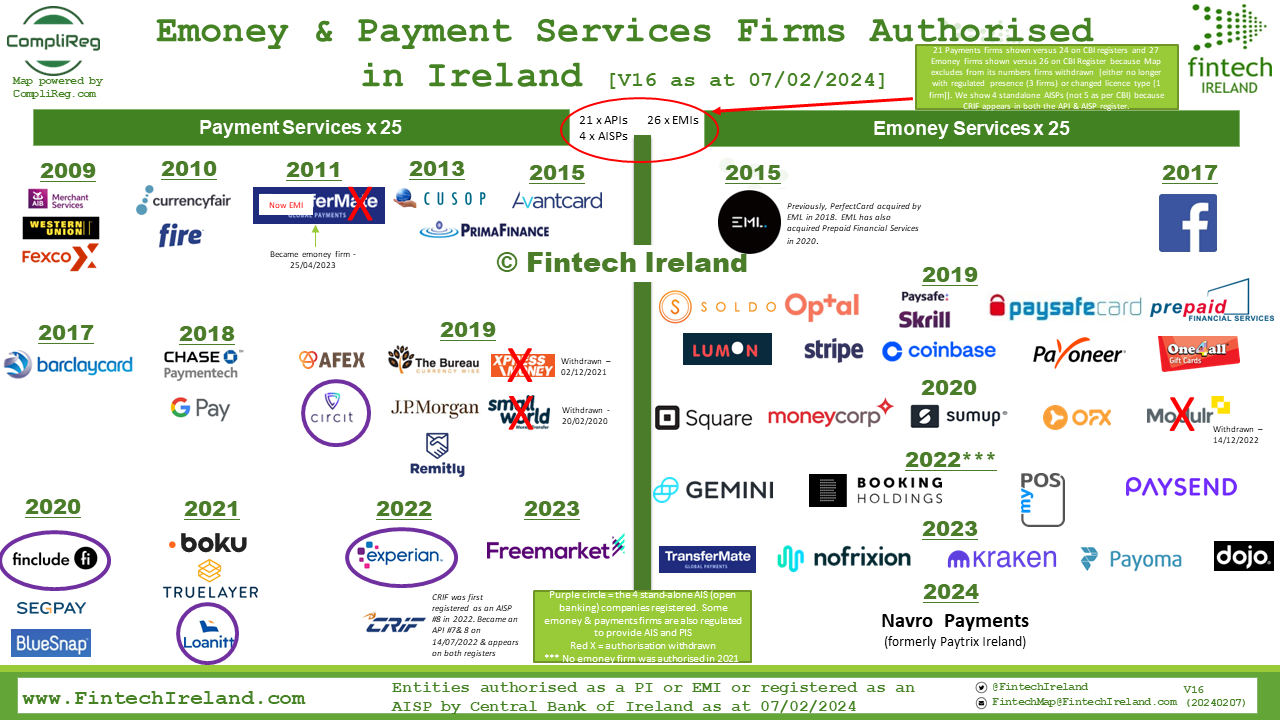

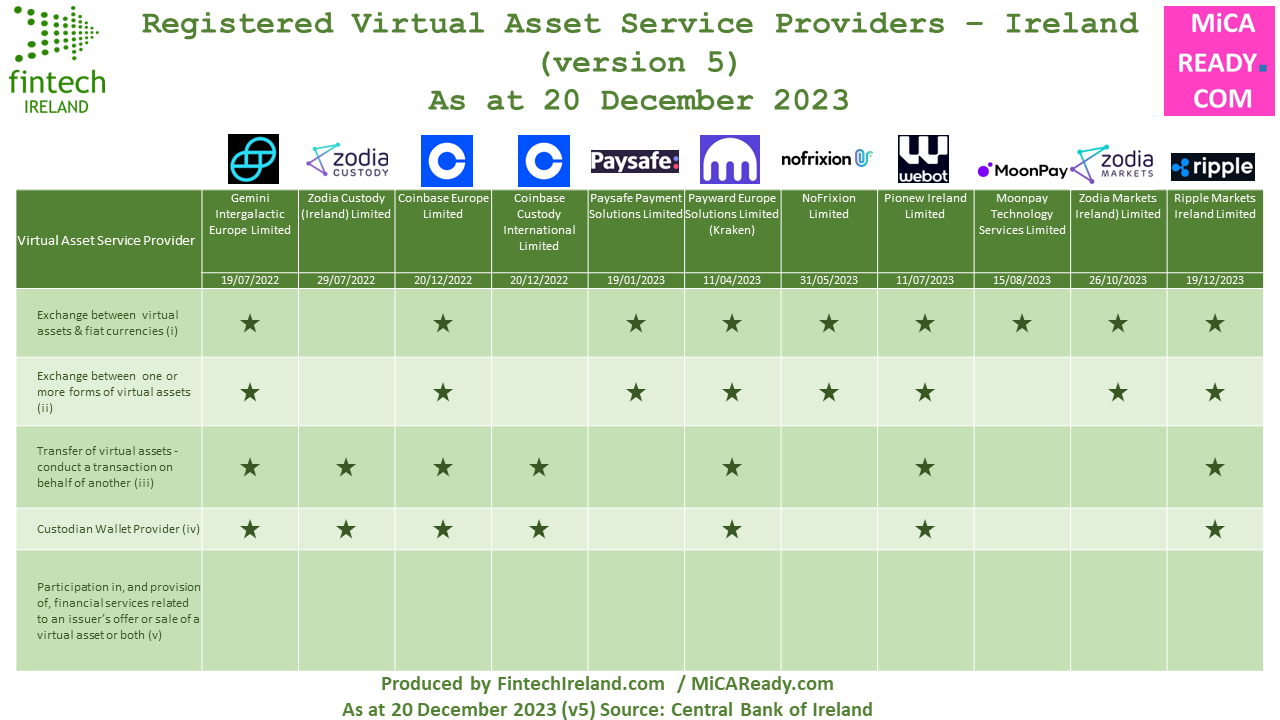

2023 saw just 5 electronic money firms become authorised in Ireland and just 1 payments institution became authorised. Given that one of the emoney firms authorised was an upgrade from a payments institution authorisation, Ireland only welcomed 4 new companies to its emoney / payments sector. There was better news for the local crypto industry with 7 virtual asset service providers becoming registered in 2023 out of a pool of 11 such firms. These virtual asset firms and others that may get registered in 2024 can look forward to a deeper and more intense authorisation process should they choose Ireland to be their European home under the Markets in Crypto Asset Regulation. Fingers crossed. And note MiCAReady.com is here to help those firms and other plan for their pan-European Union journey.

Last August it was announced that fintech industry pioneer Joe Redmond had joined the Paytrix team as the new CEO for Ireland to drive its compliance and expansion plans across Europe. Other heavy hitters involved with Navro Payments Europe includes Peter Rowan, who joined the board of directors on 28 September 2022 and is listed on his linkedin profile as General Manager in addition to his director role. Other board directors of the newly authorised Irish company are Paytrix founders Edward Harrison and Aran Brown.

Navro Payments is 100% owned by Paytrix Holding Limited. The company was rebranded Navro Payments according to Companies Registration Office records pursuant to section 32 of the Companies Act 2014.

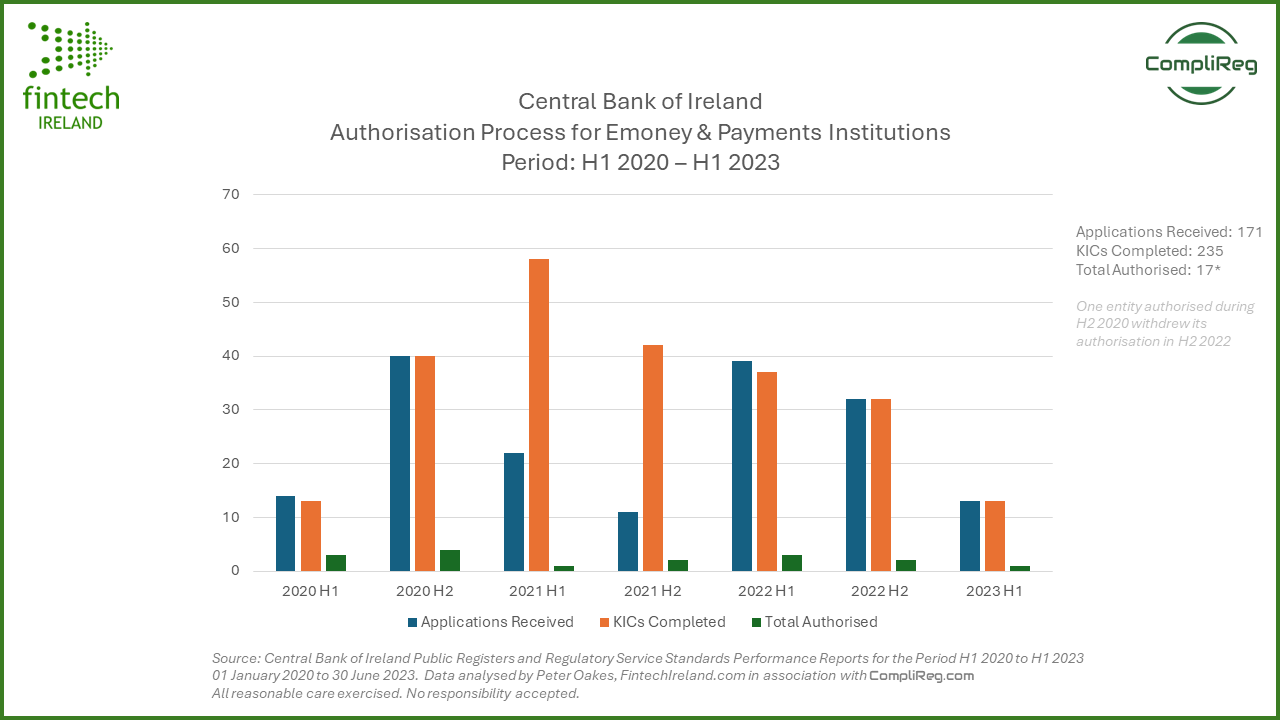

Looking back over the Period H1 2020 to H1 2023 - to co-ordinate with the Central Bank of Ireland’s own Regulatory Service Standards Performance Reports - there are some interesting observations. During that period, as shown in the image below, the regulator:

- received 171 applications

- completed 235 key information checks

- authorised 10 electronic money firms (one being an upgrade from payment institution authorisation [InterPay Limited] and another which subsequently withdrew its authorisation in 2022).

- authorised /registered just 7 payments firms, including a large portion being standalone open banking firms (i.e. AISP and PISP)

The data in the first two bullet points comes the section within the reports headed Payment Firms (Payment Institutions, Electronic Money Institutions, Small Electronic Money Institutions & Money Transmission Businesses) & Bureaux de Change Authorisations. Unfortunately the regulator's statistics for Bureaux de Change do not show the date a firm was authorised/registered. Further, in the absence of more detailed data, it is possible (if not probable) that there is some double counting here.

The data in the last two bullet points comes from the regulator's registers.

Based on the numbers of firms authorised/registered versus applications received, one might have a few questions about the throughput of applications at the Central Bank. However, there is no point speculating or over analysing the limited information available in the public domain. What we need to do so is publication of substantial, independent and detailed information about the authorisation process and deeper and richer metrics.

What is fair to say is that since since 2017, when Ireland had just two electronic money firms, that number has swelled 12 fold to the start of February 2024. Over the same period, the number of payments firms (authorised and registered) has jumped from 10 to 25 in total (21 authorised and 4 registered). More impressive is the rapid but seemingly controlled growth of quality digital asset firms totaling 11 from July 2022 to the end of last year.