- Need assistance with an emoney or payments authorisation or an account information service provider or virtual asset services provider registration application, check out Fintech Ireland and CompliReg's handy authorisation guides at https://fintechireland.com/fintech-authorisations.html.

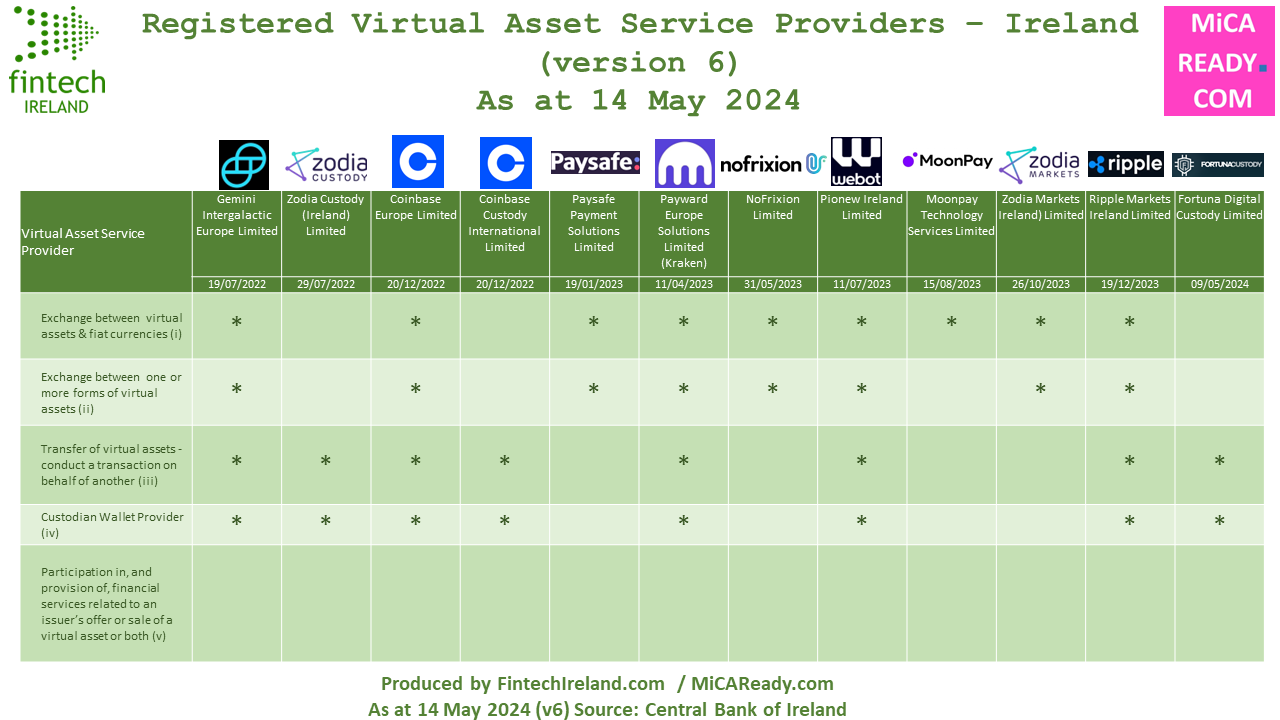

Ramp Swaps (Ireland) Limited joins the Fintech Ireland Maps following its registration as a Virtual Asset Services Provider on 17 May 2024.

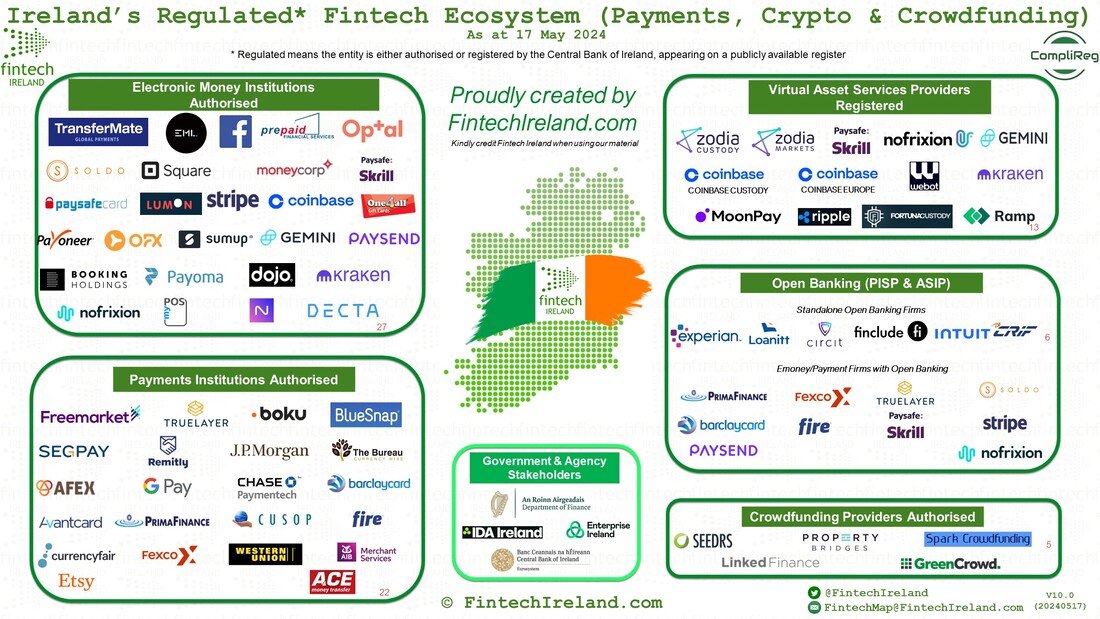

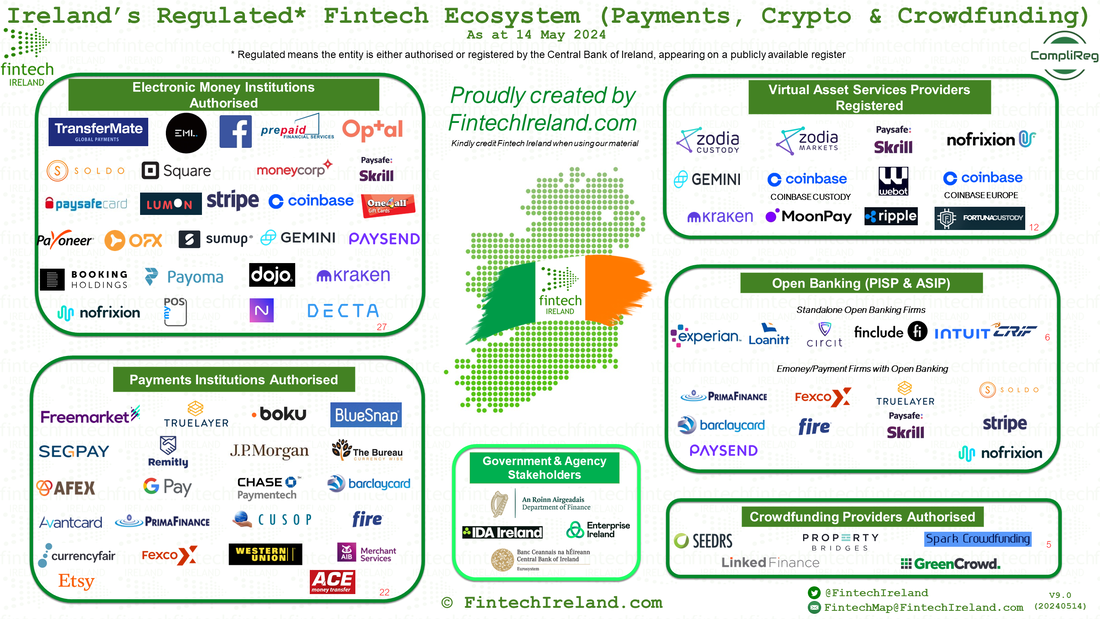

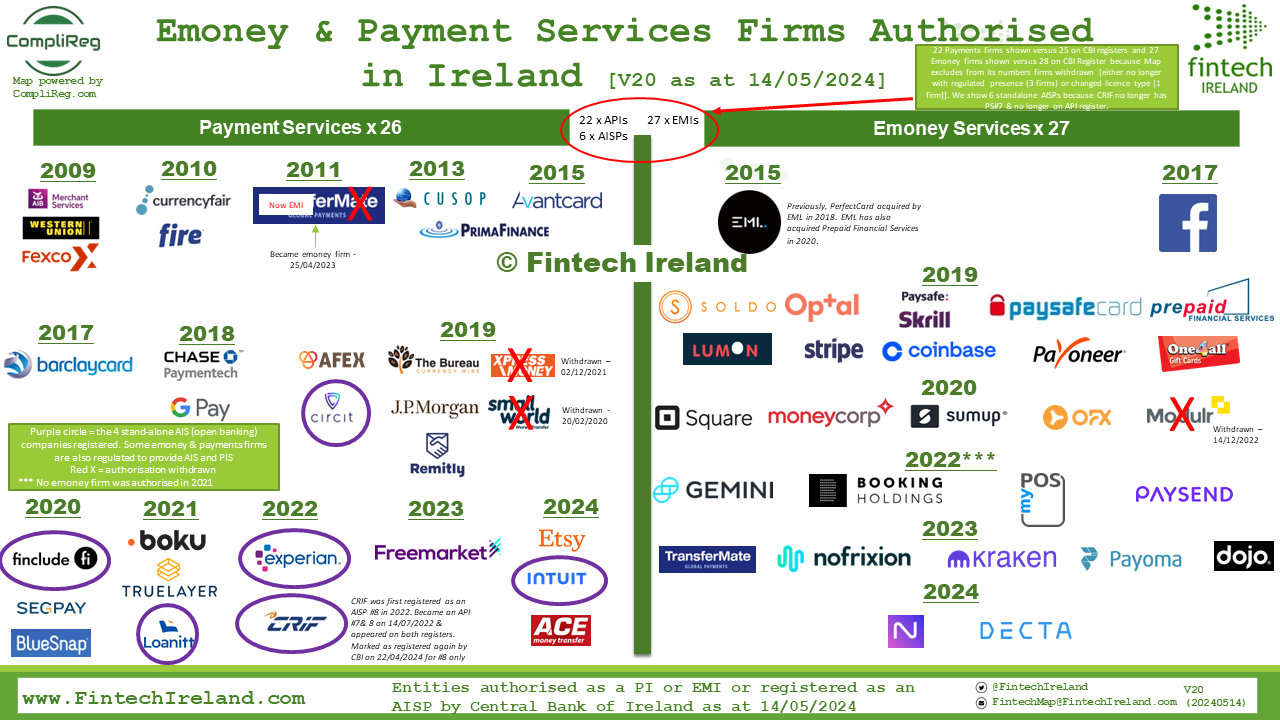

This increases the pool of regulated fintech in Ireland to at least 73, comprised of:

- 27 authorised electronic money institutions,

- 22 payments institutions,

- 6 standalone open banking firms,

- 13 virtual asset services providers, and

- 5 crowdfunding services providers.

Ramp Swaps was incorporated in Ireland on 25 April 2023. The company is the 13th firm to become registered to provide crypto services in Ireland.

Ramp, which has been described as a 'PayPal for crypto' by Business Insider also registered as a Cryptoasset Services Provider by the UK FCA. Poland's Ramp, which is building payment rails to allow more customers to invest in crypto, raised US$70mn in a Series B funding round announced on 11 November 2022.

The Series B funding co-led by Mubadala Capital and Korelya Capital was a rare silver lining against a bleak crypto backdrop. Ramp has now raised more than US$122mn in the last 12 months despite the current 'crypto winter'. The fintech will use the money to invest further in its product line, add local fiat currencies and payment methods, expand into new territories and hire fresh talent.

Coindesk reported on the registration on 23 May 2024. In its reported it noted that:

- The Ramp Network is a financial technology company building payment rails connecting crypto to the global financial system. This registration will enable its users to exchange fiat currencies for more than 100 crypto assets.

- The company wants to make Ireland its European headquarters and has established a team and operation in Dublin. It intends to get authorized as a Crypto Asset Service Provider (CASP) under the Markets in Crypto Assets Regulation (MiCA).