The company, in addition to emoney, is authorised to provide payment services 3b, 3c and 5. These allow the company to:

* (3) Execution of payment transactions, including transfers of funds on a payment account with the user’s payment service provider or with another payment service provider:

- 3 (b) Execution of payment transactions through a payment card or a similar device;

- 3 (c) Execution of credit transfers, including standing orders

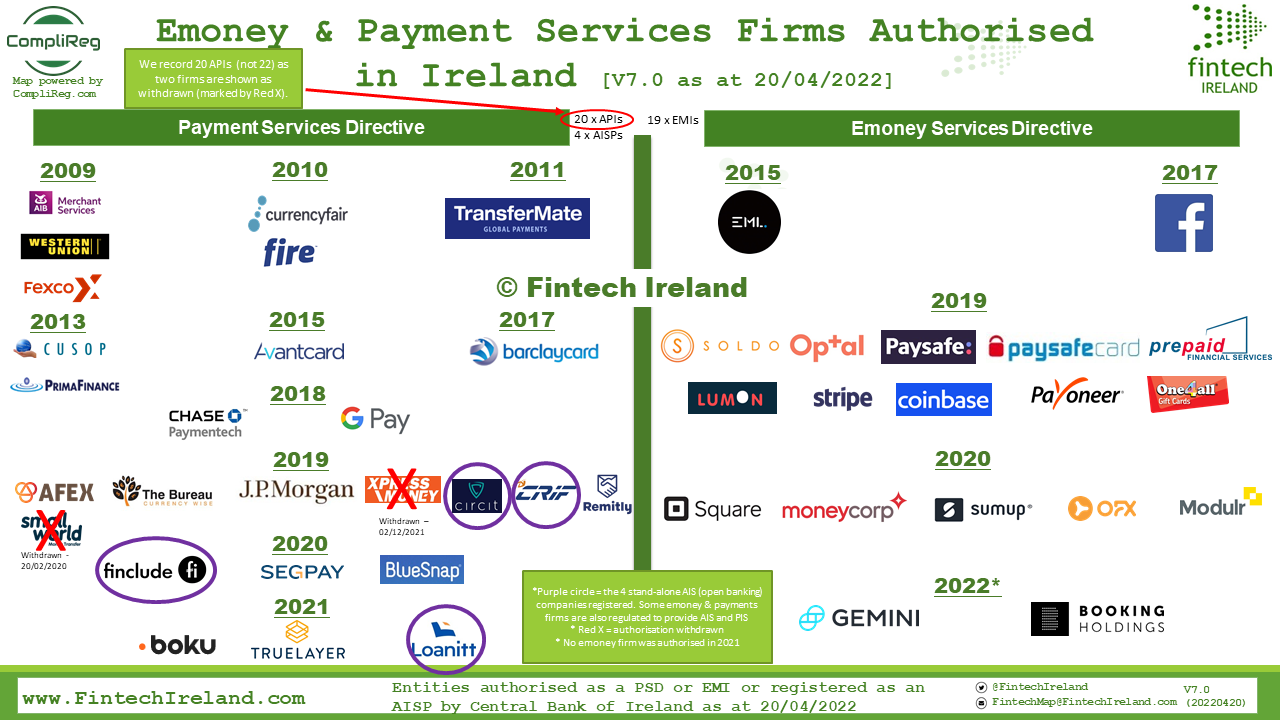

Ireland is now home to 19 authorised electronic money institutions, 20 authorised payment institutions and 4 standalone account information service providers. We have updated our regulated fintech Map to version 7.0 where we showcase these firms.

Our Peter Oakes spoke with Charlie Taylor of the Sunday Business Post on the authorisation of emoney and payment services firms and the issues firms were facing getting authorised in Ireland. See Charlie's article of 10 April 2022 titled Defensive attitude of Central Bank putting off fintech investors.

In the article Peter Oakes said:

- Speaking to the Business Post, Peter Oakes, a former Central Bank enforcement director and founder of Fintech Ireland, an industry group, said some companies which had sought authorisation through the Irish regulator had found it difficult to deal with.

- “The Central Bank is at times coming across as unnecessarily defensive and surprisingly unprepared for meetings with applicants. Wrong or right, this is a situation which has developed and one the regulator is not sufficiently in front of,” he said.

- Oakes suggested that radical changes were not required to right the current situation.

“A handful of straightforward enhancements should not only solidify the regulator’s objectives but create a better-informed industry. At the very least it would make clear whether Ireland is a ‘go-to’ effective regulatory jurisdiction for innovation and should prevent the state scoring an own goal by losing out on quality firms moving here because of the current situation,” he said.

The Central Bank admitted in a statement that authorisation could take time, but said operating a robust authorisation process was “solely aimed at protecting consumers and investors”.

A trawl through the minutes of the Central Bank of Ireland's Commission minutes makes for interesting reading on this topic.

On 7 December 2021 (not published until 8 February 2022), the record of minutes noted that:

- [Central Bank's Ed Sibley] a sizeable pipeline of change across multiple sectors, including authorisation activity, such as a high volume of Payment Institution/E-Money Institution authorisations. Work continued with applicant institutions on improving the quality of submissions. in particular with regard to risk and compliance frameworks.

- One member asked if there were any particular trends emerging concerning authorisations.

- Mr Sibley responded that there continues to be very significant change across many sectors. For banking specifically there was a significant growth in international banking sector here because of Brexit, with very significant growth in size, complexity and levels of employment.

- [Central Bank's Derville Rowland added that] "She also noted the establishment of a new type of entity, virtual asset service providers (VASPs), which were now required to register with the Bank for the purposes of anti-money laundering (AML)."

On 1 March 2022 (not published until 19 April 2022, the day before Bookings Holding was authorised), a partially omitted record of minutes dealing with the Authorisation Process (involving Mary Elizabeth McMunn and Colm Kincaid) was released, the published minutes noted that:

- Pipeline levels have remained consistently high and not all applications convert to supervised firms.

- the Bank substantially meets its published service standards across the various sectors.

- Reprioritisation of supervisory resources into authorisation work has been a key response to authorisation challenges; however, this is not without risk.

- Queries were raised in relation to some external impressions that securing authorisation in Ireland can be more onerous than other jurisdictions, and whether there was benchmarking undertaken. Other queries focused on whether post-Brexit authorisation applications had peaked and on the Bank’s engagement with advisors to applicant firms and challenges with ensuring relevant board level oversight within newly authorised entities.

- In response, it was noted that the Bank applies EU standards and norms to its authorisation process, but was seeking to be forward looking in its approach; it wanted resilient firms that can cope with changing circumstances, and that is the robustness of the approach that is taken. It was noted that there was a strong drive at EU level to have rigorous authorisation processes and a strong drive for substance. In relation to the number of applicants, this was not expected to fall off and would in all likelihood increase. While there were levels of engagement with advisors, it was essential to get to the institutions themselves. Early engagement with some of the firms at expression of interest stage was showing a stronger understanding of the Bank’s expectations. In terms of board representation, this was a real and genuine challenge and it was a wider challenge for the State to make sure the expertise is there.

- The Commission noted the update and agreed to keep under consideration how best to support this work.

Visit our Fintech Ireland Maps page for more information about the fintech and regtech companies we map.

Other Reading:

1) Irish Times Article 20 March 2022: https://www.irishtimes.com/business/financial-services/winklesvoss-twins-secure-irish-e-money-licence-for-gemini-payments-1.4831606

2) Linkedin Post 20 March 2022: https://www.linkedin.com/posts/peteroakes_paymentservices-facebook-cryptoasset-activity-6911588283806277632-GaM0