AIB Merchant Services (AIBMS) is the largest acquirer in the Irish market and is a joint venture with US company Fiserv. As well as being a major player in Ireland, AIBMS is also one of the largest eCommerce acquirers in Europe. AIBMS moved earlier this year along with Fiserv into an interesting building in the Silicon Docks at 10 Hanover Quay. The building which includes a former warehouse was voted as the public’s favourite building for 2022 in the RIAI Public Choice award. The building serves as Fiservs headquarters for EMEA.

In 2019 AIB and Fiserv also teamed up and formed a JV for the purchase of Payzone, one of the leading ISOs (Independent Sales Organisations) in Ireland and leading supplier of instore bill payments, for €100m.

If you have noticed a Clover point of sale device then more than likely the merchant is acquired by AIBMS and there is a good chance some of the software may have been developed at Fiserv’s R&D centre in Nenagh, Co. Tipperary. Sport fans may have noticed the Fiserv logo on the geansaí (Irish for jersey) of the Premier County this summer, a sponsorship deal that was renewed for another year in October.

| PTSB, the recently rebranded Permanent TSB, has a referral agreement with Worldpay. This was recently relaunched with in-branch marketing activation. Worldpay is headed up in Ireland by Garrett Clifford and they are expanding their sales force. They have a large segment of the enterprise market and if for example you have booked a train ticket online on Iarnrod Éireann, Worldpay will have processed the transaction. |

More on the movers and shakers in the Irish payment acceptance market

Elavon: has its European HQ Elavon Europe in Dublin with significant operations in Arklow. In 2019 Elavon acquired Sage Pay which was rebranded to Opayo in 2020 and the Opayo logo is familiar on many terminal splash screens.

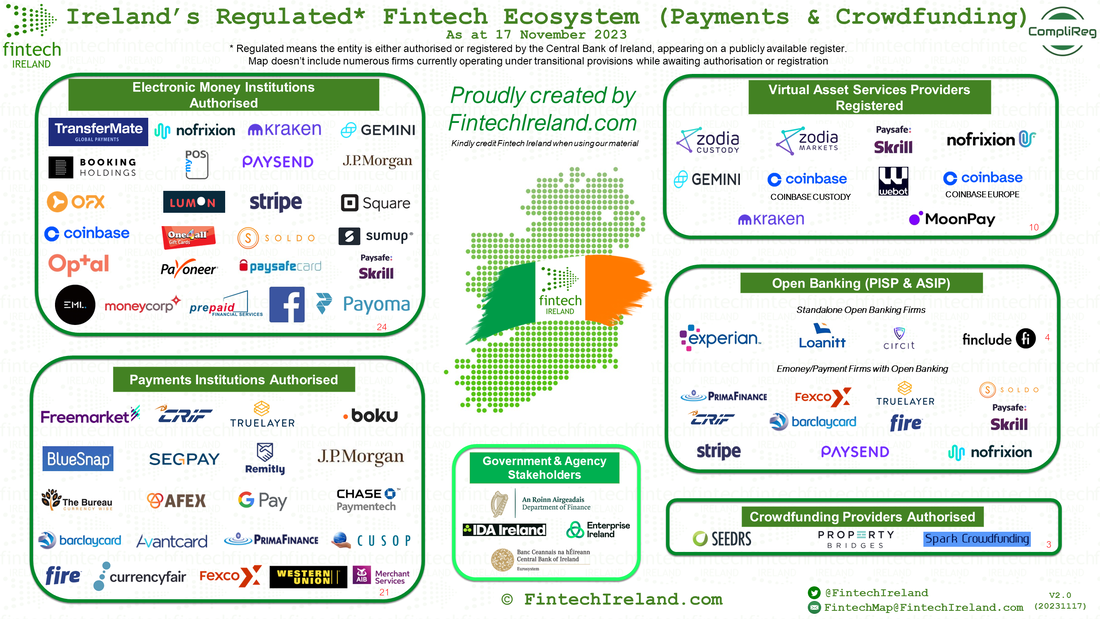

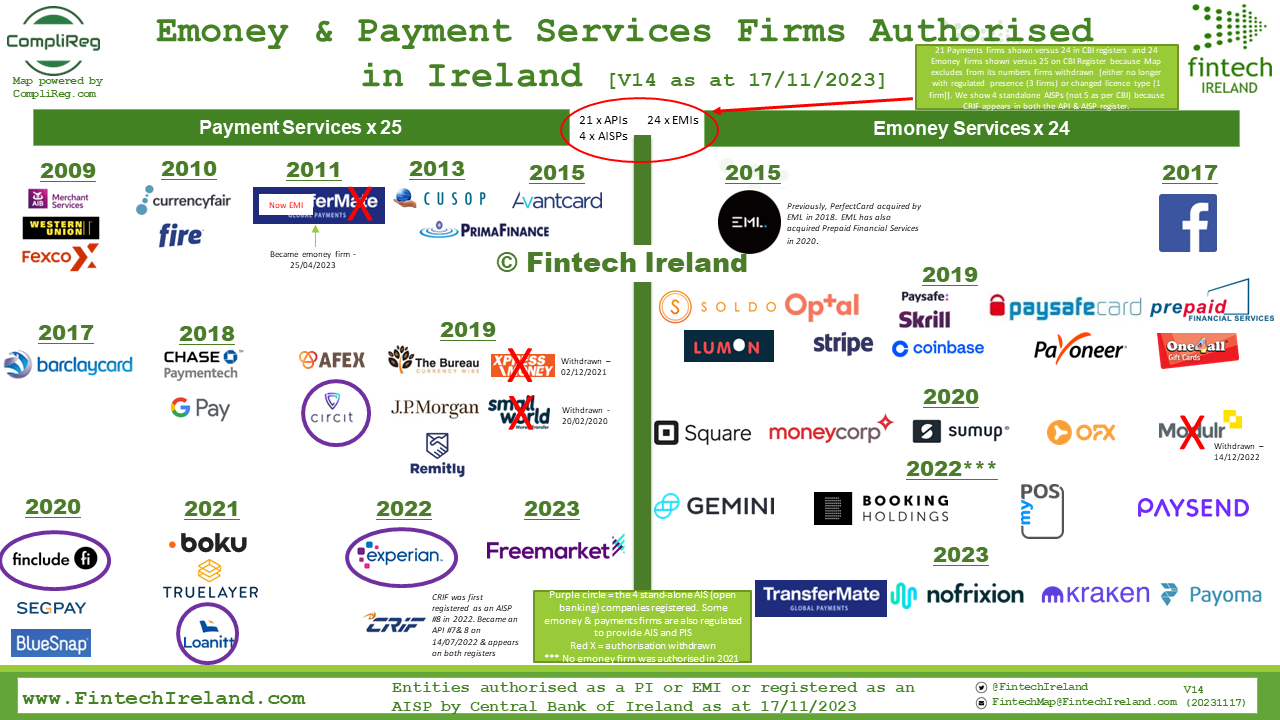

Stripe: founded by the Collison brothers Patrick and John, Stripe has a sizeable organisation in Dublin and obtained an Electronic Money Institution (EMI) licence in 2019. Stripe is often the first choice of many developers due to ease of integration. It is also used to accept payment for organisations such as the GAA and GAAGo internationally. Stripe also process payments for one of the biggest single payment events each year, the RTÉ Late Late Toy Show charity appeal. Revolut has also accepted donations for the show for the past three years.

Barclaycard Payments: has its international operations in Ireland having held a Payments Institution (PI) licence since 2017. I spotted one of their terminals offshore when visiting Spike Island, Cork during the summer which is well worth a visit.

Square: part of Jack Dorsey’s Block organisation, Square probably pioneered the micro-merchant proposition with the original iPhone dongle in the US. Square’s been authorised as an EMI in Ireland since 2020 and serve Spain and France. Look out for SQ * on statement descriptor from outlets using their devices.

| Revolut: launched their business offering Revolut Pay last year. Aer Lingus is one of the merchants who accept it online alongside debit and credit cards. Smaller micro-merchants who may not accept cards can accept Revolut by providing a QR code or the mobile phone number associated with their account. |

myPOS: received its EMI licence in Ireland 2022. As well as eCommerce and card readers it also has a tap on glass softpos option. myPOS, HQ’ed in London, was recently acquired by Advent Capital for a deal worth approximately €500m.

PayPal: its wallet payment method is accepted by many eCommerce merchants while smaller merchants may use PayPal as their merchant account. PayPal opened their EMEA HQ in Ireland in 2003.

NPI (New Payment Innovation Limited): led by Carl Churchill has ambitious plans to capture 20% of the market in Ireland and are currently recruiting with aims to have 100 people by the end of 2024. NPI are an ISO of Worldpay. Look out for their particularly vibrant terminal splash screen.

Viva: the Greek fintech that is minority owned by JP Morgan has launched in the Irish market and has a SoftPOS offering for Android and iPhone. Viva has an interesting approach with acceptance fees, for merchants that use their Viva issued debit card to pay business expenses, a cashback is earned that is to rebate their transaction fees.

Planet (formerly Fintrax): The Galway HQ’ed company that provide FX, DCC and tax back services also provide payment acceptance and some Insomnia coffee shops have Planet terminals.

Segpay: The Florida HQ’ed company have held a PI licence in Ireland since 2020 and provide card processing for online and subscription merchants.

Some industry vertical specific players include Toast the Boston, Mass HQ’ed organisation who provide their POS devices to restaurants (you may see TST on the statement descriptor from outlets using their devices). Toast also has a development function in Dublin. Phorest Salon Software an Irish founded startup focussing on the hair and beauty industry launched PhorestPay which includes card terminals powered by Stripe. For returning customers they have an interesting cardless checkout feature which stores customers payment cards processing the transaction as card on file.

If we have missed any major players feel free to get in contact.

| Author: Rónán Gallagher Rónán has over 20 years electronic payments experience and was a co-founder of Alpha Fintech who were acquired by PPRO in 2022. Rónán has worked on payments projects around the globe including the US, Mexico, UK, Germany, Thailand, Australia and New Zealand supporting clients including Amazon, Amadeus, Google and Meta. During one of the first Covid lockdowns with too much time on his hands he enrolled on a Masters in Innovation in Fintech with Atlantic Technological University graduating in 2022. Weekends are spent touring the pitches of Dublin, coaching GAA with CLG Chluain Tarbh/Clontarf GAA Club or cheering on his sons soccer matches. He can be reached on LinkedIn and occasionally on X on @payeire. Rónán is a Member of the Fintech Ireland Advisory Council. |