- Sign up to our Newsletter here.

- Need assistance with an emoney or payments authorisation or an account information service provider or virtual asset services provider registration application, check out Fintech Ireland and CompliReg's handy authorisation guides at https://fintechireland.com/fintech-authorisations.html.

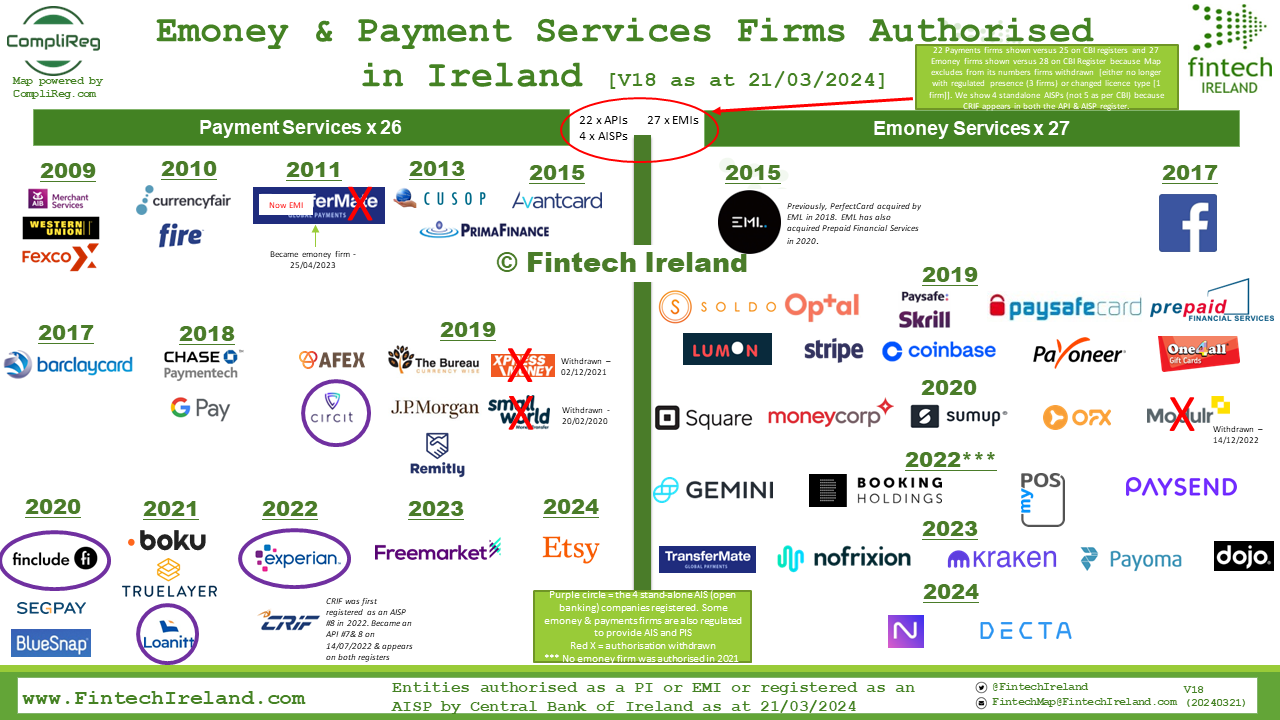

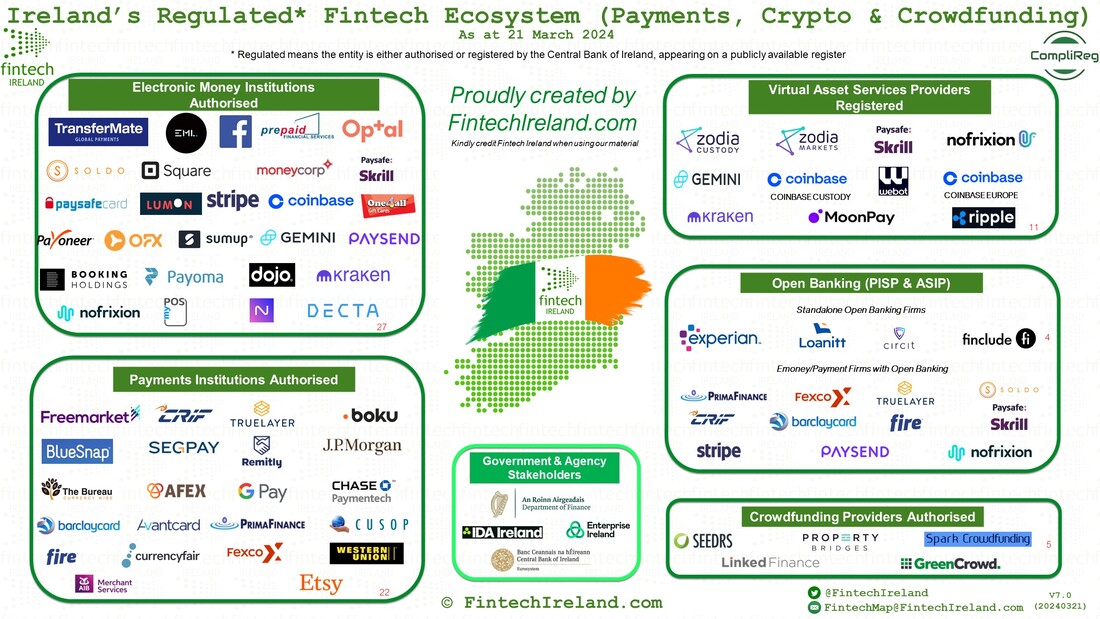

Welcome Decta Limited to the regulated fintech ecosytem in Ireland! Its authorisation brings the pool of regulated fintech in Ireland to 68, comprised of:

- 27 authorised electronic money institutions

- 21 payments institutions,

- 4 standalone open banking firms

- 11 virtual asset services providers and

- 5 crowdfunding services providers.

As we said back on 20 February 2024, we are pretty sure that these numbers will continue to grow in 2024.

In what must have felt as extended St Patrick Day's long weekend for the Irish Decta Team, the company was authorised by the Central Bank of Ireland on Tuesday 19 March 2024 as an emoney institution.

Some observations:

- Why did Decta seek an authorisation in Ireland when another Decta Limited became authorised in Cyprus for emoney services on 10 August 2023?

- The Irish company was incorporated back on 1 October 2021. That seems a long time from its incorporation date to today for an entity to become authorised - nearly 30 months. While a firm may not start an application immediately after it is incorporated, most firms - where they are the subsidiaries of foreign firms - start the journey no later than three to six months following incorporation. If one was conservative and went with the six month timeline, it may have taken Decta Limited 24 months to become authorised.

- It appointed its first set of Irish resident NEDs on 1 June 2022, with one of them leaving just after Christmas Day 2023 following the appointment of another NED just before that Christmas period.

- In addition to the NEDs, the company's local CEO sits on its board together with two group executives including its Cypriot authorised company's CEO and its Deputy CEO.

- The Irish comapny's shareholders are RRE Tradecenters Holding Limited based in Cyprus and SIA "Suharenko Family Investments" based in Latvia, holding 67% and 33% of the Irish company respectively.

- SIA "Suharenko Family Investments" is a shareholder in the Latvia Bank, AS “Rietumu Banka”.

- Irish billionaire Dermot Desmond owns a one-third stake in Rietumu Banka. Its group profits fell 37pc to €11.4m in the first nine months of 2023.

- Decta's operations in the UK, Decta Limited (UK), are authorised by the Financial Conduct Authority for emoney and payment services.

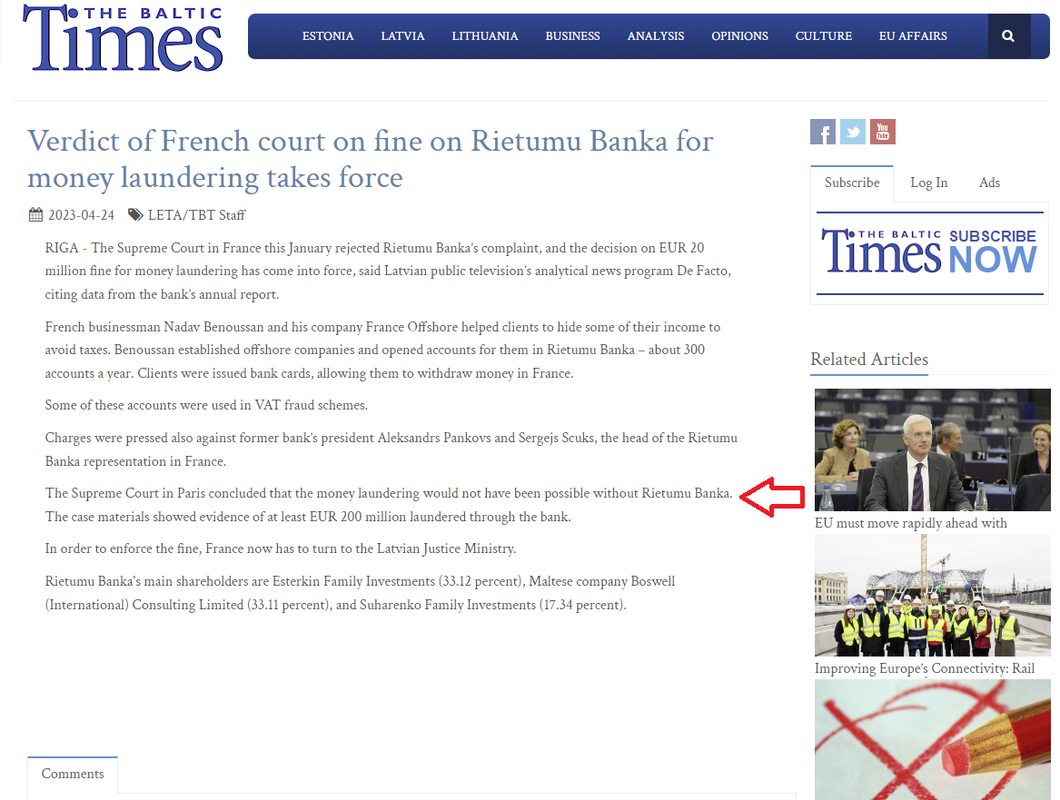

- Decta was cited by Transparency International UK in a report focused upon financial crime risk. The very informative report titled 'Together in Electric Schemes, Analysing Money Laundering Risk in E-Payments' was issued in December 2021. The Bank was hit by two regulatory sanctions. The largest sanction was a fine of €80mn later reduced by a French appeals court to €20mn. According to The Baltics Times on 24 April 2023 "The Supreme Court in Paris concluded that the money laundering would not have been possible without Rietumu Banka. The case materials showed evidence of at least EUR 200 million laundered through the bank."

- According to CRO records for Decta Limited as at year end December 2022 the company incurred a loss of €114.1K, had Net Current Assets of €46.9K and Net Liabilities of €110.6K.

"[s]ome Latvian banks now own UK EMIs. Decta Limited, a UK EMI, lists its PSC as Rietumu Holding, the firm behind Rietumu Bank in Latvia. In 2017, Rietumu was fined €80 million by French authorities after it was found to be involved in major tax and money laundering schemes. In response to an investigation by independent global media organisation, openDemocracy, Decta Limited stated it “acts in strict accordance with the requirements of FCA”, adding “we regularly pass anti-money-laundering (AML), Anti-Fraud, Know Your Customer and Combating the Financing of Terrorism audits held by Visa, Mastercard and big-four auditors, proving Decta to be complying with all latest AML standards.”

In June 2021, Rietumu was fined again for money laundering failings in Latvia, this time in relation to its association with payment service providers, including those based outside of the country. A page on the website of Latvia’s central bank (Latvijas Banka), shows Rietumu has correspondent banking relationships with at least six UK EMIs.

It is becoming increasingly clear that British EMIs using Baltic banks for clearing services raises money laundering risk for both the UK and Baltic states. UK EMIs with unsuitable owners or weak AML controls are unlikely to carry out sufficient checks on their clients, while Baltic banks may believe firms regulated by the FCA have higher AML standards than they do in reality. This situation would lead to international payments being made from British EMI accounts using Baltic correspondent banks without sufficient checks being carried out on who was making them. This is similar to the scenario that occurred in the “Laundromats” exposed by the OCCRP, which resulted in billions of pounds in suspicious transactions being sent around the world." (see page 15 of this document).

Read more media here:

19/04/2022 - Last year also saw an appeals court in Paris reduce to €20 million a previous €80 million fine levied by a French court in 2017 against the bank for allegedly enabling clients of a company called France Offshore to evade taxes and launder money through companies in tax havens.

24/04/2023 - Verdict of French court on fine on Rietumu Banka for money laundering takes force

- decision on EUR 20 million fine for money laundering has come into force

17/06/2021 - Latvian bank Rietumu fined 5.85 mln for money laundering failures

- Sign up to our Newsletter here.

- Need assistance with an emoney or payments authorisation or an account information service provider or virtual asset services provider registration application, check out Fintech Ireland and CompliReg's handy authorisation guides at https://fintechireland.com/fintech-authorisations.html.