In December 2023 Minister for Finance, Michael McGrath TD launched a public consultation on a National Payment Strategy for Ireland. At the consultation launch at the Banking & Payments Federation Ireland BPFI, parts of his speech gave an insight into the government’s view on the place of cash within a future payments strategy: “All citizens should be able to participate fully in all aspects of modern life using digital or cash methods of payment. .. I want to ensure choice is at the centre of our future payments strategy. We must recognise the important role that cash continues to play in our society and economy, and this is a role I am determined to protect.”

In the week following the consultation launch RTÉ reported that Minister McGrath called on the National Driving Licence Service to reinstate cash acceptance for driving licences at their centres around the country: "I expect all essential public services provided by the State and on behalf of the State to be accessible to members of the public whose preference is to transact in cash." His statement echoed previous government sentiment on cash acceptance which included the Minister writing to his government colleagues in September requesting that public bodies under their control maintain existing cash payment facilities pending the outcome of the National Payments Strategy.

“Lies, damned lies and statistics” – Benjamin Disraeli (maybe*)

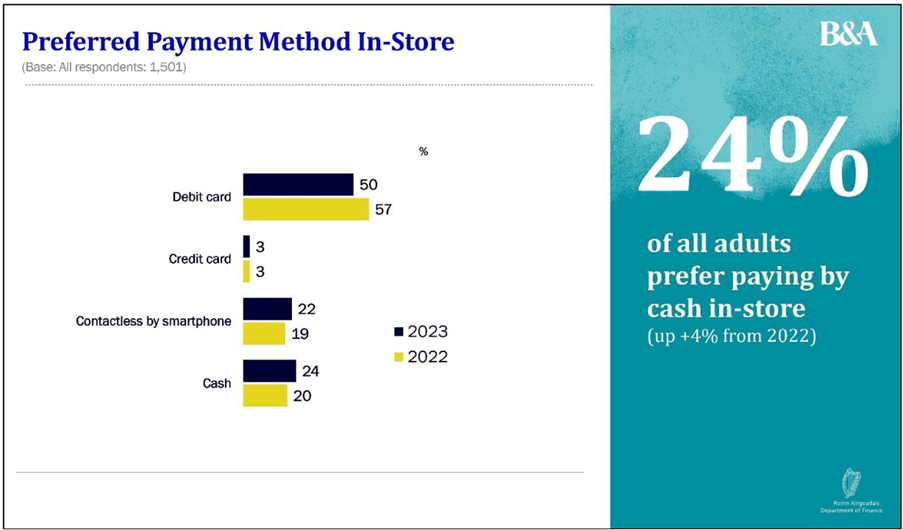

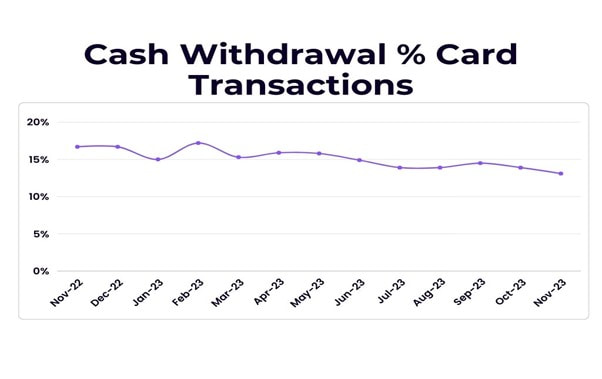

However, this survey does not seem to align with some other available data. The Department of Finance published their Consumer Banking Sentiment Survey in September 2023 and this found that cash was the preferred payment method of only 24% of respondents, albeit an increase since 2022, with debit card the preference of 50%, credit card 3% of respondents and mobile payment increasing in preference to 22%.

The NCT which was one of the services criticised over a planned cashless policy revealed that only 3% of transactions were made in cash.

And while not scientific I conducted my only little survey of some retailers in the first week of January to assess what they are seeing on the ground.

- My ‘local’ – a Dublin suburban pub: Approximately 80:20 cards to cash although they have seen an increase in cash payments in the last year.

- An Irish fashion brand with a store just off Grafton St: Majority of transactions are digital/card, when I part paid in cash at around 2pm in the afternoon I was the first cash customer they had served that day.

- An Irish sporting goods chain: The vast majority of transactions are by card, they see the odd customer paying cash.

- A café specialising in fish and chips in my hometown in Donegal: The majority of transactions are by card, last summer it was nearly all card but in the last two months they have started to see more cash transactions.

The fact that cash usage is slightly creeping up in some situations mirrors the case in the UK with the British Retail Consortium publishing their BRC Payments Survey 2023 in December which disclosed that cash usage in transactions increased to 19% from 15% in 2021, the first increase in cash usage in a decade as the cost of living saw it used more as a budgeting tool.

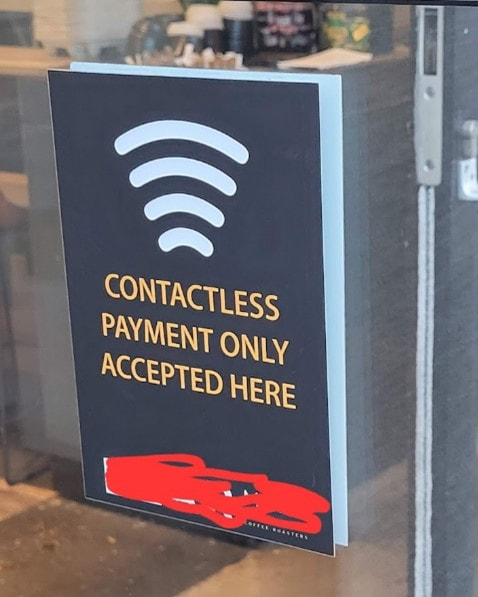

A Cork restaurant estimated the overall cost of cash handling to their business at 9% and after trading card only would not go back to accepting cash. They succinctly put it that they “are not the only show in town” so if a customer wanted to spend cash they could choose a different business.

While some businesses have gone cashless others have ditched the card machine or are encouraging their customers to pay by cash due to rising fees. Rising fees, particularly on business to business transactions such as in the building materials sector was raised by one company last year whose acquiring fees doubled.

It will be interesting to see how the National Payments Strategy balances the question of choice when it considers cash acceptance in the future.

The one area where cash cannot be used directly of course is eCommerce. Proving that what is old, is new again, Kas$sh launched in the UK in October 2023 allowing customers to pay for online purchases using a barcode at Paypoint locations. Those involved in eCommerce for a number of years may remember similar schemes such as Ukash which was acquired by Skrill and merged with Paysafecard. While in Ireland the 3V disposable VISA cards were popular for a time and 3V was purchased by Safecharge who in turn were purchased by Nuvei.

With governments looking to maintain support for cash usage, indeed the government are pumping millions of cash into the economy each week through social welfare payments paid in cash through post offices, it is likely that cash will remain in use for some time. Even Sweden, one of the countries that was envisaged as being one of the first cashless countries, has enacted legislation that the six largest banks are obliged to provide certain cash services.

The Minister for Finance has also published the Access to Cash Bill 2024 that envisages ATM infrastructure being maintained at the level of December 2022. The BPFI have called for flexibility in the scheme that would allow for demand levels to be reviewed as cash usage declines.

One of the financial institutions who are planning to invest in their access to cash are Bank of Ireland who announced a refresh of their ATM estate as part of a €60m investment in branch and ATM refreshes. However this does follow a major system issue last August that saw Gardaí being deployed at some ATMs around the country when BOI customers were able to transfer money they did not have in their account to other banks and withdraw from ATMs.

So, watch this space for the outcome of the National Payments Strategy consultation and the future place for cash.

*Mark Twain attributed it to former British Prime Minister Benjamin Disraeli but there is no proof Disraeli used this quote.

| Author: Rónán Gallagher Rónán has over 20 years electronic payments experience and was a co-founder of Alpha Fintech who were acquired by PPRO in 2022. Rónán, who recently joined Fiserv at their EMEA HQ as Product Director, has worked on payments around the globe including the US, Mexico, UK, Germany, Thailand, Australia and New Zealand supporting clients including Amazon, Amadeus, Google and Meta. During one of the first Covid lockdowns with too much time on his hands he enrolled on a Masters in Innovation in Fintech with Atlantic Technological University graduating in 2022. Weekends are spent touring the pitches of Dublin, coaching GAA with CLG Chluain Tarbh/Clontarf GAA Club or cheering on his sons soccer matches. He can be reached on LinkedIn and occasionally on X on @payeire. Rónán is a Member of the Fintech Ireland Advisory Council. |