- Sign up to our Newsletter here.

- Need assistance with an emoney or payments authorisation or an account information service provider or virtual asset services provider registration application, check out Fintech Ireland and CompliReg's handy authorisation guides at https://fintechireland.com/fintech-authorisations.html.

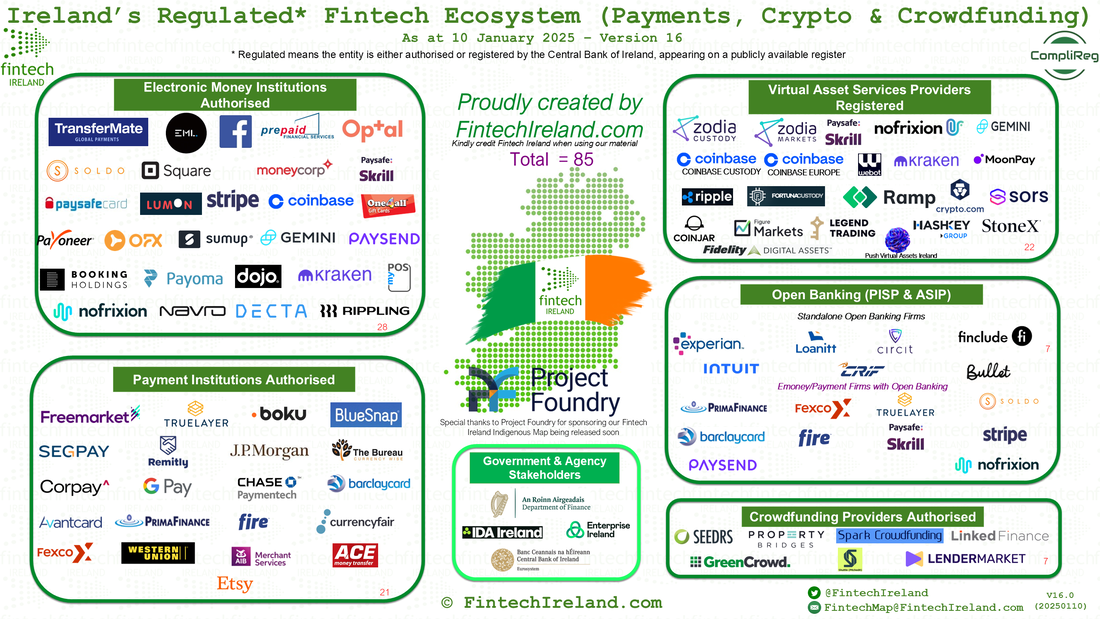

* The Fintech Ecosystem Map is limited to authorised emoney, payments and crowdfunding firm and registered virtual asset firms

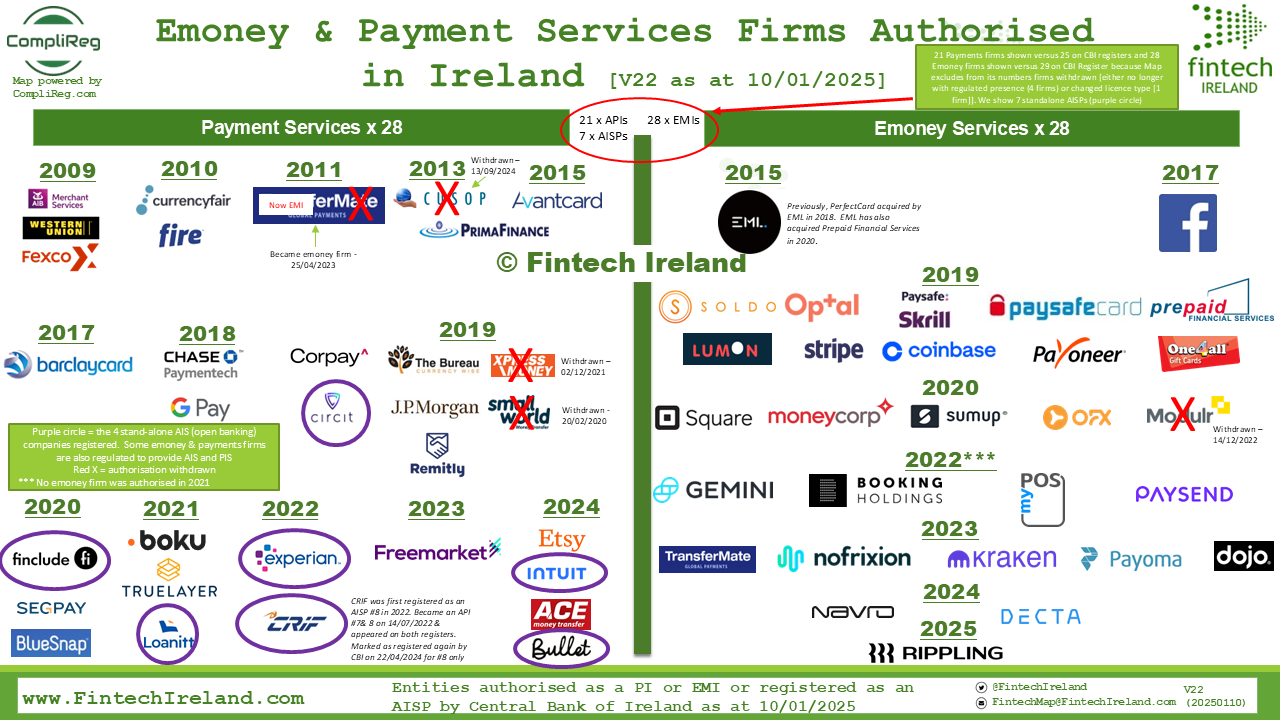

- Lendermarket Limited didn't appear on the public facing Central Bank of Ireland Register until 9 January 2025 despite receiving an early Christmas present from the Central Bank on 17 December 2024. Lendermarket was incorporated in Ireland back on 29 June 2016. The company is authorised to provide crowdfunding services type (i) only, being "The facilitation of granting of loans" and has elected to passport its services across the whole of the European Union.

- Rippling Payments Ireland Limited takes the honour of being the first fintech regulated in Ireland in 2025; authorised as an emoney institution on 6 January 2025. In addition to the issuing and redeeming of electronic money, Rippling Payments, which was incorporated in Ireland on 7 September 2022, is authorised to provide payment services 3(a) and 3(c) being "Execution of payment transactions, including transfers of funds on a payment account with the user’s payment service provider or with another payment service provider: a) execution of direct debits, including one-off direct debits and c) Execution of credit transfers, including standing orders".

- In a post by an employee on Linkedin, it was stated that it submitted its "Application formally at the end of April 2023". That would mean it took the company just over 20 months to achieve authorisation. That is certainly at the longer end of time taken to obtain authorisation based on data we are tracking. The period may have been longer if one includes the usual amount of Central Bank facing before one is invited to submit a formal application.

- Electronic Money Institutions: two were authorised in 2024 (Navro Payments Europe Limited and Decta Limited).

- Payment Institutions: 2 were authorised in 2024 (Etsy Payments Ireland Limited and Ace Money Transfer Limited) and one its authorisation was withdrawn (CUSOP (Payments) DAC).

- Account Information Service Providers (standalone): 2 were registered in 2024 (Glenman Software Development Limited and Intuit Ireland Software Limited - this ignores double counting of CRIF)

- Crowdfunding Service Providers: 2 were registered in 2024 (Pitchedit Limited and Lendermarket Limited)

- Virtual Asset Services Providers: 11 were registered (Foris DAX Global Limited, Fortuna Digital Custody Ltd, Sors Digital Assets Limited, CoinJar Europe Limited, Ramp Swaps (Ireland) Limited, HashKey Europe Limited, StoneX Digital International Ltd, Fidelity Digital Assets Ireland Ltd, Figure Markets Ireland Ltd, Push Virtual Assets Ireland Limited and Legend Financial Ireland Limited).

- Sign up to our Newsletter here.

- Need assistance with an emoney or payments authorisation or an account information service provider or virtual asset services provider registration application, check out Fintech Ireland and CompliReg's handy authorisation guides at https://fintechireland.com/fintech-authorisations.html.