New to this Map are:

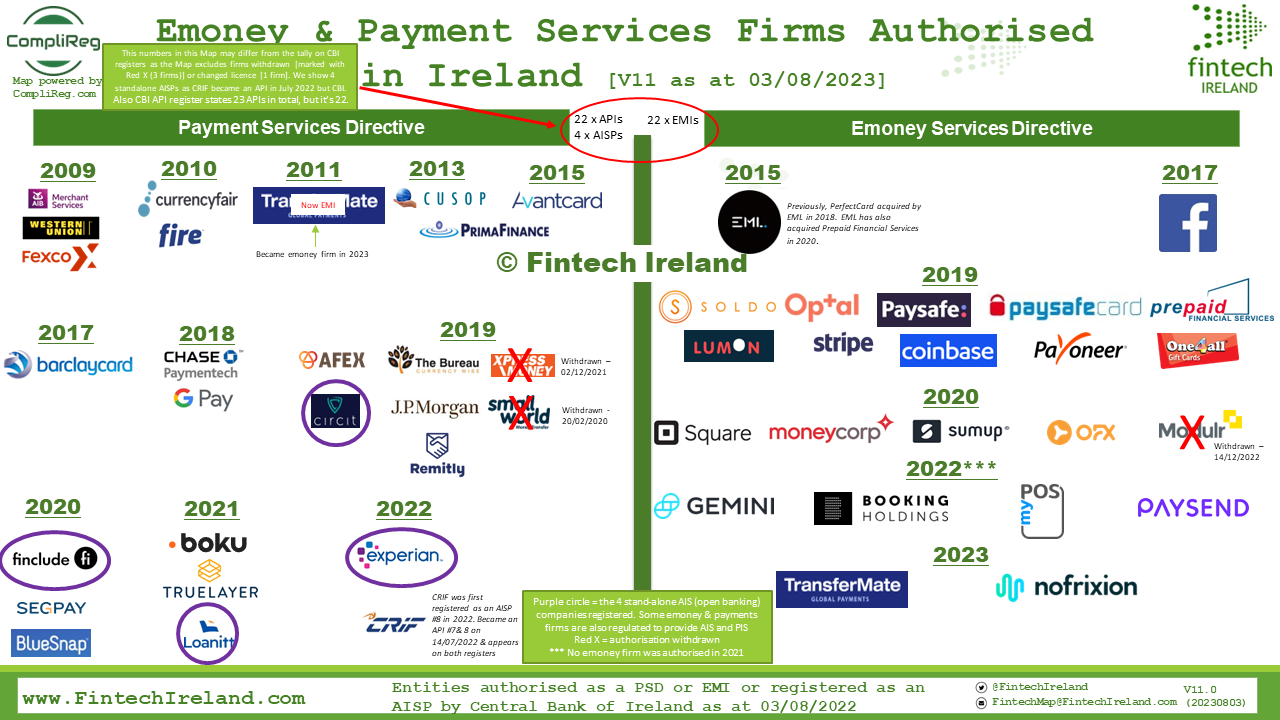

- Paysend EU DAC - authorised on 20 December 2022 to provide electronic money and payment services 3a, 3b, 3c, 5, 6, 7, 8

- InterPay Limited t/a TransferMate - a change of authorisation on 25 April 2023 to electronic money institution (from a payments institution authorisation held since 2011) and payment services 3b, 3c, 5, 6

- NoFrixion Limited - authorised on 25 July 2023 to provide electronic money and payment services 3a, 3b, 3c, 5, 7, 8. NoFrixion was registered as a Virtual Asset Services Provider on 31 May 2023.

Thus far in the first seven months of 2023, only two firms have been authorised as either an electronic money institutions (EMI) or payments institutions (API) i.e. TransferMate and NoFrixion, and TransferMate was previously authorised as a payments institution from 2011-2023 before becoming an EMI in April 2023. Thus effectively, NoFrixion is only new entity to become authorised in 2023.

- "The news was also welcomed by Peter Oakes, a former Central Bank enforcement director and founder of Fintech Ireland, an industry group."Irish customers will be able to share transactional information from their bank account with other banks and third parties. Customers will be able to better monitor, control and improve the way their banking data is used, including managing their so-called ‘credit score’ when looking for financing.

- “We are yet to see the fruits of open banking in Ireland to the same degree as elsewhere. Together with other fintechs providing open banking, Irish consumers and small businesses will enjoy more choice in an increasingly competitive landscape," Oakes said.

Further Reading: See also Charlie Taylor's article on the authorisation of emoney and payment services firms and the issues firms are facing getting authorised in Ireland in his article of 10 April 2022 titled Defensive attitude of Central Bank putting off fintech investors. And see our News posts of:

- 25 April 2022 on the announcement of Bookings Holding becoming an authorised emoney firm; and

- 10 April 2022 titled Defensive attitude of Central Bank putting off fintech investors.