https://www.hfmeuropeansummit.com/page/1831540/about

- Managing growing demands from investors around data transparency – what are investors looking for and where is this going?

- How much extra cost pressure is this putting on your ops team, and how can you combat these rising costs?

- Data around ESG – what are you being asked to present, and where are you getting your data?

- How do you free up your tech budget to ensure you’re enabling alpha creation? How can third party systems help (or hinder) this?

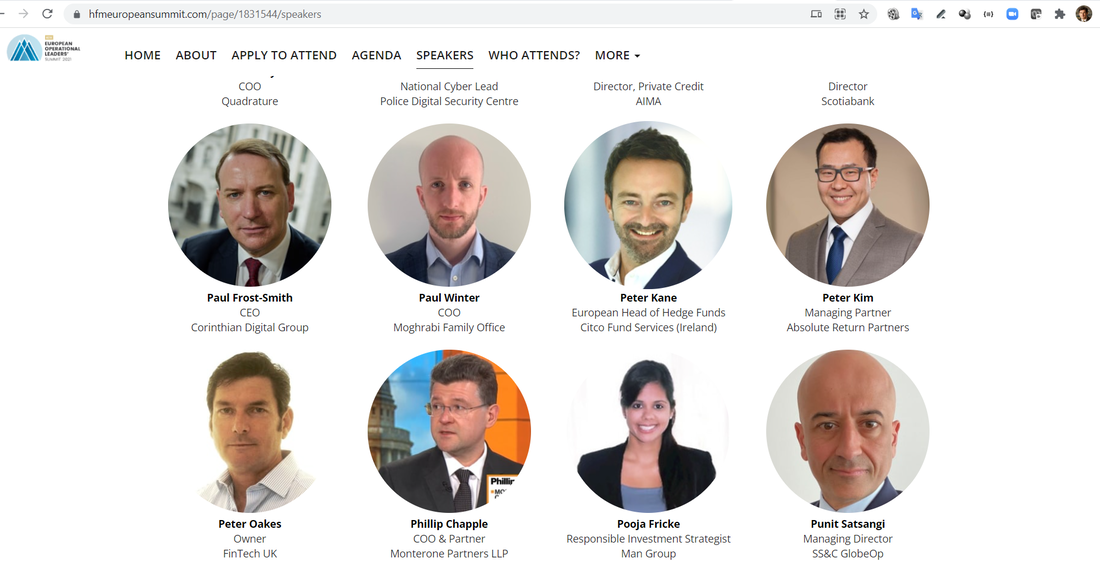

Speakers:

- Peter Oakes, Founder, FinTech UK and Fintech Ireland

- Ben Dear, CEO, Osmosis Investment Management

- Miles Courage, COO, Global Special Situations, JP Morgan Alternatives

- Jonathan White, Global Head of Funds Sales, Intertrust Group

- Eddie Steel, Partner, COO, Broad Reach Investment Management LLP

When: Thursday 16th September 2021.

Where: The Grove, Hertfordshire, United Kingdom

Cost: Ended

Registration: https://www.hfmeuropeansummit.com/page/1831544/speakers

RSS Feed

RSS Feed