What: Fintech Bridge - Ireland and Mexico Webinar

When: Tuesday 4th October 2022, 15:30 -17:00 Ireland / 09:30-11:00 Mexico.

Where: Online Event

Cost: Free

Registration: The Registration Link will appear here shortly. If you want advance notice to secure your place, make sure you are a Fintech Ireland Subscriber by visiting here. Subscribers receive priority registration.

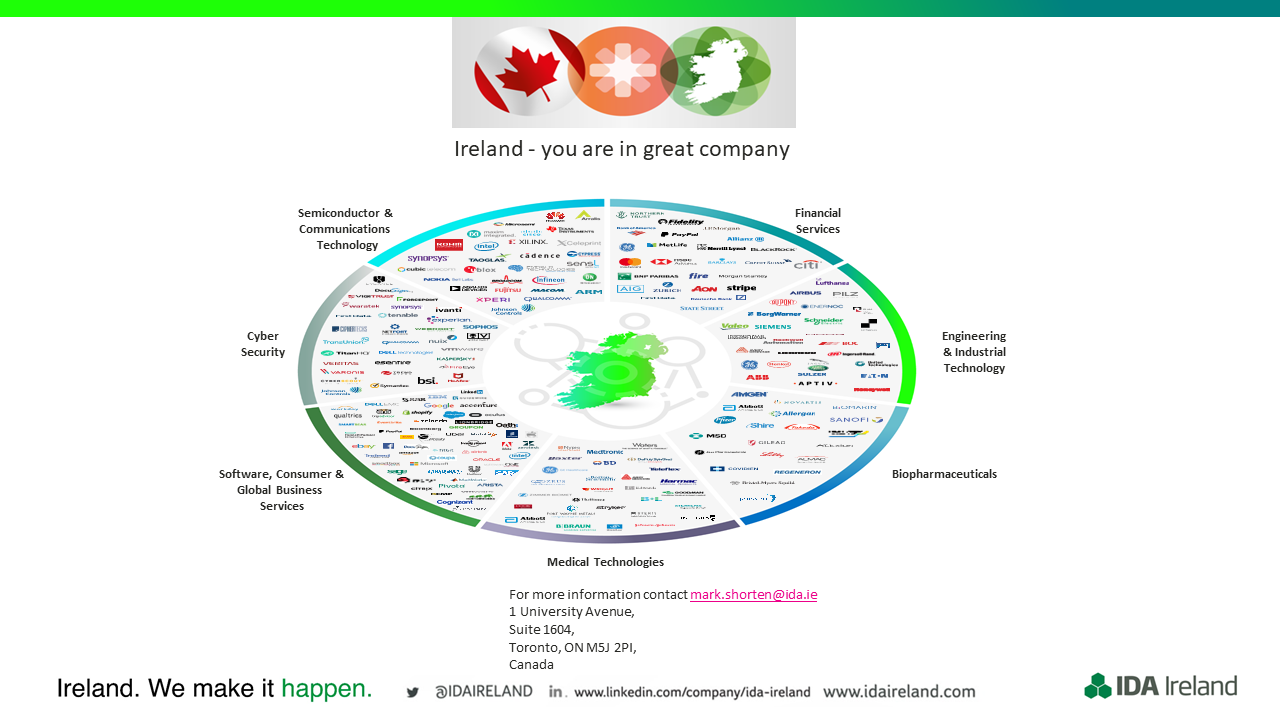

Following hot on the heels of the Release of the famous Fintech Ireland Maps for 2022, we get to take a deeper look at fintech in Mexico and Ireland and the opportunity for the industry in each other's country.

RSS Feed

RSS Feed