On 14 March 2022 (Central Bank of Ireland run date 15 March 2022), Ireland authorised Gemini Payments Limited. This was the first such authorisation of an emoney firm since 27 October 2020.

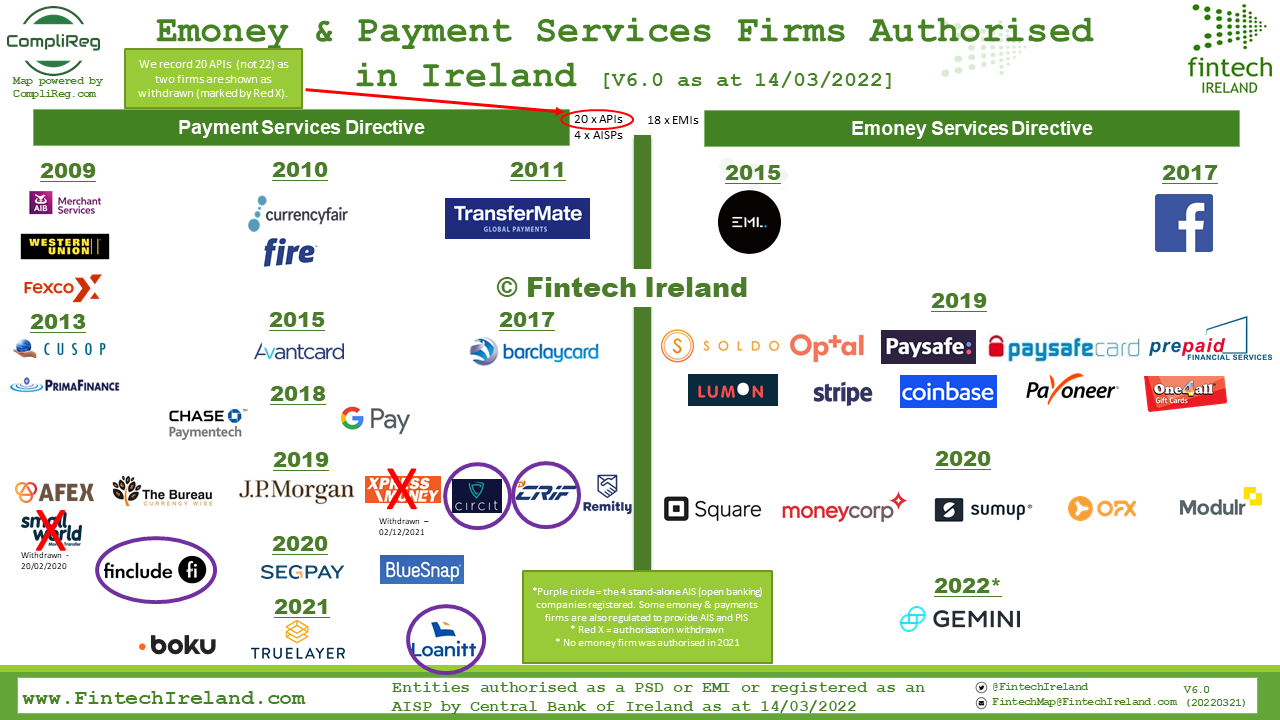

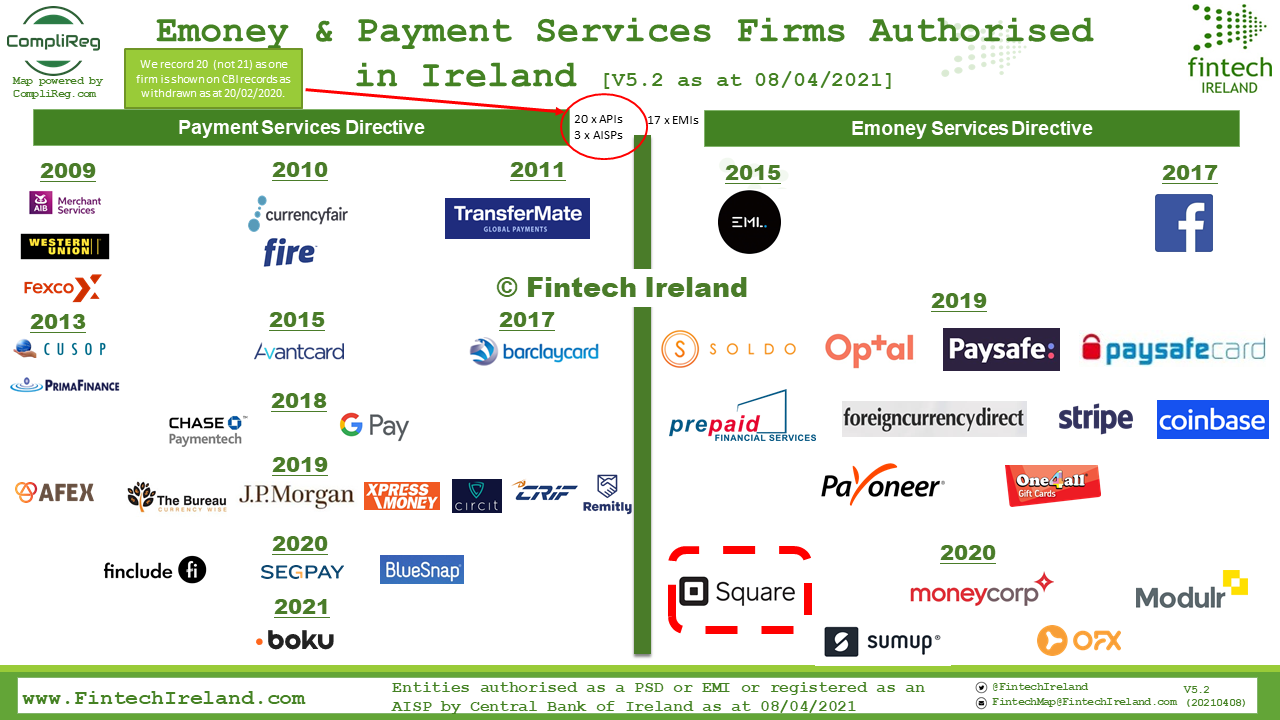

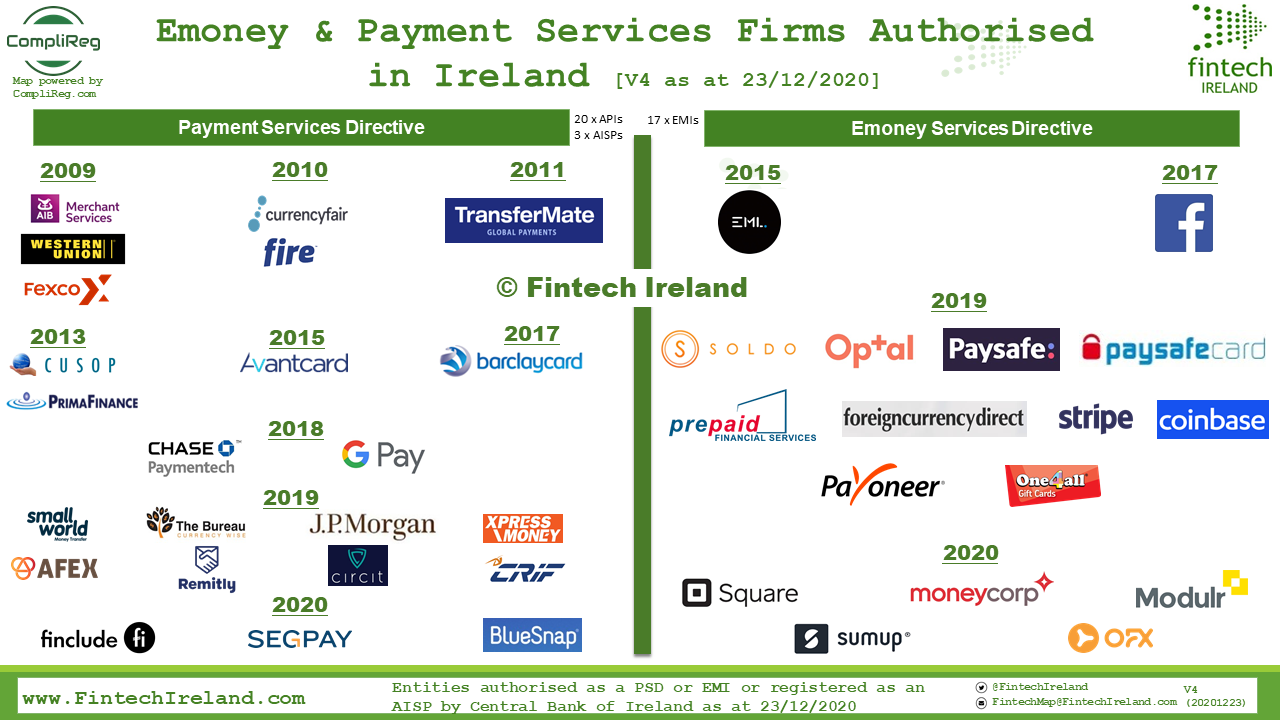

Ireland is now home to 18 authorised electronic money institutions, 20 authorised payment institutions and 4 standalone account information service providers. We have updated our regulated fintech Map to version 6.0 where we showcase these firms.

Our Peter Oakes spoke with Charlie Taylor of the Irish Times on the authorisation of the Winklevoss twins Irish licence and wider digital asset issues facing Ireland.

In the article Peter Oakes said:

- an interesting play for Gemini in Ireland could be institutional wealth management and custody. Many large financial institutions, especially US banks operating in Ireland, have a strong interest in digital assets for both themselves and their clients. They generally segregate their trading and investment activities from the very specialised but fairly lucrative pricing and custodial responsibilities of digital assets.

- he expects to see Gemini to eye up a role in servicing Ireland’s €5.4 trillion assets under administration in the IFSC in the years to come.

- while there remains challenges about the perception of Ireland being an effective home for regulated digital assets, the arrival of Gemini as well as the existing Irish business of Coinbase help set the groundwork, and attraction, for other international and hopefully indigenous fintechs to follow bolstering employment in cutting edge technology and innovation.

- he expects Gemini will complement its new fintech licence with an Irish crypto asset registration to replicate its UK and international services.

Visit our Fintech Ireland Maps page for more information about the fintech and regtech companies we map.

Links:

1) Irish Times Article 20 March 2022: https://www.irishtimes.com/business/financial-services/winklesvoss-twins-secure-irish-e-money-licence-for-gemini-payments-1.4831606

2) Linkedin Post 20 March 2022: https://www.linkedin.com/posts/peteroakes_paymentservices-facebook-cryptoasset-activity-6911588283806277632-GaM0