- Orca Money's 'Risk v Mitigation' graphic available at https://www.orcamoney.com/p2p-lending-risk-mitigation

- Orca Money's 'Innovative Finance ISA' graphic available at https://www.orcamoney.com/ifisa-infographic

| fintech IRELAND |

|

Thanks to Orca Money for sharing these useful graphics on Marketplace Lending (Risk v Mitigation) and Innovative Finance ISA. The graphics are below, however you might find the quality of these graphics better on Orca Money's website at:

0 Comments

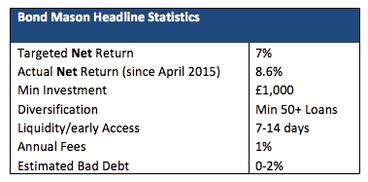

P2P asset managers to enter the market: Iain Niblock, CEO of Orca Money looks at one offering22/5/2016  The UK Peer-to-Peer Lending (P2P) market is maturing with a number of new investment instruments on the market offering different methods of investing in P2P. BondMason is one of the first P2P asset managers to enter the market. They actively select P2P investments, building portfolios and allowing retail investors to ‘effortlessly earn 7.0% p.a’. Asset Management seems a logical progression for the P2P market, so here is a deeper look into the BondMason investment offering. Bond Mason Review: Key Investor Statistics BondMason is offering retail and institutional investors access to the P2P market through a managed portfolio.  Figure 1 (above): BondMason Review BondMason’s targeted return of 7% appears appealing, particularly since they are outperforming their targets with a past performance of 8.6%, since April 2015. Although BondMason favour asset-backed P2P investments they do invest across a mixture of borrower types, including: consumer, business and property. How does investing in BondMason work? Simply put, after depositing funds into a BondMason account the investor must entrust the BondMason management team to invest their funds across a number of P2P investment opportunities. The diagram below provides an overview of how BondMason operate: Figure 2 (above): BondMason - How it works?

It is important to note that the underlying assets are the same whether investing directly through a P2P platform or through BondMason. It is the loan selection process which differs. Benefits of investing through BondMason Due Diligence: If conducting investment due diligence is daunting, investors would be advised to employ professionals. Stephen Findlay, CEO of Bond Mason, commented that they undertake a strict due diligence process. ‘We approve 1 out of 3 platforms and 1 out of 3 loan opportunities within the P2P platform. Investor funds are diversified across a minimum of 50 loans.’ 7% Targeted Returns: BondMason targets a reasonable 7% net return. This is net of a 1% annual fee and a 0-2% bad debt estimate. Double Diversification: Investors in P2P are commonly recommended to diversify across a number of loans within a platform, however, it is less commonly highlighted that investing across a number of peer-to-peer lending platforms also adds to diversification. By investing through BondMason investors are able to diversify their funds across a number of P2P platforms and across a number of loans within the P2P platforms. This is called double diversification. Reduced Cash Drag: Cash drag is a consideration that is often overlooked when investing in P2P. Cash drag is created when funds sit in an investor’s account earning no interest, waiting to be lent out. This generally happens when there is too much investor capital on a P2P platform for the level of borrowers on the platform. This is a common occurrence on platforms such as Zopa, particularly around the end of the tax year when more investors come onto the platform wanting to invest. BondMason reduces the effects of cash drag by investing their own capital in loans prior to these loans being made available on the BondMason platform. What are the risks? In addition to the common risks associated with investing in P2P there is one principal risk associated with investing through BondMason that should be considered. When referring to the peer-to-peer lending industry as a whole, Cormac Leech, a P2P analyst at Liberum Investment Bank recently stated: “Fraud risk is the biggest issue because you basically have to trust the management that they're doing what they say they are" The same is true for investing in BondMason. The principal risk is that the BondMason team make bad investment decisions. For investors it is therefore important that they have faith in Stephen Findlay and the BondMason team to invest funds as they say they will. This leads to questions around the composition of the BondMason team. On the BondMason website it states that Stephen Findlay and his seven-person team have over 50 years' combined investing experience. Taking a further look into the CV of Stephen, he has gained an impressive career as both an entrepreneur and Wealth Manager, notably holding key positions at Fidelity. Possibly not a risk, but more of an annoyance, is that investors are unable to see the underlying loans or P2P platforms which BondMason invests in prior to depositing the min deposit of £1000. For some investors it would be comforting to see the logos of some of the top platforms which BondMason are dealing with before depositing the £1000. Conclusion Asset Management is a logical step for the peer-to-peer lending market and the BondMason proposition appears to be a good one. Targeting above market rates whilst offering investor diversification may be a good option for retail investors. Ultimately, the investor will need to trust that the BondMason team can select loans that deliver the promised 7% targeted return.  Spoiler alert, if you were hoping for an announcement of an Irish ‘sandbox’ to join the UK FCA and the Aussie ASIC sandboxes in yesterday's (05 May 2016) fintech speech by the Central Bank, you’ll be disappointed. The word ‘sandbox’ is like the word ‘sex’; if you put it in the heading of a fintech article, you're sure to get attention. There is no indication that the Irish Central Bank is thinking of a sandbox or an innovation hub from today’s speech by Bernard Sheridan (Central Bank Director of Consumer Protection). However nothing in the speech reads to me that the Central Bank will not go down that path. The tone of the speech is very open and cautious, leaving the Central Bank room to manoeuvre (or pivot as we say in industry) as it responds to the challenges of fintech and, in the case of this speech, consumer protection risk. We might expect a prudential driven fintech speech in the future as the areas of financial stability and market conduct area the focal point of other Directors at the Central Bank. At a speech given at the Financial Services Innovation Centre in the Cork yesterday, the senior central banker commenced by saying he ‘was struck by the growing and significant level of interest there is in fintech developments across a wide variety of sources including international regulatory bodies’ and it being ‘a clear sign of things to come’ for regulated and non-regulated fintech firms. Reference was made to a number of Mr Sheridan’s international peers, including;

Returning to Ireland, the regulator noted that its strategic plan has identified the increased risks arising from technological developments and the increased reliance on information technology by regulated firms, their customers and suppliers. He also reminded that cyber risk is a key emerging threat and that the regulator’s Consumer Protection Outlook Report highlighted financial innovations as a key consumer risk - “[t]he consumer benefits of accessibility and convenience must be matched by service reliability, safety and security, and transparency of cost of services”. While I agree that the issue of financial stability risk arising through innovative financial services is important, this isn’t something new. Rather it seems to me that regulators, even if they considered this to be an issue previously, may not have had the confidence to express their concerns until recently. It feels like regulators have been driven out of their comfort zone and forced to confront the rapid (re)evolution in industries which they traditionally pondered about for years, if not decades, before setting out their prudential, consumer and conduct risk concerns. While it is a fair observation to note that “Fintech is transcending traditional boundaries and borders, not just physical but also regulatory as it blurs the lines between regulated and unregulated activities”, this is nothing new. The same can be said of banking and investment house conglomerates which run empires of regulated and unregulated firms, to which the same tests are applicable as to whether they are regulated or not. A significant problem in the world of fintech are the inconsistent interpretations across the EU. For example, peer-to-peer lending is considered to fall under the Payment Services Directive in Germany and Italy, but the same activity in Ireland is not. This has nothing to do with the fact that the activity is provided through fintech or not. The regulator goes on to note that “As new technologies change the everyday provision and delivery of financial services for consumers and firms, it becomes more challenging for regulators to monitor what is going on as the regulatory rulebooks and supervisory tools struggle to keep pace with developments.” Quite frankly, I don’t understand why it becomes more challenging for regulators unless they remain static and continue with outdated and backward looking supervisory systems instead of real-time and data analytic supervisory systems. The information which they need to keep abreast of is rapidly moving to digital format. They have a number of options here: (1) insist on being provided access to this data direct, which is what fintech firm Uphold Inc voluntarily does, by providing real time transaction data to the regulators; (2) ramp up their own resources, i.e. technology, understanding of data analytics, AI, staff and education; and (3) try to stop the advancement so that it remains at a level at which regulators are capable of supervising - but good luck with regulating the internet! Consumer protection and the Central Bank As we know, the Central Bank has a statutory objective of effective regulation of financial service providers and markets, while ensuring that the best interests of consumers are protected. And it is fair for the regulator to let us know its thinking that the disruptive impact of financial innovation is impacting on its risk priorities and the way it does its work. The regulator noted that “[f]intech certainly has the potential to bring many benefits for firms and consumers and the framework should protect the consumer’s best interest and enable the management of additional and new risks by firms while not stifling innovation or damaging consumers’ trust and confidence in financial services”. This sounds impressive until one asks exactly what are the precise ‘risks’ which are of concern to the local and overseas regulators? Saying general that there are risks to financial stability and consumer protection simply because change is afoot does not help inform the debate. In the eyes of the Irish regulator a few of the areas where fintech and innovation are impacting on its consumer protection work include: (1) monitoring of consumer risks; (2) authorisation process for new firms; (3) new product development; and (4) how we are changing our approach to assessing consumer risks in firms. Noting that point 4 mitigates point 1, there are really only 3 areas here. 1. Monitoring of emerging risks Under this heading the regulator noted that the findings from its consumer focus groups included people being “time poor”, people wanting more convenient and less time consuming complaints processes, including online channels for formal complaints. I get this point, but I am at a loss as to why this “presents a real challenge as to how innovation can be utilised better to marry the two consumer needs i.e. having a convenient and easy to use complaints process while at the same time enabling interaction with an experienced member of staff to resolve complaints in a fair, timely and transparent way”. Surely the advent of online and ‘direct to supplier’ chat support forums on many of today’s websites is the starting point. This is not an issue about the channels available to consumers, but rather the quality of the interaction and therefore the resolution of a complaint? I liked the next part of the speech. I think it was meant to provide comfort, but will probably spook those who feel that we live in an Orwellian society – “The Central Bank also undertakes regular social media monitoring and gathers intelligence from platforms such as social media sites, public discussion fora and media sources in order to gain an insight into and keep abreast of current issues being raised by consumers”. One suspects that monitoring might also focus on the behaviour of regulated firms in cyber space too. We learn in the speech that the European Supervisory Authorities (“ESAs”) accept that increased automation of advice to consumers provides potential benefits, such as wider access, lower cost and more consistent consumer experience. And we also learn that the ESAs are concerned about potential risks, e.g. consumers’ understanding of the nature of the service, limitations or errors in the tools and/or algorithms used. The ESAs are now considering what specific regulatory or supervisory actions should be taken to mitigate consumer risk in automated advice. 2. Authorisation Process There is nothing new under this heading. We covered this area when the changes were announced. In fact, these changes we announced following our engagement with the regulator back in 2015. See our April 2015 update here and our May update here. Suffice to say that the regulator repeated its adoption of the three key principles: accessibility; transparency; and timeliness. The Central Bank reminded that its role is not to act as advisers to potential applicants but rather to provide clarity and certainty by responding to applicants in an open and facilitative way. 3. New Product Development From 2017 new guidelines will be in place for banks and payment institutions, which will be followed by other sectors over time. These guidelines will be a key part of the overall consumer protection framework. Product oversight and governance arrangements are to be an integral part of the firm’s governance, risk management and internal control framework requiring firms, amongst other things, to identify the target market, test products before launch, monitor how the product is performing and take remedial action where problems arise. Product testing will be required to enable the firm to “assess how the product would affect its consumers under a wide range of scenarios, including stressed scenarios”. Product monitoring will be required on an on-going basis. 4. Assessing Consumer Protection Risks Under the last heading the Central Bank announced that it is developing its Consumer Protection Risk Assessment supervisory model which will assess how firms are utilising technology to support their consumer risk management including:

Future Challenges In his concluding remarks Bernard Sheridan said that there was potential for: (i) a greater level of engagement between innovators, innovation centres and regulators so that we can all be better informed and involved in helping avoid the crystalisation of consumer protection risks in new innovations; (ii) at a firm level, there is an opportunity for fintech to play a bigger part in developing products and services that help support regulated firms in monitoring and managing consumer risks; (iii) at the product level, fintech can bring forward innovative solutions for firms seeking to deliver suitable consumer-focused products and services and support firms meeting their regulatory requirements in product oversight and governance; (iv) and finally, at the consumer level, fintech can help deal with the issue of product complexity and the increasing difficulties that consumers are having in understanding financial products and services. His final words on fintech and consumer protection were, unsurprisingly, “We all can and must play our part in ensuring that innovation and consumer protection are closely aligned and, above all, that we are continuously focused on getting it right for the consumer”.  This is the full speech given by Bernard Sheridan Introduction I would like to thank the Financial Services Innovation Centre here in Cork for inviting me to speak at this event this morning. Technological innovation in the financial sector has undoubtedly been happening for some time but over the last couple of years the impact of Fintech is becoming more evident in the scale and pace of change taking place in what would have been viewed as the traditional retail financial services marketplace. As I was preparing for today I was struck by the growing and significant level of interest there is in Fintech developments across a wide variety of sources including international regulatory bodies which I think is a clear sign of things to come and of interest to both regulated and non-regulated Fintech firms. When the body responsible for promoting international financial stability becomes interested in a development then everyone should sit up and take notice. The Chair of the Financial Stability Board (FSB), Mark Carney, recently announced that global regulators are evaluating potential stability implications that emerging financial technology poses to the global financial system including: “systemic implications of financial technology innovations and the systemic risks that may arise from operational disruptions”. And the European Commission is also taking an active interest in the changing face of financial services and, in particular the impact of digitalisation, as reflected in its Green Paper on Retail Financial Services published late last year. The Commission remarked that: “the retail financial services sector is experiencing significant change as it is affected by digitalisation. New business models are emerging: online-only providers and technology companies are entering the market, offering services (within Member States and sometimes cross-border) including electronic money transfers, intermediation in online payments, financial data aggregation, peer-to-peer funding and price comparison.” Steven Maijoor, the head of the pan-European body for insurance supervisors known as EIOPA, also addressed the challenges of financial innovation at the launch of its discussion paper on automated advice when he said: “financial innovation is important and, at its best, contributes to economic growth. However, this can only be achieved and sustained where consumers have confidence in such innovations. Our role as European Supervisory Authorities is to monitor new financial activities and to take action where appropriate.” Here in Ireland, the Central Bank’s Strategic Plan identifies one of the key external environmental factors as the increased risks arising from technological developments and the increased reliance on information technology by regulated firms, their customers and suppliers. The Central Bank has also highlighted cyber risk as one of the key emerging threats to regulated firms and potentially across sectors. However the increased reliance by firms on information technology and systems to deliver products and services means the impact of a cyber-attack on the service provided is potentially much greater. Our Consumer Protection Outlook Report published in February also highlights financial innovations as a key consumer risk area: “more firms are moving increasingly towards delivery of services through online and mobile channels. This is particularly noticeable in banking and payments services but also in other sectors including insurance and investment advice. The consumer benefits of accessibility and convenience must be matched by service reliability, safety and security, and transparency of cost of services” So what is behind this mounting interest now in Fintech and its impact? I believe there is a growing realisation of the significant disruptive nature of new technologies in mainstream retail financial services. Fintech is transcending traditional boundaries and borders, not just physical but also regulatory as it blurs the lines between regulated and unregulated activities. As new technologies change the everyday provision and delivery of financial services for consumers and firms, it becomes more challenging for regulators to monitor what is going on as the regulatory rulebooks and supervisory tools struggle to keep pace with developments. There is uncertainty around the wider long-term impact and implications of Fintech and with uncertainty comes increased risks - and with increased risks comes an increased interest in the Fintech space by global bodies such as FSB and others. It is within this evolving and dynamic financial innovation context that I am making my remarks to you today and, in particular, outlining how the Central Bank is exercising its consumer protection role in response to the challenges, opportunities and risks presented by Fintech. Consumer protection and the Central Bank The Central Bank has a statutory objective of effective regulation of financial service providers and markets, while ensuring that the best interests of consumers are protected. Regulated firms must meet financial soundness rules as well as fitness and probity standards for their senior executives. They must have appropriate internal governance and controls to ensure they are properly run and importantly must ensure that they treat their customers fairly and ensure that any customer money and assets are securely held. We carry out our role in an increasingly European context and as members of the three European Supervisory Authorities (ESAs) for banking, insurance and markets. Our consumer protection objectives are based on the need to ensure that consumers are treated fairly and with respect and dignity by firms, and that firms act in their consumers’ best interests in all that they do. We deliver on our consumer protection mandate under three broad functions of gatekeeper/authorising firms and people, policy maker/influencer ensuring the framework is fit for purpose and, finally, as supervisor and enforcer of the rules and standards. As the financial system context and landscape evolves, so too does our approach to how we carry out these functions. The disruptive impact of financial innovation is also clearly impacting on our risk priorities and the way we do our work across all three functional areas. Considering that the mission statement of the Central Bank is “Safeguarding Stability – Protecting Consumers” it should not be surprising that our focus, in ensuring that the consumer protection framework is fit for current and future purpose, is largely based on risks - risks to the system, risks to the firms which operate within it and which are regulated by us and, of course, risks to consumers. Fintech certainly has the potential to bring many benefits for firms and consumers and the framework should protect the consumer’s best interest and enable the management of additional and new risks by firms while not stifling innovation or damaging consumers’ trust and confidence in financial services. It is certainly a challenge and one that we are responding to in a strategic and balanced way. By way of illustration, I would like to briefly outline a few areas where Fintech and innovation are impacting on our consumer protection work including (1) the monitoring of consumer risks, (2) authorisation process for new firms, (3) new product development and (4) how we are changing our approach to assessing consumer risks in firms. 1. Monitoring of emerging risks In the context of our consumer protection mandate it is important that we monitor current and emerging consumer risks arising from the rapidly changing face of financial services, products and business models. In order to inform and provide an evidence-based approach to our work, we undertake consumer research and significant market monitoring through our engagement with stakeholders including the Financial Services Ombudsman and the Competition and Consumer Protection Commission as well as analysing data submitted by regulated firms. For example, we will shortly be publishing our research on consumer complaints. We have found that traditional channels for making and handling complaints, such as face-to-face or telephone, are the most popular among consumers. Consumers also cited a knowledgeable and experienced point of contact within the firm as one of the most important aspects when going through the firm’s complaints process. When we delved deeper in our consumer focus groups, we found that people are “time poor” and would welcome a more convenient and less time consuming complaints process including an appropriate online channel as part of the overall formal complaints handling process and supported by knowledgeable staff. This presents a real challenge as to how innovation can be utilised better to marry the two consumer needs i.e. having a convenient and easy to use complaints process while at the same time enabling interaction with an experienced member of staff to resolve complaints in a fair, timely and transparent way. The Central Bank also undertakes regular social media monitoring and gathers intelligence from platforms such as social media sites, public discussion fora and media sources in order to gain an insight into and keep abreast of current issues being raised by consumers. Availability of service, charges and security of new payment methods, as well as customer service dissatisfaction regarding the quality of automated support services and the lack of human interaction, are regularly raised by consumers. These public fora bring greater transparency and provide a “real-time” voice for consumers on their financial services experiences. They require firms to be alert, responsive, open to feedback and willing to listen and act as a result of issues raised on social platforms. In a broader European context the issues of consumer data and automated advice are receiving greater regulatory attention, particularly with the recognition of consumer data as an important and valuable asset within firms. As part of its mandate to monitor new and existing financial activities, the European Banking Authority (EBA) is examining firms’ innovative uses of consumer data and will publish a discussion paper on the topic. The EBA’s discussion paper presents a real opportunity for all interested parties to have an open and structured debate on the benefits and risks of firms’ innovative uses of consumer data. The impact of financial innovation is also having a disrupting effect on the provision of financial advice with more and more firms automating advice to consumers. The ESAs noted this increased automation in its discussion paper published in December 2015 and highlighted some of the potential benefits (wider access, lower cost, more consistent consumer experience) as well as potential risks (consumers’ understanding of the nature of the service, limitations or errors in the tools or algorithms used). The ESAs are now considering what, if any, specific regulatory or supervisory actions should be taken to mitigate consumer risk in automated advice. Consumers place a great trust in firms that they are working in their best interests and I believe firms need to live up to that expectation and demonstrate that they are acting in the interests of all consumers including those who are more vulnerable. 2. Authorisation Process Not all Fintech activity requires an authorisation from the Central Bank. However for those specific areas of financial activity where the legislation requires providers to be authorised by the Bank, we look to see that applicants clearly demonstrate to us that they have met our required standards and will continue to do so post-authorisation. The payment and electronic money sector is one area where, as gatekeeper, the impact of new innovations is particularly evident, reflected in the growing range of business models, advances in technology and the emergence of new firms seeking to bring new products and services to the market. In 2015 we enhanced our authorisation process for payment institutions and e-money institutions based on three key principles:

Our role is not to act as advisors to potential applicants seeking authorisation but rather to provide clarity and certainty to all applicants by responding to them in an open and facilitative way while maintaining the robustness of our approach to determining what firms should be authorised. Full details of these Authorisation Processes are available in the Financial Regulation section of our Website. 3. New Product Development Developments taking place at the European level will impact greatly on how firms design, develop, sell and review their financial products. From 2017 new guidelines will be in place for banks and payment institutions in the first instance, which will be followed by other sectors over time. These guidelines will be a key part of the overall consumer protection framework placing responsibilities on firms to demonstrate that their products are delivering the best outcomes for consumers throughout their life cycle from product development to their launch and sales. Product oversight and governance arrangements will be an integral part of the firm’s governance, risk management and internal control framework requiring firms, amongst other things, to identify the target market, test products before launch, monitor how the product is performing and take remedial action where problems arise. Product testing will be required to enable the firm to “assess how the product would affect its consumers under a wide range of scenarios, including stressed scenarios”. Product monitoring will be required on an on-going basis. I believe these guidelines will really strengthen the consumer protection framework and the way we supervise firms. There is a clear opportunity for firms seeking to meet these new product guidelines to adopt new financial innovations and technologies particularly in relation to product testing and monitoring – and no doubt beyond! 4. Assessing Consumer Protection Risks Finally, financial innovation is also impacting directly on our evolving supervisory approach. We are currently developing our Consumer Protection Risk Assessment supervisory model, a key part of which is an assessment of how firms are utilising technology to support their consumer risk management including:

Future Challenges I’ve outlined to you the context within which Fintech is providing innovation and, as a consequence, causing disruption in the traditional retail financial services marketplace. I’ve also shared with you my view that these innovations can bring positive benefits to consumers and firms when managed and delivered within a strong consumer-focused culture, but equally recognise that they can also present consumer protection risks that need to be managed and mitigated. There is a step change in the regulatory interest in Fintech developments both at home and at an international level. As those of us working in this field continue to strive to enhance the consumer protection framework it is important that we manage, but do not stifle, financial innovations that help to deliver better outcomes for consumers in the short and longer term. I’d like to conclude today by providing some of my views on how we can ensure that new technologies and service and product innovations are channelled effectively to deliver for consumers. I believe there is potential for: (i) a greater level of engagement between innovators, innovation centres such as the Financial Services Innovation Centre and regulators so that we can all be better informed and involved in helping avoid the crystalisation of consumer protection risks in new innovations. Gatherings, such as this one today, is a good example of the benefits of engagement and networking; (ii) at a firm level, there is an opportunity for Fintech to play a bigger part in developing products and services that help support regulated firms in monitoring and managing consumer risks. Although it is early days, we have seen some progress being made across a number of banks and insurers in developing their internal consumer risk frameworks; (iii) at the product level, Fintech can bring forward innovative solutions for firms seeking to deliver suitable consumer-focused products and services and support firms meeting their regulatory requirements in product oversight and governance; (iv) and finally, at the consumer level, Fintech can help deal with the issue of product complexity and the increasing difficulties that consumers are having in understanding financial products and services. Fintech can also bring forward solutions to the challenge of how to satisfy the consumers’ appetite for more convenient and efficient ways to do their financial business, with their continuing need for human interaction when it comes to customer services, particularly for more vulnerable consumers. Conclusion Fintech is now an established part of how financial services are delivered to consumers across the banking, payment and wider financial system. How we approach our work is impacted by the changing financial services landscape - naturally as a regulator with responsibility for consumer protection our focus is on the risks posed to consumers alongside those risks posed to firms and the wider financial system. While it is not possible or realistic for us to be ahead of every innovation, it is essential that our focus is firmly on ensuring that the appropriate framework is in place to ensure that innovation develops in a manner that ensures the best interests of consumers are protected. There is an exciting opportunity for Fintech firms to contribute in a positive way to protecting consumers and enabling greater access and availability of financial products and services. We all can and must play our part in ensuring that innovation and consumer protection are closely aligned and, above all, that we are continuously focused on getting it right for the consumer.  Fintech Ireland is part of an international fintech network and promotion group which includes Fintech UK and Fintech Oz. The primary activity is Fintech Ireland for the time being. Founded by former Central Bank of Ireland director Peter Oakes in response to difficulties technology firms were experiencing with the previous Central Bank’s licensing process, Fintech Ireland provides guidance and advice to fintech start-ups and established financial institutions which want to enhance their offerings to increasingly tech-savvy customers. “We run seminars and meet-ups to help cultivate the digital innovation happening in Ireland,” Oakes adds. “Having worked as a central banker and board director of Bank of America’s European payments business, I am very much aware of the impact, challenges and benefits from the cumulative impact of technology, the internet, big data, and future regulation in areas such as cyber security, banking, payments, and MiFID on business and consumers. Importantly, through our network of international angel investors, venture capitalists, private equity funds, innovation hubs and technology accelerators we can help match start-up tech firms with investors.” "Simply selling a mortgage online or enabling a customer to see their account balance on their smartphone is not fintech. Fintech is about disrupting, through innovation, existing banking, payments, investment, and insurance services. Equally it is about identifying new services" Looking at future trends in the sector he says that fintech is a broad church and there are many components to it. “It is more than just the marriage of finance and technology,” he says. “Simply selling a mortgage online or enabling a customer to see their account balance on their smartphone is not fintech. Fintech is about disrupting, through innovation, existing banking, payments, investment, and insurance services. Equally it is about identifying new services.” Looking beyond the standard payments area, which tends to command most attention, he notes some other critical infrastructure changes. “In banking there is the instantaneous opening of retail and business bank accounts delivered by challenger banks, such as the UK’s Monese, Mondo, Atom, and Starling Bank. Further innovation is being driven by new banking platforms such as Cogni in Ireland and Holvi in Sweden which take advantage of recent EU open bank initiatives to bank data and customer geographic locations in order to offer each customer tailored and unique business and personal banking experiences. We are seeing the traditional bank model coming to an end as they morph into utility companies. Although the traditional banking model may come to an end, it is just the start of a new banking service paradigm.” He also points to the investments and pensions area where companies like Roboadvisers, Nutmeg in the UK, Robin Hood in the US, and Rubicoin in Ireland are providing a range of services online and through apps. In the loans and peer-to-peer or crowd-funded personal and business lending space fintech companies think of Funding Circle in the UK, OnDeck in the US, and Grid Finance in Ireland are bringing innovative new services. The emerging area of insuretech is bringing about some potentially hugely disruptive concepts such as peer-to-peer car, personal or business insurance. “Similar to peer-to-peer lending, peer-to-peer insurance sees a number of policyholders pool together,” Oakes explains. “When the insurable risk happens, the policyholders support each other financially. If there is no claim, the insurance premiums are reduced. Effectively we are seeing all the benefits of the co-operative insurance, or lending, model being accelerated by the efficiencies and speed of the internet and technology. Examples of this include FriendSurance in Germany and Guevara in the UK. There are also a number of innovative insurance people in Ireland looking at entering the market.” "Technology is critical. Without technology there is no way a central bank or a bank can be confident that they have the sufficient capital required to insulate them from the economic risks they undertake on a daily basis" He believes regtech, or regulatory technology, will be an area of significant growth. “As more and more regulation and law comes into effect, the organisations subject to those laws such as banks, insurers, investment houses and other financial providers and those that administer the laws and regulations including central banks and regulators will need to adopt technology to analyse the huge amounts of data about the stability of systemically important institutions and important compliance obligations,” he contends. “These processes cannot be performed manually. Technology is critical. Without technology there is no way a central bank or a bank can be confident that they have the sufficient capital required to insulate them from the economic risks they undertake on a daily basis. Technology is being deployed in the fight against financial crime and financing terrorism. Without technology it would simply be impossible to analyse trading and payments patterns to identify fraud, criminal behaviour, and stifle the flow of money which terrorists use to attack society. |

AuthorFintech Ireland Archives

January 2027

Categories

All

|