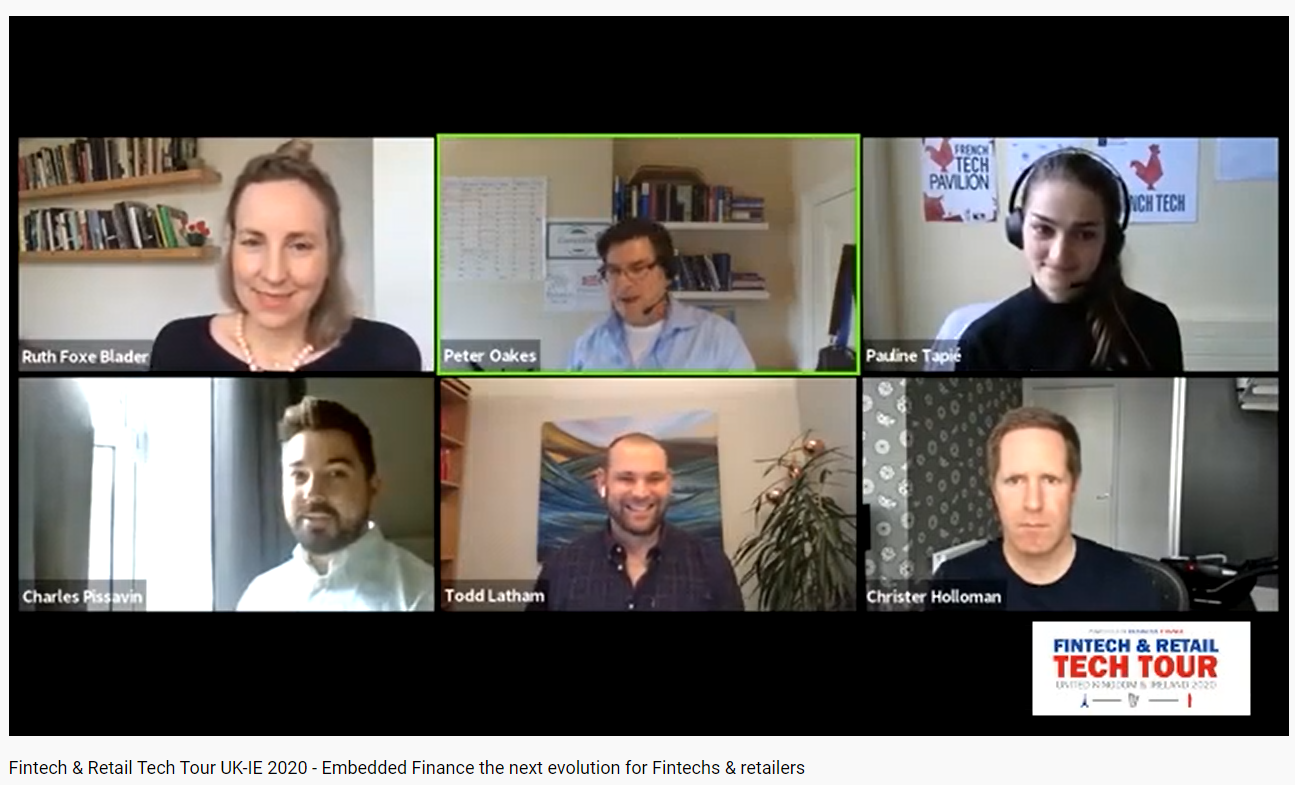

What is Embedded Finance, how is it being applied in financial services and other industries and what is the next evolution for Fintech. If you missed the event, you can watch it here - https://youtu.be/hnBWGaZZSGk

Fintech Ireland's and Fintech UK's Peter Oakes (https://www.linkedin.com/in/peteroakes/) moderated an exceptional panel of experts on Embedded Finance as part of the The Fintech Retail Tech Tour UK & Ireland (20th – 22nd October 2020).

The expert panel included:

- Ruth Foxe Blader, Partner Athemis Group (https://www.linkedin.com/in/ruthblader/);

- Christer Holloman, CEO and Co-Founder at Divido (https://www.linkedin.com/in/christerholloman/);

- Todd Latham, Chief Growth Officer at Currencycloud (https://www.linkedin.com/in/lathamtodd/); and

- Charles Pissavin, Business Development Manager at TransferMate (https://www.linkedin.com/in/charles-p-394b2a8b/)

Read more on the French Fintech & Retail Tour Tech Tour UK & Ireland 2020 (Powered by Business France. Supported by Fintech Ireland, Fintech UK & Fintech Northern Ireland)