Recommend you follow the Fintech Ireland Page on Linkedin and our Twitter Account for more regular news alerts and releases. Our Founder Peter Oakes also blogs on Fintech in Ireland and Internationally. Follow him on LinkedIN HERE.

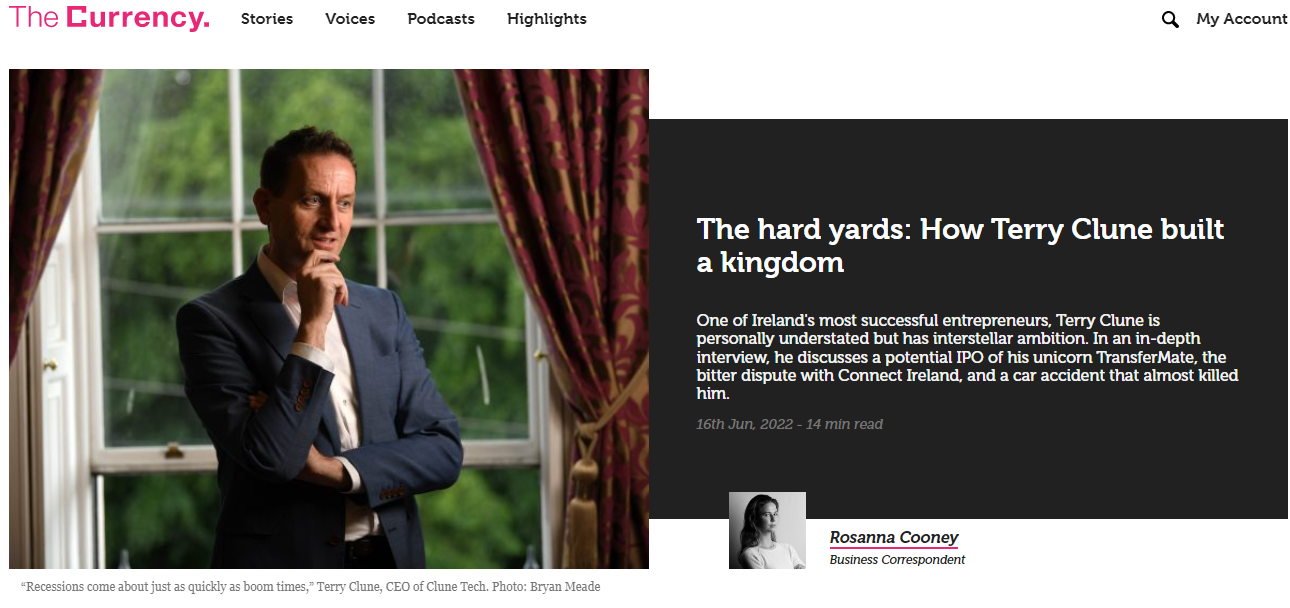

Clune Tech is a suite of eight businesses which all, bar one, were spun out of Taxback.com. Terry is arguably one of the most successful Irish entrepreneurs ever, particularly in fintech and, of course, technology. As you may know, it is one of a handful of Irish founded tech unicorns and a smaller number of fintech / regtech unicorns being recently valued at more than €1 billion following a €70 million investment from Railpen, one of the UK’s largest pension funds.

The suite of eight businesses, as reported, include Immedis; which handles global payroll, Benamic; a marketing agency, Sprintax; tax filing for non-resident professionals, Visa First; providing business and tourist travel visas, Taxback.com International; TransferMate Global Payments and Gradguide.

Read More - https://www.linkedin.com/posts/fintech-ireland_fintech-irishfintech-fintech-activity-6958054174890598401-wCjT?utm_source=linkedin_share&utm_medium=member_desktop_web