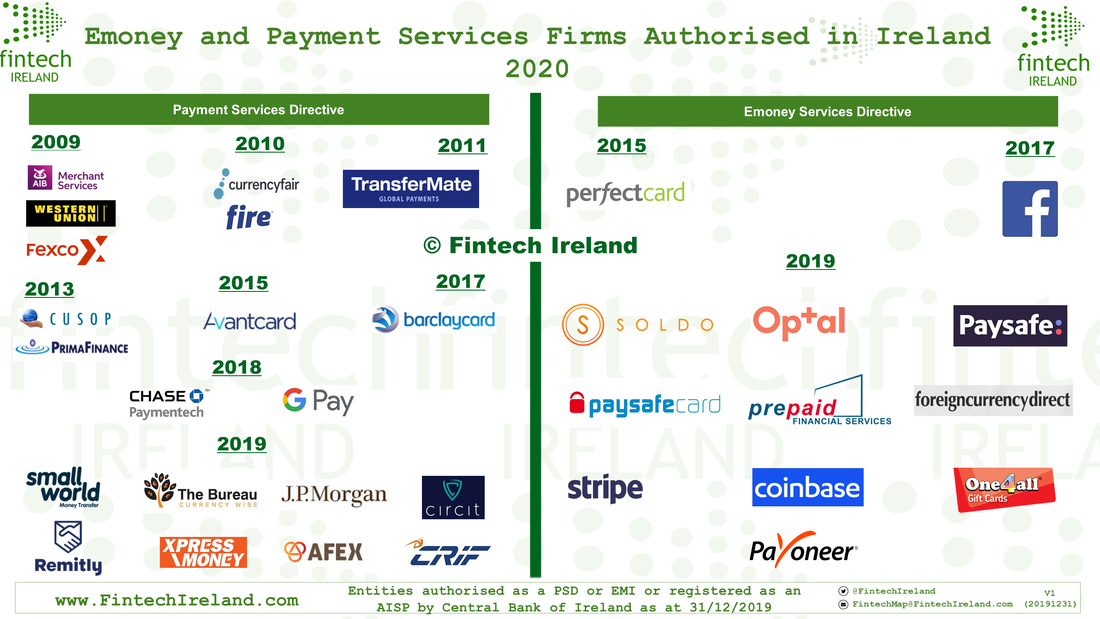

Today we posted an article on Linked with the above Fintech Ireland graphic which shows the fintech companies which have Payment Services Directive (PSD 2) and Emoney Directive authorisations from the Central Bank of Ireland (CBI) and those registered as Account Information Service Providers (AISP) with the CBI under the PSD 2.

Percentage wise there was a noticeable increase in 2019 in both PSD & Emoney firms. Figures are based on CBI data as of today. All firms were authorised by the end of 2019.

The two firms appearing at the bottom right in the PSD section Circit.io & CRIF are registered as AISPs only. However Stripe, Fexco, fire.com & Paysafe Group are all permitted to provide payment initiation services & account information services.

Particular mention is made of the regulated fintech pioneers in Ireland such payments firms - TransferMate, CurrencyFair, AIB Merchant Services, Western Union, Fexco and Fire; as well as Emoney firms Perfect Card and Facebook.

In summary, the Irish Central Bank has authorised/registered:

* 12 EMoney Firms

* 18 Payment Services Firms

* 2 AISPs

Although it is great news that Ireland is continuing to attract fintech companies to our shores, there is certainly a lot of competition out there. In a recent Financial Times article, it was reported that "[t]he Lietuvos bankas / Bank of Lithuania had, by the end of 2019, issued e-money licences to 64 fintechs with about 40 more applications under examination. That ranks well behind the UK, which has more than 150 regulated fintechs, but ahead of all other EU countries, none of whom has more than 20."

Other firms in the Fintech Ireland graphic not already mentioned above include:

Prepaid Financial Services, Optal, Soldo, Foreign Currency Direct plc, Coinbase, One4all Group, #PrimaFinance, Barclaycard, Chase, J.P. Morgan, CUSOP (Payments) Ltd, Small World Financial Services, #GooglePay and Associated Foreign Exchange