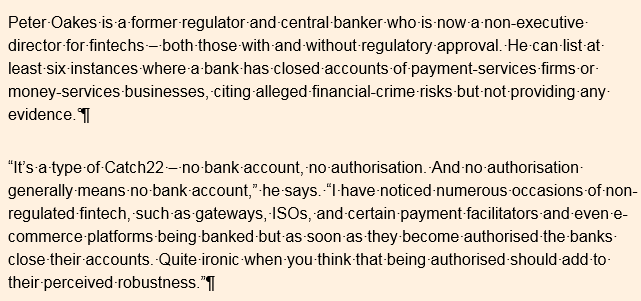

Peter Oakes, Founder of Fintech Ireland, comments to Caroline Binham of the Financial Times on the increasing instances of banks refusing to do business with fintech companies.

Imagine being a fintech start-up in the payment services space. Without warning, your banking services are pulled by a lender you have used for years. You try somewhere else. The other bank won’t even take you on.

This is a similar refrain that an increasing number of fintechs can appreciate from first-hand experience. “It’s the single biggest threat to the fintech leadership position of the UK,” says Tony Craddock, director general of the Emerging Payments Association.

“There’s increasing and mounting evidence that banks are withdrawing banking services from established and successful fintech companies," he says. "Fintech is one of the engines of growth, both pre- and post-Brexit but unless something is done it risks killing off the golden goose.”

Being able to secure basic banking services is yet another headache for a sector that is already suffering from a drop-off in funding since the Brexit referendum (more on that below).

It’s a problem now firmly on the City watchdog’s radar too. Rob Gruppetta, the head of financial crime at the Financial Conduct Authority, told a conference earlier this month that the regulator was “concerned” about competitive issues around so-called de-risking.

This is the phenomenon where banks are becoming increasingly cautious about who they take on – or even about their current customers – after a series of hefty fines by US authorities for money-laundering and sanctions breaches.

HSBC imposed a worldwide ban in 2011 on doing business with the money services sector, including digital currencies, money transfer and remittance providers, because of anti-money laundering rules and other regulatory concerns. to edit.

For charities, it may be a case of the banks taking an overly cautious approach, some experts wonder if something more sinister is going on with their attitude to fintechs?

“It’s a type of Catch22 – no bank account, no authorisation. And no authorisation generally means no bank account,” he says. “I have noticed numerous occasions of non-regulated fintech, such as gateways, ISOs, and certain payment facilitators and even e-commerce platforms being banked but as soon as they become authorised the banks close their accounts. Quite ironic when you think that being authorised should add to their perceived robustness.”

The FCA now has new competition powers, which it has not been slow to use in other areas. It’s one of the reasons why it feels it should nurture innovation and encourage disruption with initiatives like its regulatory sandbox, as a way to break up the old monopolies in banking.

So while for now the watchdog is merely sniffing around the issue, it would not be surprising if it took more robust action if incumbent lenders are deliberately shutting out their would-be rivals on spurious grounds.