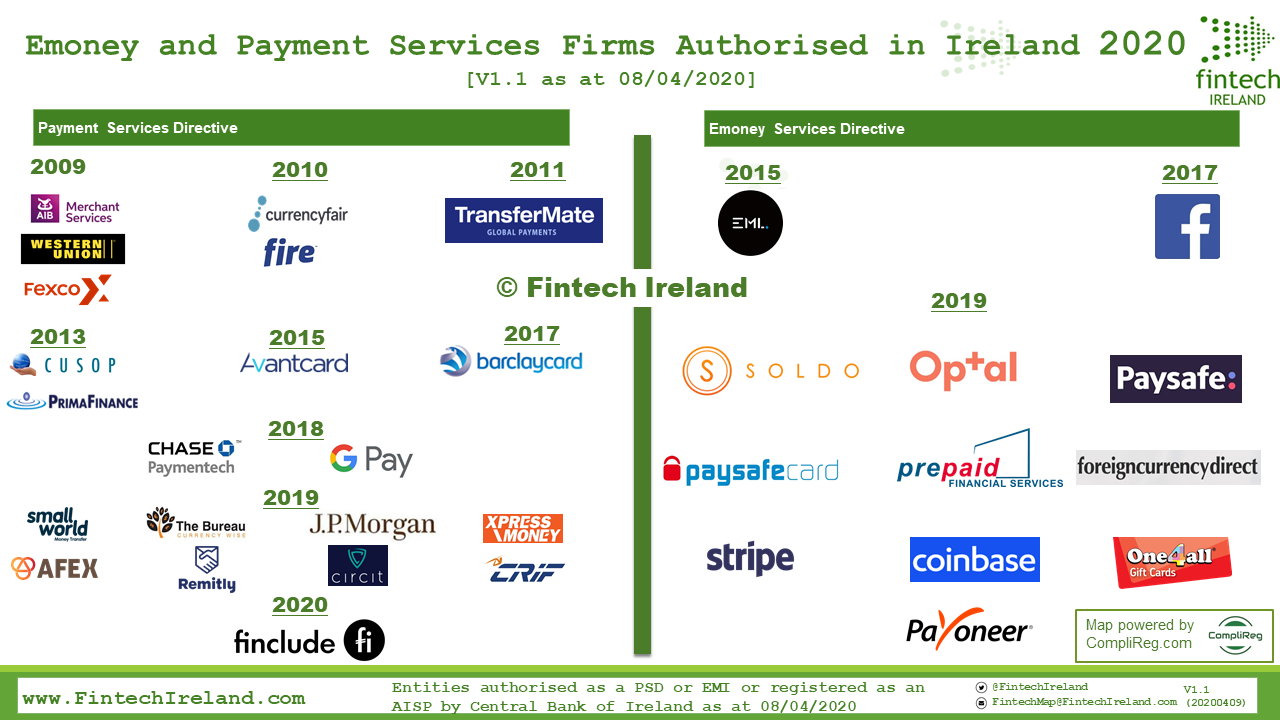

Above you will find the map of regulated emoney firms and payment services firms as displayed in the registers at the Central Bank of Ireland on 8 April 2020.

One question we are often asked is how does a company get authorised as either an emoney or a payment services firm in Ireland. To answer that recurring question, we wrote two guides in partnership with CompliReg, founded by a leading regulatory and central banking expert. You can find the authorisation guides on our website here. And please feel free to contact us or CompliReg if you have questions.

A number of non-indigenous Irish #fintech firms have asked how can Fintech Ireland make noise about their presence in Ireland. The easiest way for us to do so is where the fintech has received an authorisation/registration from the Central Bank of Ireland (CBI).

The map immediately above (powered by CompliReg) shows those firms appearing on the CBI's public records displayed on 8 April 2020 as either authorised/registered #payments service firms or authorised #emoney firms. The group includes both indigenous Irish fintech and international fintech authorised in one of those two categories.

They are:

Payments Firms:

AIB Merchant Services, Western Union, Fexco, CurrencyFair.com, TransferMate Global Payments, #Fire, CUSOP (Payments) Ltd, #PrimaFinance, Avantcard, Barclaycard, #Chasepaymentech, Google Pay, #smallworld, AFEX, BUREAU BUTTERCRANE LTD, Remitly, J.P. Morgan, Circit.io, Xpress Money, CRIF & Finclude (fka. Verge.Capital)

Emoney Firms:

EML, Facebook, Soldo, Optal, Paysafe Group, paysafecard.com, Prepaid Financial Services Limited (PFS), #foreigncurrencydirect, Stripe, Coinbase. One4all Group & Payoneer.

Those firms in the above map which are indigenous to Ireland also appear on our bigger Fintech Ireland Map version 3.0 which you can find here.