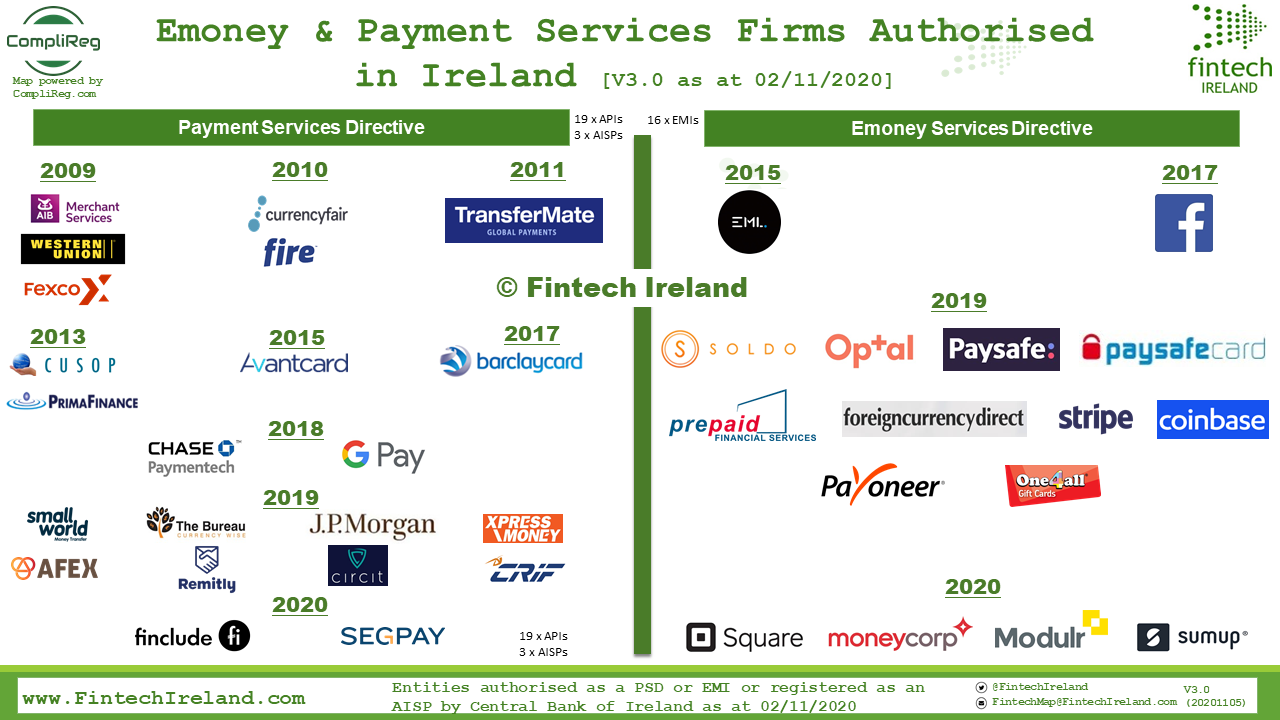

Our last post on additions to the Irish regulated fintech family of payment services firms and electronic money firms was back on 30 September when we released Version 2.1 of the 'Emoney & Payment Services Firms Authorised in Ireland Map' as at 11 September 2020.

Again thanks to CompliReg we have released an update to that Map, which now stands at Version 3.0. The new joiners are Modulr FS Europe Limited and SumUp Limited. In addition to their emoney authorisations, both firms can provide payment services 3(c) and (5), and in addition, SumUp can also provide payment services 3(b). See below for a description of these payment services numbers*.

Followers of Fintech Ireland will recall that we co-hosted an event with Modulr at the start of the year (when during pre-covid 19 days we could all get together) on 3rd March 2020, aptly titled 'The Future of E-Money - Modulr & Fintech Ireland' with Myles Stephenson, Founder and Chief Executive and John Irwin, General Manager of Modulr and Fintech Ireland's/Fintech UK's our Peter Oakes.

Welcome to Ireland SumUp and Modulr and soon too the many others making their way through the Central Bank of Ireland authorisation pipeline!

Those firms in the above Map which are indigenous to Ireland also appear on our bigger Fintech Ireland Map version 3.0 which you can find here. If you think you should be on the Fintech Ireland Map, complete our Survey. Do it soon as version 4 of that Map is slated for release very shortly!

If you are looking to get authorised in Ireland as an emoney or payments firm, see these Authorisation Guides and feel free to contact us for a informative dialogue on the authorisation process. We are chatting with about 2-3 firms a week.

* Payment Services:

3 Execution of payment transactions, including transfers of funds on a payment account with the user’s payment service provider or with another payment service provider:

(b). Execution of payment transactions through a payment card or a similar device;

(c). Execution of credit transfers, including standing orders

5. Issuing of payment instruments and/or acquiring of payment transactions