Twitter: @ostiasolutions

What is Open Banking and how does it relate to PSD2?

The concept of Open Banking is being used around the world to describe the goal to make banking more dynamic. In the past, people often opened a bank account with one bank and stuck with that bank for the rest of their lives. Banks often used that fact to ensure that their systems and processes were extremely closed making it extremely difficult to move accounts from bank to bank or use the services of another bank. It also meant using different applications to access information from each different bank.

Governments have pushed banks through regulation to make it much easier to switch between providers. While the banks resisted this in the past, it is now a fact of life and the banks know to support this they will need to make their IT systems and processes more accessible. In parallel to this has come a technological revolution enabling consumers to do far more than ever was thought possible on mobile devices. As the banks are now being targeted by high tech, so called ‘challenger banks’, they are attempting to open up their systems for use by small, agile and clever organizations (commonly known as ‘Fintechs’) building products around those banks.

Continue reading at https://www.ostiasolutions.com/blog/blog/97-psd2-and-openbanking

What Does Open Banking Mean to Consumers?

Open Banking as a concept is targeted such that individuals or large and small businesses can benefit from it. Many use the analogy of what the ‘Open Skies’ policy did for air travel in Europe. ‘Open Skies’ opened up air travel to a wider group of people through competition and resulted in a significant reduction in fares. In this blog we try to foresee what ‘Open Banking’ could mean to your average consumer.

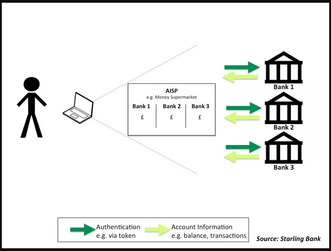

Access to Accounts in one Place

The most obvious benefit will be an ability to see all of your financial information in one place. At the moment, taking the simplest example, when you have bank accounts with different banking institutions, you generally need to install and use multiple applications to see your accounts. When extended to credit cards and mortgages, many banks don’t always offer an ability to see these online. Consider that in the future, Open Banking will offer you an opportunity to see your current financial position in a single application on your phone.

Continue reading at https://www.ostiasolutions.com/blog/blog/98-what-does-open-banking-mean-to-consumers

What Does Open Banking / PSD2 Mean to Banks?

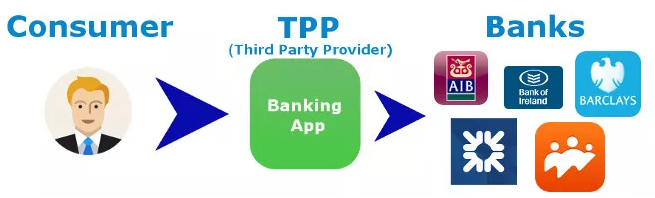

Security and Culpability

This is potentially one of the things that keeps most bankers awake at night. The potential is there for someone to compromise their security and thus steal many millions of euro from customer accounts or simply even customer data with GDPR (General Data Protection Regulation) on the horizon. In the past, only the bank and its own internal applications and some select external partners could access the data. This enabled them to ensure a belt and braces attitude to security and avoid any potential breaches. Most have now moved to include behavioural monitoring to determine if unexpected behaviour is seen on an account. As they open up access to their data, monitoring this will become even harder as determining what is ‘unexpected behaviour’ on an account will be even more difficult as Third Party Providers (TPPs) will find new and unusual ways to use the data to which they have been given access. This is a major challenge for the banks at the moment.

Continue reading at https://www.ostiasolutions.com/blog/blog/99-what-does-open-banking-psd2-mean-to-banks

Open Banking Ecosystems and Developer Portals Being Delivered by the Banks

As Open Banking / PSD2 comes into force, the banks that have embraced open banking (and fintech in general) as an opportunity rather than a threat are attempting to engage with the development community, both individual developers and larger development organizations. It is through this engagement that these banks are hoping to benefit from the world of open banking. We will discuss how and why in this article.

What is an Open Banking Ecosystem?

The banks are keen to attract developers and organizations of all sizes to their Application Programming Interfaces (APIs). Many are attempting to create an Ecosystem supporting developers and enabling them to on board and engage with the banks in as frictionless a way as possible. This Ecosystem can consist of a number of things:

- Open and informative online content about what APIs the bank have available and what they are planning.

- Documents, white papers and training materials to enable developers to interact easily with the bank’s APIs.

- Online forums where developers and the bank can engage in open discussion about what is good and bad about the ecosystem so that it can be improved.

- Workshops, where appropriate, to work through issues with developers.

- Hackathons, where developers of all sizes can show their skills and socialise their ideas.

- The final, and most important part of this ecosystem, is the Developer Portal.

Continue reading at https://www.ostiasolutions.com/blog/blog/100-open-banking-ecosystems-and-developer-portals-delivered-by-banks