We look forward to seeing you in Limassol, Cyprus in early April.

|

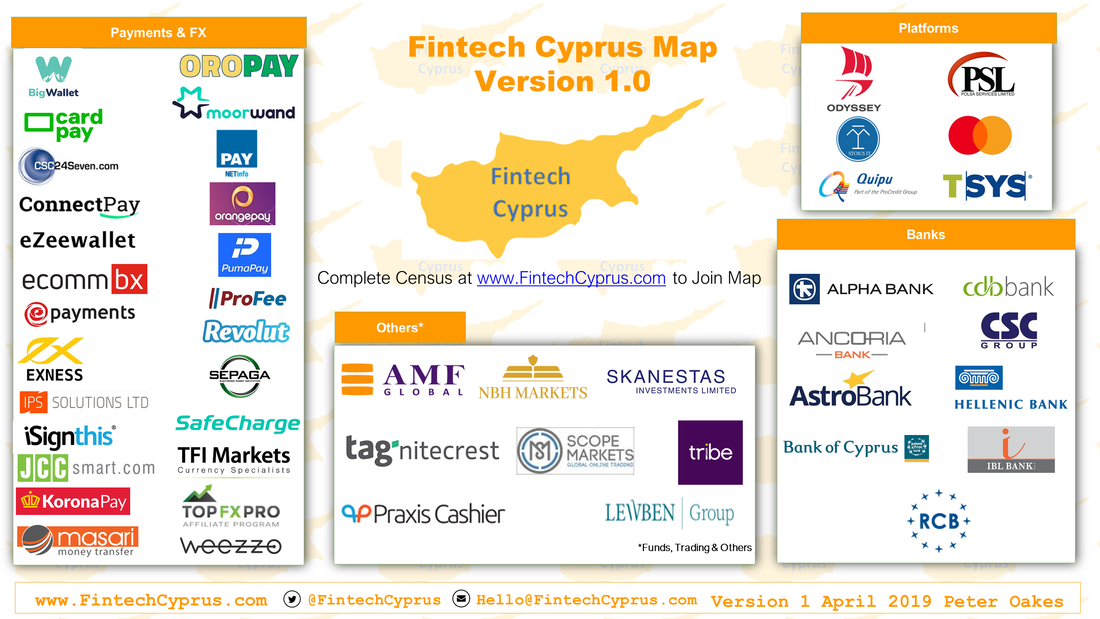

Coinciding with the QUBE Events 6th NextGen Payments Forum, Peter Oakes of Fintech Ireland has helped launch www.fintechcyprus.com. Join us at QUBE Events 6th NextGen Payments Forum in Limassol, Cyprus on 4th and 5th April 2019 to learn more about Fintech Cyprus.

We look forward to seeing you in Limassol, Cyprus in early April.

0 Comments

If you intend to use our data, graphics and images please ensure that you credit the team at Fintech Ireland - just as we do! for others.

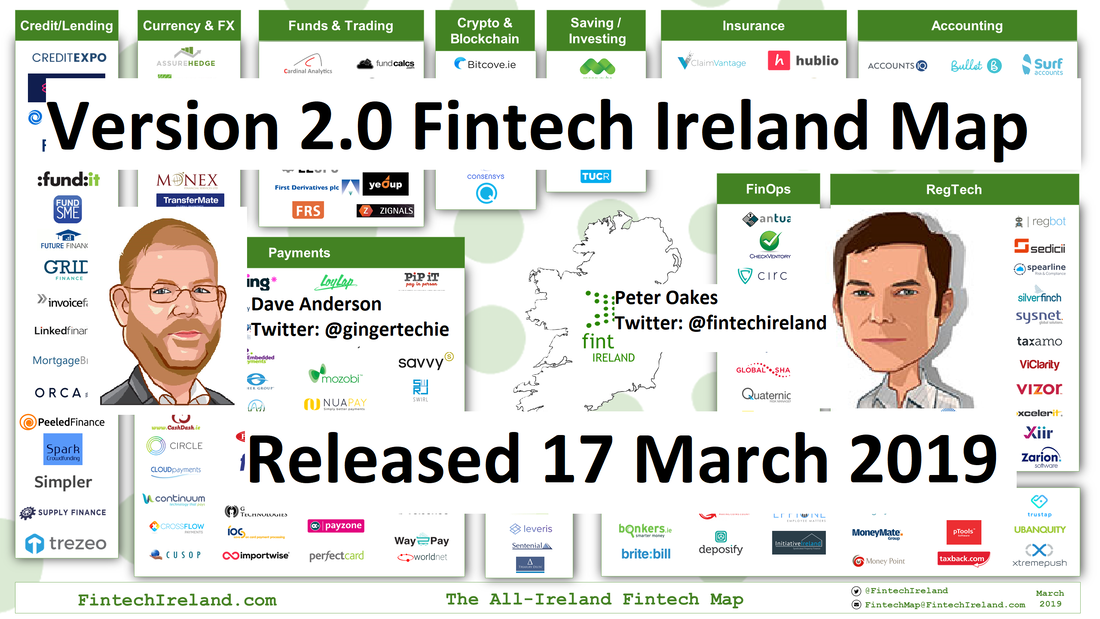

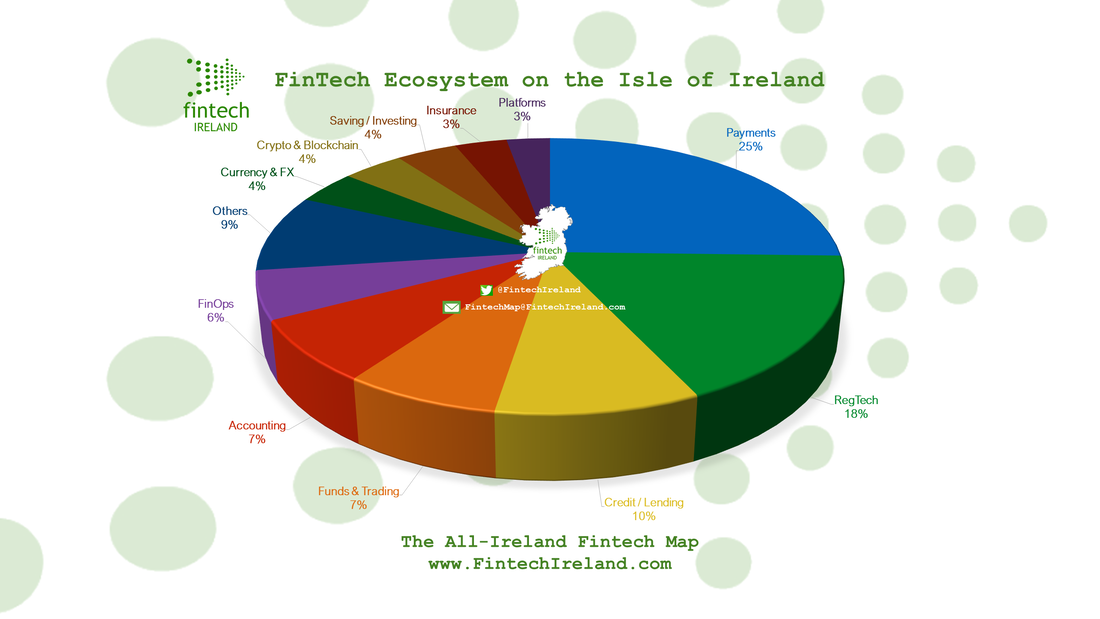

It’s been a full year since we updated the Fintech Map - and there are LOTS of changes! ● Credit & Lending - 8 new companies ● Funds & Trading - 2 new companies ● Crypto & Blockchain - 5 new companies ● Saving & Investing - 1 new company ● Insurance - 1 new company ● FinOps - 1 new company ● Regulation - 13 new companies ● Payments - 10 new companies ● Others - 5 new companies This shows that the Fintech ecosystem in Ireland is continuing to grow and evolve, both in the Republic and Northern Ireland. If we were to draw one headline from this, it would be the explosive growth of Regulation (RegTech), with thirteen new companies added in the last year. If you are Irish FinTech / RegTech and feel that you should be on the Map, complete our Survey (at https://fintechireland.com/fintech-survey.html) and we will review before the release of our next edition. To reflect the all-Ireland nature of Fintech Ireland, we’ve updated the design to be a little less Dublin-centric, and bumped the version number to 2.0. Thank you to everyone who contributed to the update this year, including those who completed the on-going Fintech Ireland Survey! As we say above, to join the Map, complete the Survey on www.fintechireland.com. Any questions on the Map, please send them to [email protected]. If you like to stay in touch with what we are doing, our events for 2019 and Irish fintech news, join the mailing list here and follow us on twitter at @fintechireland, @gingertechie and @oakeslaw As we can see from the below pie chart, RegTech and Payments are the dominant sectors within the Fintech Ireland ecosystem. This is no surprise and matches data emanating from other bodies, including data from the central Bank of Ireland.  Following the Central Bank of Ireland's announcement on 20 April 2018 about open and active engagement with FinTech and innovation, it launched its Innovation Hub as a direct point of contact for innovative firms. The Innovation Hub provides an open platform for the Central Bank to listen to innovators and enhance its sight of ongoing and upcoming developments in FinTech. It uses that information to build on its existing intelligence on changes in the financial services landscape. The direct engagement approach, through the Innovation Hub, facilitates a deeper understanding among firms of the Central Bank's regulatory and supervisory expectations. A couple of points to note from the 2018 Update are:

Read the 2018 Update here. Read more about the Innovation Hub here.  Click here to download the ODCE Report "ICOs are global in nature and trade easily across borders. A more coordinated global approach is necessary to prevent regulatory arbitrage and allow ICOs to deliver their potential for the financing of blockchain-based SMEs, while also adequately protecting investors." Greg Medcraft, Director OECD Directorate for Financial and Enterprise Affairs.  Fintech Ireland hits the Big Apple, New York City Friday 12th-Monday 15th October 2018 Check out our New York Event happening 15th October While we are checking out some new blockchain applications moving from stealth to production mode shortly, a few wealthtech opportunities and catching up with peers in the in USA fintech scene we thought we'd gauge the appetite on short notice for an event in New York for a morning seminar on Irish Fintech in the USA and the opportunities for USA fintech to establish in Ireland given the challenges and uncertainty of Brexit. Fintech Ireland is one of the most trusted fintech networks in Ireland and globally on the topic of Irish fintech. Message Peter Oakes via Linkedin at https://www.linkedin.com/in/peteroakes/ |

AuthorFintech Ireland Archives

December 2026

Categories

All

|