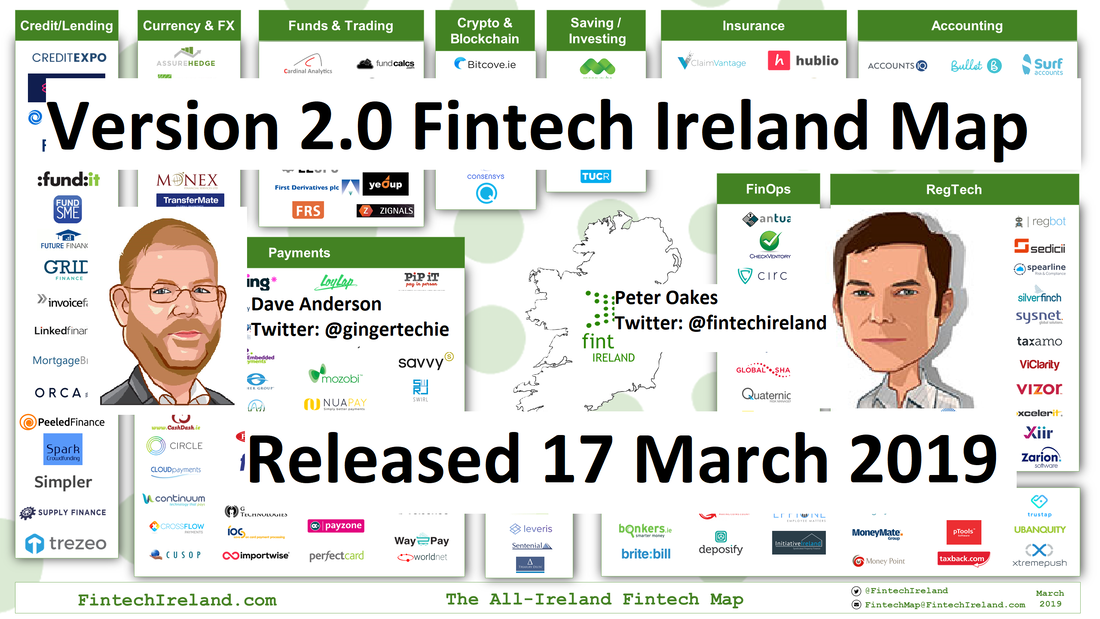

It’s been a full year since we updated the Fintech Map - and there are LOTS of changes!

● Credit & Lending - 8 new companies

● Funds & Trading - 2 new companies

● Crypto & Blockchain - 5 new companies

● Saving & Investing - 1 new company

● Insurance - 1 new company

● FinOps - 1 new company

● Regulation - 13 new companies

● Payments - 10 new companies

● Others - 5 new companies

This shows that the Fintech ecosystem in Ireland is continuing to grow and evolve, both in the Republic and Northern Ireland. If we were to draw one headline from this, it would be the explosive growth of Regulation (RegTech), with thirteen new companies added in the last year.

If you are Irish FinTech / RegTech and feel that you should be on the Map, complete our Survey (at https://fintechireland.com/fintech-survey.html) and we will review before the release of our next edition.

To reflect the all-Ireland nature of Fintech Ireland, we’ve updated the design to be a little less Dublin-centric, and bumped the version number to 2.0.

Thank you to everyone who contributed to the update this year, including those who completed the on-going Fintech Ireland Survey! As we say above, to join the Map, complete the Survey on www.fintechireland.com.

Any questions on the Map, please send them to [email protected].

If you like to stay in touch with what we are doing, our events for 2019 and Irish fintech news, join the mailing list here and follow us on twitter at @fintechireland, @gingertechie and @oakeslaw

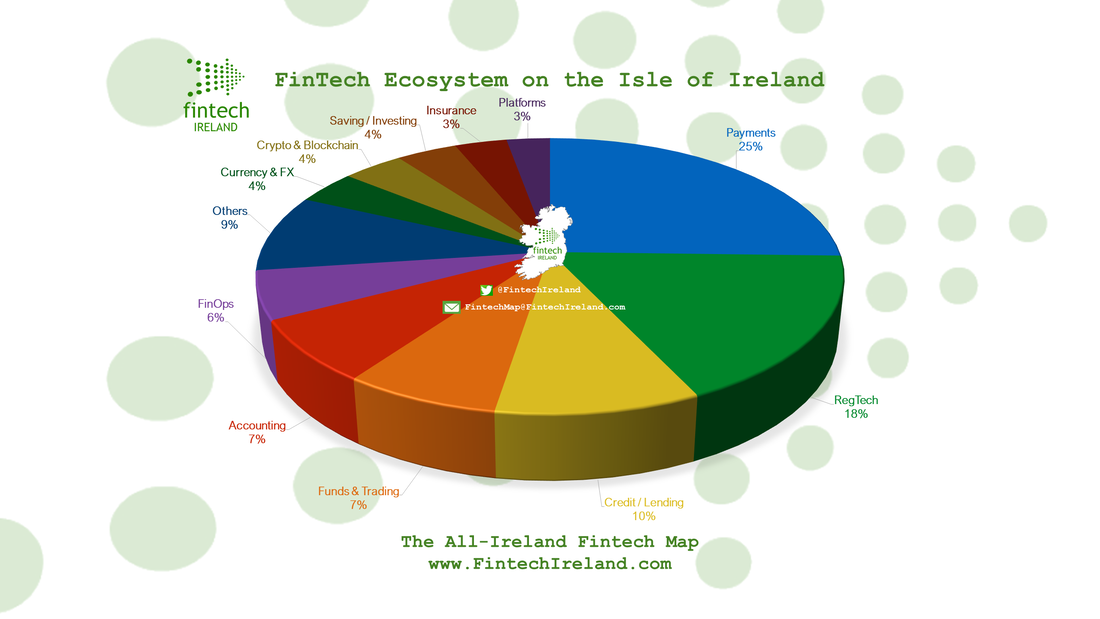

As we can see from the below pie chart, RegTech and Payments are the dominant sectors within the Fintech Ireland ecosystem. This is no surprise and matches data emanating from other bodies, including data from the central Bank of Ireland.