FREE ENTRY: We have access to the International Delegate link which means if you are from outside of Australia, you can use this link for FREE ENTRY - www.intersektfestival.com/page/1307007/international-attendees (NB - Ends 2 November, so hurry)

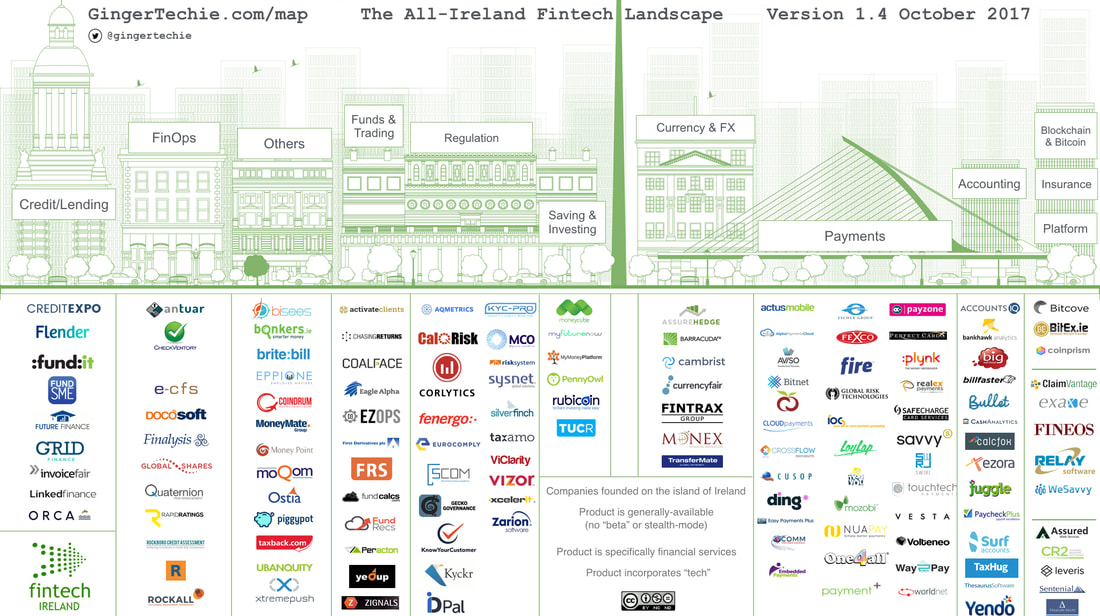

Fintech Ireland, as part of its big Fintech Trip Down Under is heading to Intersekt in Melbourne. The Intersekt team have worked their butts off to pull together this year's must-attend fintech event, its 2017 Collab/Collide Summit. Fintech Ireland is very appreciative of being a valued event partner!

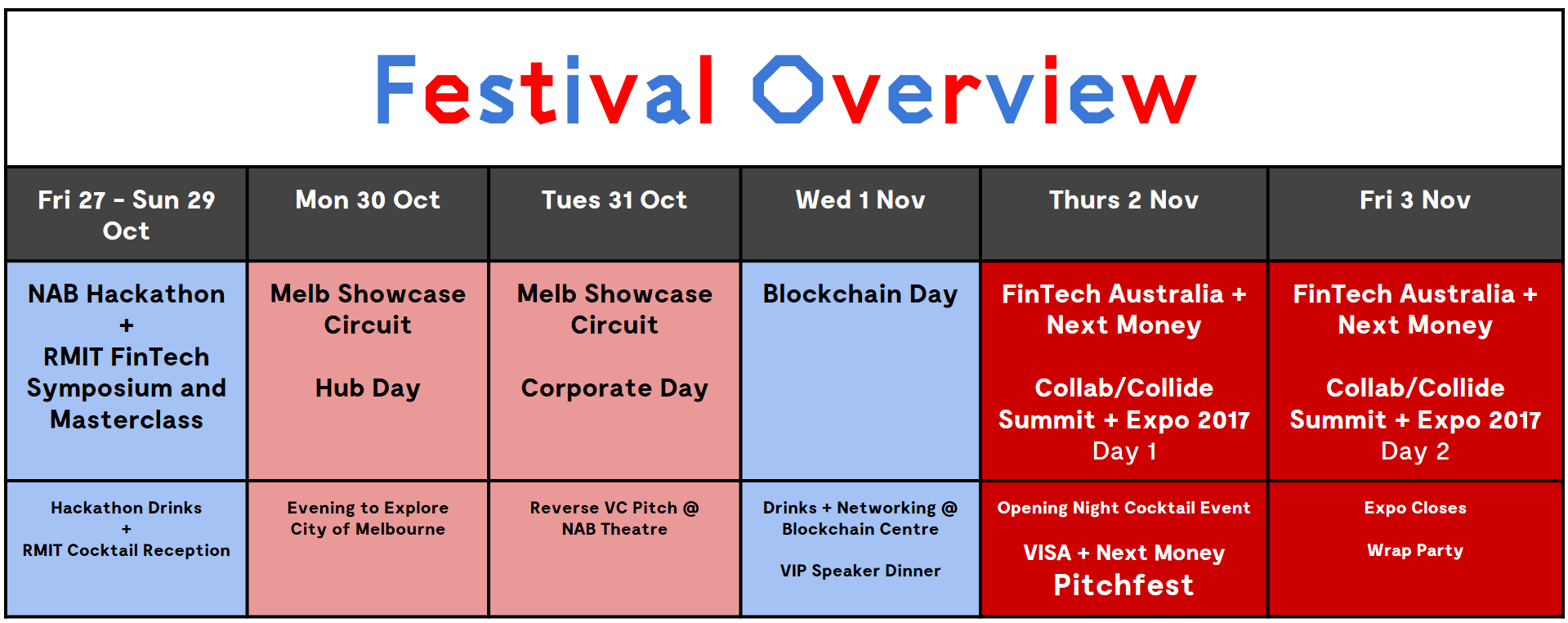

Be immersed in the ideas shaping Australian FinTech that are influencing the world by joining FinTech Australia + Next Money, Collab/Collide Summit 2nd & 3rd November 2017, at Intersekt.

The Summit is the highlight event of the Intersekt Festival and will bring the whole FinTech Ecosystem together - Startups, Corporates, Government and Regulators.

The event is now confirmed with:

- Over 300 summit delegates from Australia, NZ, China, Hong Kong, Germany, USA, Ireland, Singapore, UAE, Uruguay and more...

- 100+ speakers

- 40+ sessions

- Over 20+ exhibitors

- Next Money FinTech Finals pitchfest, to find Australia's hottest new fintech startup

If you don't qualify for free entry as an international delegate, you can still get the below tickets:

Corporate Emerging Leaders and Startup Offer - CODE: EL342

For bright, up-and-coming leaders who are under 30, they will get a free ticket if they bring two friends/mentors. That's 3 tickets for the price of 2… more than 30% off!!!

50% off 5 or more for recipients of this email: 5plus50

Just buy 5 Corporate tickets or more, and use the above code for 50% off!

See you in Victoria!