Check out the MiCAR KFD Roundtable Event - Thursday 12th December 2024 - CLICK HERE FOR DETAILS

- Sign up to our Newsletter here.

- Need assistance with an emoney or payments authorisation or an account information service provider or virtual asset services provider registration application, check out Fintech Ireland and CompliReg's handy authorisation guides at https://fintechireland.com/fintech-authorisations.html.

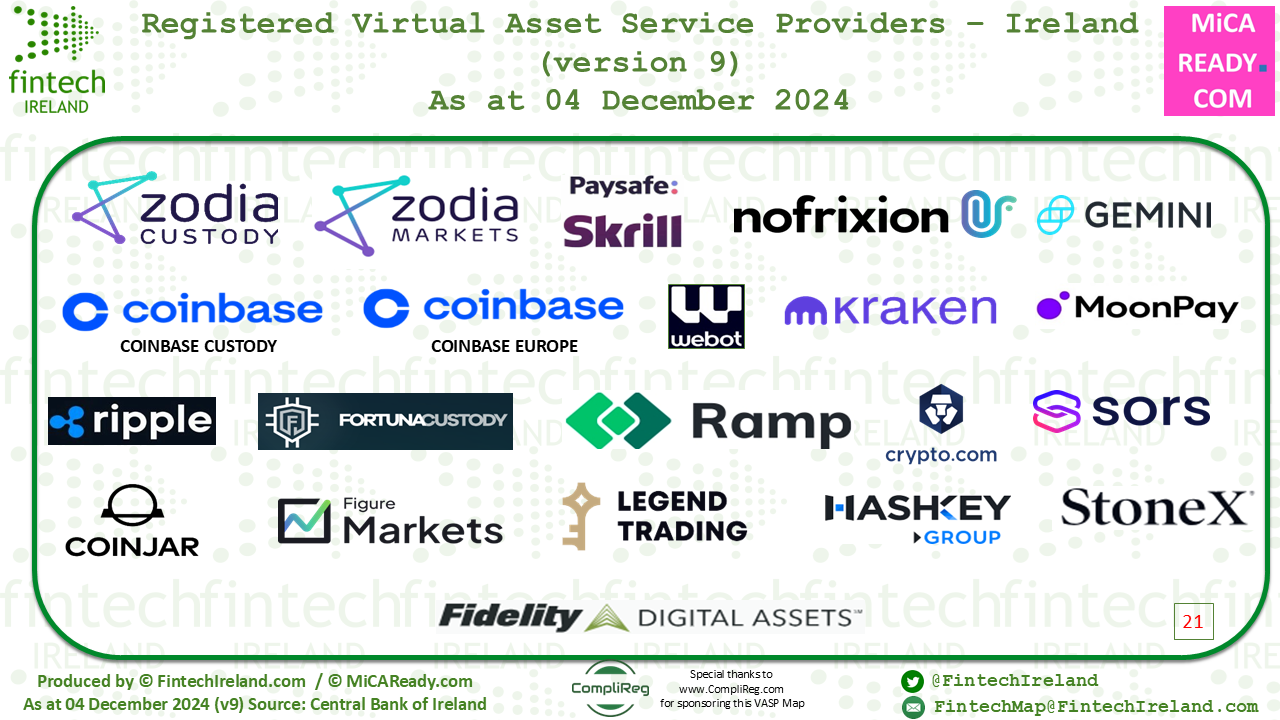

Joining the Irish Fintech Ecosystem are:

- CoinJar Europe Limited - registered to provide services: #i, ii, iii & iv *

- Figure Markets Ireland Ltd - registered to provide services: #iii

- Legend Financial Ireland Limited - registered to provide services: #i & ii

- HashKey Europe Limited - registered to provide services #i, ii, iii & iv

- Fidelity Digital Assets Ireland Ltd - registered to provide services #i, iii & iv

- StoneX Digital International Ltd - registered to provide services ##i, ii, iii & iv

* Service Provided as appearing on Central Bank Register as at 4 December 2024:

(i) Provision of exchange services between virtual assets and fiat currencies

(ii) Exchange between one or more forms of virtual assets;

(iii) Transfer (to conduct a transaction on behalf of another natural or legal person that

moves a virtual asset from one virtual asset address or account to another) of virtual assets

(iv) Custodian wallet providers

The above six VASPs bring the total number of Registered VASPs in Ireland to 21, joining these other 15 VASPs.

- Gemini Intergalactic Europe Limited

- Zodia Custody (Ireland) Limited

- Coinbase Europe Limited

- Coinbase Custody International Limited

- Paysafe Payment Solutions Limited

- Payward Europe Solutions Limited (Kraken)

- NoFrixion Limited

- Pionew Ireland Limited

- Moonpay Technology Services Limited

- Zodia Markets (Ireland) Limited

- Ripple Markets Ireland Limited

- Fortuna Digital Custody Ltd

- Ramp Swaps (Ireland) Limited

- Foris DAX Global Limited (Crypto.com)

- Sors Digital Assets Limited

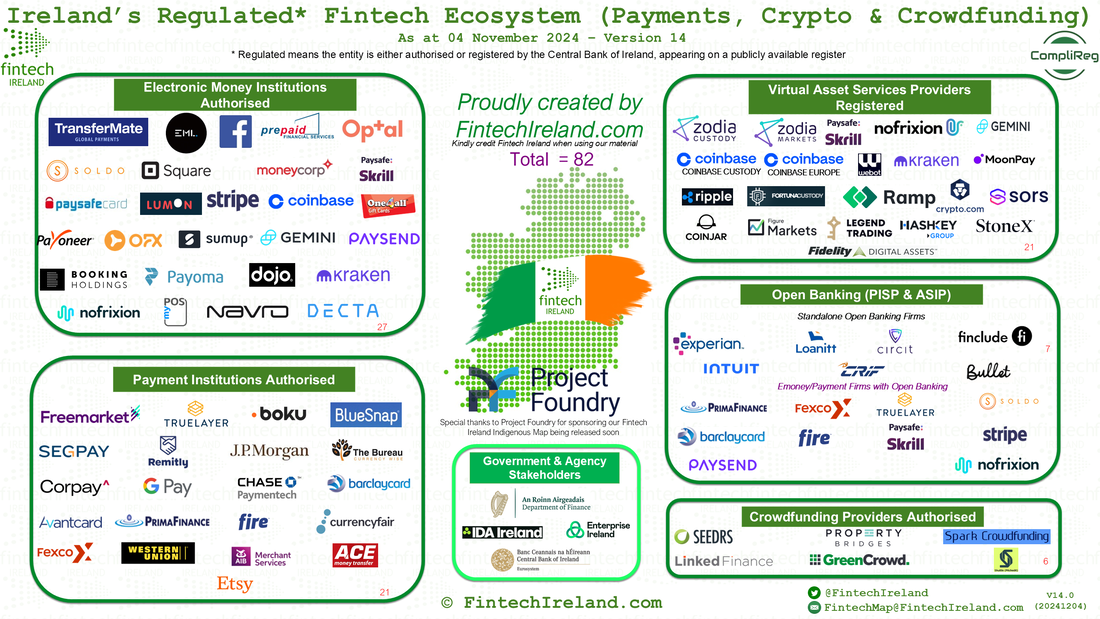

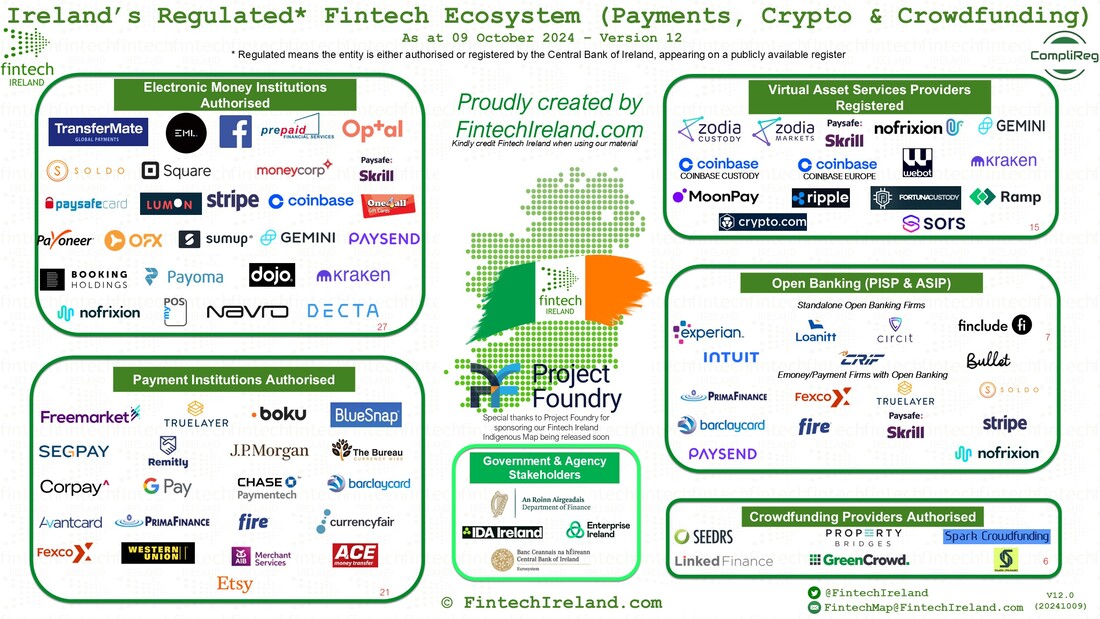

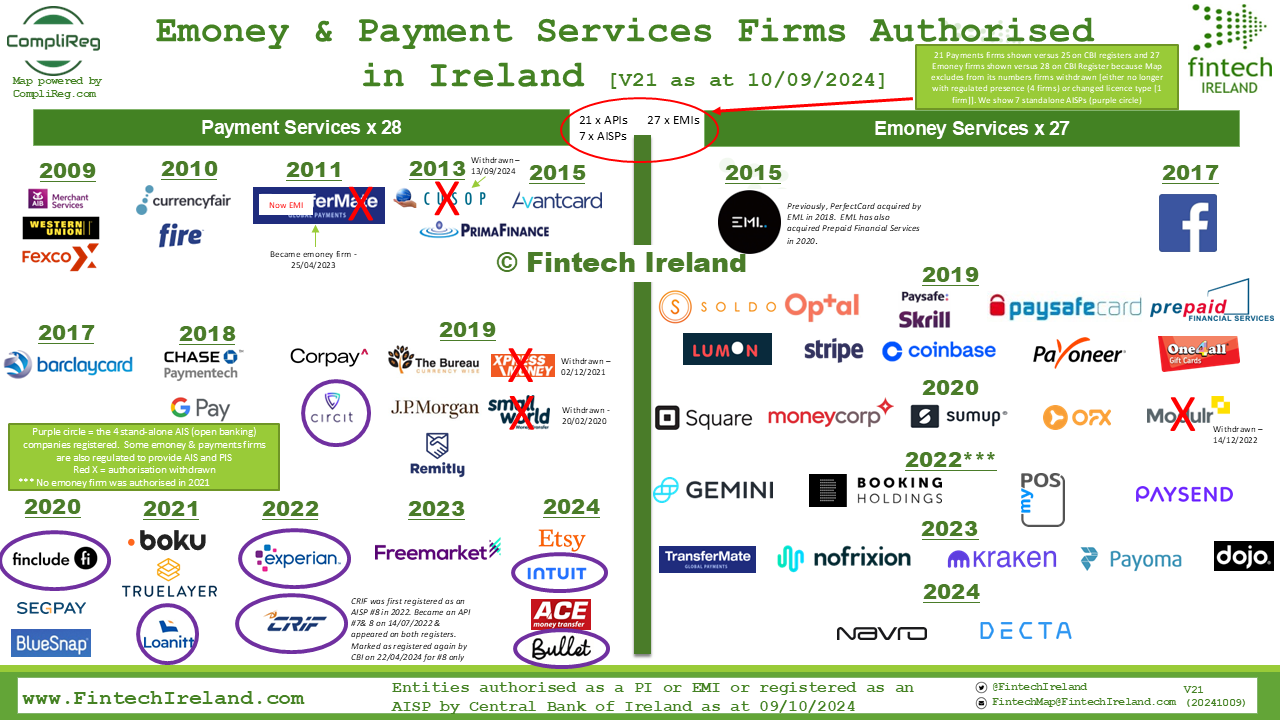

Ireland is now home to 82 Authorised or Registered Fintechs

Find these 82 Authorised and Registered fintechs on the Map below.

- Sign up to our Newsletter here.

- Need assistance with an emoney or payments authorisation or an account information service provider or virtual asset services provider registration application, check out Fintech Ireland and CompliReg's handy authorisation guides at https://fintechireland.com/fintech-authorisations.html.