“The growth of peer-to-peer lending shows no sign of stopping, and the sector presents a powerful opportunity for financial advisers to add value to their clients. But it’s currently being overlooked – and we want to change this.”

The wealth management sphere has been divided when it comes to peer-to-peer lending. The majority of advisory platforms and IFAs have scrutinized the “new-wave” asset class. Jason Hollands of Tilney Bestinvest was forthright that his firm will not be offering an Innovative Finance ISA, and insists their client base would not be interested in a peer-to-peer investment:

“The industry is still very young, with the world’s first P2P platform only launched to the public in 2005.”

However, direct to consumer giant Hargreaves Lansdown has been vocal in its assurance that it will be providing its clients with a peer-to-peer lending option in Autumn 2016. This, alongside Octopus Investments’ recent revelation surely cements the notion that P2P lending as has now become a mainstream product now? With £2.722bn invested in 2015 according to Liberum Altfi Volume Index (UK), and over 50 active platforms on the market catering to approximately 250,000 retail investors, it is no surprise that this exponential growth in the market has attracted the likes of Octopus and Hargreaves - let’s not forget RateSetter’s partnership with FNZ in Autumn 2015 either.

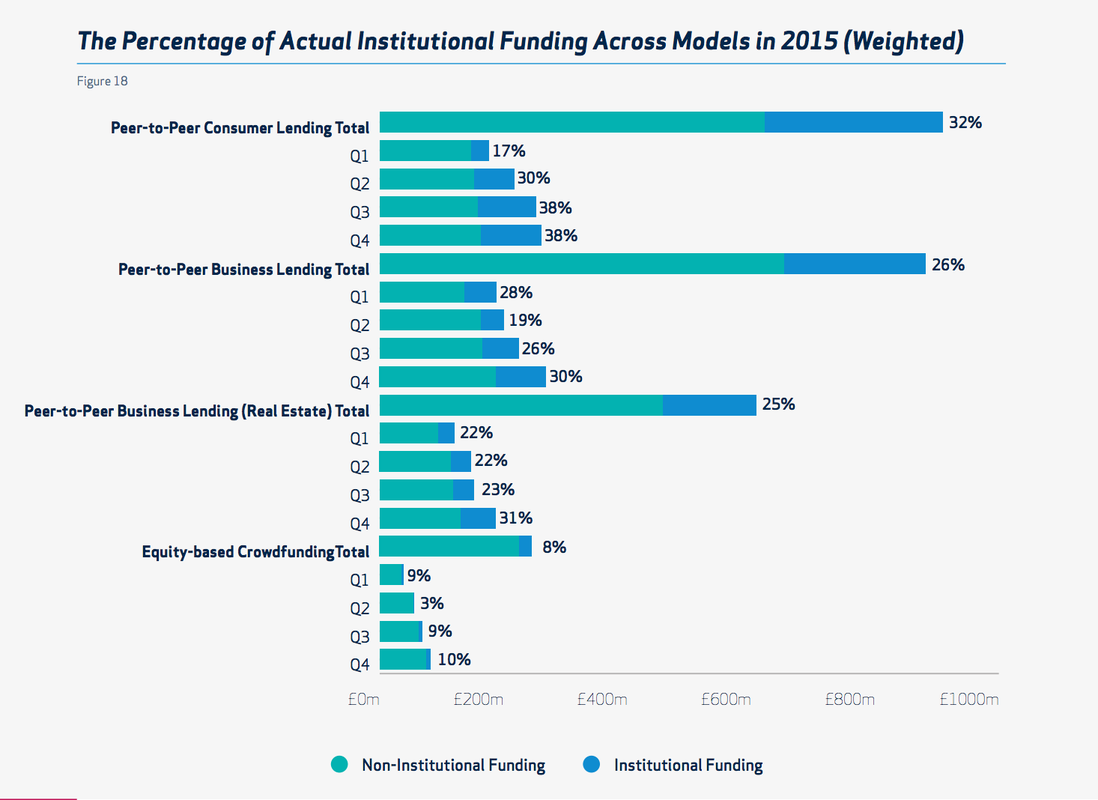

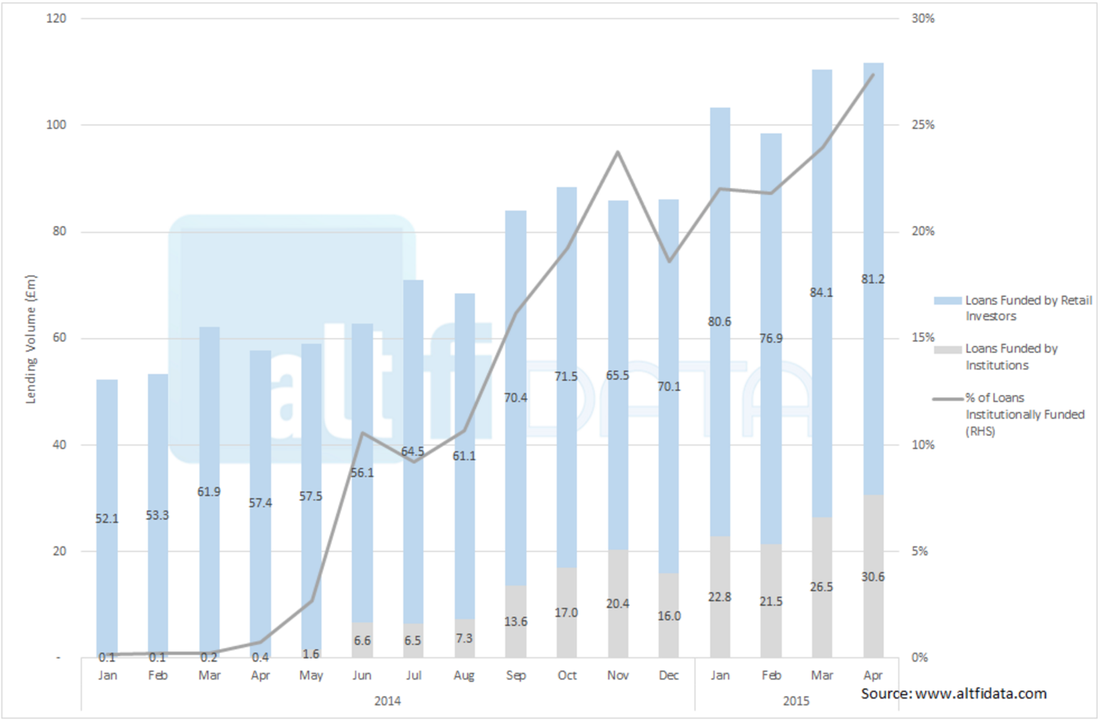

Another thing, in 2015 36.4% of investment in Funding Circle, RateSetter and Zopa came from institutional deployment, according to AltFi Data. Whole loans (exclusive to institutional investors) were being funded through platforms like Funding Circle, whilst Zopa and RateSetter similarly sought institutional funding for loans (Zopa partnered with Metro Bank). P2P Global Investments (MW Eaglewood – Manager) bundle P2P loans from U.S marketplace lenders as well as the “big three” in the U.K and a wider rang of UK platforms.

There are arguably two critical tipping points that have stimulated the financial advisory community to take notice of marketplace lending:

1. Innovative Finance ISA

April 6th saw the introduction of the Innovative Finance ISA, or “peer-to-peer ISA” as it’s affectionately termed. This is expected to bring in a wave of savers disgruntled with the excruciating rates on offer by via traditional savings products, and now prepared for an alternative investment. The FT predicted over 400,000 new investors will surge onto the P2P market. This will probably not be the case. Only a handful of ISA Plan Managers can offer the IFISA presently, excluding the “big three” P2P lenders: Zopa, RateSetter and Funding Circle, amongst several most other major P2P platforms. This is due to a backlog in the FCA’s regulations authorization process: P2P platforms must have full authorization from the FCA – many platforms operating on interim permissions only at present – and have ISA permissions from the HMRC. Crowdstacker is one of few platforms that can offer the IFISA currently.

2. FCA regulated advising on P2P agreements

On the same date, 6th April, the FCA announced that it’ll be regulating P2P advice. IFAs that who personally recommend a peer-to-peer investment opportunity to a client must be “assessed as competent” according to the FCA. Any P2P opportunity advised by an IFA will also “have recourse with the FSCS”. Advisors will be held liable, basically.

So, there are two potential catalysts to encourage the wealth management community to follow leaders, Octopus and Hargreaves. Will the temptation of a new ISA product, greater regulation (good or bad for advisors?) for investors and some momentum from big industry players be enough to tip the sector over to the…dark side…? Sophisticated investors require deeper, more granular, data analysis to make a decision when it comes to peer-to-peer lending. The attraction of rates 5% +, liquidity on the P2P platform and a “provision fund” doesn’t cut it. Data-analytics tools and a portfolio management service would encourage affluent, possibly even high-net-worth investors to invest, should their advisors be willing to advise.

Jordan is a FinTech enthusiast and co-founder of UK’s no.1 peer-to-peer lending comparison service, where the everyday person can research, compare and feel empowered to invest and earn more money on their money. [email protected], @orca_money, www.orcamoney.com