12 April 2020: We are excited to release version 3 of the mighty Fintech Ireland Map, today (Easter Sunday 12 April 2020) showcasing 230 Irish fintechs up 30% from 2019.

Unlike last year, the Easter Bunny got dibs on the release of the Map over Saint Patrick (whose proxy is ‘Liam the Leprechaun’). Version 3 of the Map is powered by CompliReg.com (regulatory, compliance and fintech solutions). Get in touch with us at [email protected] if you would like to sponsor Map updates going forward.

We will be making a lot of noise about the Map in the coming days through social media. Make sure you follow our social media handles particularly our twitter handle @fintechireland and please retweet. We started making noise when we showed an advance copy of the Map at the first of our series of webinars on Thursday 9 April, at which we were joined by Margaret Clancy of TransferMate and Tommy Kearns of Xtremepush.

Our last Fintech Ireland Map update was in December 2019. The changes made at that point included a couple of additions and some cosmetics (name changes and updating logos).

Version 3 update is a very big update - and there are LOTS of changes! Even up until this afternoon on the long Easter Weekend we have received Surveys from fintechs looking to join the Map (thank you).

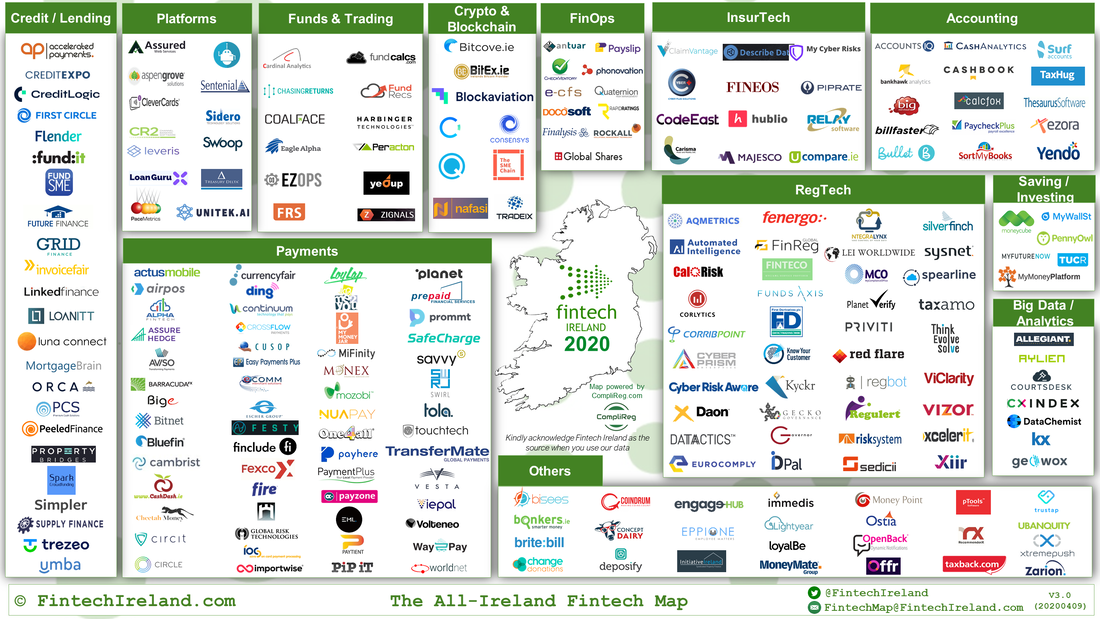

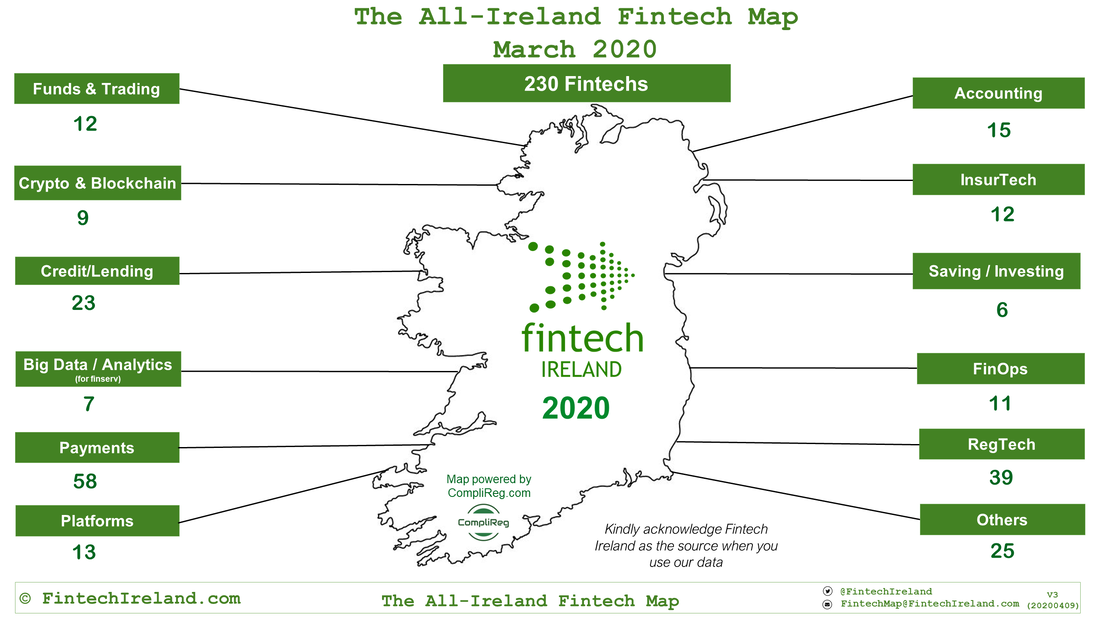

Firstly, we have made changes to our categories. We still have 12 categories, and following the merger of ‘Currency & FX’ with ‘Payments’ and the addition of ‘Big Data / Analytics’ (for finserv) the categories are:

- Credit & Lending

- Platforms

- Funds & Trading

- Crypto & Blockchain

- FinOps

- InsurTech

- Accounting

- Payments

- RegTech

- Savings / Investing

- Big Data / Analytics

- Others

Secondly, the number of firms in each category is shown in the diagram below. Some firms in 2020 changed from their categories 2019. Bear that in mind if you try to reverse engineer the data contained in the 2019 Map (versions 2.0-2.2) and the first 2020 Map (version 3.0).

During 2019, at numerous Fintech Ireland events we noted to audiences that RegTech will continue to enjoy significant growth. RegTech is an interesting area. During 2019 two RegTech firms asked that they move categories – one to Others and the other to the new category of Big Data / Analytics (for finserv). Although there are now 39 companies in the RegTech category, if we look at the sector more generally, it is arguable that there are in fact 47 companies whose technology assists firms comply with their regulatory obligations. The statement that ‘fintech’ is a broad church applies equally to ‘regtech’ too.

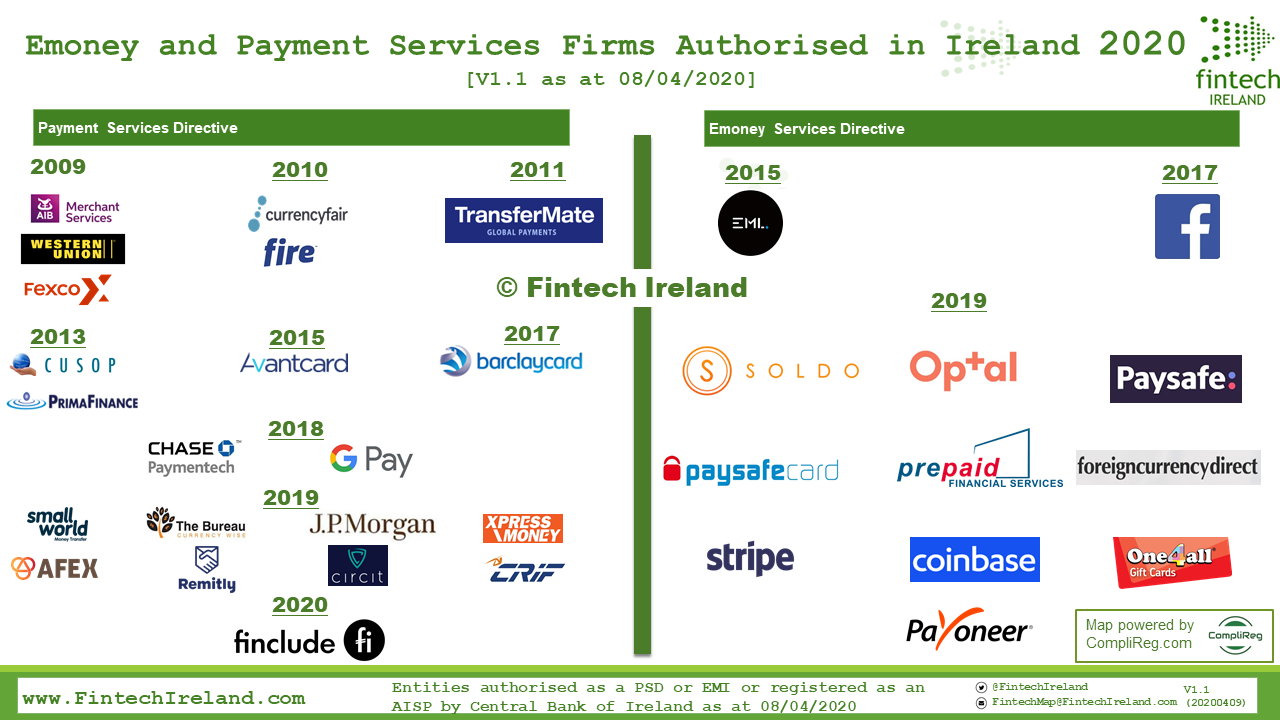

The crown for the greatest number of companies remains with Payments, which saw a net increase of 13 to 58. We expect to see continued growth in payments during 2020, particularly regulated payments given the number of applications filed by indigenous companies with the Central Bank of Ireland.

Other notable news relating to the 2020 Map includes:

- Others: impressive growth from 17 in 2019 to 25 in 2020

- InsurTech: one leaver and seven new entrants.

- Crypto & Blockchain: two new entrants

- Credit & Lending: six new entrants

If you are Irish FinTech / RegTech and feel that you should be on the Map, please complete our Survey (at https://fintechireland.com/fintech-survey.html) and we will review before the release of our next edition. If you are on the Map and you have not completed the Survey would you please complete the Survey.

Like every year, a big thank you to everyone who contributed to the update this year, especially to those who completed the on-going Fintech Ireland Survey! As we say above, to join the Map, complete the Survey on www.fintechireland.com. Any questions on the Map, please send them to [email protected].

If you like to stay in touch with what we are doing, our events for 2020 and Irish fintech news, join the mailing list at https://fintechireland.com/get-involved.html and follow us on twitter at @fintechireland and @oakeslaw