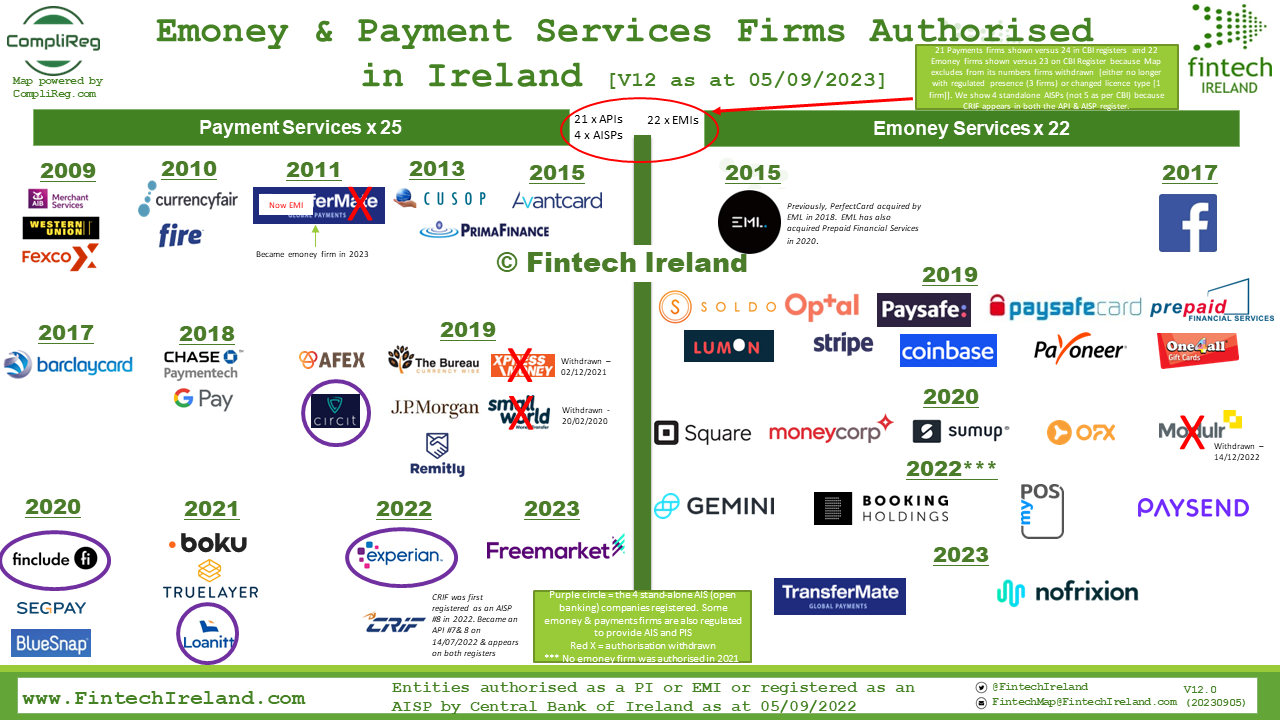

As of 5 September 2023 we have produced an updated Fintech Ireland Map of authorised electronic money institutions, authorised payment institutions and registered account information services providers.

New to version 12 of the Map is Freemarketfx Ireland Limited, which was authorised on Monday 4 September 2022 to payment services 3c and 5. These services allow Freemarkefx Ireland to provide:

- #3) Execution of payment transactions, including transfers of funds on a payment account with the user’s payment service provider or with another payment service provider: (c) Execution of credit transfers, including standing orders; and

- #5) Issuing of payment instruments and/or acquiring of payment transactions.

To date since the start of 2023, Ireland's Central Bank has authorised just three firms as either an electronic money institution (EMI) or a payments institutions (API) i.e. Freemarketfx Ireland (API), TransferMate (Interpay Limited) (EMI) and NoFrixion Limited (EMI). TransferMate was previously authorised as a payments institution from 2011-2023 before becoming an EMI in April 2023. Thus effectively, NoFrixion and Freemarketfx Ireland are the only new entities to become authorised in 2023 (2 authorisations in 8 months).

Freemarketfx Ireland Limited was authorised more than 2.5 years after it was incorporated in Ireland on 23 March 2021. According to Irish companies registration records, Freemarketfx Ireland is 100% owned by FreemarketFX Limited in the UK, which as per the UK FCA records, has been an Authorised Payment Institution since 16 May 2018.

Our Peter Oakes last spoke with Charlie Taylor of the Business Post on the topic of regulatory authorisations on Sunday 20 August 2023.

- Peter Oakes, a former Central Bank enforcement director and founder of Fintech Ireland, said a firm setting up in Ireland needs to be aware that the upfront and post-authorisation costs in the first year will set them back about €1.5 million.

- “A considerable part of this outlay is required ahead of approval with no guarantee it will be given,” Oakes said.

- “No one wants to say this because everyone will say that by doing this you are not flying the green flag. Some consultants hide behind that because they might not be engaged [by clients] and risk losing other client work both pre and post authorisation in areas such as tax, IP, employment, commercial and corporate work. No-one should be surprised by this,” he added.

Ireland is now home to 47 legal entities which provide either payment services or emoney services. There are 26 payments services firms in Ireland which includes 4 account information services providers and 22 emoney firms. The records of four firms state that their authorisations were withdrawn. The three that are no longer authorised to provide services in Ireland are Xpress Money Services Limited, SWFS Ireland Limited and Modulr FS Europe Limited. The 4th entity, noted above, Interpay Limited (TransferMate) switched from payments services only to an electronic money (plus payment services 3b, 3c, 5, 6).

Further Reading: See our post on the release of version 11 of this Map for more information.